“Human beings, who are almost unique in having the ability to learn from the experience of others, are also remarkable for their apparent disinclination to do so. “

– Douglas Adams

Jobs Update

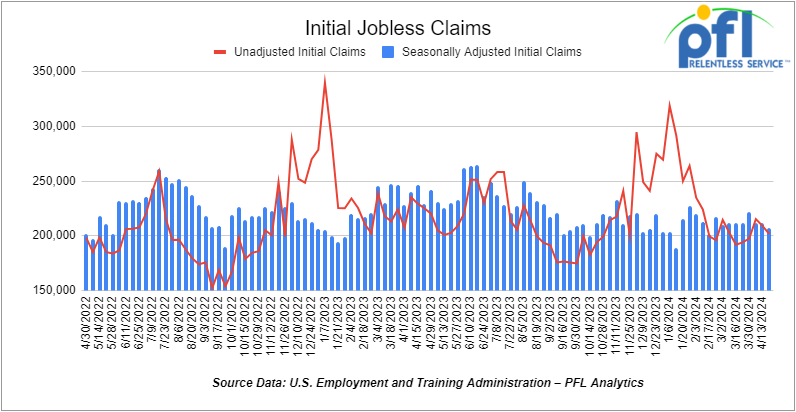

- Initial jobless claims seasonally adjusted for the week ending April 20th, 2023 came in at 207,000, down -5000 people week-over-week.

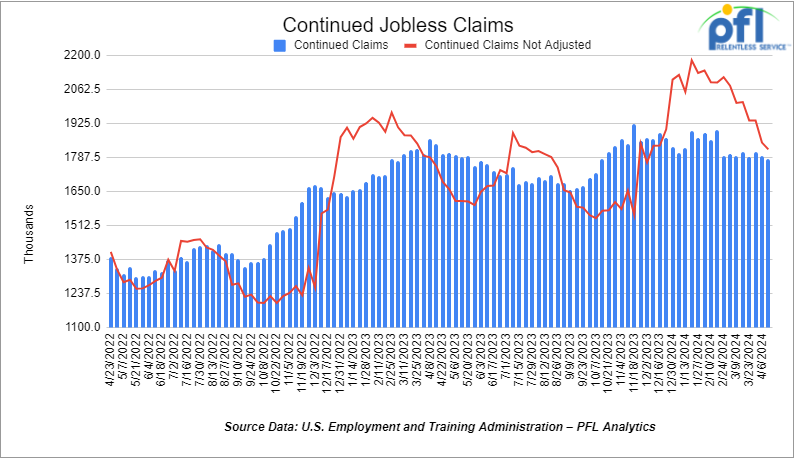

- Continuing jobless claims came in at 1.781 million people, versus the adjusted number of 1.796 million people from the week prior, down -15,000 people week-over-week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 153.86 points (0.4%), closing out the week at 38,239.66, up 253.26 points week-over-week. The S&P 500 closed higher on Friday of last week, up 51.54 points (1.02%), and closed out the week at 5,099.96, up 132.73 points week-over-week. The NASDAQ closed higher last week, up 316.14 points (2.07%), and closed out the week at 15,927.9, up 645.89 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 38,482 this morning up 41 points.

Crude oil closed higher on Friday of last week and higher week over week.

WTI traded up $0.28 per barrel (0.34%) to close at $83.85 per barrel on Friday of last week, up $0.71 per barrel week-over-week. Brent traded up US$0.49 per barrel (0.55%) on Friday of last week, to close at US$89.50 per barrel, up US$2.21 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled Friday at US$12.60 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$69.88 per barrel.

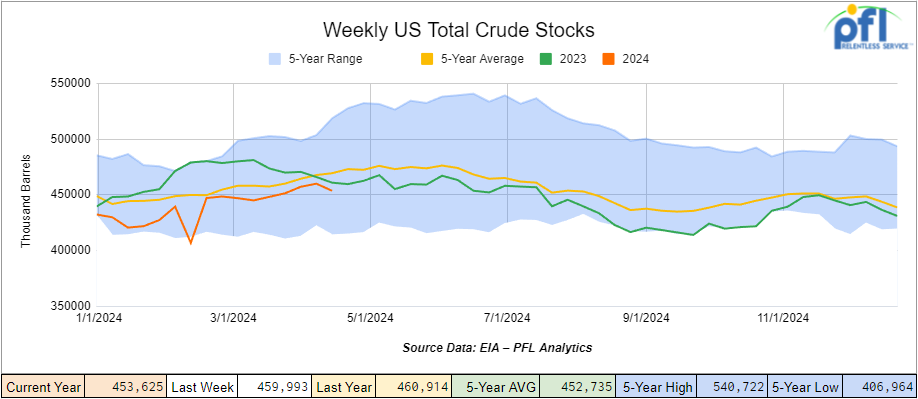

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6.4 million barrels week-over-week. At 453.6 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

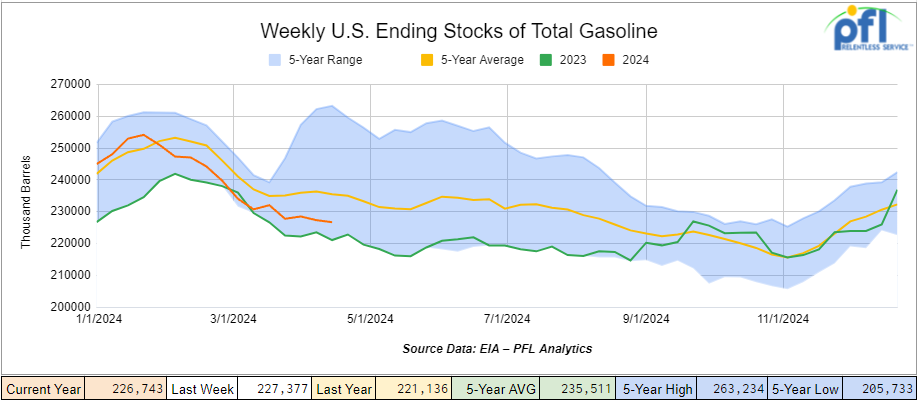

Total motor gasoline inventories decreased by 600,000 barrels week-over-week and are 4% below the five-year average for this time of year.

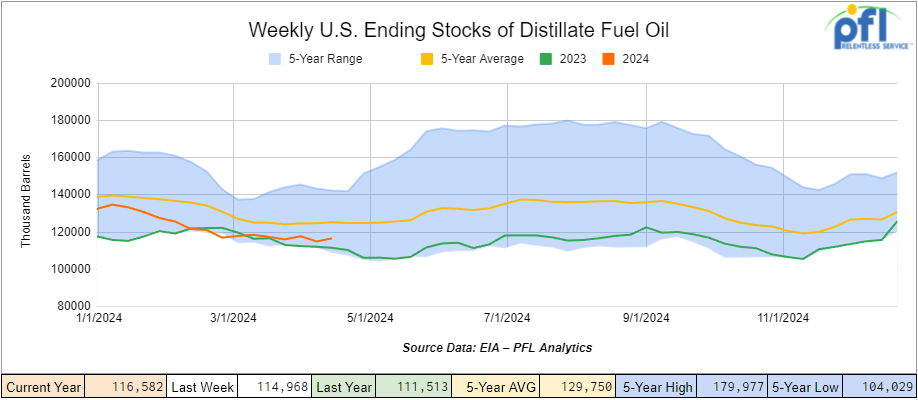

Distillate fuel inventories increased by 1.6 million barrels week-over-week and are 7% below the five-year average for this time of year.

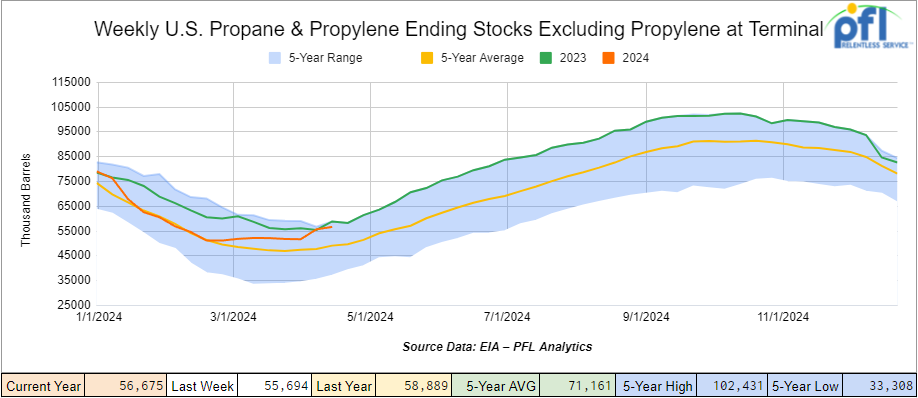

Propane/propylene inventories increased by 1 million barrels week-over-week and are 14% above the five-year average for this time of year.

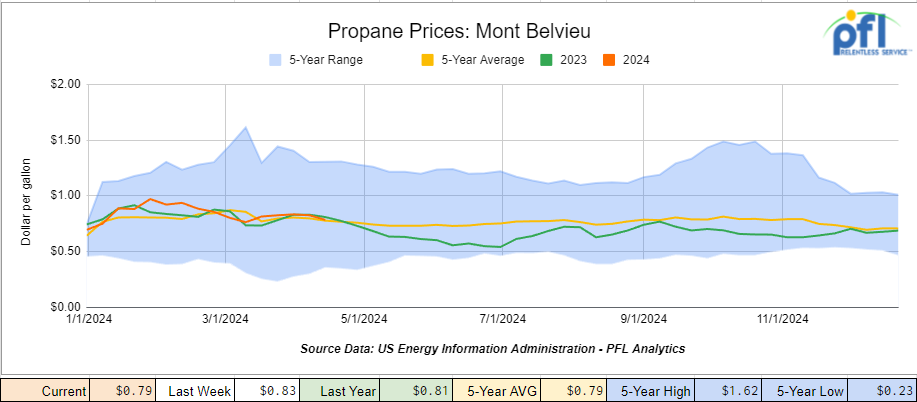

Propane prices closed at 79 cents per gallon, down 4 cents week-over-week and down 2 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 3.8 million barrels during the week ending April 19th, 2024.

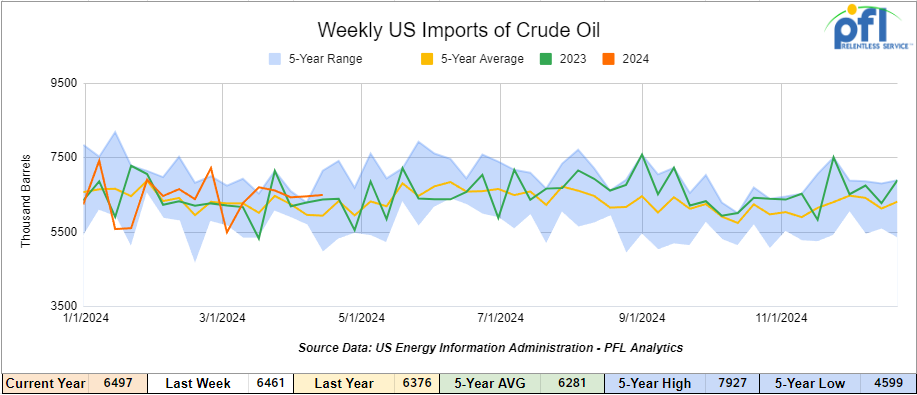

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending April 19th, 2024, an increase of 36,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, slightly more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 780,000 barrels per day, and distillate fuel imports averaged 138,000 barrels per day during the week ending April 19th, 2024.

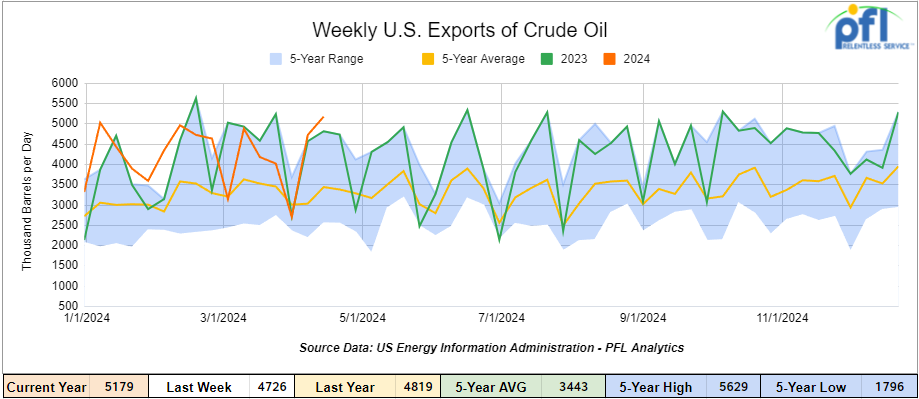

U.S. crude oil exports averaged 5.179 million barrels per day for the week ending April 19th, 2024, an increase of 453,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4,159 million barrels per day.

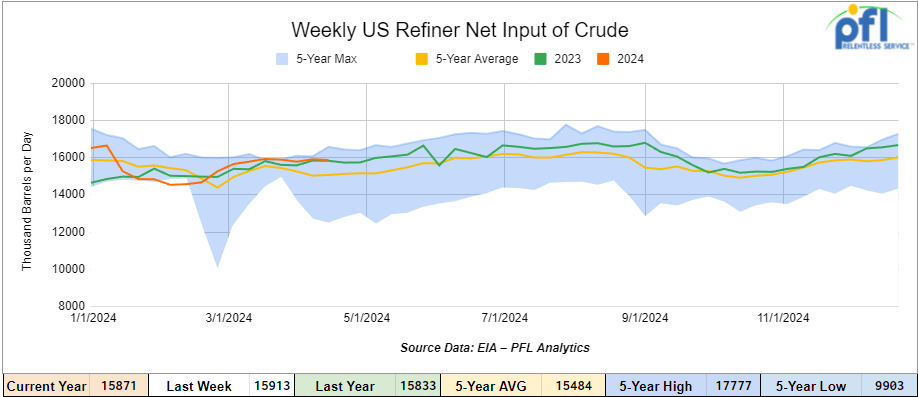

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending April 19, 2024, which was 42,000 barrels per day less week-over-week.

WTI is poised to open at $83.63, down 22 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending April 24th, 2024.

Total North American weekly rail volumes were up (0.88%) in week 17, compared with the same week last year. Total carloads for the week ending on April 24th were 341,675, down (-4.82%) compared with the same week in 2023, while weekly intermodal volume was 323,987, up (+7.68%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-27.47%). The most significant increase came from Petroleum and Petroleum Products which was up (+15.83%).

In the East, CSX’s total volumes were down (-0.01%), with the largest decrease coming from Grain, down (-12.76%) while the largest increase came from Petroleum and Petroleum Products (20.04%). NS’s volumes were up (7.3%), with the largest increase coming from Other (+24.43%) while the largest decrease came from Farm Products (-8.55%).

In the West, BN’s total volumes were up (+1.37%), with the largest increase coming from Petroleum and Petroleum Products (+23.65%) while the largest decrease came from Coal, down (-39.32%). UP’s total rail volumes were down (-2.04%) with the largest decrease coming from Coal, down (-40.18%) while the largest increase came from Petroleum and Petroleum Products which was up (+23.36%).

In Canada, CN’s total rail volumes were down (-3.47%) with the largest decrease coming from Grain, down (-47.35%) while the largest increase came from Nonmetallic Minerals, up (+19.24%). CP’s total rail volumes were up (+17.4%) with the largest increase coming from Intermodal (+76.43%) while the largest decrease came from Coal, down (-36.93%).

KCS’s total rail volumes were down (-10.87%) with the largest decrease coming from Other (-39.47%) and the largest increase coming from Grain (+17.18%).

Source Data: AAR – PFL Analytics

Rig Count

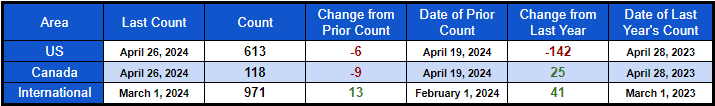

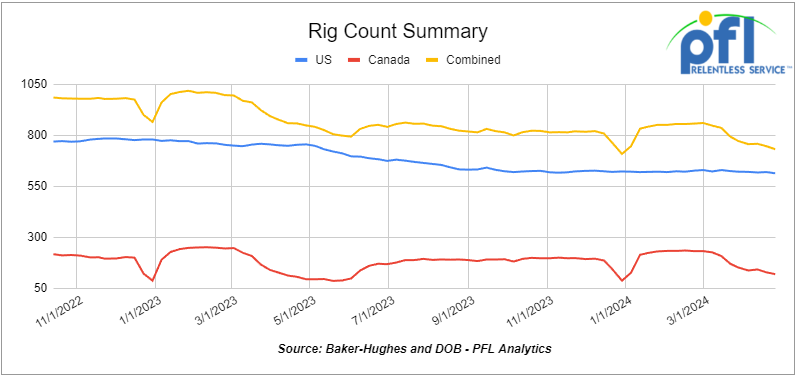

North American rig count was down by -15 rigs week-over-week. U.S. rig count was down by -6 rigs week-over-week, and down by -142 rigs year-over-year. The U.S. currently has 613 active rigs. Canada’s rig count was down by -9 rigs week-over-week, but up by 25 rigs year-over-year. Canada’s overall rig count is 118 active rigs. Overall, year-over-year, we are down -117 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,056 from 27,869 which was a gain of 187 rail cars week-over-week, breaking seven weeks of consecutive week-over-week declines. Canadian volumes were mixed. CPKC’s shipments were higher by +3.7% week over week. CN’s volumes were lower by -2.4% week-over-week. U.S. shipments were up across the board. The UP had the largest percentage increase and was up by +9.8%.

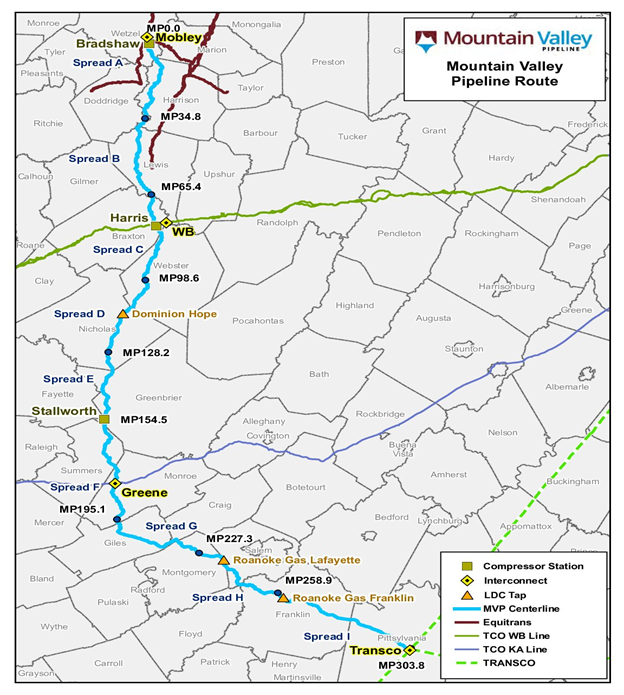

We are watching the Mountain Valley Natural Gas Pipeline

The Mountain Valley Pipeline is largely completed, the company said on Monday of last week requesting federal approval for it to be placed in service.

Although some work remains, the company asked the Federal Energy Regulatory Commission to issue an order by May 23 that would allow it to begin operations.

“Mountain Valley has completed all waterbody and wetland crossings project-wide,” Matthew Eggerding, deputy general counsel for the joint venture building the natural gas pipeline, wrote in a letter filed late on Monday of last week to the FERC docket.

The news marked a near-final milestone for the project, which has been delayed repeatedly over the last six years by controversy and lawsuits that took issue with its environmental impact.

Some are not happy – “We are watching our worst nightmare unfold in real time; the reckless MVP is barreling towards completion,” Russell Chisholm, co-director of the Protect Our Water, Heritage, Rights Coalition, said in a statement.

The greenfield MVP project was originally scheduled to enter service in November 2018 at a cost of $3.3 billion but has faced an onslaught of regulatory delays that have held up the pipeline’s construction and increased costs dramatically.

The Mountain Valley Pipeline (MVP) project is a natural gas pipeline system that spans approximately 303 miles from northwestern West Virginia to southern Virginia – and is an interstate pipeline that will be regulated by the Federal Energy Regulatory Commission (FERC). The MVP will be constructed and owned by Mountain Valley Pipeline, LLC (Mountain Valley), which is a joint venture formed among affiliates of each of Equitrans Midstream Corporation; NextEra Energy, Inc.; Consolidated Edison, Inc.; AltaGas Ltd.; and RGC Resources, Inc. Equitrans Midstream will operate the pipeline and own a significant interest in the joint venture.

With a vast supply of natural gas from Marcellus and Utica shale production, the MVP is expected to provide 2 Bcf per day of firm transmission capacity to markets in the mid and south-Atlantic regions of the United States. The MVP will extend from the Equitrans transmission system in Wetzel County, West Virginia, to Transcontinental Gas Pipeline Company’s (Transco) Zone 5 compressor station 165 in Pittsylvania County, Virginia. Under 20-year contracts, Mountain Valley has secured firm commitments for the full capacity of the MVP.

Source: MVP – PFL Analytics

We are Watching Trans Mountain Pipeline – Will it Start up on May 1?

Some shippers on Canada’s Trans Mountain expansion project are raising concerns that the long-delayed oil pipeline will not be fully in service by its projected start date of May 1st, according to a letter to the Canada Energy Regulator (CER) on Tuesday of last week.

Apparently, line fill on the expanded pipeline will be completed in early May and not by the end of April as anticipated.

In a letter to the CER, Suncor Energy said reasonable questions remain over whether Trans Mountain will be able to deliver contracted crude volumes from May 1 given some sections of the pipeline are still awaiting leave to open from regulators.

Shippers are concerned about the obligation to pay tolls from the start of May, the letter said, filed by Suncor’s legal counsel on behalf of other shippers including BP and Marathon.

“While it is possible that Trans Mountain might be able to complete the physical construction of Expansion facilities by May 1, 2024, there appears to be a real likelihood that those facilities will not be capable of providing Firm Service at that time,” said the letter, which appeared on the CER website.

The C$34-billion ($24.81 billion) project, bought by the Canadian government in 2018 to ensure it went ahead, will carry an extra 600,000 barrels per day (bpd) of oil from Alberta to Canada’s Pacific coast.

It has struggled with years of regulatory delays and cost overruns and Canadian oil producers are keenly anticipating its start-up, which will open up access to export markets on the U.S. West Coast and Asia and should narrow the price discount on Canadian heavy crude versus U.S. benchmark oil.

A number of contracted shippers are “locked in dispute” with Trans Mountain over tolls on the expanded system, citing concerns about significant cost increases.

Trans Mountain is facing a number of complaints from its shippers, who have contracted 80% of the expanded pipeline’s volume.

In a separate filing on April 12, Canadian Natural Resources Ltd supported by Suncor and Imperial Oil wrote to the CER arguing that the vapor pressure limit on the expanded pipeline is too high and would hurt the sales price of the crude.

Trans Mountain said the first ship carrying crude from the pipeline expansion is expected to load in the second half of May. Stay tuned to PFL for further developments, we are watching this one closely.

We continue to watch Canada’s Potential Rail Strike

No real news to report, although we will know on May 1 the outcome. Members of the Teamsters Canada Rail Conference (TCRC) are in the middle of a strike vote. The vote comes after three collective agreements, covering CN and CPKC engineers and conductors as well as rail traffic controllers at CPCK, expired on December 31.

The TCRC electronic strike vote began April 8th and will wrap up May 1st, the earliest a strike or lockout can legally occur is May 22nd. PFL has been working with a number of shippers to provide backup rail car storage, particularly for customers heading back to Canada after exporting products into the United States. Please call PFL for further details.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. The lease is available until Fall.

- 50, ~5400, covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year

- 53, 2 containers, Flats Intermodel Double Stacks located off of KCS in Texas. Cars are clean Lease or sell

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

- 15, 29.2, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 15, 25.5, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website