“Opportunities multiply as they are seized.”

-Sun Tzu

Who is Sun Tzu? Sun Tzu Chinese was a Chinese general, military strategist, writer and philosopher in ancient China (544 BC). Sun Tzu is traditionally credited as the author of The Art of War, an influential work of military strategy that has affected Western and East Asian philosophy and military thinking. Bottom line is, seize the opportunity while you can and we at PFL hope those opportunities and ability to seize them will multiply for you!

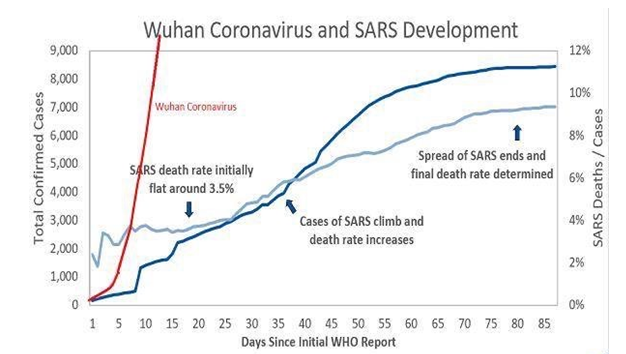

The Latest and Greatest on Coronavirus

- The coronavirus has killed more people than SARS did.

- Nearly 40,000 people infected worldwide and nearly 900 people have died from the virus.

- More cases are reported in Britain and Spain.

- Quarantine ends for cruise ship held in Hong Kong.

- Automakers are feeling the pinch of plant closures.

- Cruise ship quarantined in Japan has six more cases, passengers were told.

Total North American rail volumes were up 6.2% year over year in week 5 (U.S. +2.4%, Canada +13.9%, Mexico +34.7%), resulting in quarter to date volumes that are down 3.9%. 7 of the AAR’s 11 major traffic categories posted year over year gains with the largest increases coming from intermodal (+10.0%), metallic ores & metals (+19.3%) and petroleum (+21.2%). The largest decrease came from coal (-10.4%).

In the East, CSX’s total volumes were up 11.8%, with the largest increase coming from intermodal (+17.2%). The largest decrease came from coal (-8.6%). NS’s total volumes were up 2.5%, with the largest increases coming from petroleum (+40.2%) and intermodal (+1.4%). The largest decrease came from coal (-11.1%).

In the West, BN’s total volumes were up 4.1%, with the largest increases coming from intermodal (+7.4%) and motor vehicles & parts (+30.5%). The largest decreases came from other carloads (-48.5%) and grain (-19.1%). UP’s total volumes were down 2.4%, with the largest decreases coming from coal (-23.5%) and intermodal (-4.5%). The largest increase came from petroleum (+20.4%).

In Canada, CN’s total volumes were up 15.2% with the largest increases coming from intermodal (+15.9%), petroleum (+47.7%) and metallic ores (+19.2%). RTMs were up 14.6%. CP’s total volumes were up 14.6%, with the largest increases coming from intermodal (+23.1%), petroleum (+50.2%) and grain (+27.9%). The largest decrease came from coal (-16.3%). RTMs were up 9.2%.

KCS’s total volumes were up 12.2%, with the largest increases coming from intermodal (+27.1%) and petroleum (+35.3%).

Crude by rail has been accelerating a good clip on the class ones, but we have a serious head wind developing. Early last Monday a unit train derailed in Saskatchewan Canada releasing 1.5 million liters (396,000 gallons) into the environment and ignited a blaze that could be seen for miles. Initial reports were that the train was hauling crude in 117R and CPC1232 cars. However, later reports confirmed by Transport Canada that the Conoco Phillips train was actually DOT-117J’s, the safest car on the track. Luckily, there were no injuries in the crash.

In response to the accident, Transport Canada ordered that trains carrying 20 or more cars with hazardous goods slow down to 20 miles an hour in metropolitan areas and 25 mph outside of metropolitan areas for 30 days. The speed restrictions took place midnight Friday of this past week. “I am very concerned about the derailments of railway cars containing dangerous goods in the past 12 months. That is why I am issuing an immediate order to slow trains carrying significant quantities of dangerous goods on federally regulated railway tracks across Canada,” said Transport Minister, Marc Garneau on Thursday of last week. CP agreed with the Minister of Transport’s decision citing safety as its number one priority and the safe movement of commodities through its network. What is unclear is if these reduced speed limits are also on CP and CN track owned in the U.S. The ramifications in the immediate term and long term are significant:

- CP and CN are going to be hugely effected and the fluidity of their network in question is at risk. CN, in an announcement, said that they will comply with the order but will issue an embargo with permits on TIH, Crude Oil and propone traffic. The embargo took effect yesterday and will continue until further notice.

- Costs to class ones will rise significantly during the period of lower train speeds. Lower train speeds mean more engineers are needed to move the same train from point A to point B. Twice the amount with going ½ the speed that is typical.

- Shippers are disrupted and their costs are going to rise significantly. With moving half the speed, it is going to take double the time to get product from point A to point B, meaning you need double the cars to move the same volume. In effect, you now have doubled your transportation costs making crude by rail seemingly uneconomic in today’s low crude price environment.

- Refiners and export markets that are expecting supply in a timely manner, cannot count on it being consistent and reliable, as competition is expected to open up to water borne vessels from Russia to fill the heavy crude gap.

- Trains moving in manifest service will have to be closely monitored to prevent exceeding 19 hazardous cars. We don’t want 20 hazmat cars holding up the speed of an entire train disrupting other supply chains.

- The big question is: what is the future of crude by rail and regulations that follow? The fact that the cars involved in this accident were 117J’s the safest car on the track, where do we go from here in regards to crude by rail? What about Alberta’s crude by rail program and the producers in Canada set to serve that market? Another shot in the arm for Alberta just as their crude by rail program gets under way. Stay tuned to PFL we are monitoring this situation very carefully.

Crude Derailment in Saskatchewan

Its official – pipelines in the Permian are now overbuilt for hauling crude oil. Three major pipelines came on last year – Gray Oak (900,000 barrels per day), Cactus 2 (670,000 barrels per day) and Epic (400,000) barrels per day. This is providing much needed relief for the frac sand producers as pipelines are discounting long term space. We do not expect to see any opportunities going east for quite some time if at all for crude by rail. There are still scattered opportunities for West coast moves from New Mexico, but we are seeing that Arb getting skinnier.

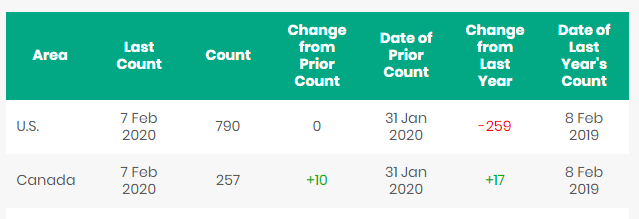

North American Rig count is up 10 rigs week over week with the U.S. flat and Canada gaining 10 rigs week over week. Year over year we are down 242 Rigs collectively.

North American Rig Count Summary

PFL Field Services is now First Verified qualified – to find out more information on First Verified safety verification click here. Call PFL today to trouble shoot return on lease scenarios, cleaning, maintenance, repair and the market in general. We will through this process identify your needs – we are here to help and have the capability and know how to do so! A phone call doesn’t cost you anything, so reach out to us today.Please see below some of PFL Field Service’s equipment that it utilizes in its cleaning fleet

Advanced Oil & Water Reclamation Unit

PFL Field Services LLC has been actively cleaning cars nationwide. PFL uses a boiler unit to steam cars (tank cars), and a man is not allowed in our cars until it is commodity free – for more information on PFL equipment and process please call us today. PFL Field Services will clean, inspect, and provide maintenance for ALL CAR TYPES including full gasket change outs and railcar repairs on a mobile basis with a PFL Guarantee. We added UT testing to our venue of expanding services. Call us today for a competitive quote and book a time! See boiler unit hooked up to multiple cars:

Mobile Boiler

PFL currently has Transloaders available for immediate delivery. The Transloaders in question can be used for petroleum products such as gasoline, jet fuel and crude oil. For specs and pictures please visit www.pflpetroleum.com a pop up ad will appear directing you to view the inventory.

The market is extremely active. Storage is continuing its trend with many facilities filling up. This trend is causing some facilities to expand their operations to accomodate the demand.

We have been busy with all sorts of subleases, trouble shooting for return on lease programs and turn keyed storage programs to reduce costs and maximize utilization. Call PFL today for the latest and greatest!

Hot Markets

PFL is offering: 340Ws for long and short term lease, 117Rs last in diesel service, various box cars for lease, 31.8’s clean and last in refined prodcuts and 25.5K 117Js. Call PFL for details today!

PFL is seeking: 117s with magnetic gauging devices for lease, 89 ft flat cars for purchase, DDG hoppers for lease, 117Js last in ethanol and 4750s for use in coke service.

Call PFL today for the latest and greatest!

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair and scrapping of all railcars at strategic partner sites. PFL will get it done for you. We also assist fleets and lessors with leases and sales, offer “Total Fleet Evaluation Services”. We will analyze your current leases, storage if applicable and company objectives and draw up a plan of action. We can assist on return on lease scenarios saving Lessor and Lessee thousands of dollars.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|