“The man who will use his skill and constructive imagination to see how much he can give for a dollar, instead of how little he can give for a dollar, is bound to succeed.”

– Henry Ford

Jobs Update

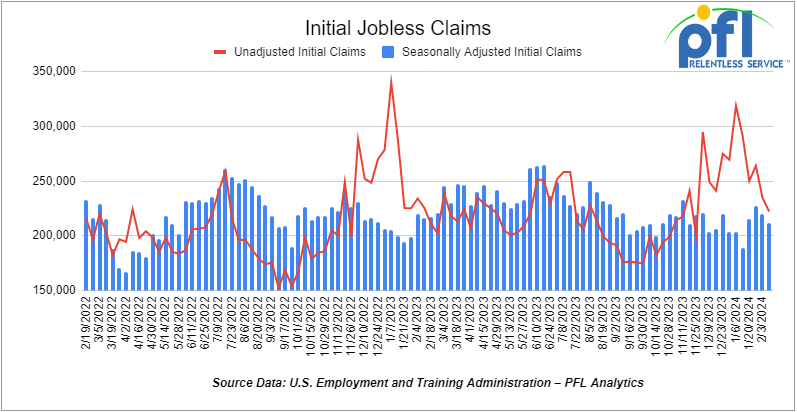

- Initial jobless claims seasonally adjusted for the week ending February 10th, 2023 came in at 212,000, down -8,000 people week-over-week.

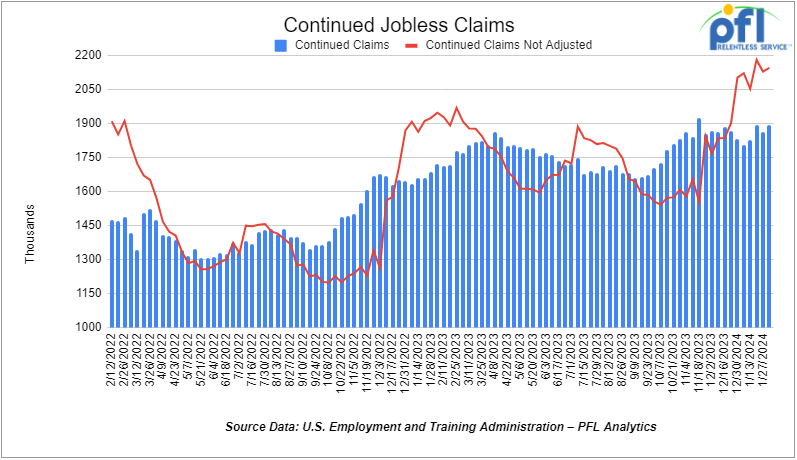

- Continuing jobless claims came in at 1.895 million people, versus the adjusted number of 1.865 million people from the week prior, up 30,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -145.13 points (-0.37%), closing out the week at 38,627.99, down -43.70 points week-over-week. The S&P 500 closed lower on Friday of last week, down -24.16 points (-0.48%), and closed out the week at 5,500.57, down -21.04 points week-over-week. The NASDAQ closed lower on Friday of last week, down -130.52 points (-0.82%), and closed out the week at 15,775.65, down -215.01 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 38,615 this morning down 82 points.

Crude oil closed higher on Friday of last week and higher week over week.

WTI traded up $1.16 per barrel (1.49%) to close at $79.19 per barrel on Friday of last week, up $2.35 per barrel week-over-week. Brent traded up US$0.61 per barrel (0.74%) on Friday of last week, to close at US$83.47 per barrel, up US$1.28 per barrel week-over-week.

One Exchange WCS for April delivery settled on Friday of last week at US$17.75 below the WTI-CMA. The implied value was US$60.09 per barrel. On Thursday of last week, it settled at US$17.80 below the WTI-CMA for April delivery. The implied value was US$59.31 per barrel.

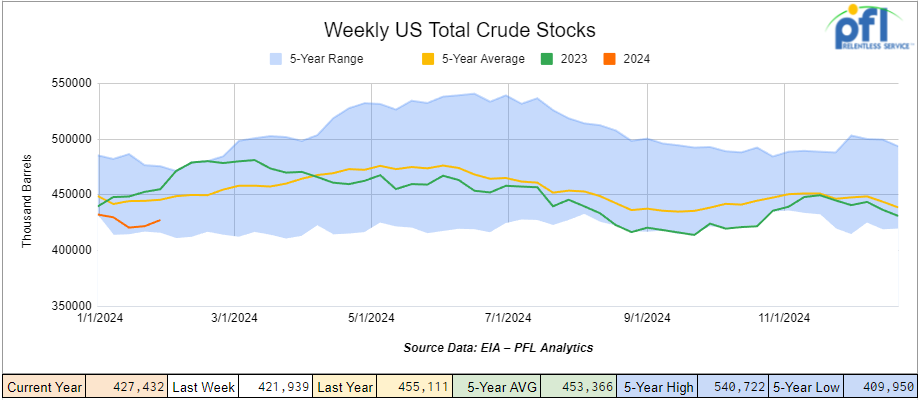

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve)increased by 12 million barrels week-over-week. At 439.5 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

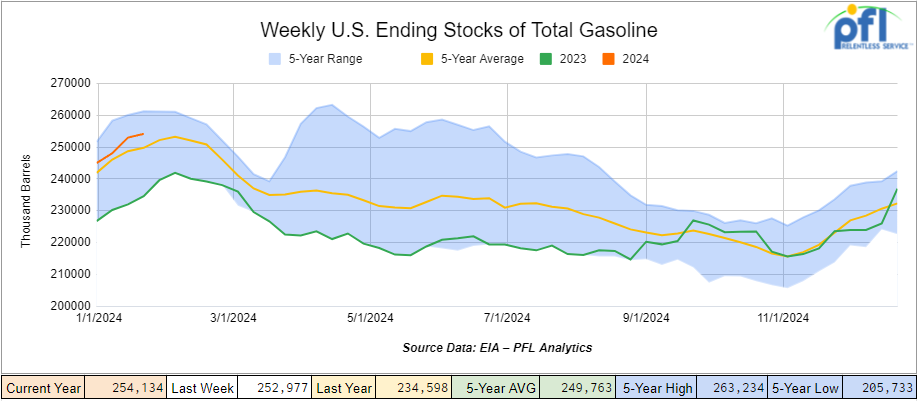

Total motor gasoline inventories decreased by 3.7 million barrels week-over-week and are 2% below the five-year average for this time of year.

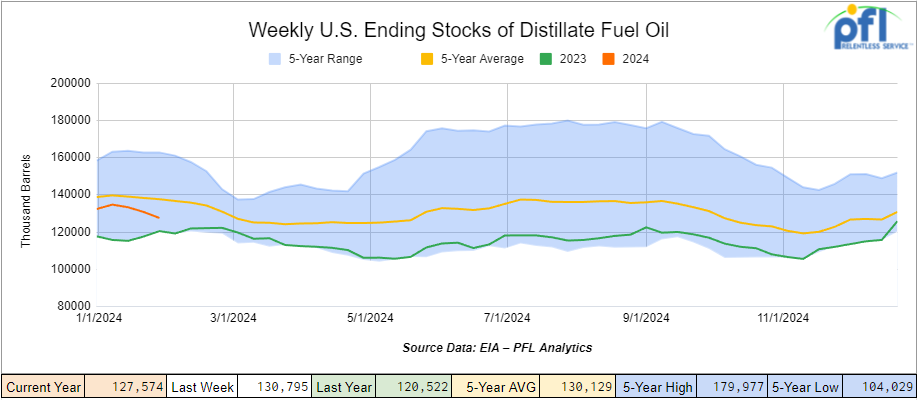

Distillate fuel inventories decreased by 1.9 million barrels week-over-week and are 7% below the five-year average for this time of year.

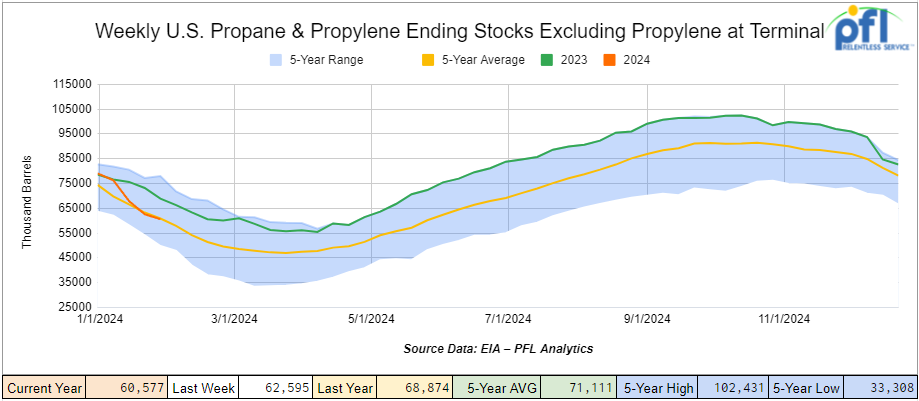

Propane/propylene inventories decreased by 3.7 million barrels week-over-week and are 1% above the five-year average for this time of year.

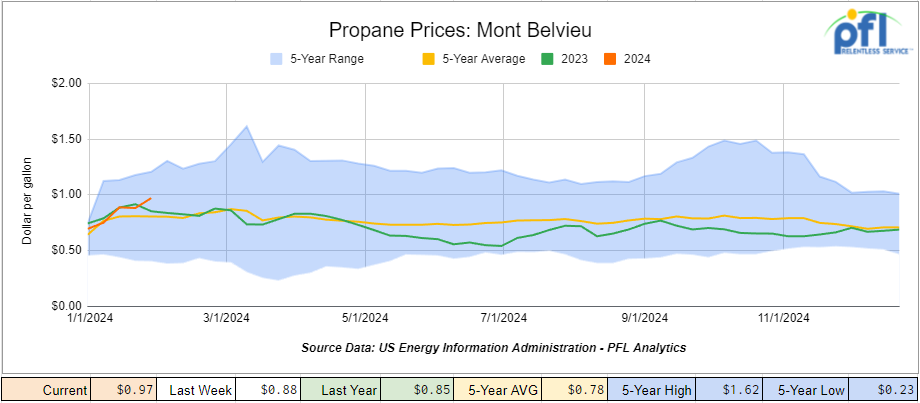

Propane prices closed at 97 cents per gallon, down -5 cents per gallon week-over-week and up 8 cents per gallon year-over-year

Overall, total commercial petroleum inventories increased by 5.2 million barrels during the week ending February 9, 2024.

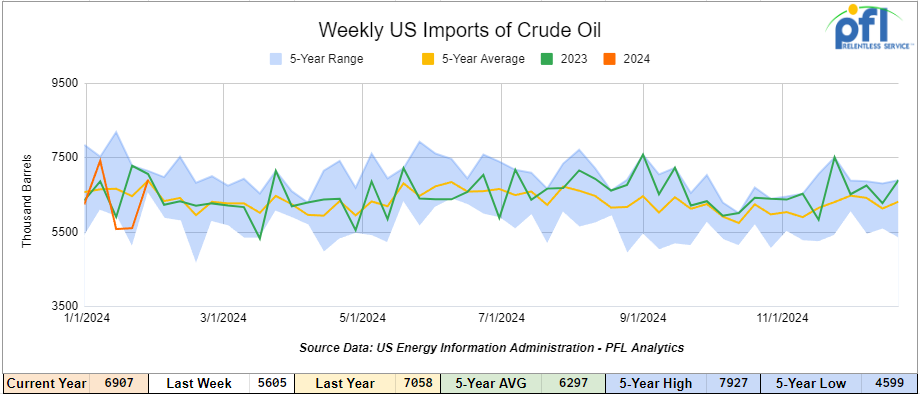

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending February 9, 2024, a decrease of 437,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 7.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 436,000 barrels per day, and distillate fuel imports averaged 135,000 barrels per day during the week ending February 9, 2024.

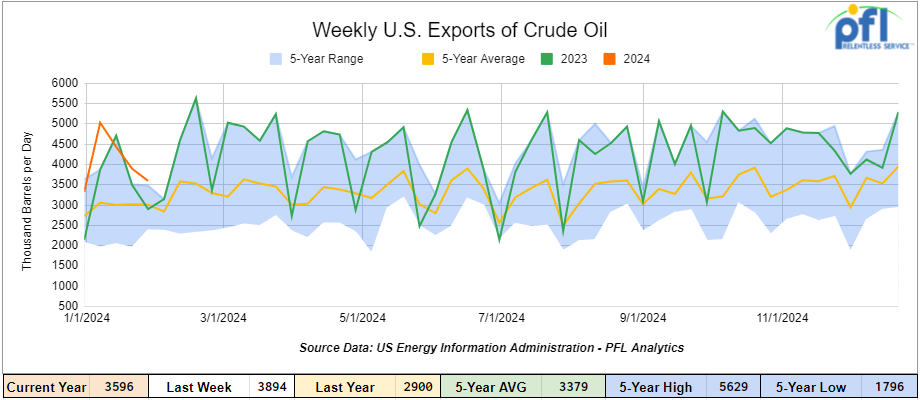

U.S. crude oil exports averaged 4.347 million barrels per day for the week ending February 9th, 2024, an increase of 751,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.068 million barrels per day.

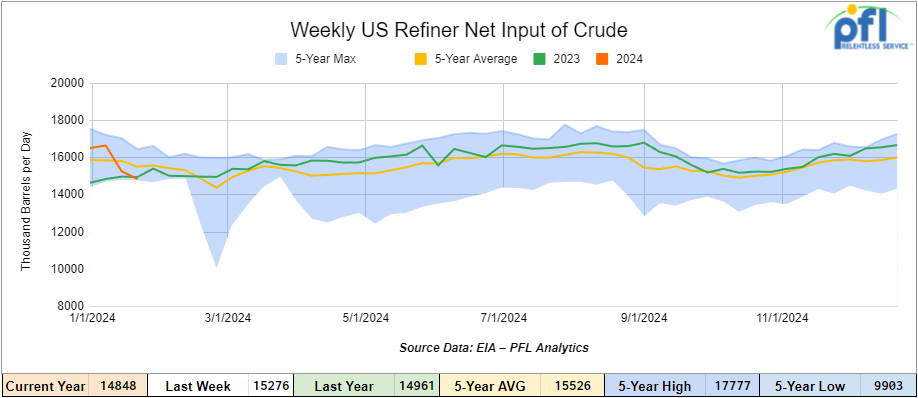

U.S. crude oil refinery inputs averaged 14.5 million barrels per day during the week ending February 9, 2024, which was 297,000 barrels per day less week-over-week.

WTI is poised to open at $78.91, down -0.28 per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 14th, 2024.

Total North American weekly rail volumes were up (2.51%) in week 7, compared with the same week last year. Total carloads for the week ending on February 14th were 351,412, down (-1.23%) compared with the same week in 2023, while weekly intermodal volume was 328,502, up (6.83%) compared to the same week in 2023. 8 of the AAR’s 11 major traffic categories posted year-over-year increases with the largest decrease coming from Coal, down (-9.95%) while the largest increase came from Motor Vehicles and Parts up (+11.01%).

In the East, CSX’s total volumes were up (2.03%), with the largest decrease coming from Grain, down (-28.65%) while the largest increase came from Petroleum and Petroleum Products up (19.16%). NS’s volumes were up (4.95%), with the largest increase coming from Grain (+16.96%) while the largest decrease came from Petroleum and Petroleum Products (-13.12%).

In the West, BN’s total volumes were up (7.51%), with the largest increase coming from Intermodal (+17.13%) while the largest decrease came from Coal, down (-16.12%). UP’s total rail volumes were up (0.47%) with the largest decrease coming from Nonmetallic Minerals, down (-17.49%) while the largest increase came from Motor Vehicles and Parts which was up (23.78%).

In Canada, CN’s total rail volumes were down (-0.7%) with the largest decrease coming from Other, down (-36.09%) while the largest increase came from Nonmetallic Minerals, up (+14.41%). CP’s total rail volumes were up (+20.62%) with the largest increase coming from Other (+126.92%) while the largest decrease came from Petroleum and Petroleum Products, down (-17.16%). KCS’s total rail volumes were down (26.71%) with the largest decrease coming from Other (-50.91%) and the largest increase coming from Nonmetallic Minerals (+9.24%).

Source Data: AAR – PFL Analytics

Rig Count

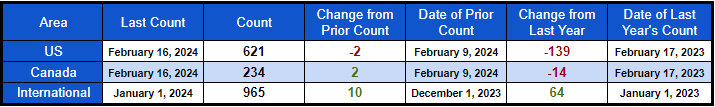

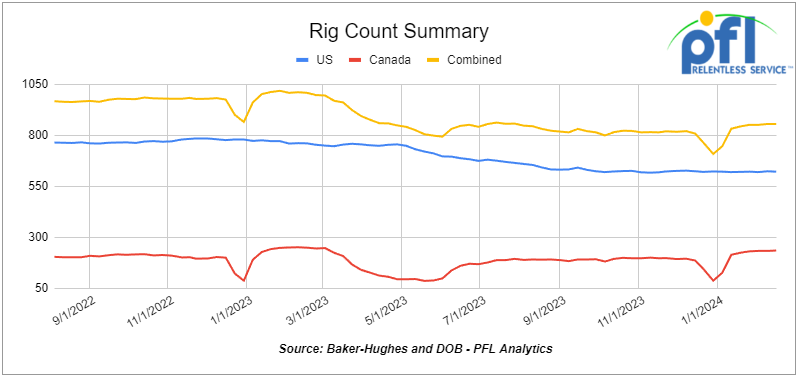

North American rig count was flat week-over-week. U.S. rig count was down by 2 rigs week-over-week and down by -139 rigs year-over-year. The U.S. currently has 621 active rigs. Canada’s rig count was up by 2 rigs week-over-week, but down by -14 rigs year-over-year. Canada’s overall rig count is 234 active rigs. Overall, year-over-year, we are down -153 rigs collectively.

North American Rig Count Summary

A few things we are watching:

Folks, Imagine This World

Imagine we lived in a world where all the cars we drove were EVs and then comes along a new invention, the “Internal Combustion Engine”! Think about how well they would sell: A vehicle half the weight, half the price that will almost quarter the damage done to the road. A vehicle that can be refueled in 1/10th of the time and has a range up to 4 times the distance in all weather conditions. It does not rely on the use of environmentally damaging non-renewable rare earth elements to power it, and uses far less steel and other materials.

Just think how excited people would be for such technology. It would sell like hotcakes!

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,994 from 28,930, which was a gain of +64 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments fell by -13% week-over-week, CN’s volumes were higher by +3.5% week-over-week. U.S. shipments were lower across the board. The BN was the largest percentage decrease and was down by -9.5%

We Continue to Watch Canada’s Trans Mountain Pipeline

Although nothing has been announced publicly, it is expected that the pipeline will be completed sometime in March and will start receiving line pack at that point. This is one of the reasons why basis tightened last week. The impact that this will have on the rail market is unknown at this point. On a good note, production is growing fast, Enbridge notified shippers that 20% of heavy crude nominations and 25% of light crude nominations flowing through Kerrobert, Saskatchewan were apportioned for March deliveries on its 3 million barrel per day mainline. That is quite a bit of stranded volume. It is anticipated that Enbridge will not see any material decrease in volume once the Trans Mountain pipeline comes on stream. Stay tuned to PFL for any new developments we are watching this one closely.

We Continue to Watch Renewables and crumbling Prices

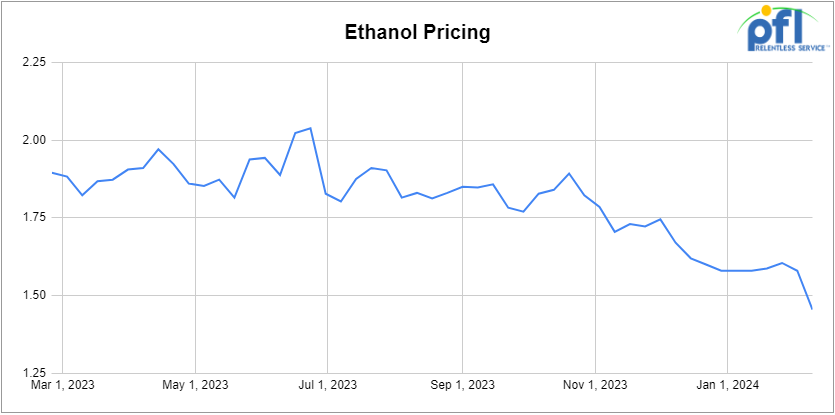

Softer Corn Values, higher production and swelling inventories put pressure on Ethanol Prices last week.

In-tank trading at the Chicago area’s Argo facility traded as low as $1.465 per gallon on Thursday of last week and traded even lower on Friday. Ethanol at Argo closed on Friday of last week at $1.45 and ½ of a cent per gallon, down 1 and ½ cents per gallon day over day and down 13 cents per gallon week over week.

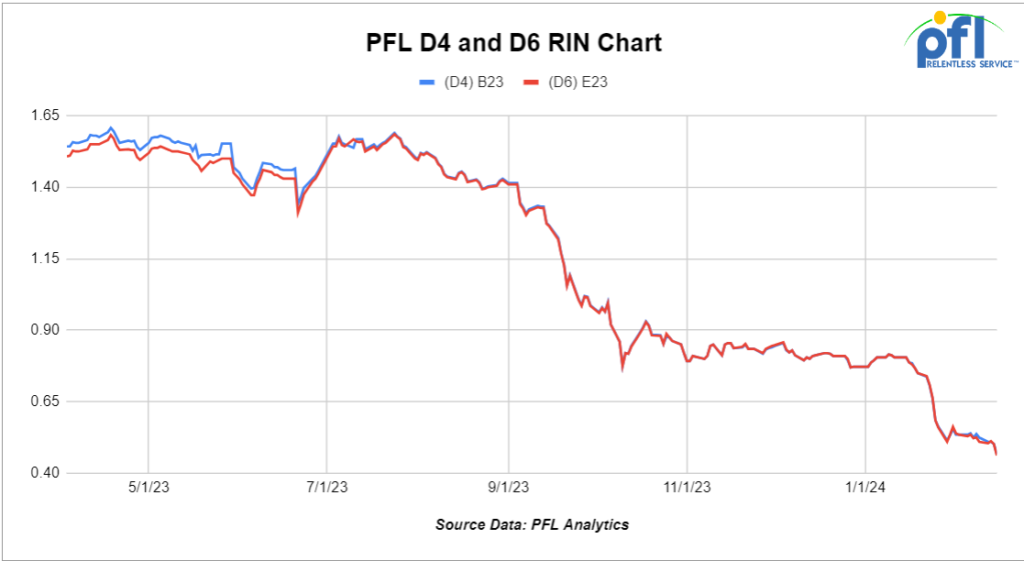

D4 RINS closed on Friday of last week at 46 cents per RIN, down 2 cents per RIN day over day and down 8 cents per RIN week over week. D6 RINS closed at 44 and ½ of a cent per RIN, down 3 cents per RIN day over and down 8 and ½ cents per RIN week over week.

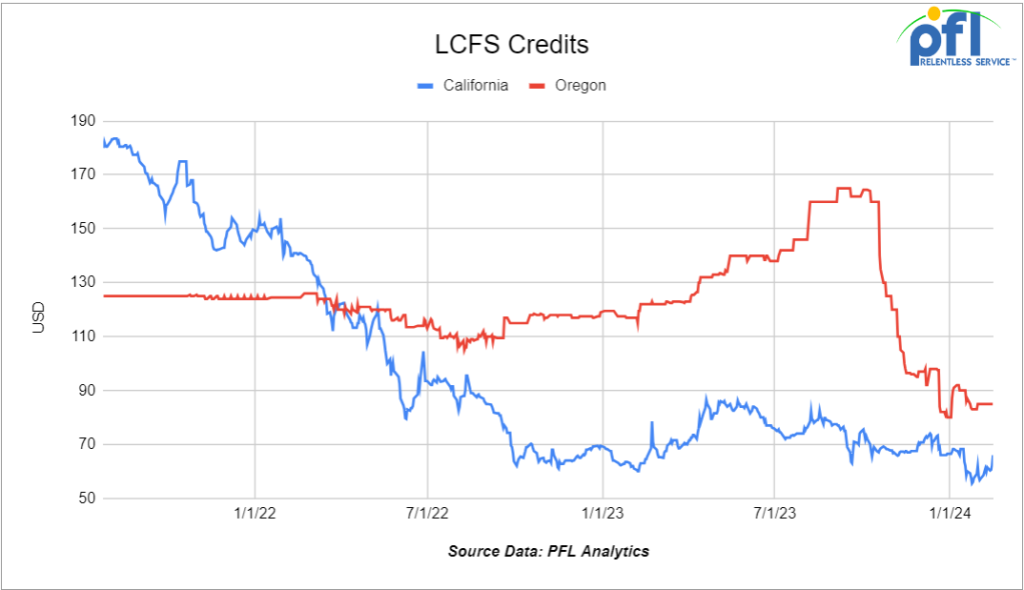

LCFS credits in California closed out the day and the week at $63 per MT, down $5 per MT day over day but up $1.50 per MT week over week.

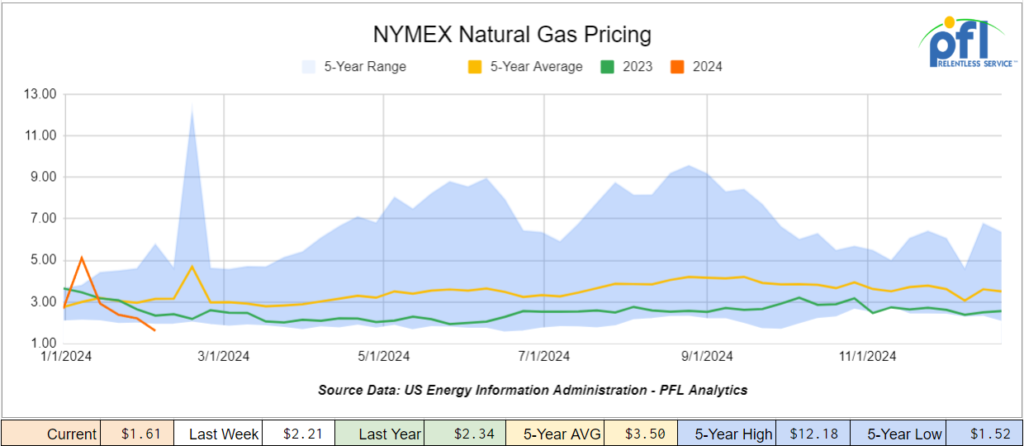

We continue to Watch Natural Gas and Natural Gas Liquids

1) NatGas production continues to decline – Production drop continues, but slows. The latest monthly U.S. Energy Information Administration (EIA) Drilling Productivity Report (DPR) for February, issued on Thursday of last week, shows EIA shale gas production across the seven major plays tracked in the monthly DPR for March will decrease production month over month. This is the eighth month in a row that EIA has predicted shale gas production will decrease for the combined seven plays.

2) NatGas Producers Making Cuts – U.S. NatGas drillers have cut spending, reduced activity amid a price crash. According to Reuters, U.S. natural gas producers are slashing spending and reducing drilling activity following a sharp decline in prices. Many producers kept output steady on expectations that demand would rise in 2024 and 2025 when several liquefied natural gas (LNG) export plants enter service. Although the Biden administration has taken a pause at looking at new facilities, there are quite a few already permitted and under construction.

3) Shell said that it expects LNG demand to surge 50% by 2040 in a clean-fuel transition. Demand for natural gas globally may peak after 2040 – the appetite for LNG and LPG’s will continue growing as China and other developing Asian nations switch from dirtier coal to the comparatively cleaner fuel.

4) The Mountain Valley Pipeline keeps progressing. Mountain Valley Pipeline LLC won its bid on Tuesday of last week to continue construction on a more-than-300-mile-long natural gas pipeline through Virginia despite a protest from affected property owners. The U.S. Court of Appeals for the D.C. Circuit, after remand from the U.S. Supreme Court, affirmed the district court’s decision to dismiss for lack of jurisdiction a lawsuit brought by landowners whose properties were in the path of the pipeline and were seized by eminent domain.

5) On a final note, even though Natural Gas Prices are low now, production declines and soon to be greater access to world markets coupled with higher prices for Propane, Natural Gasoline and other LPG’s not to mention producer discipline should lead to a nice pop for Natgas in the not so distant future. Natgas closed at $1.609 per MMbtu on Friday of last week – to cheap not to buy!

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 250, 4000 Rapid Hoppers needed off of the BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 50-100, 4750CF Open/Covered Hoppers needed off of the BN in Washington for Feb-Jun. Cars are needed for use in Petcoke service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K DOT117R, DOT117J, DOT111 Tanks needed off of UP in Iowa for 2-3 years. Cars are needed for use in feedstock service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 years. Cars are needed for use in Crude service.

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in the Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 20-30, Open Top Hoppers needed in the Northeast. Cars are needed for use in Aggregate service. Gravity dump

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 80, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Long-term Lease.

- 50, 33K, 340W Pressures currently moving. Cars were last used in Propane. 1-year lease

- 50, 33K, 340W Pressures currently moving. Cars were last used in Propane. 6-year lease

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website