“I’d rather live with a tender heart, because that is the key to feeling the beat of all the other hearts.”

– Jenny Slate

Jobs Update

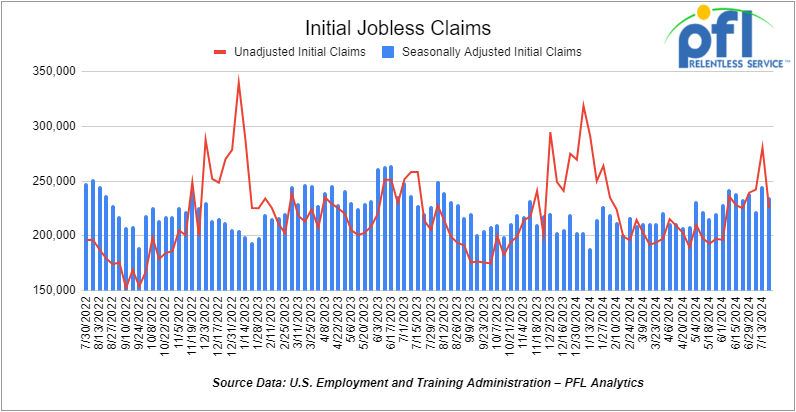

- Initial jobless claims seasonally adjusted for the week ending July 20th, 2024 came in at 245,000, down 10,000 people week-over-week.

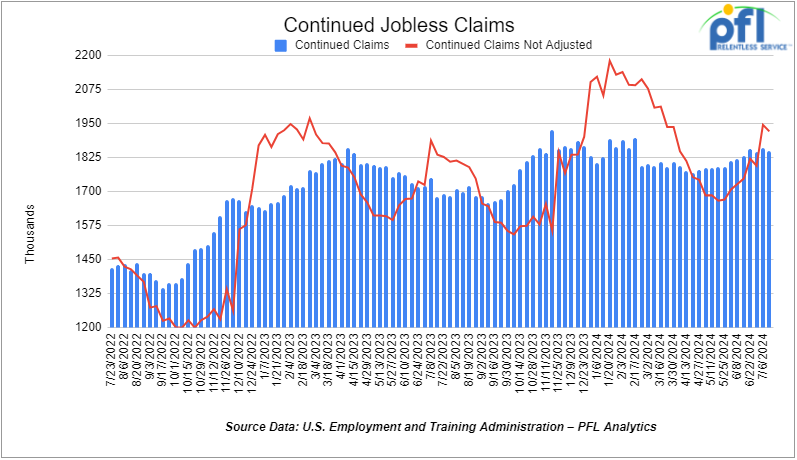

- Continuing jobless claims came in at 1.851 million people, versus the adjusted number of 1.86 million people from the week prior, down 9,000 people week-over-week.

Stocks closed higher on Friday of last week, but mixed week over week

The DOW closed higher on Friday of last week, up 654.27 points (1.64%), closing out the week at 40,589.34, up 301.71 points week-over-week. The S&P 500 closed higher on Friday of last week, up 59.88 points (1.11%), and closed out the week at 5,459.1, down -156.25 points week-over-week. The NASDAQ closed higher on Friday of last week, up 176.16 points (0.99%), and closed out the week at 17,357.88, down -369.05 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 40,941 this morning up 110 points.

Crude oil closed lower on Friday of last week and lower week over week.

WTI traded lower -$1.12 per barrel (-1.4%) on Friday of last week, to close at $77.16 per barrel, down $2.97 per barrel week-over-week. Brent traded down -US$1.24 per barrel (-1.5%) to close at US$81.13 per barrel on Friday of last week, down US$1.49 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for September delivery settled on Friday of last week at US$15.40 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 61.71 per barrel.

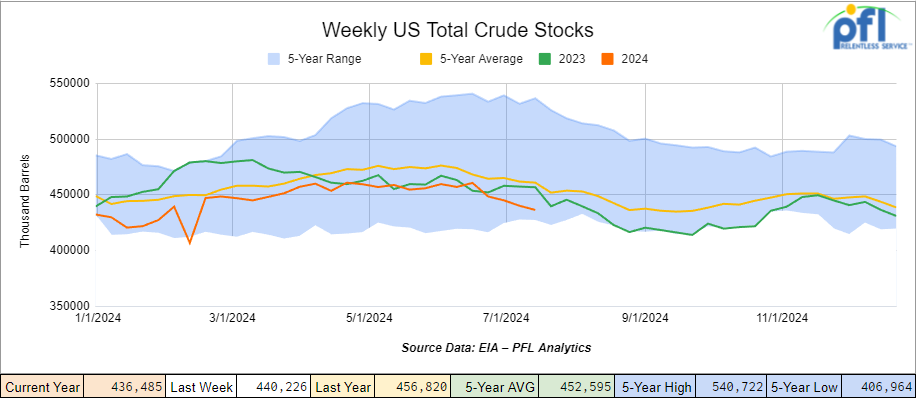

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.7 million barrels week-over-week. At 436.5 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

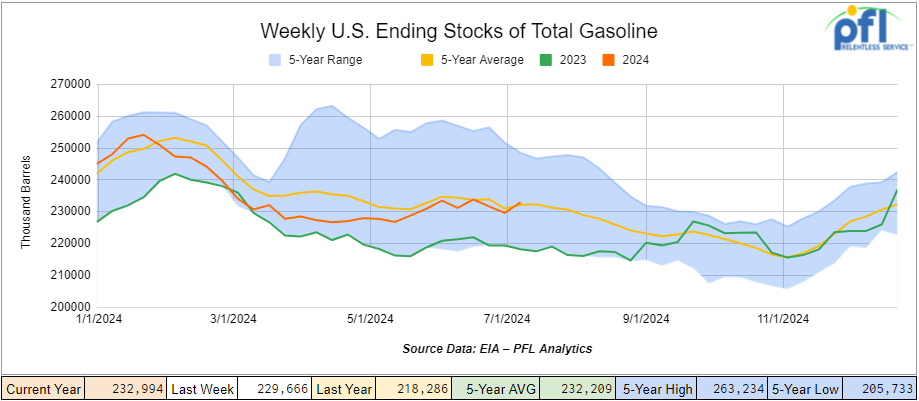

Total motor gasoline inventories decreased by 5.6 million barrels week-over-week and are 2% below the five-year average for this time of year.

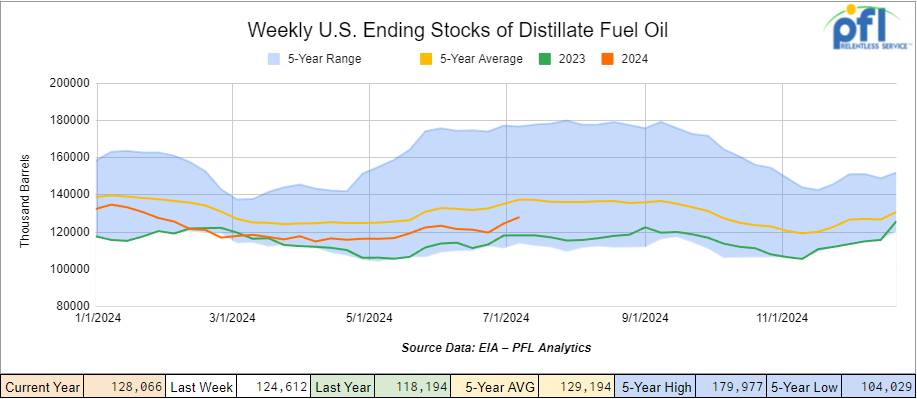

Distillate fuel inventories decreased by 2.8 million barrels week-over-week and are 9% below the five-year average for this time of year.

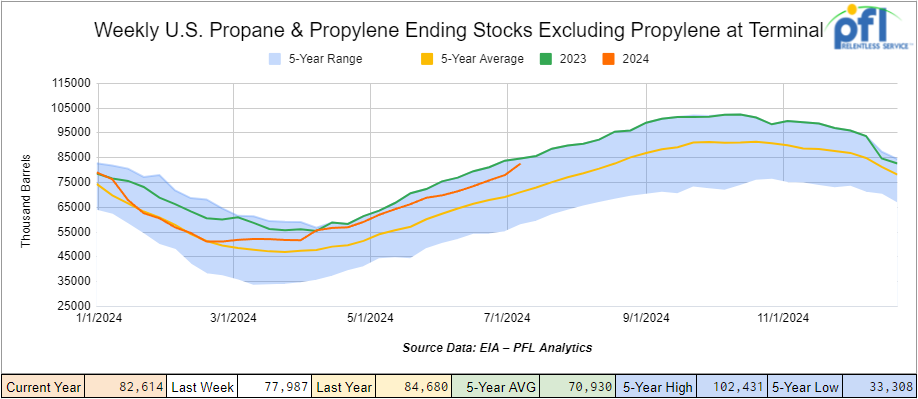

Propane/propylene inventories increased by 1.8 million barrels week-over-week and are 15% above the five-year average for this time of year.

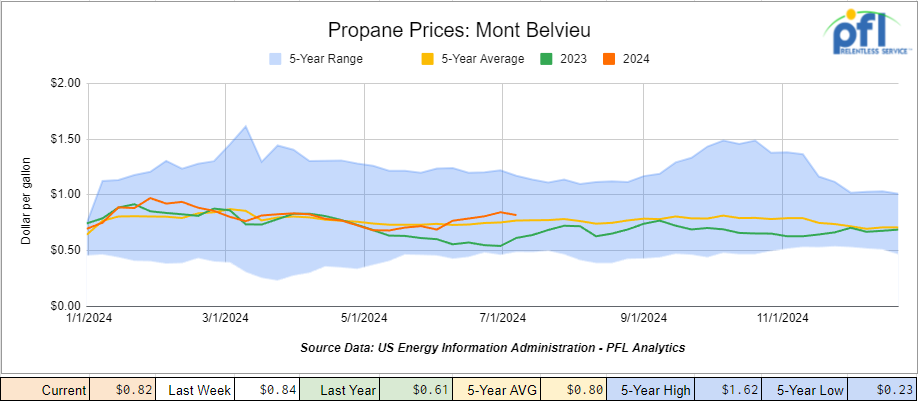

Propane prices closed at 78 cents per gallon, down 4 cents week-over-week, but up 14 cents year-over-year

Overall, total commercial petroleum inventories decreased by 4.6 million barrels during the week ending July 19th, 2024.

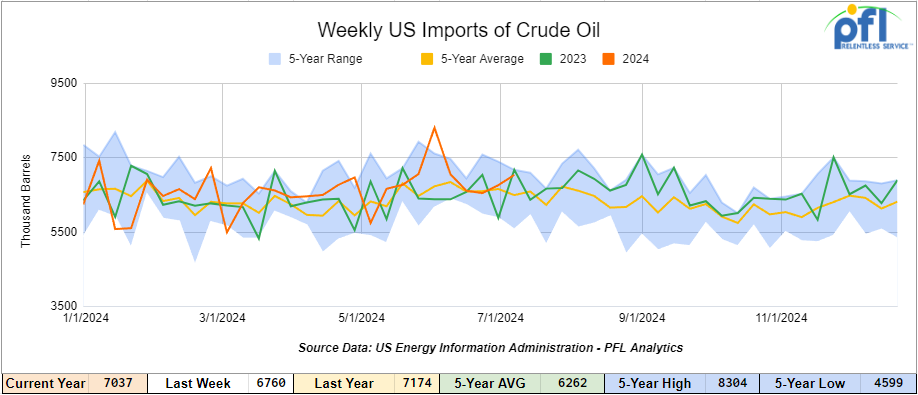

U.S. crude oil imports averaged 6.9 million barrels per day during the week ending July 19th, 2024 an increase of 166,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.8 million barrels per day, 2.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 778,000 barrels per day, and distillate fuel imports averaged 112,000 barrels per day during the week ending July 12th, 2024.

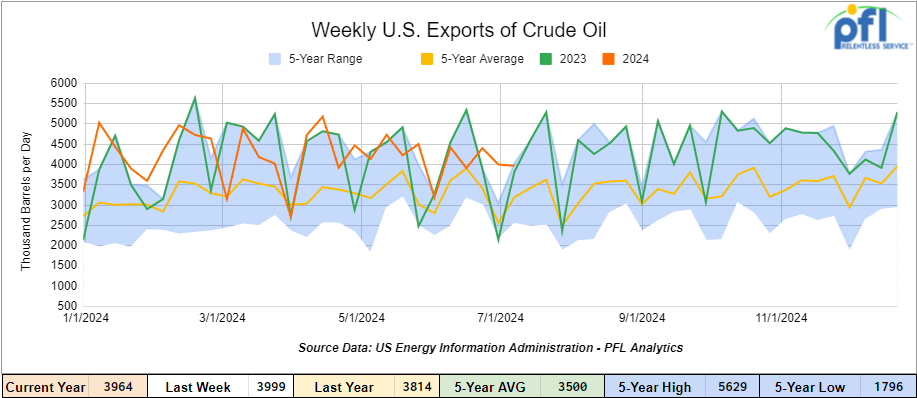

U.S. crude oil exports averaged 4.186 million barrels per day for the week ending July 19th, 2024, an increase of 222,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.138 million barrels per day.

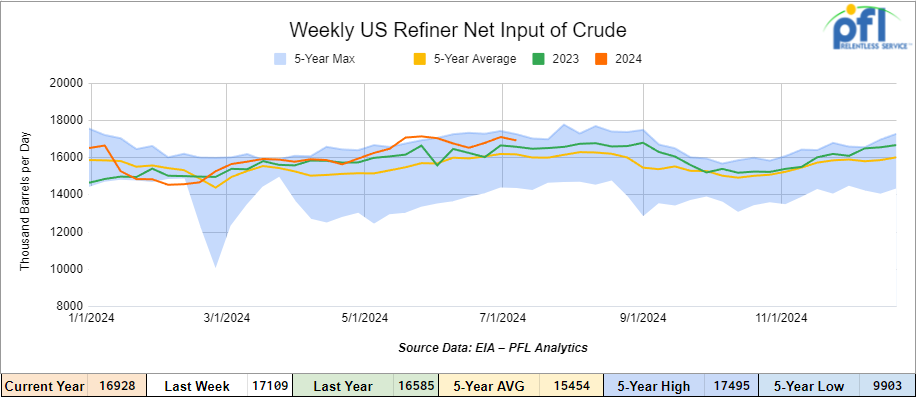

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending July 19, 2024, which was 521,000 barrels per day less week-over-week.

WTI is poised to open at $76.89, down 27 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 24th, 2024.

Total North American weekly rail volumes were down (-0.07%) in week 30, compared with the same week last year. Total carloads for the week ending on July 24th were 331,013.70, down (-3.69%) compared with the same week in 2023, while weekly intermodal volume was 327,234, up (+3.89%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Motor Vehicles and Parts, which was down (-17.4%). The most significant increase came from Grain which was up (+16.39%).

In the East, CSX’s total volumes were down (-2.84%), with the largest decrease coming from Motor Vehicles and Parts (-18.22%) while the largest increase came from Grain (34.19%). NS’s volumes were up (1.36%), with the largest increase coming from Grain (+17.49%) while the largest decrease came from Motor Vehicles and Parts (-32.11%).

In the West, BN’s total volumes were up (6.72%), with the largest increase coming from Grain (27.39%) while the largest decrease came from Coal down (-10.78%). UP’s total rail volumes were down (-0.37%) with the largest decrease coming from Coal, down (-20.91%) while the largest increase came from Grain which was up (+10.63%).

In Canada, CN’s total rail volumes were down (-10.92%) with the largest decrease coming from Grain, down (-37.40%) while the largest increase came from Other, up (+13.36%). CP’s total rail volumes were down (-2.13%) with the largest increase coming from Other (+102.78%) while the largest decrease came from Coal, down (-42.46%).

KCS’s total rail volumes were down (-14.9%) with the largest decrease coming from Motor Vehicles and Parts (-35.56%) and the largest increase coming from Grain (+16.62%).

Utility coal demand has been in a freefall. Markets ranging from lumber to steel, rock to grains are also weak. This is the same for America’s industrial economy more broadly. Housing construction remains depressed. Railroad labor costs are up and lower-margin intermodal freight is accounting for a greater share of what railroads are moving. Two U.S. rail giants – Union Pacific and Norfolk Southern – both managed to increase revenues and lower their operating costs last quarter, resulting in better operating ratios. Both railroads are becoming more efficient and productive, moving more freight per worker, with fewer locomotives and railcars. They’re able to do so, most importantly, by increasing network velocity. This, furthermore, is helping UP and NS win more business. It helps that the U.S. economy overall continues to grow steadily, because of healthy consumer spending. New threats are looming, including business concerns in advance of the November presidential election, and strike fears as the east and Gulf Coast dockworker contract expires after September. The STB has called a special meeting with all class 1’s to discuss lackluster growth and what to do about it.

Source Data: AAR – PFL Analytics

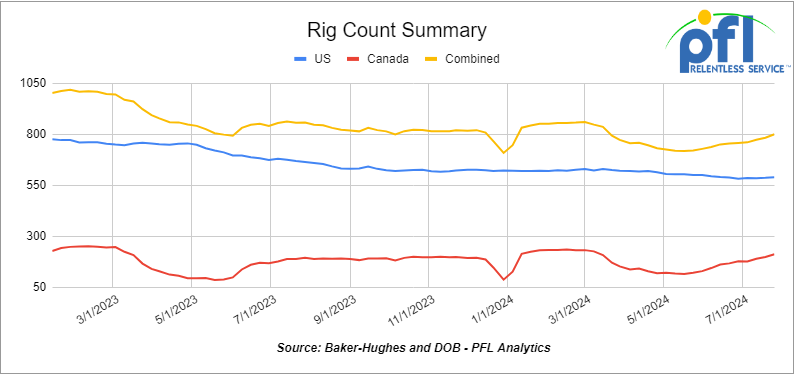

Rig Count

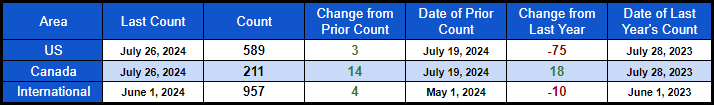

North American rig count was up by 17 rigs week-over-week. U.S. rig count was up by 3 rigs week-over-week, but down by -75 rigs year-over-year. The U.S. currently has 589 active rigs. Canada’s rig count was up by 14 rigs week-over-week, and up by 18 rigs year-over-year. Canada’s overall rig count is 211 active rigs. Overall, year-over-year, we are down -57 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,813 from 27,872, which was a loss of 59 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments rose by +1.9% week over week, CN’s volumes were higher by +0.7% week-over-week. U.S. shipments mostly higher. The NS was the sole decliner and was down by -5.6%.

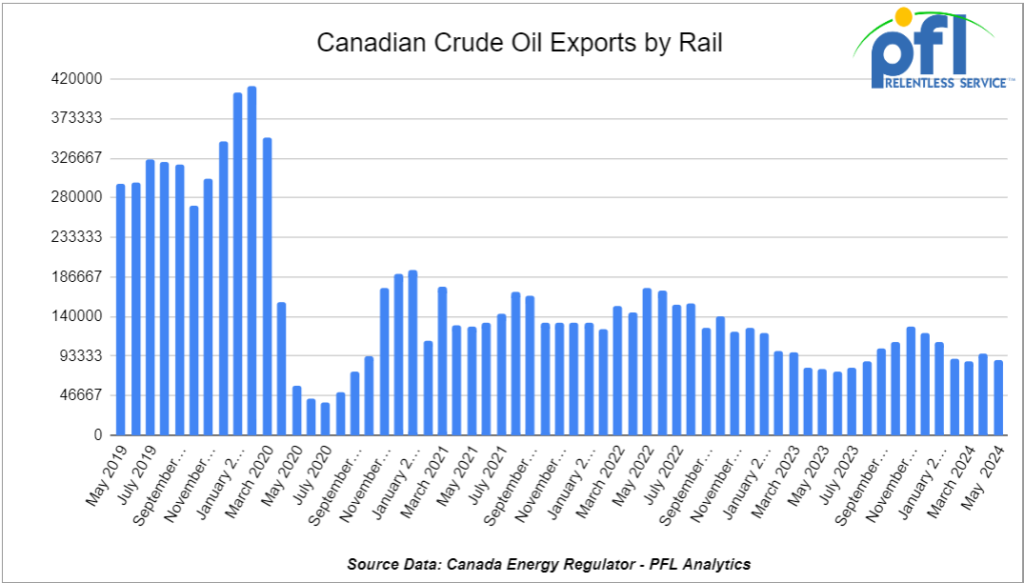

We are Watching Crude by Rail out of Canada

Crude by rail out of Canada declined month over month. The Canadian Energy regulator reported on July 24, 2024, that 89,141 barrels were exported during the month of May 2024 from 96,323 barrels in April of 2024 a decrease of 7,182 barrels per day month over month.

As shippers grapple with availability from Trans Mountains 600,000 barrel per day pipeline expansion, coupled with weaker Asian demand and demand here in the U.S., expect increased volatility as fundamentals settle in. Prices for the Canadian barrel were affected in a negative way for crude exported via the Trans Mountain expansion when Exxon shuttered its 252,000 barrel-per-day Joliet refinery. The refinery was shut down on July 15 due to severe weather but is expected to come onstream mid-August.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines and for raw bitumen, which is shipped as a non-haz product and is not able to flow in pipelines. It is competitive with pipeline tolls and is a growing market to keep an eye on. Other factors would be existing long-term contractual commitments and basis -we really need to see basis the WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to -17 per barrel for sustained periods of time to make economic sense.

We are watching LNG up in Canada

As the U.S. is halting or trying to delay the expansion of natural gas consumption in the U.S, Canada surprisingly is embracing it. Looking for frac sand from Wisconsin several projects are set to come online in British Columbia, Canada.

One of those projects is LNG Canada who is preparing to come online as the Canadian LNG industry is taking off including the fractionation of new wells. LNG Canada is a joint venture company of five global energy companies with substantial experience in liquefied natural gas (LNG) – Shell, PETRONAS, PetroChina, Mitsubishi Corporation and KOGAS. The facility will initially export up to 14 million tons (1.84 bcf per day natural gas equivalent) of LNG per annum.

LNG CANADA

Source: LNG Canada – PFL Analytics

Steve Glanville, president and chief executive officer of STEP Energy Services Ltd., said his company is engaged in conversations with large producers committed to Canadian energy. With LNG Canada’s first phase approved and more projects on the way, he is hopeful for increased activity. STEP is focusing on completions and transportation of its proppant from Wisconsin.

The frack market is seemingly more balanced than it has been and operators are more open to heading to RFPs more frequently to secure better pricing or top-end next-generation equipment.

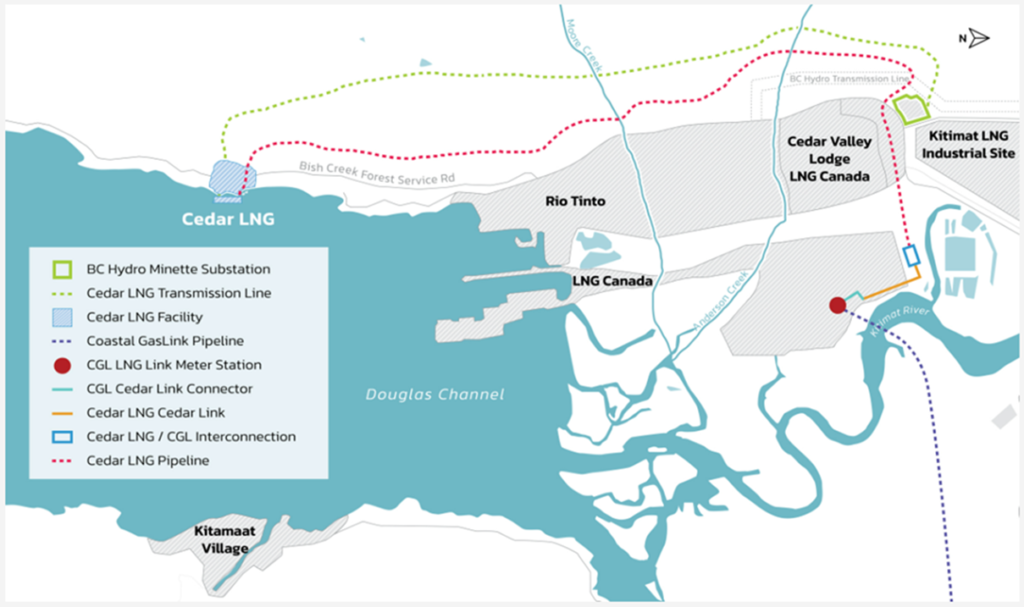

Another Canadian project is ready to go – Cedar LNG. Cedar LNG is a partnership between Pembina Pipeline Corporation (Pembina) and the Haisla Nation to develop a proposed floating LNG facility in Kitimat, B.C., within the traditional territory of the Haisla Nation. Cedar LNG is the world’s first Indigenous majority-owned LNG project, and claiming to have one of the cleanest environmental profiles in the world, the project will provide opportunities for both the Haisla Nation and the region, the company said. The project is expected to be online in 2028 and all regulatory approvals have been met and early construction has begun.

Source: Cedar LNG – PFL Analytics

The developments in Canada are great news for rail. More and more frac sand will be moved from Wisconsin to British Columbia helping the Wisconsin frac sand producer. There are still ample frac sand cars in storage and available for immediate lease or purchase here in the U.S. Not only that, but condensate produced by the LNG process will be railed to markets from the Kitamaat area. Another plus for the U.S. is that discussions are underway on moving rigs and idle equipment to Canada from the U.S. We can only hope that the U.S. war against natural gas and LNG will quickly be abandoned, and we can participate in Canada’s party. Stay tuned to PFL for further details, as we are watching this one.

Lease Bids

- 8, 28-30K any type Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 80, 25.5K-29K any type Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 25, 25.5K DOT 111 Tanks needed off of UP in LA for 1-5 Years. Cars are needed for use in Lubricant service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 30, 33K Pressure Tanks needed off of Any Class 1 in Any Location for 6 Months. Cars are needed for use in Propane service. Needed for Winter

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 10, 25.5 117J Tanks needed off of All class ones in Chicago for Epoxy Resin. Cars are clean 5 years

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 200, 30K any type Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 10, 30k any type Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 10, 3250 thru hatch Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Agg service.

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 50, 5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 53, 2 containers, Flats Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 60, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website