“A wise man can learn more from a foolish question than a fool can learn from a wise answer.”

– Bruce Lee

Jobs Update

- Initial jobless claims seasonally adjusted for the week ending December 16th, 2023 came in at 205,000, up 2,000 people week-over-week.

- Continuing jobless claims came in at 1.865 million people, versus the adjusted number of 1.866 million people from the week prior, down -1,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed lower on Friday of last week, down -18.38 points (-0.05%), closing out the week at 37,385.97, up 80.82 points week-over-week. The S&P 500 closed higher on Friday of last week, up 7.88 points (+0.17%), and closed out the week at 4,754.63, up 35.44 points week-over-week. The NASDAQ closed higher on Friday of last week, up 29.11 points (+0.2%), and closed out the week at 14,992.97, up 179.05 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 37,794 this morning up 54 points.

Crude oil closed lower on Friday of last week, but up week over week

WTI traded down $-0.33 per barrel (-0.44%) to close at $73.56 per barrel on Friday of last week, but up $2.13 per barrel week-over-week. Brent traded down -US$0.32 per barrel (-0.39%) on Friday of last week, to close at US$79.07 per barrel, up US$2.52 per barrel week-over-week.

In Canada One Exchange, WCS for February delivery settled on Friday of last week at minus nineteen dollars and seventy-five cents (-US$19.75) below the WTI-CMA. The implied value was US$54.01 per barrel.

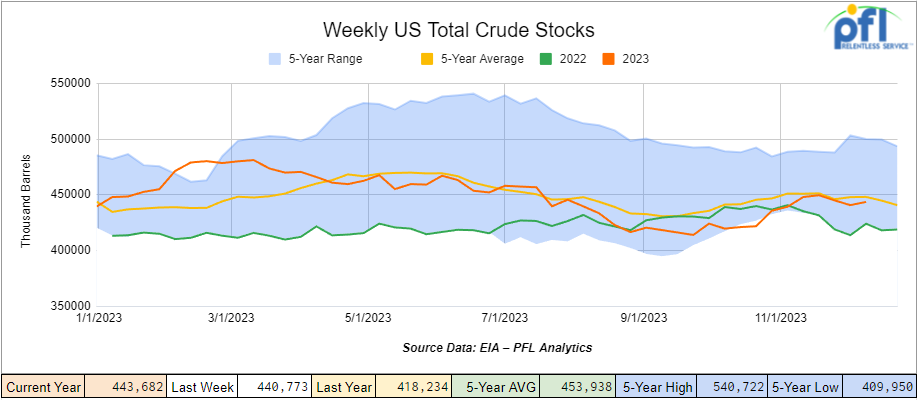

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.9 million barrels week-over-week. At 443.7 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

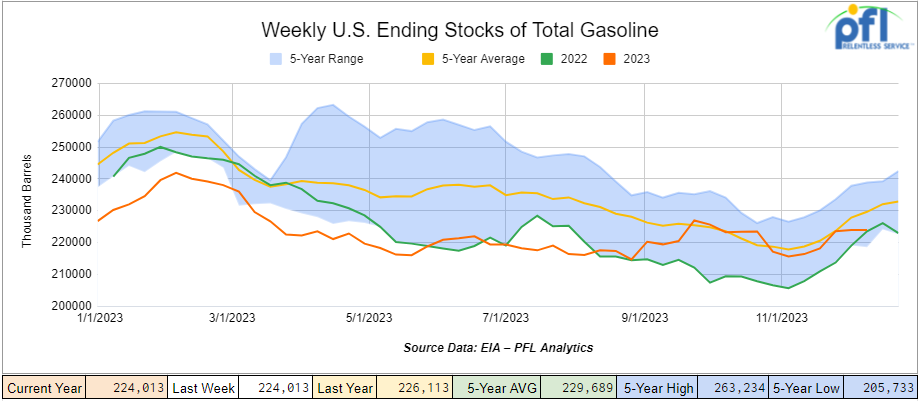

Total motor gasoline inventories increased by 2.7 million barrels week-over-week and are 2% below the five-year average for this time of year.

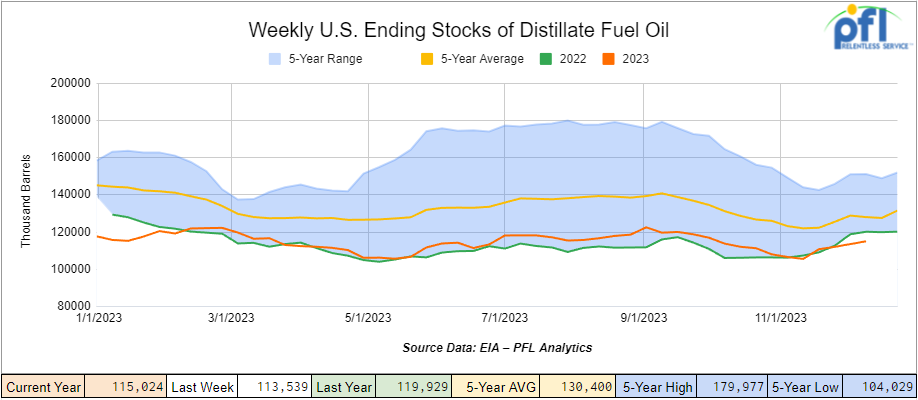

Distillate fuel inventories increased by 1.5 million barrels week-over-week and are 10% below the five-year average for this time of year.

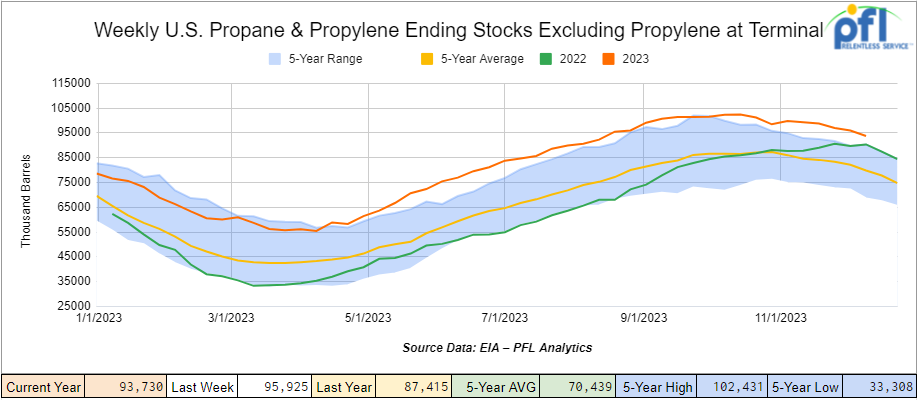

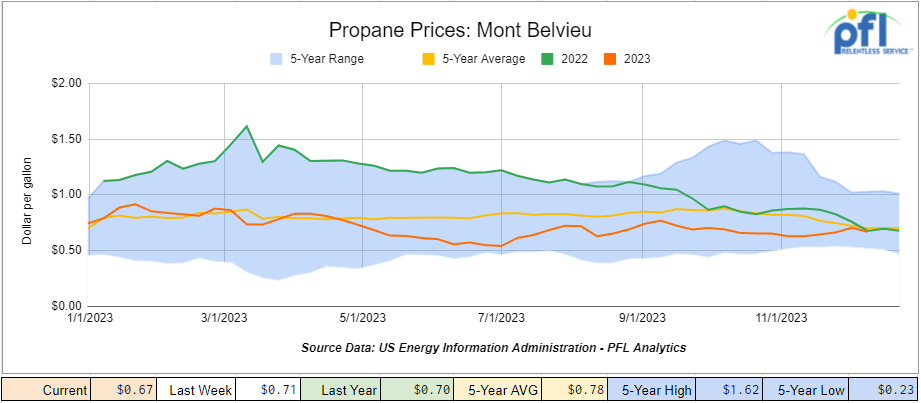

Propane/propylene inventories decreased by 2.2 million barrels week-over-week and are 19% above the five-year average for this time of year.

Propane prices closed at 67 cents per gallon, down -4 cents week-over-week, and down -3 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 2.7 million barrels during the week ending December 15th, 2023.

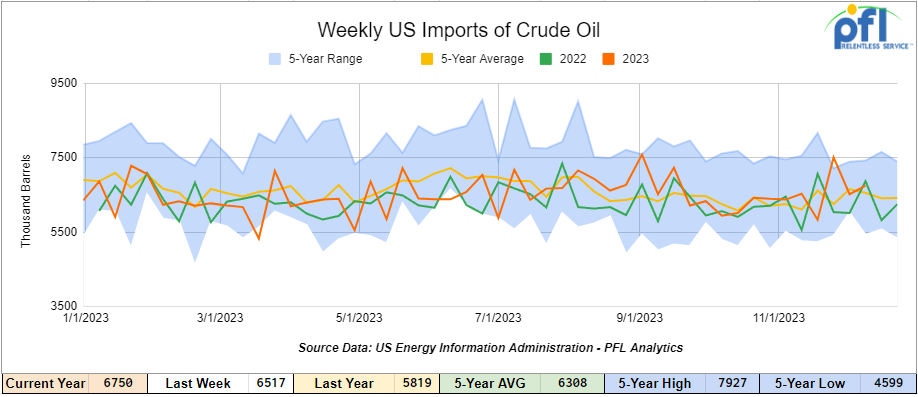

U.S. crude oil imports averaged 6.8 million barrels per day during the week ending December 15th, 2023, an increase of 233,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 7.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 537,000 barrels per day, and distillate fuel imports averaged 225,000 barrels per day during the week ending December 15th, 2023.

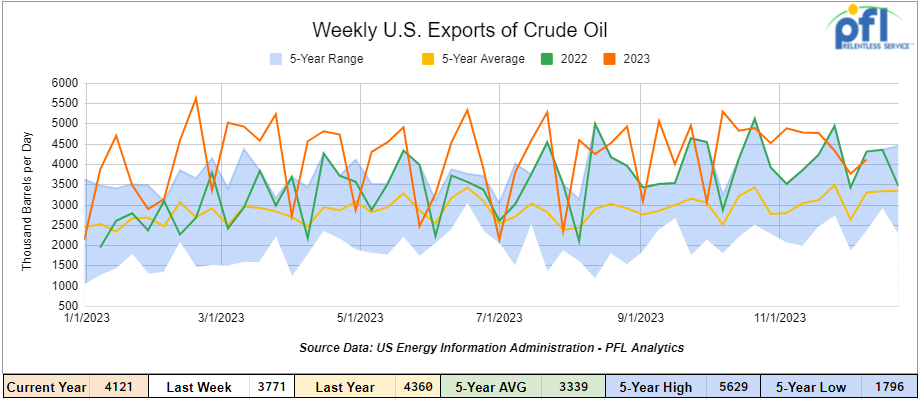

U.S. crude oil exports averaged 4.121 million barrels per day for the week ending December 15th, an increase of 350,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.252 million barrels per day.

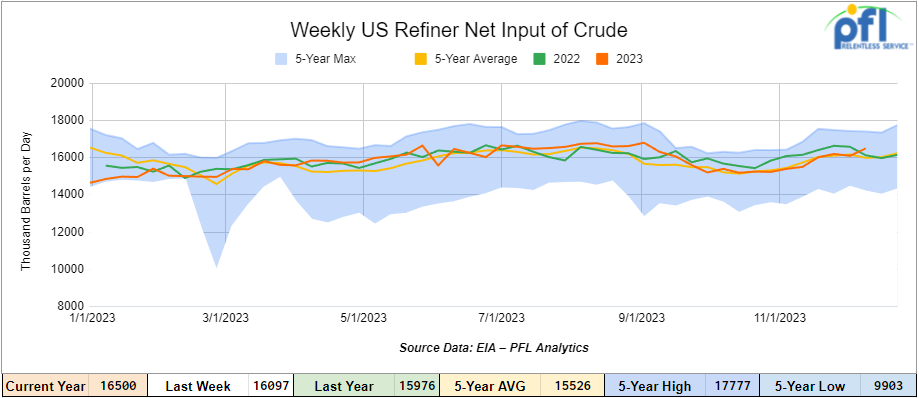

U.S. crude oil refinery inputs averaged 16.5 million barrels per day during the week ending December 15, 2023, which was 403,000 barrels per day more week-over-week.

WTI is poised to open at 73.32, down -24 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 20th, 2023.

Total North American weekly rail volumes were up (6.01%) in week 50, compared with the same week last year. Total carloads for the week ending on December 20th, 2023 were 358,122, up (5.52%) compared with the same week in 2022, while weekly intermodal volume was 333,776, up (6.53%) compared to the same week in 2022. 9 of the AAR’s 11 major traffic categories posted year over year increases with the most significant decrease coming from Farm Products (-1.54%). The largest increase came from Motor Vehicles and Parts (+11.63%).

In the East, CSX’s total volumes were up (4.62%), with the largest decrease coming from Farm Products (-8.84%) and the largest increase from Other (+12.27%). NS’s volumes were up (+2.83%), with the largest decrease coming from Grain (-17.42%) and the largest increase from Motor Vehicles and Parts (+13.35%).

In the West, BN’s total volumes were up (+9.2%), with the largest decrease coming from Farm Products (-1.4%), and the largest increase coming from Other (+41.12%). UP’s total rail volumes were up (+8.3%) with the largest decrease coming from Other (-21.09%) and the largest increase coming from Grain (+20.3%).

In Canada, CN’s total rail volumes were up (2.81%) with the largest increase coming from Metallic Ores and Metals (+17.13%) and the largest decrease coming from Grain (-34.67%). CP’s total rail volumes were up (22.19%) with the largest decrease coming from Petroleum and Petroleum Products (-37.58%) and the largest increase coming from Other (+1025%).

KCS’s total rail volumes were down (-5.61%) with the largest decrease coming from Other (-28.1%) and the largest increase coming from Grain (+42.34%).

Source Data: AAR – PFL Analytics

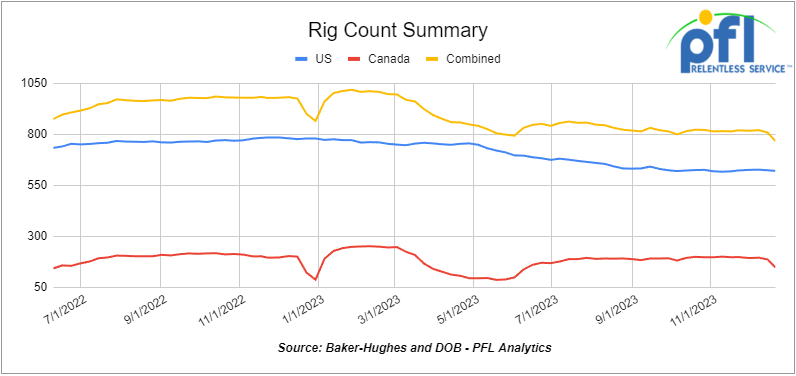

Rig Count

North American rig count was down by -42 rigs week-over-week. U.S. rig count was down by -3 rigs week-over-week, but down by -159 rigs year-over-year. The U.S. currently has 620 active rigs. Canada’s rig count was down by -39 rigs week-over-week , but up by 25 rigs year over year. Canada’s overall rig count is 146 active rigs. Overall, year-over-year, we are down -134 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,383 from 28,935, which was a gain of +448 rail cars week-over-week. The third week of consecutive week-over-week increases. Canadian volumes were higher. CPKC’s shipments rose by +10.2% week over week, and CN’s volumes were higher by 3.9% week-over-week. U.S. Shipments were mostly higher The NS was the largest percentage increase and was up by +8.5%. The CSX was the sole decliner and was down by -9.6%.

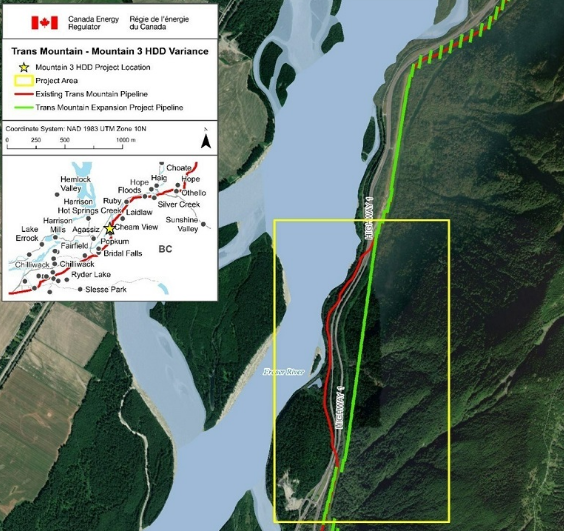

We are Watching Trans Mountain Pipeline

The Commission of the Canada Energy Regulator (CER) has determined that Trans Mountain did not adequately address concerns about pipeline integrity and related environmental protection impacts in its pipe size variance application.

Trans Mountain later warned of delays as a result of the regulatory setback.

The 2.3-kilometre section located beside the Fraser River, between Hope and the Burnaby Tank Terminal, was approved to be constructed with a 36-inch pipe. However, Trans Mountain faced slow progress due to challenging horizontal directional drilling (HDD) conditions and proposed using a smaller 30-inch pipe that would not affect overall capacity.

“The Commission found that the drawbacks outweighed Trans Mountain’s stated benefits,” said the CER.

Specifically, it had concerns about:

Quality of materials: Trans Mountain did not demonstrate compliance with its Quality Management Program. The company did not show that the quality of materials for the 30-inch pipe would meet the standard of those used in the rest of the TMEP, said the CER.

In-line inspections: Trans Mountain did not demonstrate how they would conduct in-line inspections before beginning operations on the full 138.4-kilometer pipeline section between Hope and the Burnaby Tank Terminal. Without in-line inspections (ILI), they could not ensure the safety and integrity of this section of pipe to the same level as the rest of the TMEP.

Pipeline integrity and environmental protection: Trans Mountain did not adequately address potential environmental impacts from material quality changes and lack of ILI capability. Trans Mountain did not provide satisfactory responses or solutions to address the Commission’s requests for additional information.

On Dec. 14, 2023, Trans Mountain filed a new variance application for the same pipeline section. The CER is currently evaluating this application.

We continue to watch China and The Green New Deal

Folks you are not going to believe the latest and greatest – at PFL nothing surprises us anymore – we report, you decide.

China is prohibiting the export of some technologies to process rare earth elements to protect its national security as the race for critical minerals supply intensifies.

China’s Commerce Ministry banned on Thursday of last week the export of technology to extract and separate rare earth elements, a group of 17 critical metals used in the manufacturing of permanent magnets that are used in electronics, EV technologies, and wind turbines.

The move follows last month’s directive from the Chinese authorities to exporters of rare earth minerals to report transactions and is the latest escalation of the trade spat between China and the West.

Earlier this year, China, the world’s largest producer and supplier of graphite, said it would require export permits for some graphite products as of December 1 as it seeks to protect its national security. Graphite and graphite products are critical for the manufacturing of any electric vehicle battery, and China is the dominant player in the market.

The restriction on exports of graphite products was the latest Chinese attempt to exert its market influence to control the supply of critical minerals.

China has now banned the export of production technology for rare earth metals and alloy materials, and technology to produce some rare earth magnets.

In rare earths, China controls 60% of global supply and a massive 90% of the global refining of rare earth elements, the International Energy Agency (IEA) said in a report on the vulnerabilities of the clean energy supply chains earlier this year. China is also the only large-scale producer of heavy rare earth ores. The current administration wants to go green with more wind and solar, which is not even green and we don’t even produce the rare earth minerals here – oh my gosh fasten your seatbelt folks we are in for one heck of a ride.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K Dot 111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K 117R, 117J, DOT 111 Tanks needed off of UP in Iowa for 2-3 Years. Cars are needed for use in feedstock service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 Year. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 Dot 111 Tanks needed off of Any Class 1 in USA for 5 Year. Cars are needed for use in Asphalt service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in Northeast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service. Q1

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service. Q2-Q3

- 10, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Iowa for 2 Years. Cars are needed for use in Biodiesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

Sales Bids

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 10, 28.3K, 117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean Brand New. 2-5 Year Lease

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Mix of dirty and clean cars

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT-111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT-111 Tanks located off of various class 1s in multiple locations.

- 120, 31.8K, CPC 1232 Tanks located off of various class 1s in multiple locations.

- 300-500, 3250s, Covered Hoppers located off of various class 1s in multiple locations.

- 140, 60ft, Boxcars located off of various class 1s in multiple locations.

- 150, 29.2K, 117R Tanks located off of various class 1s in multiple locations.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|