One man with conviction will overwhelm a hundred who have only opinions.

– Winston Churchill

PFL was at MARS!

Folks it was a great MARS conference in Chicago last week. We view this conference as the kick off for the New Year, as usual activity was brisk and the speakers were great. Well done Bill, we appreciate you putting this conference together for us. This year’s record attendance was nearly 900 people and the weather cooperated so we are grateful! People this year unlike past years were not as optimistic as class ones struggle with volume, manufactures are seeing headwinds as PRS implementation continues and more cars continue to move into storage.

While shippers remain generally skeptical of PSR implementation, there have been some positive developments in Class 1 car velocity and operating ratios. The happy folks are storage operators, shops and railcar repair companies, as cars are being returned to their rightful owners and need to be worked on before being released. Some of the latest volume increases are from petroleum products.

We are seeing some bright spots in crude by rail coming out of Canada so fingers crossed. WCS at Hardisty, Alberta closed out the January trading cycle at -24.60 per barrel against WTI at Cushing, Oklahoma representing its deepest discount since November of 2018. The spread has widened $9 per barrel over the last three months as rising stocks due to pipeline upsets have put pressure on the contract. Our take away from the conference in Chicago – class ones continue to charge too much for empty moves to get cars into service and are KILLING deals – and leasing companies need to get a little more creative on taking back dirty cars and leasing them out dirty in the short term to get through this reduced demand period. Please call PFL for further dialog as it relates to MARS.

Geopolitical Risk

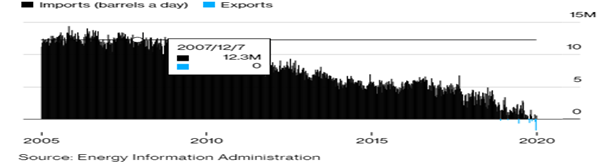

Geopolitical risk is seemingly having a lessor impact on oil prices. It’s a trading pattern that would have been unthinkable a decade ago, but has become increasingly familiar. The threat of conflict loomed over the heart of the global oil market this past week, but the usual panic buying by traders was met quickly by a wave of U.S. shale drillers locking in future pricing and hedging their output. The big guys used to be able to push the market around, the problem is there are too many hedgers these days and traders are getting run over.

Why? There is a lot on the line, shale producers are working in a thin margin environment right now and they have pressure from investors to show returns. As prices spike they hedge, and the more they hedge the more they can produce. The strategy has been working see 15 year chart below that tells the story:

Crude Oil Export Record

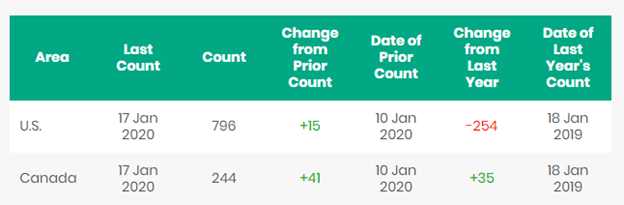

North American Rig Count

North American Rig count is up sharply week over week with 56 new rigs put back to work. The U.S. gained 15 rigs week over week and Canada gained 41 rigs week over week. Year over year we are down 219 rigs collectively, however, Canada is up 35 Rigs year over year which represents the first positive year over year increase in some time.

Total North American rail volumes were down 8.1% year over year in week 2 (U.S. -9.6%, Canada -5.2%, Mexico +1.9%) resulting in quarter to date volumes that are down 6.4%. 9 of the AAR’s 11 major traffic categories posted y/y decreases with the largest declines coming from intermodal (-7.7%), coal (-17.6%), grain (-18.7%), metallic ores & metals (-10.3%), motor vehicles & parts (-7.8%) and nonmetallic minerals (-3.6%). The largest increase came from petroleum (+6.0%).

In the East

CSX’s total volumes were down 6.6%, with the largest decreases coming from intermodal (-5.8%), coal (-13.4%) and motor vehicles & parts (-18.0%). NS’s total volumes were down 12.9%, with the largest decreases coming from intermodal (-13.2%), coal (-23.9%) and motor vehicles & parts (-19.0%).

In the West

BN’s total volumes were down 8.7%, with the largest decreases coming from intermodal (-7.0%), coal (-12.1%) and grain (-24.8%). UP’s total volumes were down 12.4%, with the largest decreases coming from intermodal (-13.9%), coal (-32.0%) and grain (-30.3%).

In Canada

CN’s total volumes were down 7.0% with the largest decreases coming from metallic ores (-17.5%), intermodal (-3.8%), chemicals (-15.6%) and motor vehicles & parts (-22.5%). RTMs were down 6.4%. CP’s total volumes were down 1.9%, with the largest decrease coming from intermodal (-4.7%). The largest increase came from petroleum (+31.3%). RTMs were up 3.2%.

Kansas City Southern

KCS’s total volumes were up 1.6%, with the largest increase coming from petroleum (+20.2%).

Class ones are now starting to miss earnings with most analysts assigning hold or equal weight to class one target prices.

The market is extremely active. Storage is continuing its trend with many facilities filling up. This trend is causing some facilities to expand their operations to accomodate the demand.

We have been busy with all sorts of subleases, trouble shooting for return on lease programs and turn keyed storage programs to reduce costs and maximize utilization. Call PFL today for the latest and greatest!

Hot Markets

PFL is offering:

- 340Ws for long and short term lease

- 117Rs last in diesel service

- Various box cars for lease

- 31.8’s clean and last in refined products

- 25.5K 117Js.

PFL is seeking:

- 117s with magnetic gauging devices for lease

- 89 ft flat cars for purchase,

- DDG hoppers for lease,

- 117Js last in ethanol

- 4750s for use in coke service.

Call PFL today for the latest and greatest!

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|