“Spectacular achievement is always preceded by unspectacular preparation.”

– Robert H. Schuller

Jobs Update

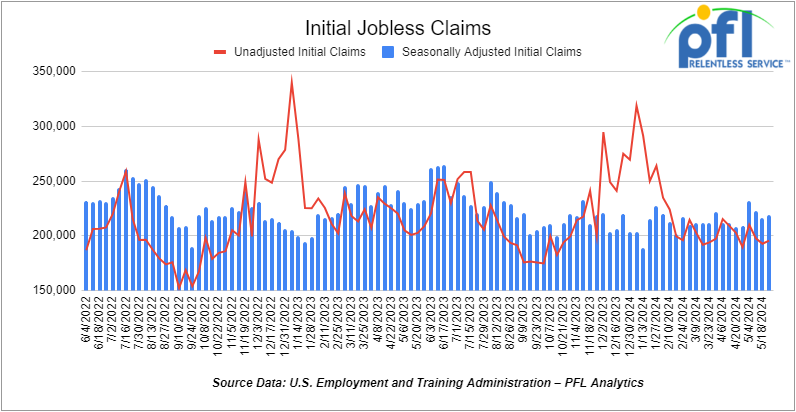

- Initial jobless claims seasonally adjusted for the week ending May 25th, 2024 came in at 219,000, up 3,000 people week-over-week.

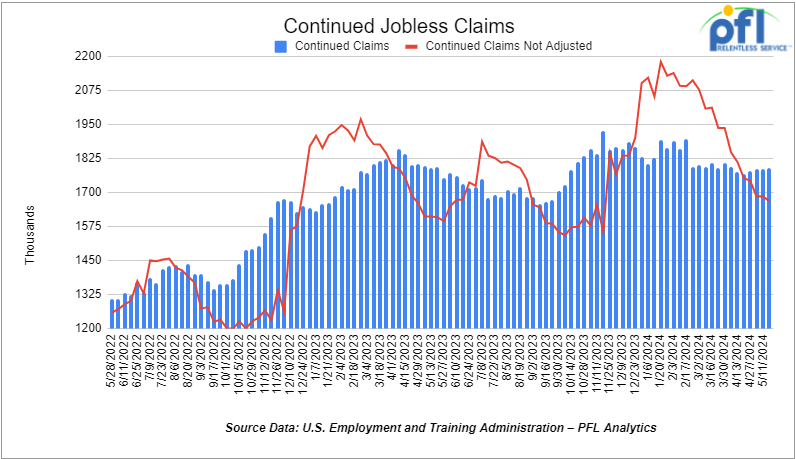

- Continuing jobless claims came in at 1.791 million people, versus the adjusted number of 1.787 million people from the week prior, up 4,000 people week-over-week.

Stocks closed mixed on Friday of last week and mixed lower week over week

The DOW closed higher on Friday of last week, up 574.84 points (1.51%), closing out the week at 38,686.32, down -1,317.27 points week-over-week. The S&P 500 closed higher on Friday of last week, up 42.03 points (0.8%), and closed out the week at 5,277.51, down -25.76 points week-over-week. The NASDAQ closed lower on Friday of last week, down -2.06 points (-0.01%), and closed out the week at 16,735.02, up 49.05 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 38,757 this morning down 34 points.

Crude oil closed lower on Friday of last week – lower week over week.

WTI traded lower -$0.92 per barrel (-1.2%) on Friday of last week, to close at $76.99 per barrel, down -$0.73 per barrel week-over-week. Brent traded down -US$0.24 per barrel (-0.3%) to close at US$81.62 per barrel on Friday of last week, down -US$0.50 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for July delivery settled Friday at US$11.75 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$65.66 per barrel.

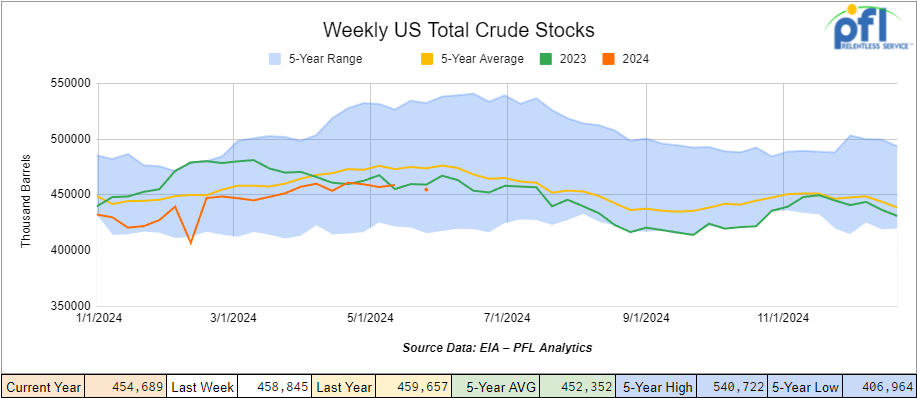

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.2 million barrels week-over-week. At 454.7 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

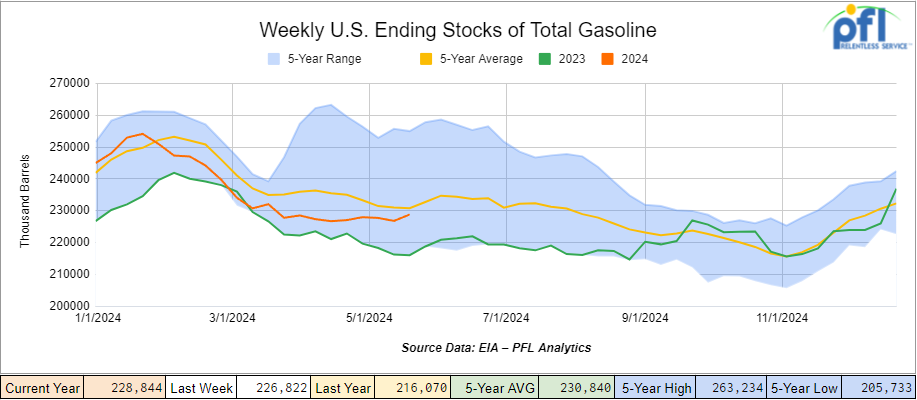

Total motor gasoline inventories increased by 2 million barrels week-over-week and are 1% below the five-year average for this time of year.

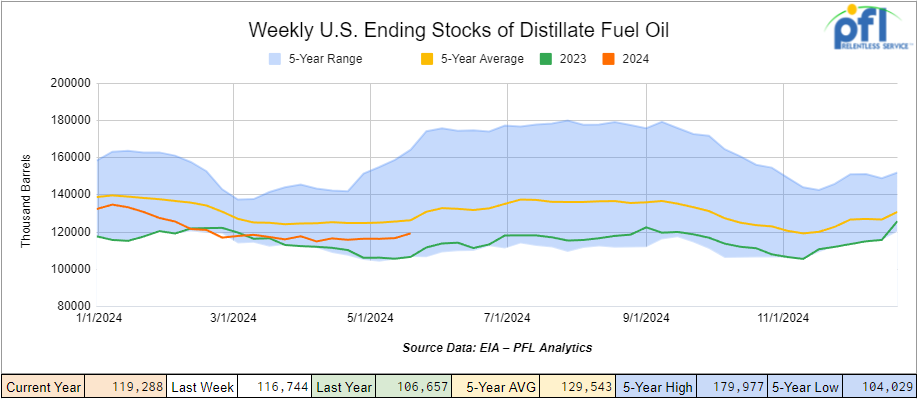

Distillate fuel inventories increased by 2.5 million barrels week-over-week and are 6% below the five-year average for this time of year.

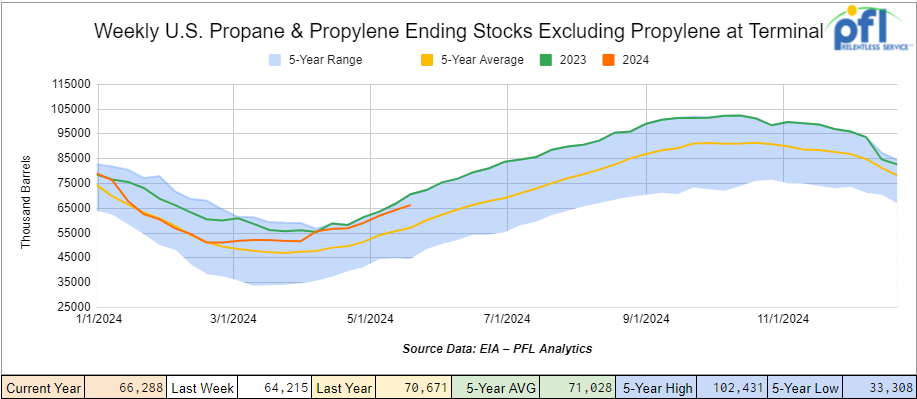

Propane/propylene inventories increased by 2.1 million barrels week-over-week and are 15% above the five-year average for this time of year.

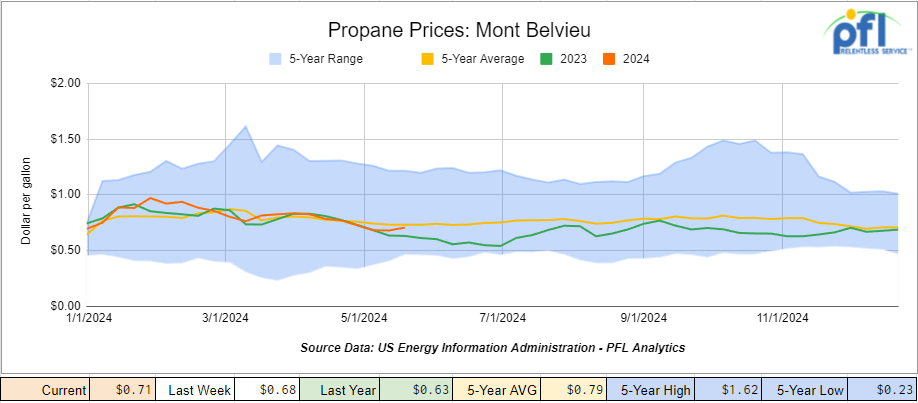

Propane prices closed at 71 cents per gallon, up 3 cents week-over-week, but down 8 cents year-over-year.

Overall, total commercial petroleum inventories increased by 12.7 million barrels during the week ending May 24th, 2024.

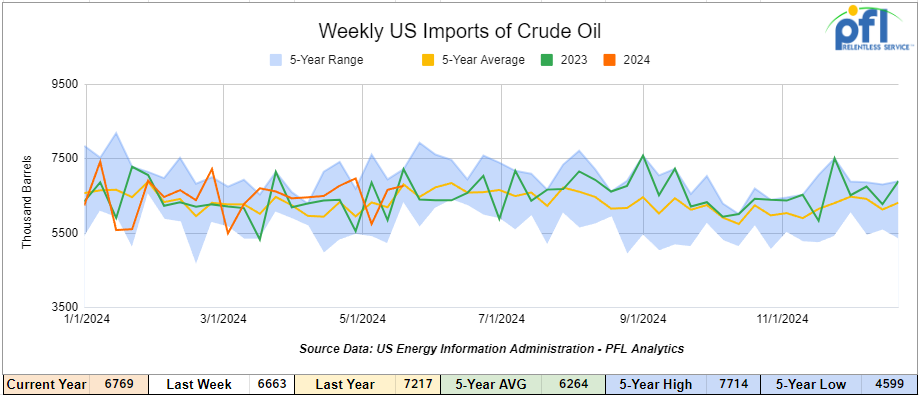

U.S. crude oil imports averaged 6.8 million barrels per day during the week ending May 24th, 2024, an increase of 106,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.8 million barrels per day, 6.5% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 1.1 million barrels per day, and distillate fuel imports averaged 165,000 barrels per day during the week ending May 24th, 2024.

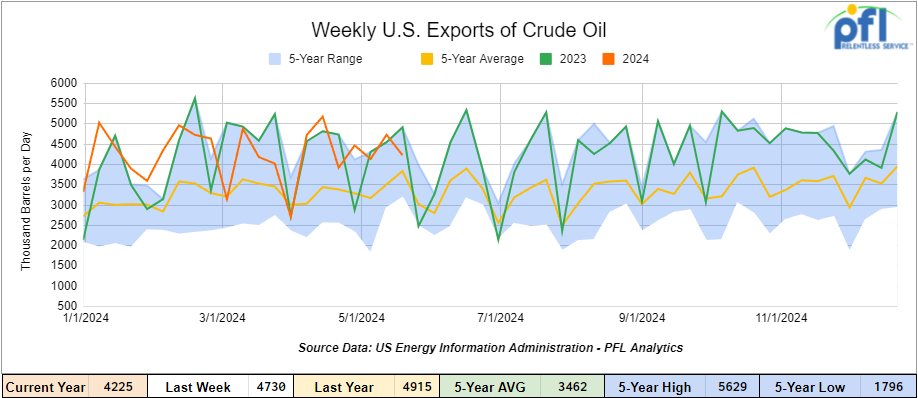

U.S. crude oil exports averaged 4.225 million barrels per day for the week ending May 29th, 2024, a decrease of -505,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.39 million barrels per day.

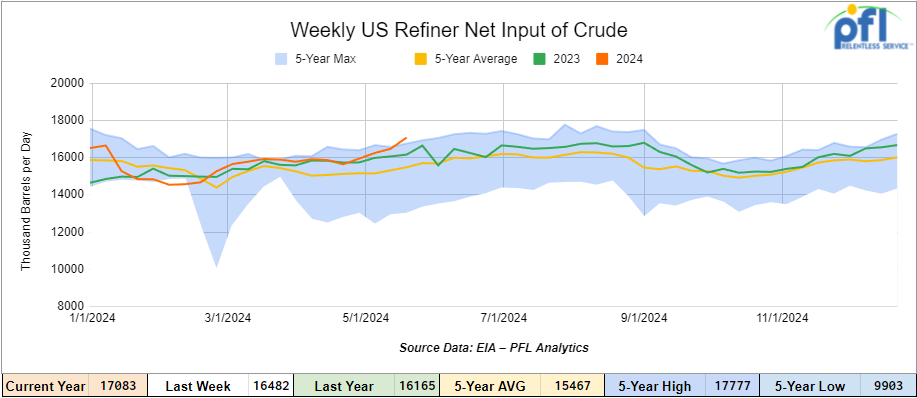

U.S. crude oil refinery inputs averaged 17.1 million barrels per day during the week ending May 24, 2024, which was 601,000 barrels per day more week-over-week.

WTI is poised to open at $77.07, up 8 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 29th, 2024.

Total North American weekly rail volumes were up (1.07%) in week 22, compared with the same week last year. Total carloads for the week ending on May 29th were 339,400, down (-4.41%) compared with the same week in 2023, while weekly intermodal volume was 333,278, up (+7.34%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Coal, which was down (-19.84%). The most significant increase came from Petroleum and Petroleum Products which was up (+12.05%).

In the East, CSX’s total volumes were up (3.89%), with the largest decrease coming from Other (-7.09%) while the largest increase came from Petroleum and Petroleum Products (21.82%). NS’s volumes were up (1.39%), with the largest increase coming from Forest Products (+12.97%) while the largest decrease came from Coal (-18.6%).

In the West, BN’s total volumes were up (4.78%), with the largest increase coming from Petroleum and Petroleum Products (37.15%) while the largest decrease came from Coal, down (-26.29%). UP’s total rail volumes were up (0.51%) with the largest decrease coming from Coal, down (-23.09%) while the largest increase came from Grain which was up (+35.98%).

In Canada, CN’s total rail volumes were down (-7.87%) with the largest decrease coming from Grain, down (-38.56%) while the largest increase came from Nonmetallic Minerals, up (+15.08%). CP’s total rail volumes were down (-7.38%) with the largest increase coming from Other (+60%) while the largest decrease came from Coal, down (-69.97%).

KCS’s total rail volumes were down (-14.21%) with the largest decrease coming from Nonmetallic Minerals (-26.05%) and the largest increase coming from Other (+17.35%).

Source Data: AAR – PFL Analytics

Rig Count

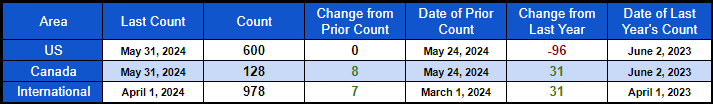

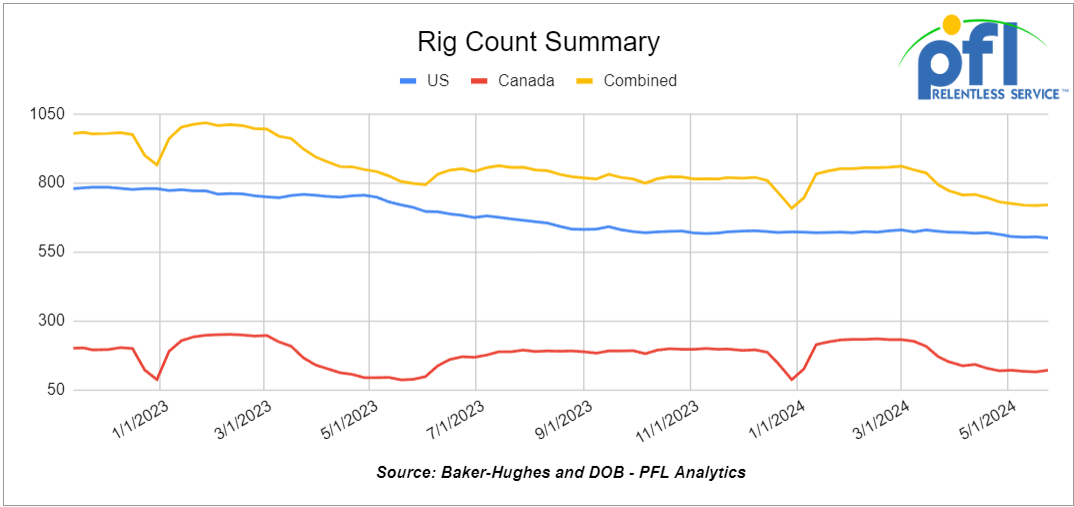

North American rig count was up by 8 rigs week-over-week. U.S. rig count was flat week-over-week, and down by -96 rigs year-over-year. The U.S. currently has 600 active rigs. Canada’s rig count was up by 8 rigs week-over-week, and up by 31 rigs year-over-year. Canada’s overall rig count is 128 active rigs. Overall, year-over-year, we are down -65 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,287 from 28,053 which was an increase of 234 rail cars week-over-week Canadian volumes were lower. CPKC’s shipments were lower by -11.8% week over week. CN’s volumes were lower by -5.1% week-over-week. U.S. shipments were up across the board. The BN had the largest percentage increase and was up by +11.9%.

We’re Watching Canada’s Potential Rail Strike

We are not out of the woods yet on this one, however, the start of a potential strike at the CN and CPKC has been delayed again. If a strike does occur, it will be sometime after June 17th at the earliest. The Canada Industrial Relations Board (“CIRB”) is investigating Canadian Federal government concerns and has postponed reply comments to June 14th from May 31 as originally planned. The CIRB met on Monday of last week with the class 1s and discussed comments filed by groups that could be affected by a strike. Meanwhile, talks with the Teamsters and the railroads continue. We are keeping a close eye on this one so stay tuned to PFL.

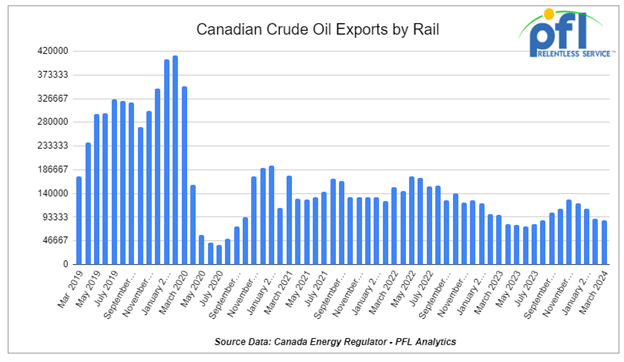

We are watching Crude by Rail out of Canada.

We finally got some numbers out of the Canadian Energy Regulator folks, they were two months behind on their reporting. For February 2024, Canada exported 90,137 barrels per day by rail (down by -19,564 barrels per day from January’s revised number). For March 2024, Canada exported 86,766 barrels per day by rail (down by -3,371 barrels per day from February). Both February and March’s data were released on May 27th, 2024. This was the fourth consecutive month-over-month decline after seven consecutive month-over-month increases and the lowest reading since July of 2023.

We are expecting to see volumes shipped by rail to increase despite Trans Mountain pipeline expansion completion. As we see it right now, Cenovus and Strathcona will play a big part of this growth. Both companies, amongst other things, are focused on producing undiluted bitumen which is shipped via rail as a non-haz product in unit trains. This method of transport is competitive with pipelines.

We are watching Climate Change – In Canada

Just like the Green New Deal in the United States, Canadian producers are going to have to deal with a similar Bill called C-59. Bill C-59 amongst other hidden gems will target environmental claims. Bill C-59 would amend the country’s Competition Act by requiring companies to show proof when making representations about protecting, restoring, or mitigating environmental, social, and ecological causes or effects on climate change. Canada is involving the international community to help set its standards. Violations will get expensive, $10 million (CAD) for the first offense then higher from there. The far left-leaning NDP party and the Liberal Party run by Justin Trudeau pushed the bill through – while the Conservatives and the Quebec Separatist party (the Bloc – wants to separate from the rest of Canada) voted against it. Canada’s Parliamentary system consists of the House of Commons which currently has 338 seats and has multiple parties within the system. Typically 2 parties will get together to form a shaky coalition government which is what the NDP and the Liberal Party have done. The Bill now hits the Senate. The Senate in Canada has appointed Senators and is currently leaning towards the left so we expect this one to pass and become law. Many in Canada think Bill C-59 will introduce many lawsuits and is a cash grab that will result in millions and millions of dollars worth of fines that at the end of the day consumers that consume energy will ultimately pay for. Just like inflation, another hidden tax.

Lease Bids

- 20, 4750’s Thru Hatch Hopper Covereeds needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 25, 30K 117R Tanks needed off of in for 2-3 Year. Cars are needed for use in Condensate service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term, would look at a longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year

- 53, 2 containers, Flats Intermodel Double Stacks located off of KCS in Texas. Cars are clean Lease or sell

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 25.5K, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 25, 33K, 400W Pressure Tanks located off of IHB in Hammond, IN. Cars were last used in propylene. 1-year term.

Sales Offers

- 20, Refer Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website