“The return we reap from generous actions is not always evident.”

– Francesco Guicciardini

Jobs Update

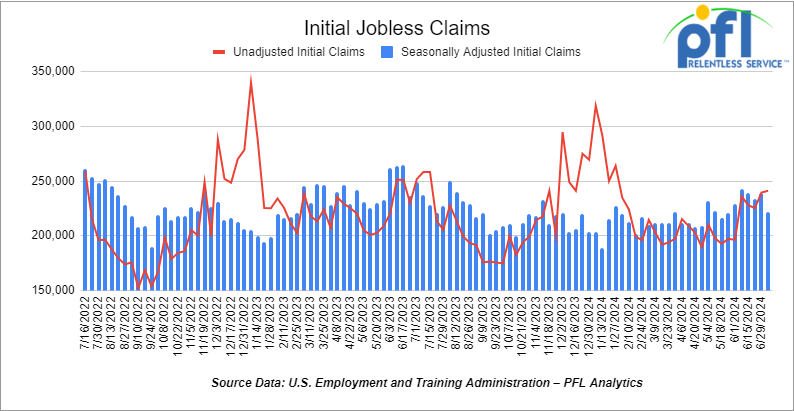

- Initial jobless claims seasonally adjusted for the week ending July 6th, 2024 came in at 222,000, down -17,000 people week-over-week.

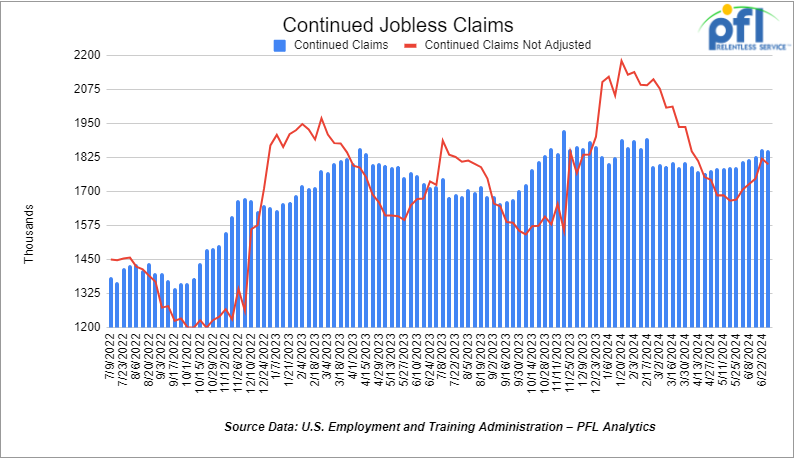

- Continuing jobless claims came in at 1.852 million people, versus the adjusted number of 1.856 million people from the week prior, down -4,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 247.15 points (0.62%), closing out the week at 40,000.9, up 625.03 points week-over-week. The S&P 500 closed higher on Friday of last week, up 30.18 points (0.55%), and closed out the week at 5,615.35, up 154.87 points week-over-week. The NASDAQ closed higher on Friday of last week, up 115.04 points (0.63%), and closed out the week at 18,398.45, up 45.69 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 40,493 this morning up 192 points.

Crude oil closed lower on Friday of last week and lower week over week.

WTI traded lower -$0.41 per barrel (-0.5%) on Friday of last week, to close at $82.21 per barrel, down $0.95 per barrel week-over-week. Brent traded down -US$0.37 per barrel (-0.4%) to close at US$85.03 per barrel on Friday of last week, down US$1.51 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for August delivery settled Friday at US$13.60 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 67.41 per barrel.

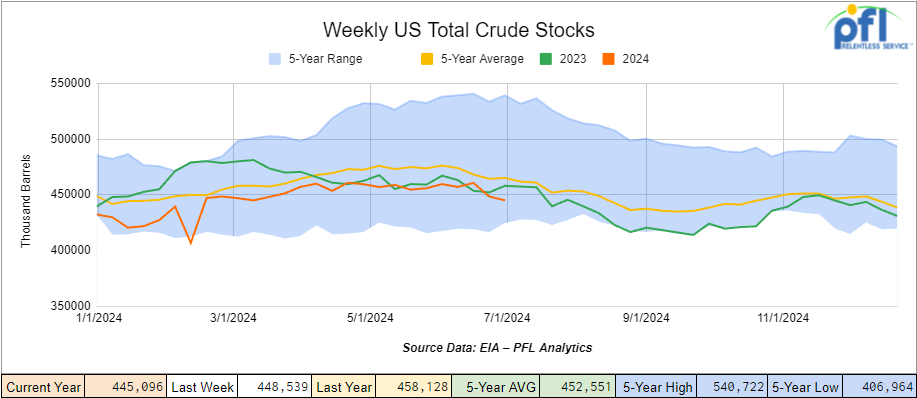

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.4 million barrels week-over-week. At 445.1 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

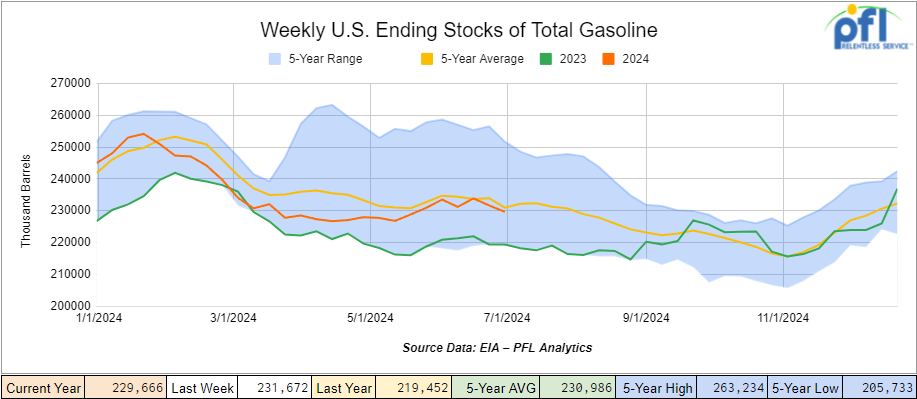

Total motor gasoline inventories decreased by 2 million barrels week-over-week and are 1% below the five-year average for this time of year

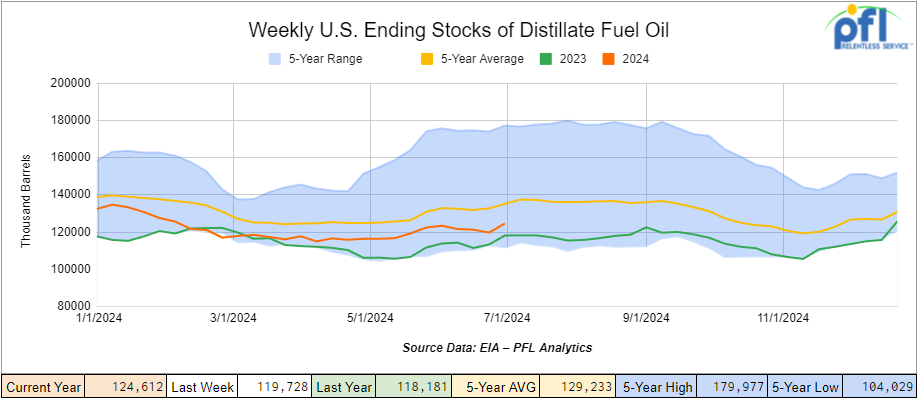

Distillate fuel inventories increased by 4.9 million barrels week-over-week and are 8% below the five-year average for this time of year.

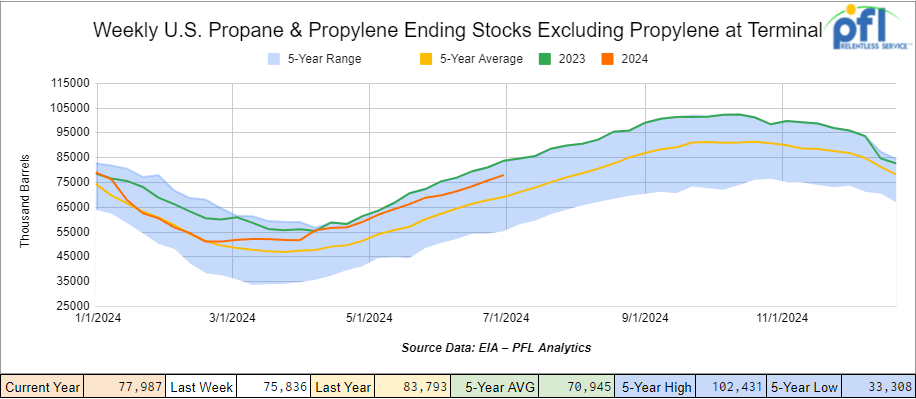

Propane/propylene inventories increased by 2.2 million barrels week-over-week and are 12% above the five-year average for this time of year.

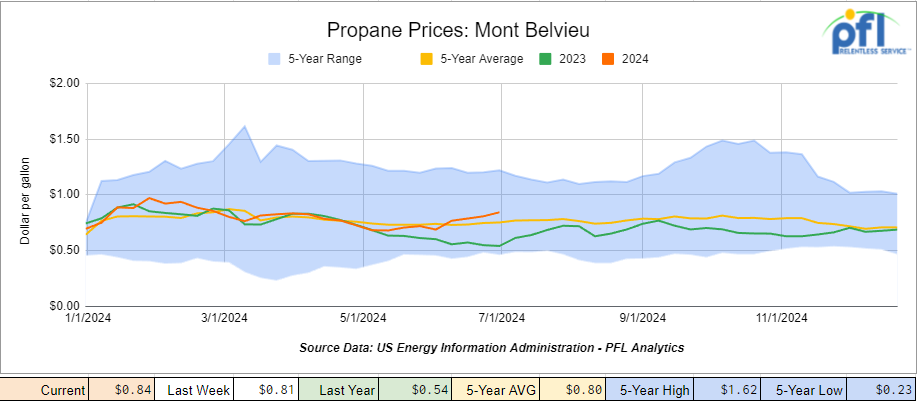

Propane prices closed at 84 cents per gallon, up 3 cents week-over-week, and up 30 cents year-over-year.

Overall, total commercial petroleum inventories increased by 2.6 million barrels during the week ending July 5th, 2024.

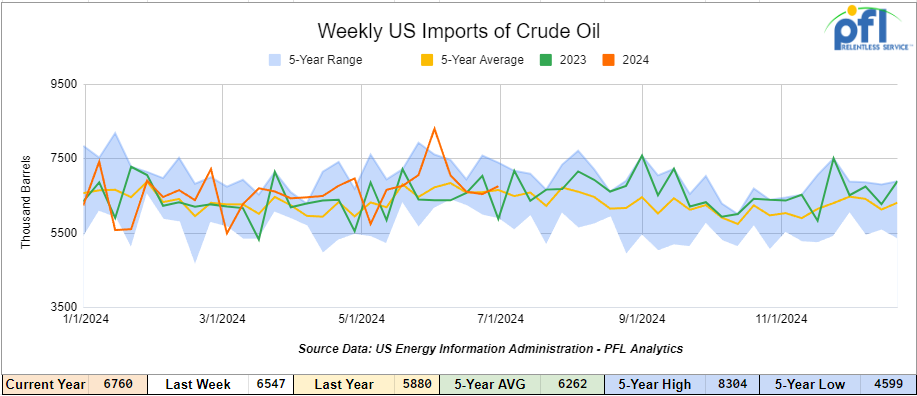

U.S. crude oil imports averaged 6.8 million barrels per day during the week ending July 5th, 2024, an increase of 214,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 5.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 768,000 barrels per day, and distillate fuel imports averaged 139,000 barrels per day during the week ending July 5th, 2024.

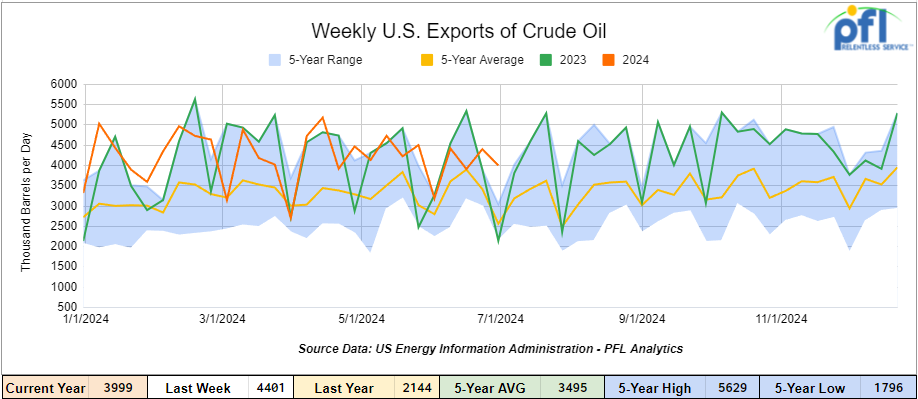

U.S. crude oil exports averaged 3.999 million barrels per day for the week ending July 5th, 2024, a decrease of -402,000 per day week-over-week. Over the past four weeks, crude oil exports averaged 4.182 million barrels per day.

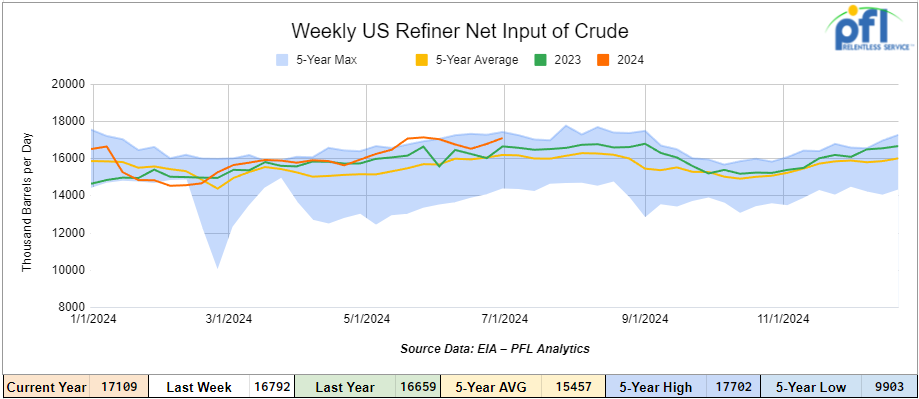

U.S. crude oil refinery inputs averaged 17.1 million barrels per day during the week ending July 5, 2024, which was 317,000 barrels per day more week-over-week.

WTI is poised to open at $82.29, up 0.08 per barrel from Friday’s close.

North American Rail Traffic

Week Ending July 10th, 2024.

Total North American weekly rail volumes were up (5.79%) in week 28, compared with the same week last year. Total carloads for the week ending on July 10th were 318,872, up (1.03%) compared with the same week in 2023, while weekly intermodal volume was 293,250, up (+11.5%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-13.21%). The most significant increase came from Grain which was up (+34.47%).

In the East, CSX’s total volumes were up (2.54%), with the largest decrease coming from Coal (-4.79%) while the largest increase came from Grain (49.13%). NS’s volumes were up (9.26%), with the largest increase coming from Coal (+16.61%) while the largest decrease came from Motor Vehicles and Parts (-12.08%).

In the West, BN’s total volumes were up (7.08%), with the largest increase coming from Grain (66.31%) while the largest decrease came from Coal down (-18.86%). UP’s total rail volumes were up (1.39%) with the largest decrease coming from Coal, down (-22.49%) while the largest increase came from Grain which was up (+17.6%).

In Canada, CN’s total rail volumes were up (19.89%) with the largest decrease coming from Motor Vehicles and Parts, down (-27.41%) while the largest increase came from Intermodal Units, up (+113.9%). CP’s total rail volumes were up (5.53%) with the largest increase coming from Intermodal (+37.6%) while the largest decrease came from Coal, down (-23.31%).

KCS’s total rail volumes were down (-3.82%) with the largest decrease coming from Coal (-27%) and the largest increase coming from Motor vehicles and Parts (+84.19%).

Source Data: AAR – PFL Analytics

Rig Count

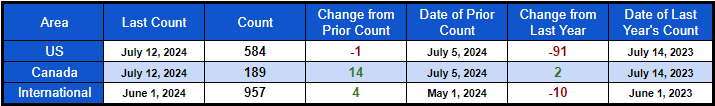

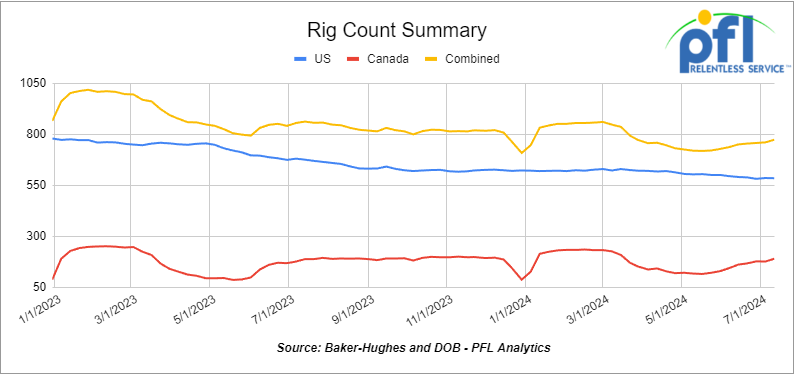

North American rig count was up by 13 rigs week-over-week. U.S. rig count was down by -1 rigs week-over-week, and down by -91 rigs year-over-year. The U.S. currently has 584 active rigs. Canada’s rig count was up by 14 rigs week-over-week, and up by 2 rigs year-over-year. Canada’s overall rig count is 189 active rigs. Overall, year-over-year, we are down -89 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,293 from 28,579, which was a loss of 286 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments fell by – 0.3% week over week, CN’s volumes were lower by -3.5% week-over-week. U.S. shipments were lower across the board. The NS had the largest percentage decrease and was down by -20.1%.

We were Watching the Calgary Stampede Last Week

Folks, PFL attended the Calgary Stampede last week in full force. It is turning out to be one of the must-go-tol rail events to attend in North America. We would rank it up there with MARS in Chicago in January and SWARS’ fall conference. Storage companies from all over the U.S. and Canada were in attendance, together with all leasing companies and manufactures. Of course, there are a lot of shippers in Calgary itself, but shippers from all over North America gathered in Calgary last week. Events and company sponsored get-togethers were numerous and hard to quantify. Lots of deals on the table and getting done at this year’s Calgary Stampede. For more information on The Calgary Stampede, call PFL today!

We are Watching the Biden Administration and the SPR

Folks, on Monday of last week we reported the following:

“Surprise surprise – everyone saw this one coming. In the latest and greatest the Biden administration has not awarded contracts in recent solicitation to purchase an additional 6 million barrels of sour crude for delivery to the countries Strategic Petroleum Reserves. The crude was supposed to be delivered between September and January. At the time of the solution crude was trading around $75 per barrel but has recently blown through the self-imposed price cap set by the Biden Administration of $79.00 per barrel. It is unclear why they held off on awarding the contracts.”

On Wednesday of last week, the DOE announced the following:

Today, the U.S. Department of Energy’s (DOE) Office of Petroleum Reserves announced a new solicitation for up to 4.5 million barrels of oil for delivery to the Strategic Petroleum Reserve’s Bayou Choctaw site from October through December. Building on the successful direct purchase strategy that has secured nearly 40 million barrels and the completion of the Bayou Choctaw’s Life Extension 2 Project, this action is another step in DOE’s strategy to make consistent solicitations when oil prices are favorable for taxpayers. DOE continues to aim for $79 per barrel or less, significantly lower than the average of about $95 per barrel DOE received for 2022 emergency SPR sales. To date, DOE has purchased a total of 38.6 million barrels of oil for delivery to the Big Hill SPR site for an average price of $77 per barrel, as well as accelerated nearly 4 million barrels of exchange returns, pursuant to its strategy to refill the SPR. DOE will continue to evaluate options to refill the SPR while securing a good deal for taxpayers, taking into account planned exchange returns and market developments.

Today’s announcement advances the President’s commitment to safeguard and replenish this critical energy security asset. This follows his historic release from the SPR to address the significant global supply disruption caused by Putin’s war on Ukraine and help keep the domestic market well supplied, ultimately helping to bring down prices for American consumers and businesses. Analysis from the Department of the Treasury indicates that SPR releases in 2022, along with coordinated releases from international partners, reduced gasoline prices by as much as 40 cents per gallon.

Bids for the solicitation will be due no later than 11:00 a.m. Central Time on July 18, 2024.

These solicitations are in addition to the 9 million barrels we have already secured for purchase into Big Hill for delivery during the same time period of September, October, and November.

The Administration’s ongoing three-part replenishment strategy to get the best deal for taxpayers while increasing SPR stocks includes: (1) Direct purchases with revenues from emergency sales; (2) Exchange returns that include a premium of oil above the volume delivered; and (3) Securing legislative solutions that avoid unnecessary sales unrelated to supply disruptions. DOE has already secured cancellation of 140 million barrels of congressionally mandated sales scheduled for Fiscal Years 2024 through 2027. These cancellations have resulted in significant progress toward replenishment.

The SPR continues to be the world’s largest supply of emergency crude oil. The federally owned oil stocks are stored in underground salt caverns at four sites in Texas and Louisiana. Through scheduled maintenance periods and the Life Extension 2 program, DOE continues to prioritize the operational integrity of the SPR to ensure that it can continue to meet its mission as a critical energy security asset. The SPR has a long history of protecting the economy and American livelihoods in times of emergency oil shortages.

Folks, they are making solicitations to buy crude at below market prices and then don’t purchase it – who would sell at a discount. Don’t know why they are doing this – we report and you decide.

We are Watching Some Key Economic Indicators

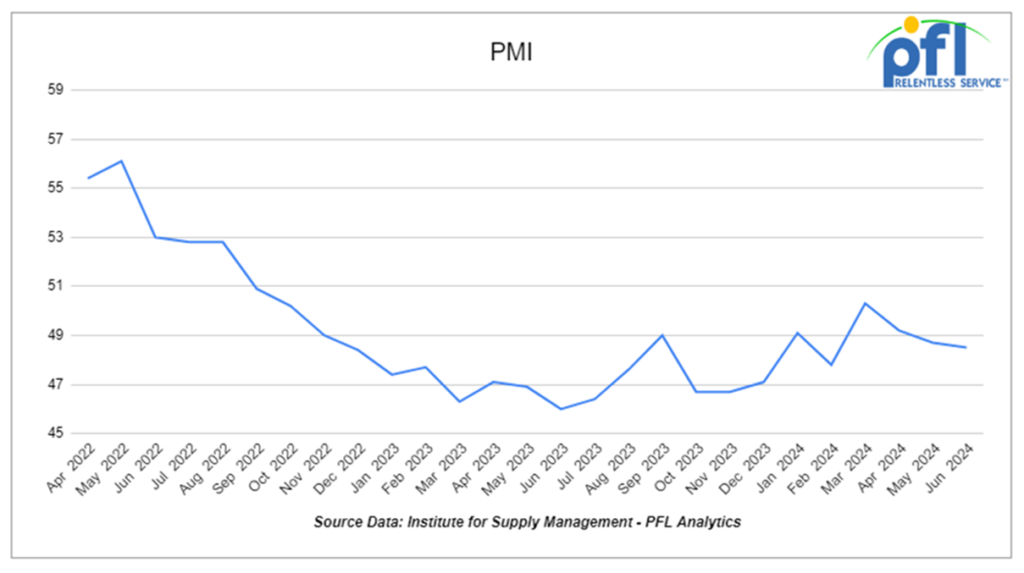

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50.

The Manufacturing PMI in June was 48.5%, down from 48.7% in May and 49.2% in April. This is the third straight monthly contraction in PMI. In a bit of better news: the new orders subindex rose to 49.3% in June from 45.4% in May.

The Services PMI unexpectedly fell to 48.8% in June, down from 53.8% in May and the second time in three months in which it’s been in “contraction” territory (below 50%). The decline in the index in June was due largely to a big drop in new orders.

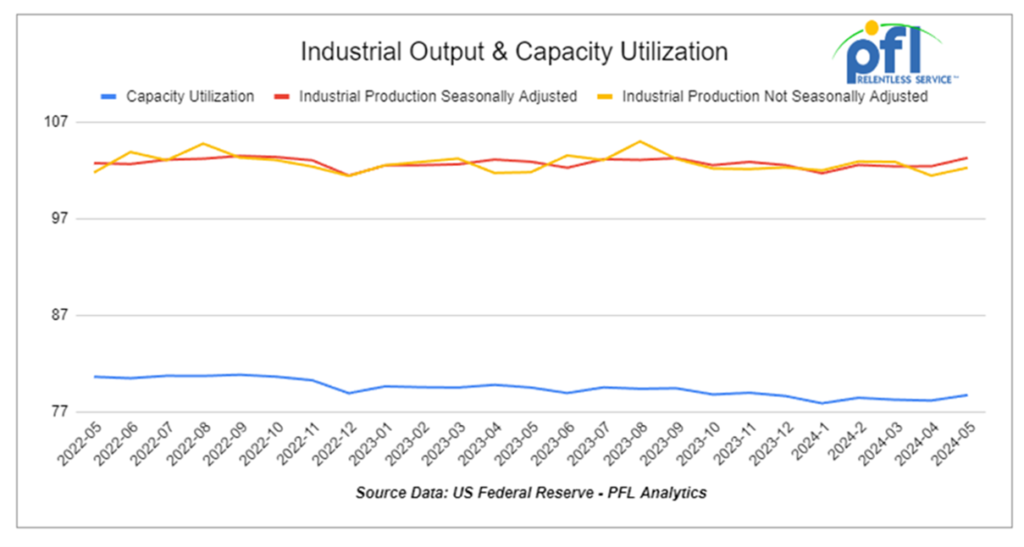

Industrial Output & Capacity Utilization

Manufacturing accounts for approximately 75% of total output. manufacturing output in May was up a preliminary 0.9% from April 2024, much better than the 0.4% decline in April and 0.1% decline in March. If this holds it would be the biggest gain in 10 months.

There was a big decline in output when the pandemic hit, a rapid recovery in the second half of 2020 and in 2021, but since early 2023 there has been very little change. Until there is, numerous rail carload categories will be constrained.

Industry sectors that have been trending higher over the past six months include railroad rolling stock, paper products, grain mill products, and motor vehicles and parts. Sectors trending down over the past six months include iron and steel, plastic resins, and agricultural chemicals. For many sectors, a trend up or down isn’t discernible — petroleum refineries, wood products, and nonmetallic minerals fit this

Capacity utilization is a measure of how fully firms are using the machinery and equipment — was up slightly from April in May..

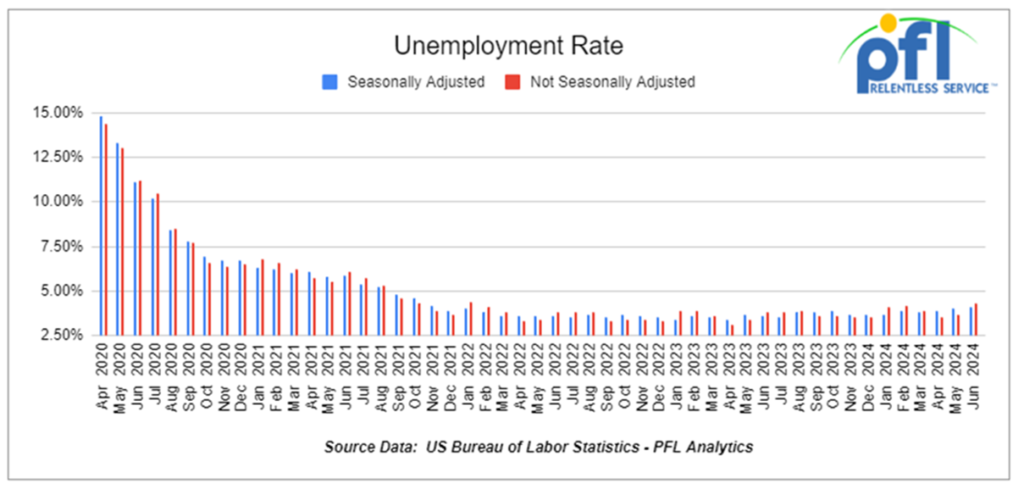

U.S Unemployment

On July 5, the BLS reported that a preliminary 206,000 net new jobs were created in June 2024, and figures for April and May 2024 were revised substantially downward. May was revised down to 218,000 new jobs and April to 108,000.

According to the BLS, so far this year, net new job gains have totaled 1.33 million. The official unemployment rate was 4.1% in June, up 0.1% month over month.

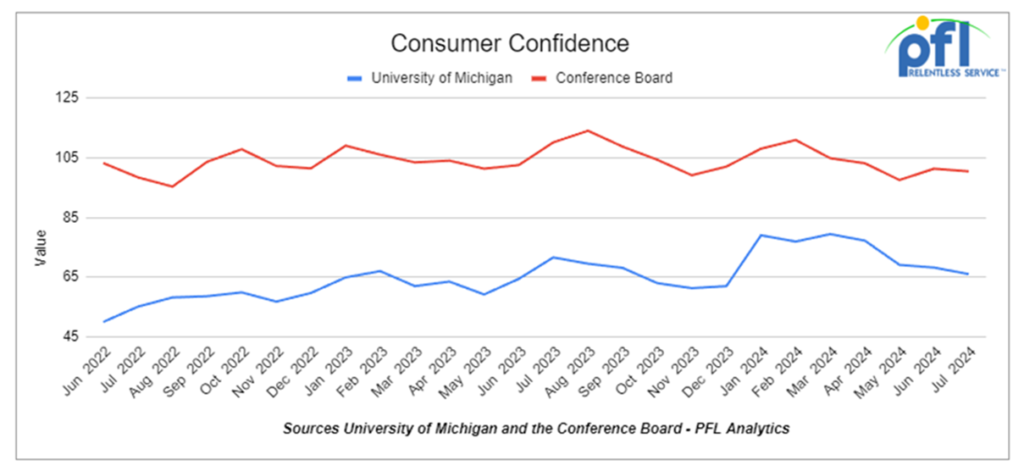

Consumer Confidence

The Conference Board’s Index of Consumer Confidence decreased to 100.4 in June from 101.3.

The Index of Consumer Sentiment from the University of Michigan decreased from 68.2 in June to 66.0 in July.

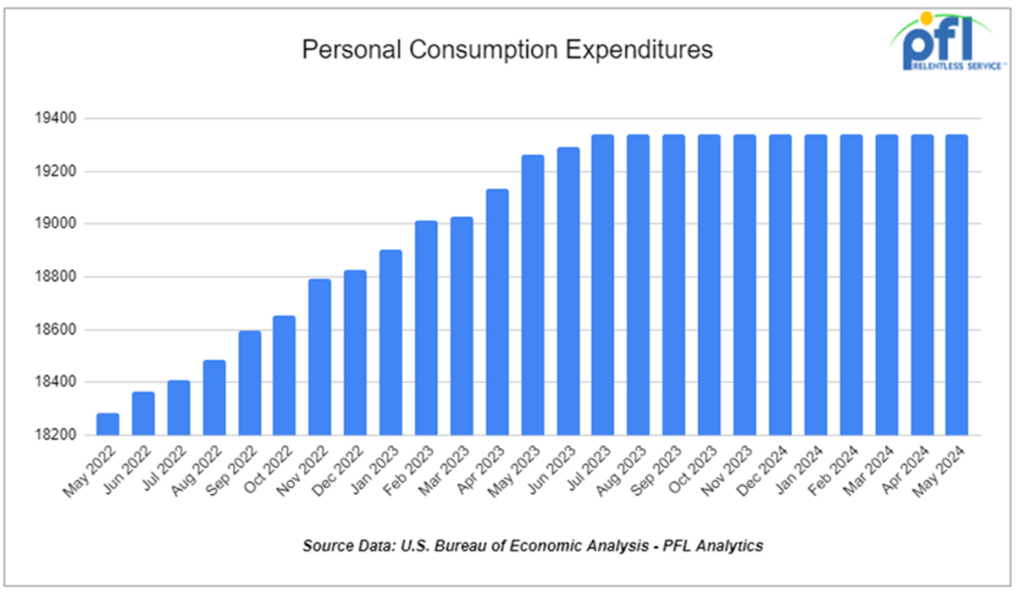

Consumer Spending

In May 2024, total consumer spending adjusted for inflation rose a preliminary 0.3% over April 2024. This follows a drop of .1% in April and gain of .4% in March. Year-over-year inflation-adjusted total spending in May 2024 was up 2.4%.

Inflation-adjusted spending on goods rose a preliminary 0.6% in May, after a 0.7% decline in April 2024. Inflation-adjusted spending on services rose 0.1% in May, the same gain as in April and the ninth straight month-to-month increase.

Lease Bids

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 200, 30K Any Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 80, 25.5K-29K Any Tanks needed off of NS or CSX in Northeast for 1-5 Years. Cars are needed for use in Crude service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 53, 2 containers, Flats Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 15, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 25.5K, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website