“To effectively communicate, we must realize that we are all different in the way we perceive the world and use this understanding as a guide to our communication with others.” – Tony Robbins

Jobs Update

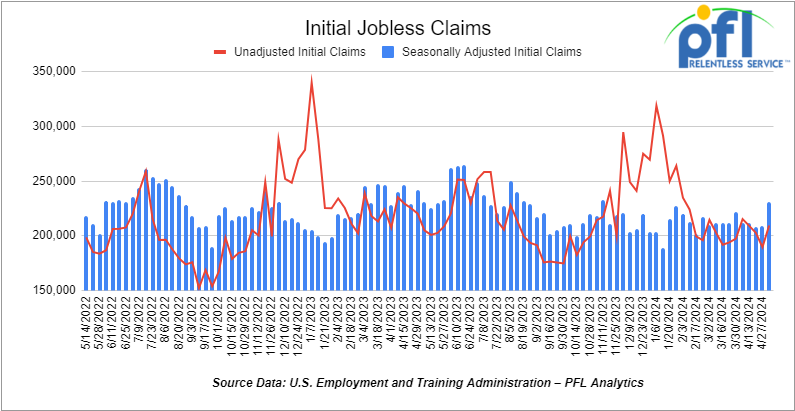

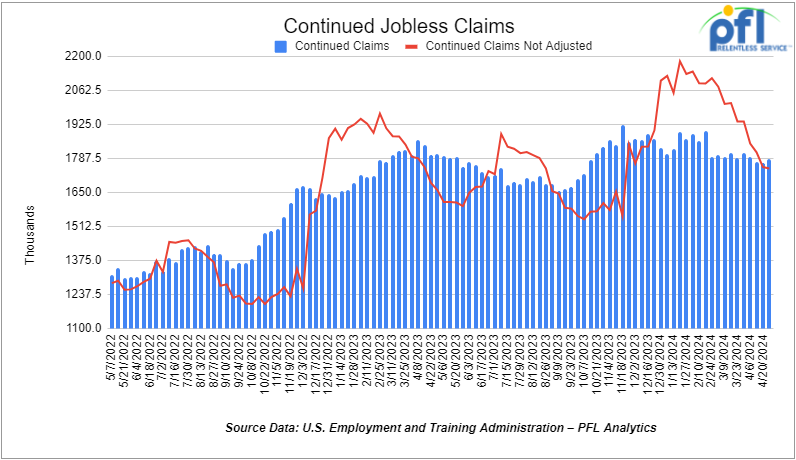

- Initial jobless claims seasonally adjusted for the week ending May 4th, 2023 came in at 231,000, up 22,000 people week-over-week.

- Continuing jobless claims came in at 1.785 million people, versus the adjusted number of 1.768 million people from the week prior, up 17,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 125.08 points (0.32%), closing out the week at 39,512.84, up 837.16 points week-over-week. The S&P 500 closed higher on Friday of last week, up 8.6 points (0.16%), and closed out the week at 5,222.68, up 94.89 points week-over-week. The NASDAQ closed lower on Friday of last week, down -5.4 points (-0.03%), and closed out the week at 16,340.87, up 184.54 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 39,670 this morning, up 28 points.

Crude oil closed lower on Friday of last week – mixed week over week.

WTI traded down -$1 per barrel (-1.03%) to close at $78.26 per barrel on Friday of last week, but up $0.15 per barrel week-over-week. Brent traded down -US$1.09 per barrel (-1.3%) on Friday of last week, to close at US$82.79 per barrel, down -US$0.14 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled Friday at US$12.20 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$66.34 per barrel.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.4 million barrels week-over-week. At 459.5 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

Total motor gasoline inventories increased by 900,000 barrels week-over-week and are 2% below the five-year average for this time of year.

Distillate fuel inventories increased by 600,000 barrels week-over-week and are 7% below the five-year average for this time of year.

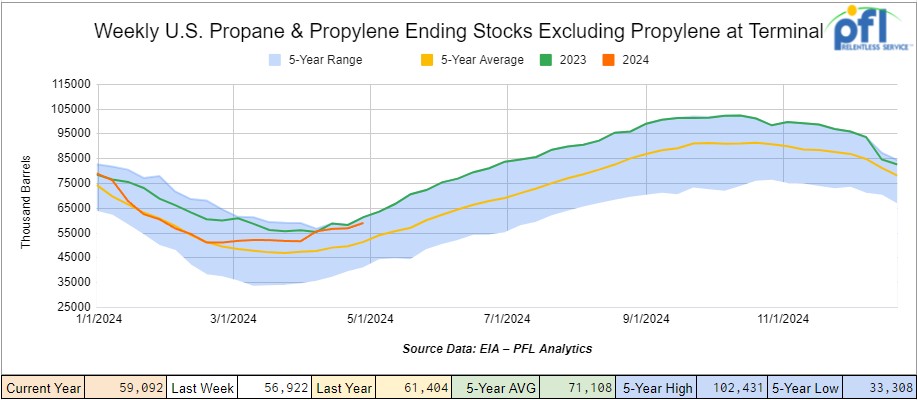

Propane/propylene inventories increased by 2.2 million barrels week-over-week and are 13% above the five-year average for this time of year.

Propane prices closed at 73 cents per gallon, down 4 cents per gallon week-over-week and flat year-over-year.

Overall, total commercial petroleum inventories decreased by 2.1 million barrels during the week ending May 3rd, 2024.

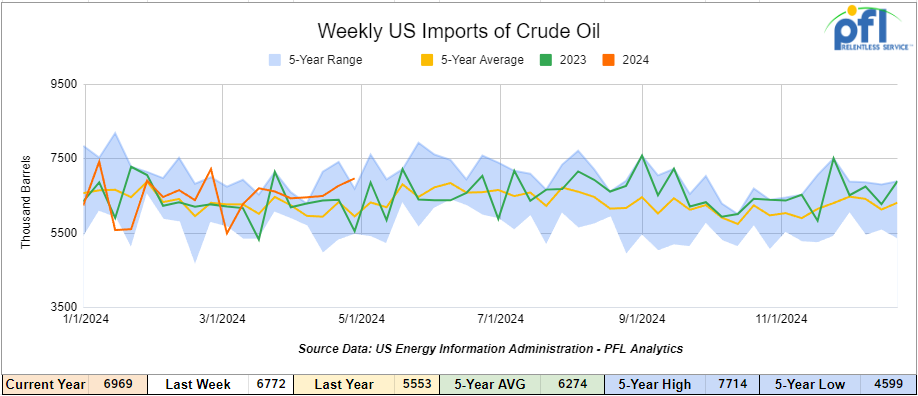

U.S. crude oil imports averaged 7 million barrels per day during the week ending May 3rd, 2024, an increase of 198,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 8.4% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 719,000 barrels per day, and distillate fuel imports averaged 111,000 barrels per day during the week ending May 3rd, 2024.

U.S. crude oil exports averaged 4.468 million barrels per day for the week ending May 3rd, 2024, an increase of 550,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.573 million barrels per day.

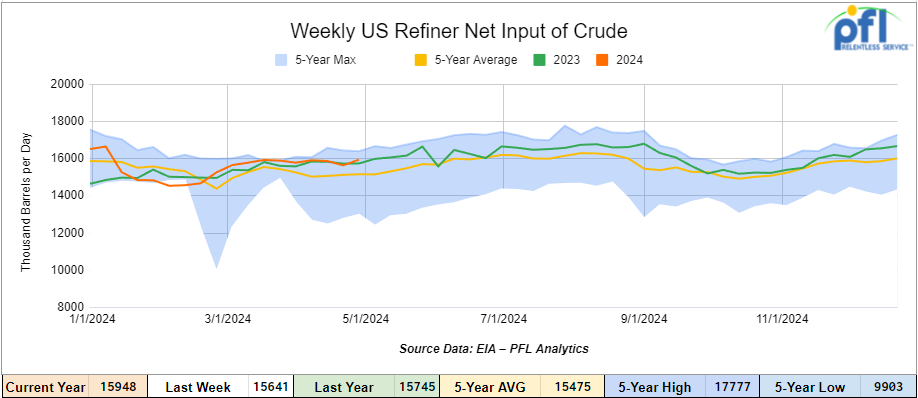

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending May 3, 2024, which was 307,000 barrels per day more week-over-week.

WTI is poised to open at $78.48, up 22 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 8th, 2024.

Total North American weekly rail volumes were down (0.17%) in week 19, compared with the same week last year. Total carloads for the week ending on May 8th were 335,162, down (-3.65%) compared with the same week in 2023, while weekly intermodal volume was 314,162, up (+3.82%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Coal, which was down (-21.32%). The most significant increase came from Petroleum and Petroleum Products which was up (+10.08%).

In the East, CSX’s total volumes were up (0.26%), with the largest decrease coming from Coal, down (-12.33%) while the largest increase came from Metallic Ores and Metals (14.17%). NS’s volumes were up (3.21%), with the largest increase coming from Nonmetallic Minerals (+12.02%) while the largest decrease came from Coal (-10.37%).

In the West, BN’s total volumes were down (-0.63%), with the largest increase coming from Petroleum and Petroleum Products (-32.2%) while the largest decrease came from Coal, down (-31.47%). UP’s total rail volumes were down (-0.96%) with the largest decrease coming from Coal, down (-20.79%) while the largest increase came from Motor Vehicles and Parts which was up (+15.19%).

In Canada, CN’s total rail volumes were down (-2.52%) with the largest decrease coming from Other, down (-11.61%) while the largest increase came from Chemicals, up (+11.94%). CP’s total rail volumes were up (0.26%) with the largest increase coming from Intermodal (+29.11%) while the largest decrease came from Coal, down (-40.16%).

KCS’s total rail volumes were down (-7.72%) with the largest decrease coming from Other (-32.56%) and the largest increase coming from Chemicals (+21.86%).

Source Data: AAR – PFL Analytics

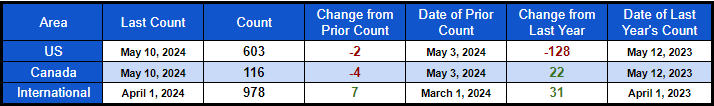

Rig Count

North American rig count was down by -6 rigs week-over-week. U.S. rig count was down by -2 rigs week-over-week, and down by -128 rigs year-over-year. The U.S. currently has 603 active rigs. Canada’s rig count was down by 4 rigs week-over-week, and up by 22 rigs year-over-year. Canada’s overall rig count is 116 active rigs. Overall, year-over-year, we are down -106 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,944 from 28,878 which was an increase of 934 rail cars week-over-week Canadian volumes were lower. CPKC’s shipments were lower by -1.5% week over week. CN’s volumes were lower by -2.1% week-over-week. U.S. shipments were mostly lower. The NS had the largest percentage decrease and was down by -15.2%. The BN was the sole gainer and was up by 21.1%

We are watching the Biden Administration and the SPR

The Biden Administration is raising the price the U.S. is willing to pay to refill the Strategic Petroleum Oil Reserves (“SPR”) that the administration drained in front of the midterms in an attempt to lower gas prices at the pump for the benefit they said of the “American Consumer”. The selling of crude out of the SPR lowered our reserves to the lowest level in 40 years. The Energy Department said in a filing that it will pay as much as $79.99 a barrel. This is the first time the administration has set an explicit price ceiling and is higher than the previous informal cap of $79 per barrel.

We Continue to Watch Trans Mountain Pipeline Expansion

With line pack pretty much complete on Trans Mountain, we have yet to see any effect on Enbridge’s system. Line pack was only 4.2 million barrels representing roughly 1 day of Alberta’s production. Line pack was achieved by dipping into Alberta’s crude oil inventories that stood at 73 million barrels at the end of March according to the Alberta Energy Regulator. Regular flows of crude during the process as a result continued as normal. When inventories get lower (are the highest they have been since December 2022) then we will see how the fundamentals all shake out.

The 598,000 barrel-per-day expansion is now operational, The total capacity of the new pipeline system is 890,000 barrels per day. Construction delays from environmental and indigenous groups raised havoc on the project. Now there is a dispute with shippers on tolls – we are watching this one closing – stay tuned to PFL.

Trans Mountain Pipeline system Map

Source: Trans Mountain – PFL Analytics

We are Watching Renewables

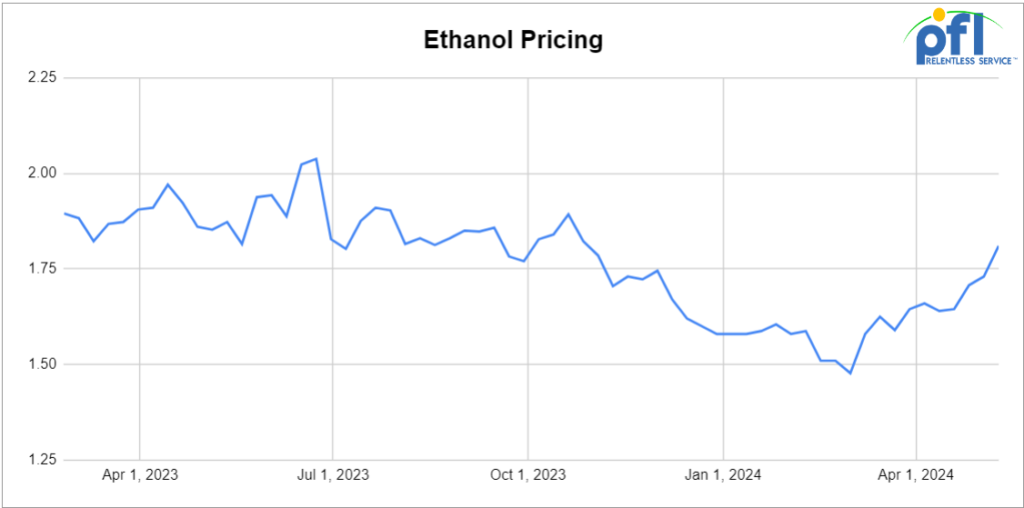

Ethanol rallied last week as it was boosted by a big supply draw – Ethanol seems to be the only bright spot in the renewable space right now. Renewable markets are plagued by subsidies that the consumer always pays for. We all know that Solar and Wind are not what they claimed them to be – we see lots of hidden costs and continued failing business models by the current administration mandates.

Solar is great in certain applications and we don’t have anything against using the sun’s energy to harvest power, however, for solar and wind to be a replacement for conventional energy as well as replacing a big chunk of the grid is a pipedream. It just does not make any sense from an environmental or economic perspective.

Ethanol at Argo closed on Friday of last week at $1.81 per gallon, up 1 and ½ of a cent per gallon day over day, and up 8 cents per gallon week over week.

Source Data: PFL Analytics

As it relates to Renewable Diesel – despite associated credits together with government incentives that come with it, we are starting to see some problems with that model. Whether they are long-term or just a bump in the road is anybody’s guess but has a big impact on rail at all levels.

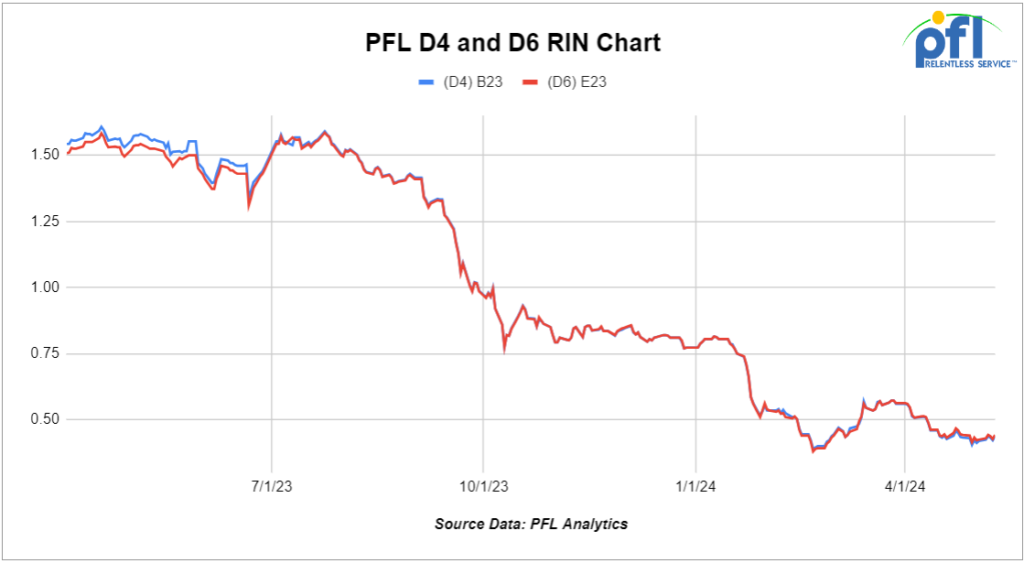

1) There has been a mad rush by bigger companies to hop on the bandwagon to take in tallow and other waste products – convert it into renewable diesel and sell into the California Market that gives the producer the benefit of collecting LCFS Credits and D4 RIN credits. The problem is those credits have been collapsing due to an overproduction of D4 RINS and LCFS credits and we don’t think the party to the downside is over anytime soon barring any government intervention – which in today’s environment could happen! The Renewable diesel producer competes against the Biodiesel producer where Biodiesel is blended with conventional diesel to reduce emissions. Chevron has already shuttered at least 1 biodiesel facility.

2) Renewable diesel plants have had startup problems – we are starting to see some length in the C/I rail car because of this and other factors (Trans Mountain Pipeline coming on stream covered in today’s report).

3) Earnings have come out by some and they are not great for their renewable initiatives

i) Renewable Diesel giant Neste has had a change in management and has taken a 43.86% hit in their share price this year mainly on the back of falling RIN and LCFS credits they receive for importing renewable diesel into California.

ii) Phillips has delayed their startup of the conversion of its refinery in San Francisco to the 3rd quarter of this year. Once that refinery comes online it may put pressure on the price received for RINS and LCFS credits.

iii) The renewable fuels producer Aemetis said on Thursday of last week that its renewable segment is showing promise of further revenue growth after receiving permit approval for a sustainable aviation fuel plant, but the company nonetheless reported a $24 million net loss in the quarter ended March 31.

iv) HF Sinclair on Wednesday of last week said its renewables segment lost tens of millions of dollars during the first quarter of 2024 due to weaker prices for Renewable Identification Number credits (D4 RINS) and California Low Carbon Fuel Standard credits, but it’s not “giving up” on its renewable diesel operations, with hopes for the segment to at least break even soon despite macroeconomic headwinds.

v) Calumet Specialty Products on Friday of last week reported a $41.6 million net loss in the first quarter, including a $29.1 million loss at its Montana Renewables unit, but company officials remain bullish on renewable fuels production. The company reported net income of $18.6 million in Q1 2023 and a nearly $37 million loss at its renewable fuels operations.

RINS continue to trade at or near their lows. D4 RINS closed on Friday of last week at 46 cents per RIN, up 2 cents per RIN day over day, and up 2 and ½ cents per RIN week over week. Meanwhile, D6 RINS also closed at 46 cents per RIN, also up 2 cents per RIN day over day, and up 2 and ½ cents per RIN week over week.

LCFS credits in California broke $50 per MT closing on Friday of last week at $48 per MT. Meanwhile, Oregon’s Clean Fuels Program (CFP) Credit closed at $61 per MT on Friday of last week.

We are watching Shipping Routes – China Continues to Knock on our Door

New shipping routes highlight growing Asia-to-Mexico trade – Cosco launched express shipping services connecting Asian countries to Mexico. Cosco has started offering container shipping services from Asia directly to Mexico, calling at locations such as the Port of Manzanillo on the Pacific Coast.

Port of Manzanillo

Source: Freight Waves – PFL Analytics

The shipping lanes became operational on Monday of last week, as several global ocean carriers have initiated services targeting Asia-to-Mexico trade. In addition to Cosco, global ocean carriers Mediterranean Shipping Co. and CMA CGM have launched services to tap into soaring container volumes and growing investment in Mexico by Chinese companies.

Cosco Shipping Lines and its subsidiary OOCL’s new Transpacific Latin Pacific 5 (TLP5) line offer direct connections between China, South Korea, Japan, and Mexico.

Import container bookings from China to Mexico have skyrocketed over the past year, with Chinese direct investments in the country increasing 11% year over year in 2023 to $135 billion.

What is driving the demand for more ocean container service between the two countries? Experts have said the nearshoring of manufacturing to Mexico to the ongoing geopolitical tensions between the U.S. and China are reasons for the surge in shipments from China to Mexico.

US-Mexico trade topped $200B in the first quarter of 2024 and is up 44% year over year and 145% since March 1.

Lease Bids

- 25, 30K 117R Tanks needed off of in for 2-3 Year. Cars are needed for use in Condensate service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year

- 53, 2 containers, Flats Intermodel Double Stacks located off of KCS in Texas. Cars are clean Lease or sell

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

- 15, 29.2, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 15, 25.5, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 25, 400W Pressure Tanks located off of IHB in Hammond, IN. Cars were last used in propylene . 1 year term.

Sales Offers

- 20, Refer Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website