“Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Systematically you get ahead, but not necessarily in fast spurts. Nevertheless, you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day. At the end of the day – if you live long enough – most people get what they deserve.” – Charles “Charlie” Munger

COVID 19 and Markets Update

The United States currently has 4,371,992 confirmed COVID 19 cases and 149,850 confirmed deaths

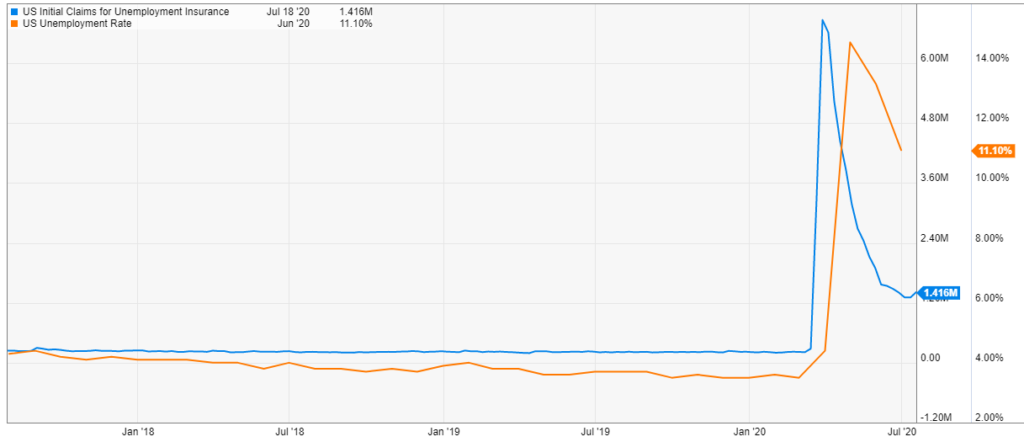

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 1.4 million jobless claims, bringing the total job losses since the coronavirus pandemic to 50.5 million exceeding expectations and the markets suffered as a result.

U.S. Unemployment Initial Claims and Unemployment Rate

The DOW closed lower on Friday, down 182.44 points (- 0.68%) to finish out the week at 26,469.89. The S&P 500 traded down 20.03 points (-0.62%) on Friday, closing at 3,215.63. The Nasdaq finished the session lower as well, losing 98.24 points and closing out the week at 10,363.18. In overnight trading, DOW futures traded higher and is expected to open up this morning 108 points.

West Texas Intermediate (WTI) traded up 22¢ to close at $41.29 on Friday on the New York Mercantile Exchange, up 70¢ per barrel week over week on the back of a weaker dollar and stronger economic indicators, however, tensions between the U.S. and China limited further advancement. Euro zone business activity grew in July for the first time since the virus, according to IHS Markit’s flash Composite Purchasing Managers’ Index. The index is seen as a good indicator of the Europe’s economic health. Also U.S. business activity increased to a six-month high in July, however, U.S. companies reported a drop in new orders as new COVID-19 cases spiked. The Chinese COVID 19 virus continues to plague the U.S. Some states have reinstated restrictions, which will most likely reduce fuel consumption.

Brent traded up 3¢ cents to close at $43.34 on Friday of last week, a gain of 10¢ per barrel week over week.

U.S. crude inventories increased by 4.89 million barrels last week and now stands at 536.54 MM/bbls.

Gasoline inventories were down by 1.8 MM/bbls while distillate inventories decreased by 1.07 MM/bbls.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at 41.29 down 22 ¢/ barrel from Friday’s close.

Petroleum car loads increased week over week. The four-week moving average of petroleum carloads rose from 19,939 to 20,133 week over week. CP volumes decreased by 0.5% while CN’s volumes rose by 11.2%. Folks, we continue to be of the belief some Canadian crude by rail shippers have sunk transportation costs with the class 1’s (CP and CN), so traditional basis economics don’t come into play for some at this point in time. When digging deep into CN’s earnings while their crude by rail volumes are down significantly their revenues are down marginally.

Folks, there are so many factors affecting the outlook for crude by rail right now that it is almost impossible to predict here a few things PFL is following very closely:

- Will DAPL be shut down? – The deadline to have filed supporting briefs in the DAPL appeals case passed last week, on Thursday, July 23. A total 14 legal briefs were filed from a broad spectrum of interest groups, representing energy, agriculture and state governments, expressing support for the continued operation of the controversial pipeline through the long appeals process ahead. The court’s decision on the emergency stay could come anytime in the next few weeks. Hearings before the appeals court have not been scheduled. We don’t see how DAPL can be shut down but stranger things have happened. If DAPL is shut down, expect a significant increase in crude by rail traffic out of the Bakken.

- Will Marathon’s High Planes Crude Oil Pipeline out of North Dakota be shut down? – In the case of High Plains, which delivers oil to Marathon’s 74,000 barrel-a-day Mandan refinery, the U.S. Interior Department’s Bureau of Indian Affairs ordered it shut after determining the pipeline was trespassing on Native American land. The ruling also found Marathon responsible for $187 million in damages and gave it 30 days to appeal. Marathon said on Friday of last week it intends to appeal. The pipeline is a 700 mile system that transports 270,000 barrels per day. Folks this is crazy stuff the pipeline has been operating since 1957. This has not been a good year for North Dakota and its producers but could prove to be a significant tail wind for crude by rail.

- Canadian producers are increasing production and on the back of that we are seeing wider basis differentials in the forward curve seemingly favorable for crude by rail. On Q2 earnings calls last week two Canadian heavyweight oil giants said they are ready to begin their crude by rail programs in a moment’s notice.

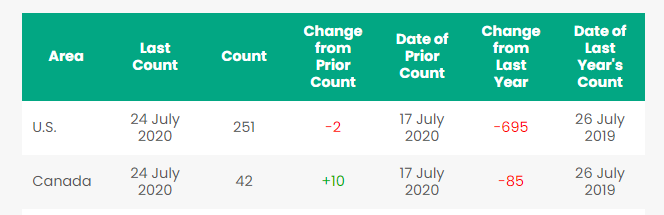

Rig Count

North America rig count moved higher and is up 8 rigs week over week with the U.S. losing 2 rigs and Canada gaining 10 rigs. Year over year we are down 780 rigs collectively. Canada now has 42 rigs nationwide operating and the U.S. has 251 rigs operating.

North American Rig Count Summary

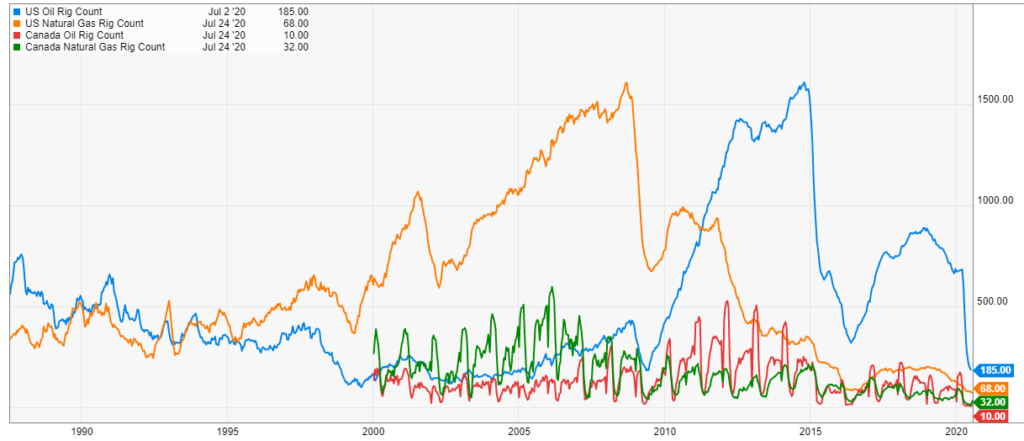

In the U.S. there are 181 rigs drilling for oil, 68 rigs drilling for natural gas and two miscellaneous rigs according to Baker Hughes. This is the fourth consecutive week where we have seen U.S. rig counts continue to deteriorate while Canadian rig counts posted gains. According to Baker Hughes, this is the lowest level of U.S. rig count activity since 1987.

North American Rig Count Activity by Commodity 30 Year Chart

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

North American Rail Traffic

Total North American rail volumes were down 7.5% year over year in week 29 (U.S. -8.5%, Canada -9.4%, Mexico +13.7%), resulting in quarter to date volumes that are down 9.0% and year to date volumes that are down 11.7% (U.S. -12.8%, Canada -8.5%, Mexico -9.9%). 7 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from coal (-28.1%), nonmetallic minerals (-17.0%) and metallic ores & metals (-19.2%). The largest increases came from grain (+4.7%) and farm products & food (+4.5%).

In the East, CSX’s total volumes were down 6.2%, with the largest decrease coming from coal (-30.9%). NS’s total volumes were down 12.4%, with the largest decreases coming from coal (-37.7%) and intermodal (-6.1%).

In the West, BN’s total volumes were down 11.4%, with the largest decreases coming from coal (-28.2%), petroleum (-39.0%), metallic ores (-80.5%) and stone sand & gravel (-39.8%). The largest increase came from grain (+10.3%). UP’s total volumes were down 6.2%, with the largest decreases coming from coal (-26.2%), stone sand & gravel (-26.9%), petroleum (-30.7%) and chemicals (-7.4%). The largest increase came from intermodal (+1.9%).

In Canada, CN’s total volumes were down 8.7% with the largest decreases coming from petroleum (-30.2%), chemicals (-21.9%) and stone sand & gravel (-46.2%). RTMs were down 14.0%. CP’s total volumes were down 11.8%, with the largest decreases coming from intermodal (-13.9%), petroleum (-54.4%) and stone sand & gravel (-64.0%). RTMs were down 10.0%.

KCS’s total volumes were down 7.7%, with the largest decreases coming from intermodal (-7.0%) and motor vehicles & parts (-36.9%).

Source Stephens

Railcar Markets

PFL is offering: Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel and crude oil. Lease terms negotiable, short and long term opportunities available. C02 cars are now available for lease, so get them while you can. Leases on 117Js and 117Rs, dirty for as little as 6 month lease or sublease. Clean cars are available for longer terms. 61 ft. bulkhead flat cars, lease only. PFL has a number of steel and aluminum hoppers for various commodities and tank cars, all for sale. Additionally sand cars, box cars, coal cars and hoppers including sugar covered and plastic pellet cars, are also available for sale and lease in various locations and terms. Call us today!

PFL is seeking: 40 cars for LPG service needed in Kansas for Oct-Mar service, dirty preferred, clean considered. 200 25.5 cpc 1232 cars for use in Mexico for 1-3 years for heavy fuel oil. 100 DOT 117s R’s or J’s for gasoline service – needed in Port Arthur for 2 months with a two months option. 2 Covered hoppers for purchase, 5500 series, for storage at plant site in the Chicago area, BN or NS connection. 25-50 chip gons for lease or sale, UP location preferred. 5-10 syrup cars are needed in the Midwest. Need 100 steel coal gons for sale. Need 10 20K to 23.5 coiled and insulated for one year in ethylene glycol. 10 CPC 1232 or other for industrial alcohol use in Indiana off the NS for 6 months: lessee would take ethanol cars clean then use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels please call to discuss). Please contact PFL with any of these opportunities, very much appreciated!

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE HAVE JUST COMPLETED A JOB IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|