“Happiness is not something ready made. It comes from your own actions.”

– Dalai Lama

Jobs Update

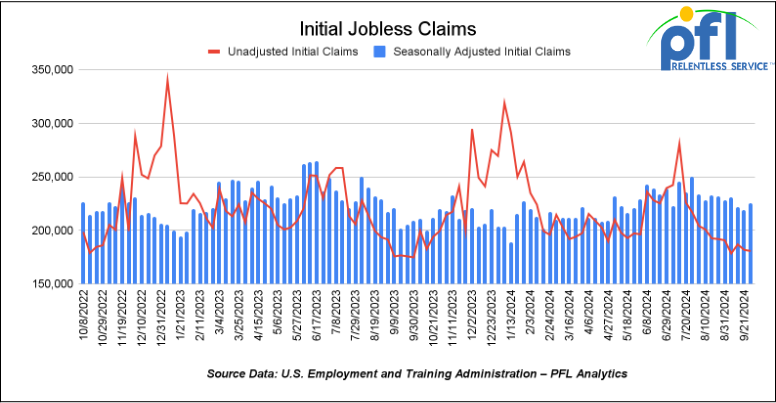

- Initial jobless claims seasonally adjusted for the week ending September 28th came in at 225,000, up 6,000 people week-over-week.

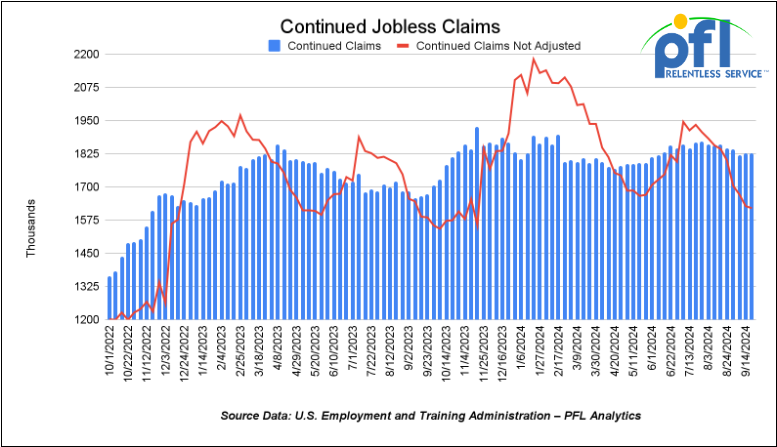

- Continuing jobless claims came in at 1.826 million people, versus the adjusted number of 1.827 million people from the week prior, down -1,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher, on Friday of last week up 341.16 points (0.81%), closing out the week at 42,352.75, up 39.75 points week-over-week. The S&P 500 closed higher on Friday of last week, up 51.13 points and closed out the week at 5,751.07, up 12.9 points week-over-week. The NASDAQ closed higher on Friday of last week, up 219.38 points (1.21%) and closed out the week at 18,137.85, up 18.26 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 42,434 this morning down -212 points.

Crude oil closed higher on Friday of last week and is up week over week.

West Texas Intermediate (WTI) crude closed up $0.67 per barrel (0.9%) to close at $74.38 per barrel on Friday of last week, up $6.20 per barrel week over week. Brent traded up $0.43 USD per barrel (0.6%) on Friday of last week, to close at $78.05 per barrel, up $6.07 per barrel week-over-week. One Exchange WCS (Western Canadian Select) for November delivery settled Friday on last week at US$12.75 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 60.27 per barrel.

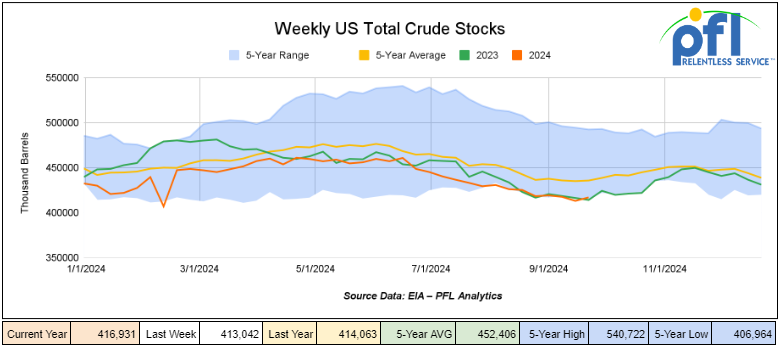

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.9 million barrels week-over-week. At 416.9 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

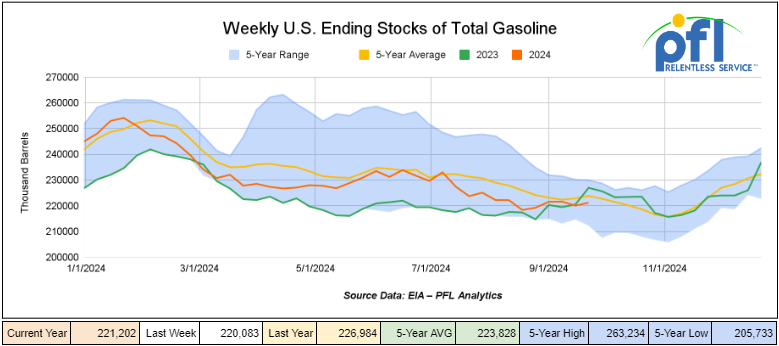

Total motor gasoline inventories increased by 1.1 million barrels week-over-week and are 1% below the five-year average for this time of year.

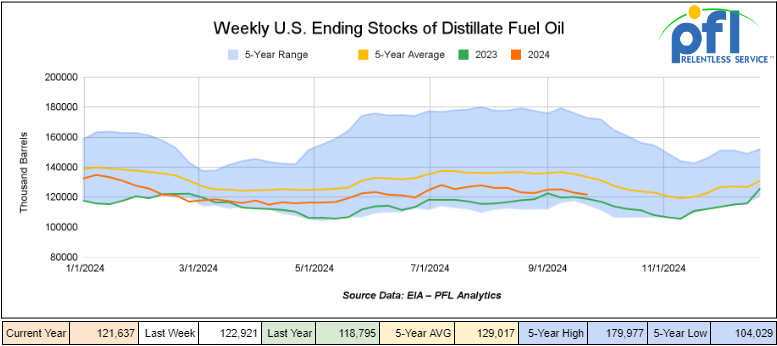

Distillate fuel inventories decreased by 1.3 million barrels week-over-week and are 8% below the five-year average for this time of year.

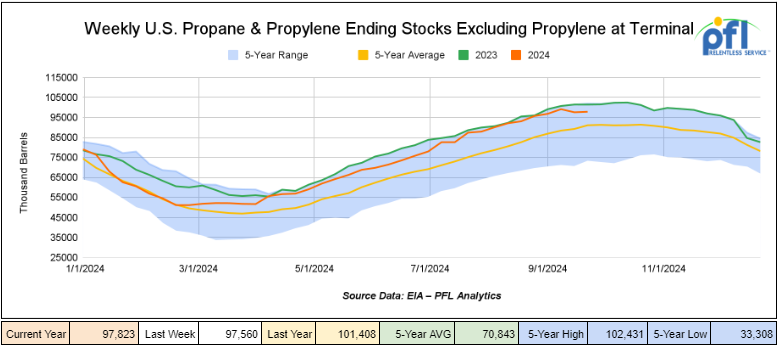

Propane/propylene inventories increased by 300,000 barrels week-over-week and are 7% above the five-year average for this time of year.

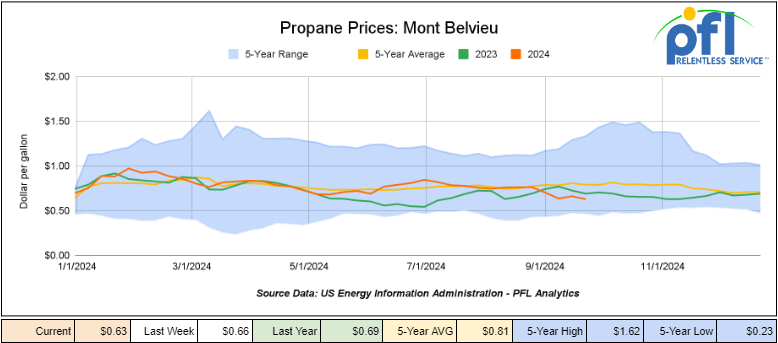

Propane prices closed at 63 cents per gallon on Friday of last week, down 3 cents per gallon week-over-week and down 6 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 900,000 barrels during the week ending September 27, 2024.

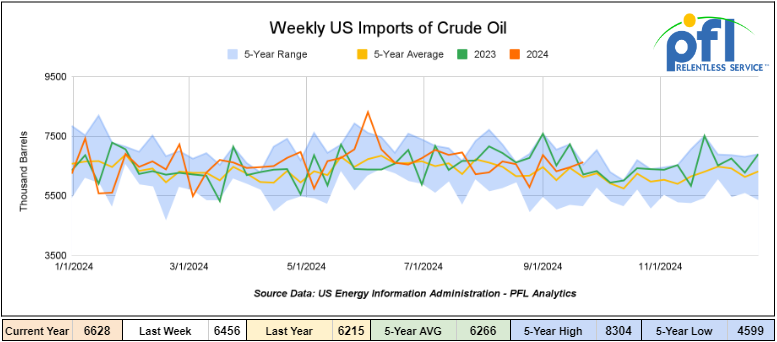

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending September 27, 2024, an increase of 171,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.6 million barrels per day, 4.6% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 540,000 barrels per day, and distillate fuel imports averaged 194,000 barrels per day during the week ending September 27, 2024.

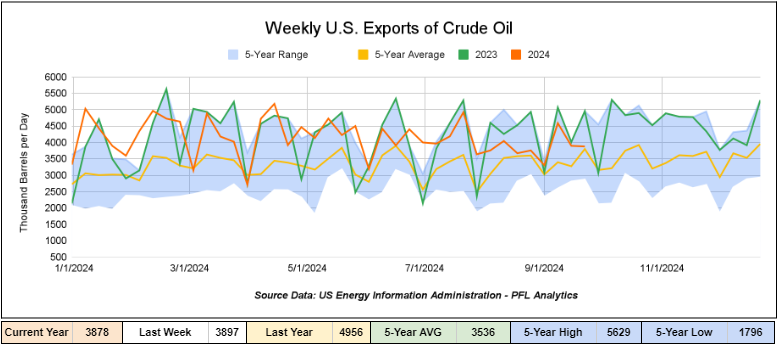

U.S. crude oil exports averaged 3.878 million barrels per day during the week ending September 27th, 2024, a decrease of -19,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.917 million barrels per day.

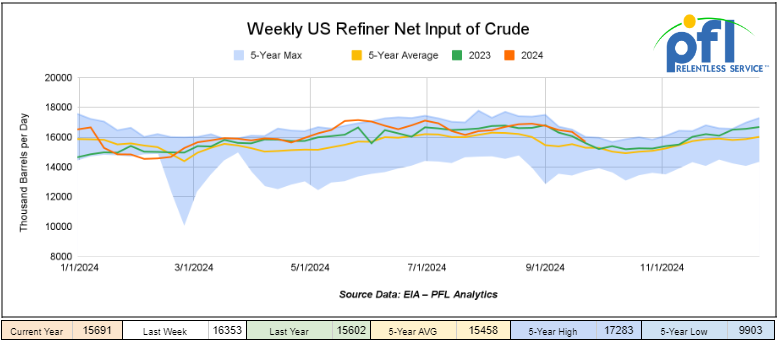

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending September 27, 2024, which was 662,000 barrels per day less week-over-week.

WTI is poised to open at $76.09, up $1.71 per barrel from Friday’s close.

North American Rail Traffic

Week Ending October 2nd, 2024.

Total North American weekly rail volumes were up (+1.19%) in week 40, compared with the same week last year. Total carloads for the week ending on October 2nd were 349,211, down (-3.05%) compared with the same week in 2023, while weekly intermodal volume was 349,344, up (+5.81%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Coal, which was down (-10.72%). The most significant increase came from Motor Vehicles and Parts which was up (+9.95%).

In the East, CSX’s total volumes were down (-3.37%), with the largest decrease coming from Coal (-14.15%) while the largest increase came from Motor Vehicles and Parts (+9.67%). NS’s volumes were down (-1.54%), with the largest increase coming from Grain (+28.66%), while the largest decrease came from Petroleum and Petroleum Products (-14.66%).

In the West, BN’s total volumes were up (+7.21%), with the largest increase coming from Grain (+29.95%) while the largest decrease came from Nonmetallic Minerals, down (-12.04%). UP’s total rail volumes were up (+5.06%) with the largest decrease coming from Coal, down (-18.81%), while the largest increase came from Motor Vehicles and Parts, which was up (+17.7%).

In Canada, CN’s total rail volumes were down (-7.02%) with the largest decrease coming from Coal, down (-23.79%) while the largest increase came from Grain, up (+36.07%). CP’s total rail volumes were down (-3.62%) with the largest increase coming from Motor Vehicles and Parts (+74.03%), while the largest decrease came from Metallic Ores and Metals (-50.83%). KCS’s total rail volumes were down (-11.76%) with the largest decrease coming from Other (-26.27%) and the largest increase coming from Motor Vehicles and Parts (+47.24%).

Source Data: AAR – PFL Analytics

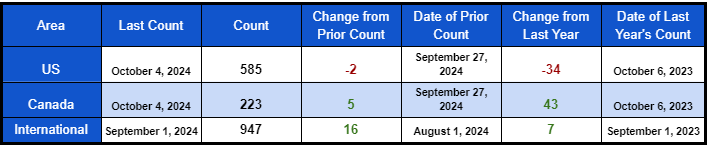

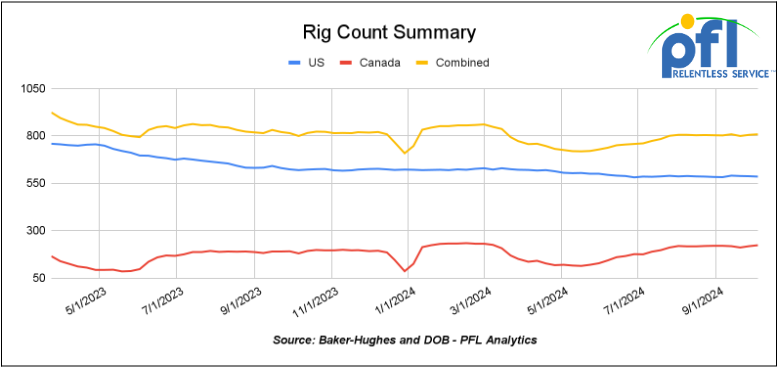

Rig Count

North American rig count was up by 3 rigs week-over-week. The U.S. rig count was down by -2 rigs week-over-week, and down by -34 rigs year-over-year. The U.S. currently has 585 active rigs. Canada’s rig count was up 5 rigs week-over-week and up by 43 rigs year-over-year and Canada’s overall rig count is 223 active rigs. Overall, year over year we are up 9 rigs collectively.

International rig count was up by 16 rigs month-over-month and up by 7 rigs year-over-year. Internationally there are 947 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching industry conferences

Folks, PFL was a proud APP sponsor and had a table and attended in full force this fall’s SWARS rail conference last week in Houston, Texas. Curtis Chandler, Brian Baker and David Cohen were there representing PFL. It was a great conference, one of our favorites with 925 people registered and many more hanging out in the hotel for onsite meetings. The mood was upbeat with everyone experiencing high utilization rates and deals were made. For more information regarding SWARS, please call the desk at 239-390-2885.

Next week we will be at the well-attended tank car committee meeting in Dallas.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,272 from 28,487, which was a loss of 215 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments rose by 0.4% week over week, CN’s volumes were higher by 3.2% week-over-week. U.S. shipments were mixed higher. The NS was the largest percentage decrease and was down 14.7%. The UP had the largest percentage increase and was up by +5%.

We are watching Hurricane Milton

Milton is expected to have maximum sustained winds of 110 mph around the time it makes landfall on the Gulf coast of Florida by Wednesday – between Fort Myers and just north of Tampa. As a Category 4 hurricane according to the National Hurricane Center 4:00 am update. Key messages from the hurricane center:

1) Hurricane conditions are expected across portions of the northern Yucatan Peninsula. A dangerous storm surge with damaging waves is also likely along portions of the coast of the northern coast of the Yucatan Peninsula.

2) There is an increasing risk of life-threatening storm surges and damaging winds for portions of the west coast of the Florida Peninsula beginning Tuesday night or early Wednesday. Storm surge and Hurricane watches are now in effect for positions on the west coast in that area should follow any advice given by local officials and evaluate if told to do so.

3) Arears of heavy rainfall will impact portions of Florida today ahead of Milton with heavy rainfall more directly related to the system expected later Tuesday through Wednesday night. This rainfall will bring the risk of considerable flash, urban, and areal flooding, along with the potential for moderate to major river flooding.

Projected Hurricane Path as of 5:00 AM EST

We Were Watching the U.S. East and Gulf Coast Ports Strike

A recent strike by dockworkers on U.S.’s East and Gulf Coasts, which disrupted ocean shipping, ended on Thursday of last week, but the underlying issue of automation remains unresolved. The strike, involving around 45,000 workers from the International Longshoremen’s Association (ILA), was called off after a tentative wage agreement was reached, including a 62% wage increase. Both sides agreed to extend their contract until January 15, 2025, while continuing negotiations on a new six-year labor deal. A key sticking point remains automation, which unions view as a threat to jobs, while companies see it as a path to greater efficiency and throughput. January 15th will get us through Christmas and the election but expect more on this one.

“We got to keep fighting automation and semi-automation,” said ILA leader Harold Daggett during the strike in New Jersey, where workers held signs reading, “Machines don’t feed families” and “Fight automation, save jobs.” The ILA argues that the use of automated systems, like the gate system at a port in Mobile, Alabama, violates their contract. APM Terminals, the port operator, insists the system has been in place since 2008 and complies with their agreement.

Similar labor disputes over automation have emerged in Canada, where the International Longshore and Warehouse Union (ILWU) has rejected proposals tied to automation at Vancouver ports. “Workers are challenging automation because they know the negative effects that disappearing jobs have on our families and communities,” said a spokesperson for the ILWU.

As East and Gulf Coast ports resume operations, entrepreneur and “Shark Tank” star Kevin O’Leary weighed in on the situation, criticizing the inefficiency of U.S. ports. “The trouble with East Coast ports is they’re very old, they’re very inefficient,” O’Leary said on “Varney & Co.” He compared them unfavorably to modern ports in Asia, such as Singapore, which he argued are much more productive.

O’Leary also sees automation as a necessary step, arguing that “there’s zero evidence” that automating ports on the East and West Coasts would hurt wages. Instead, he suggested it could lead to wage growth for workers trained to operate advanced systems, stating, “Automation helps job creation and helps the value of wage growth.”

Eric Hoplin, CEO of the National Association of Wholesaler-Distributors, echoed O’Leary’s view, calling union demands against automation “unrealistic.” He noted that major ports worldwide, including those in Shanghai, Rotterdam, and Singapore, have embraced automation, while U.S. ports lag behind by “three decades.”

The recent strike raised concerns about potential disruptions to the U.S. supply chain. An analysis by JPMorgan estimated that each day of the strike could have cost the U.S. economy between $3.8 and $4.5 billion, as operations slowed across the affected ports. If you ask us, Biden called in a favor – the next President of the U.S. whoever it is will have to deal with this mess in the New Year.

We Are Watching Key Economic Indicators

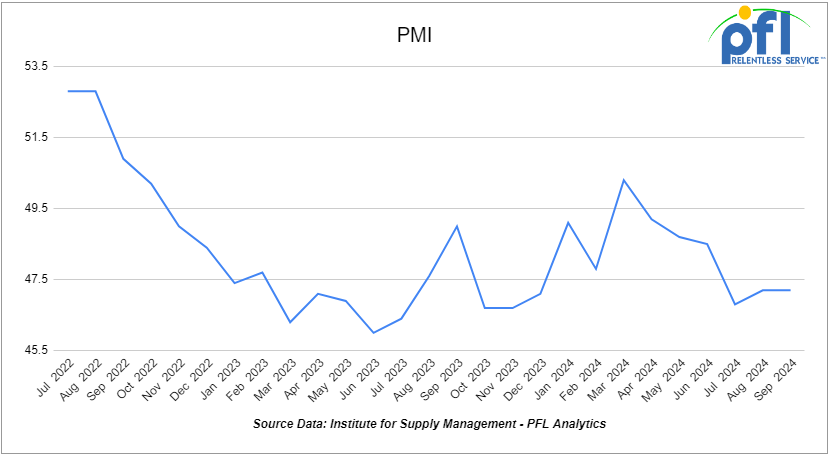

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50.

The ISM Manufacturing PMI for September 2024 was 47.2, unchanged from August and slightly below expectations of 47.5. This marks the sixth consecutive month of contraction in the manufacturing sector.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 90, 25.5K, DOT 111 Tanks located off of UP in Texas. Cars were last used in Fuel OIl. 2-3 Year Term

- 50, 28.3K, 117R Tanks located off of All Class 1s in St. Louis. Cars are clean 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations. Will take 90K

- 300, 31.8K, CPC 1232 Tanks located off of BN in Texas.

- 40, 33K, 340W Pressure Tanks located off of Multiple in All over.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website