“The beauty is that through disappointment you can gain clarity, and with clarity comes conviction and true originality.” – Conan O’Brien

Jobs Update

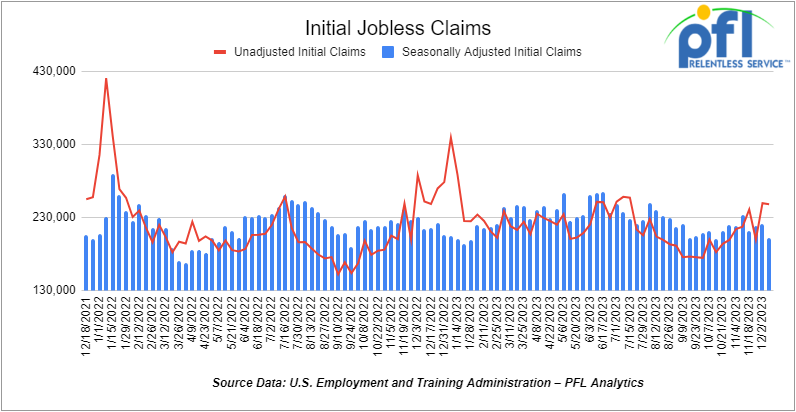

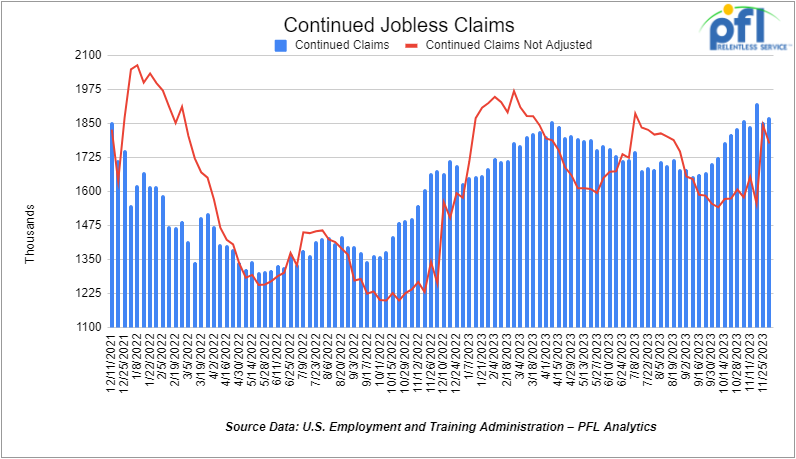

- Initial jobless claims seasonally adjusted for the week ending December 9th, 2023 came in at 202,000, down -19,000 people week-over-week.

- Continuing jobless claims came in at 1.876 million people, versus the adjusted number of 1.856 million people from the week prior, up +20,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 56.81 points (+0.15%), closing out the week at 37,305.16, up 1,057.29 points week-over-week. The S&P 500 closed lower on Friday of last week, down -0.36 points (-0.01%), but closed out the week at 4,719.19, up 114.82 points week-over-week. The NASDAQ closed higher on Friday of last week, up 52.36 points (+0.36%), and closed out the week at 14,813.92, up 409.95 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 37,753 this morning up 92 points.

Crude oil closed lower on Friday of last week, but up week over week

WTI traded down $-0.15 per barrel (-0.21%) to close at $71.43 per barrel on Friday of last week, but up $0.20 per barrel week-over-week. Brent traded down -US$0.06 per barrel (-0.8%) on Friday of last week, to close at US$76.55 per barrel, up US$0.71 per barrel week-over-week.

In Canada, One Exchange WCS for January delivery settled on Friday of last week at minus twenty-three dollars and fifty cents per barrel (US$23.50) below the WTI-CMA. The implied value was US$51.64 per barrel.

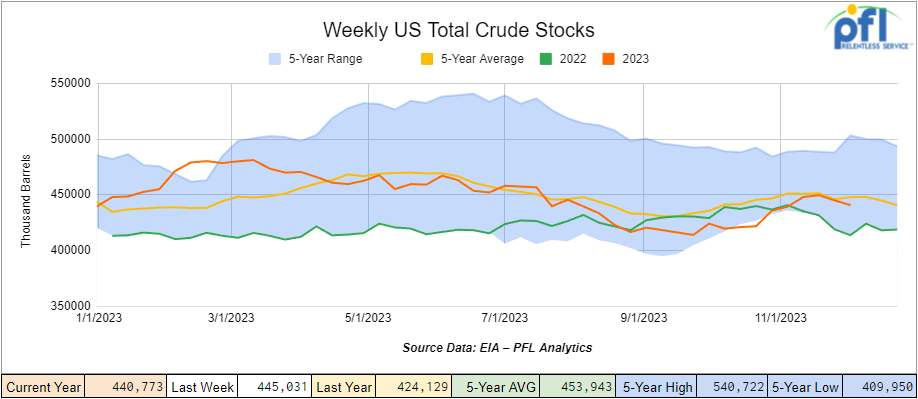

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by -4.3 million barrels week-over-week. At 440.8 million barrels, U.S. crude oil inventories are 2% below the five-year average for this time of year.

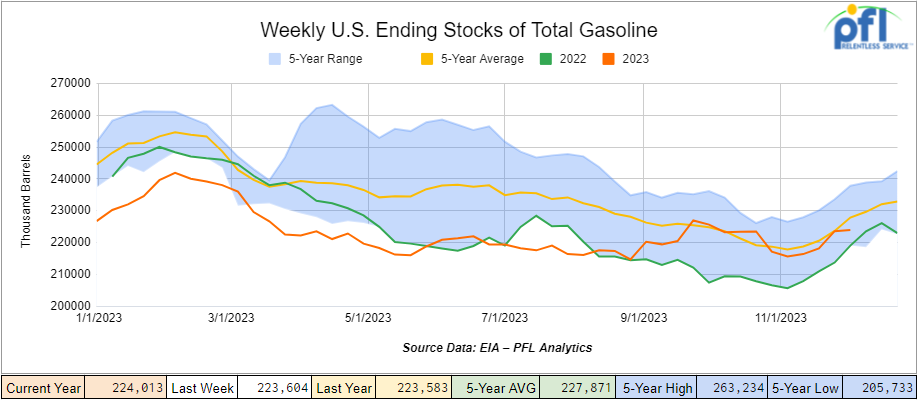

Total motor gasoline inventories increased by +400,000 barrels week-over-week and are 2% below the five-year average for this time of year.

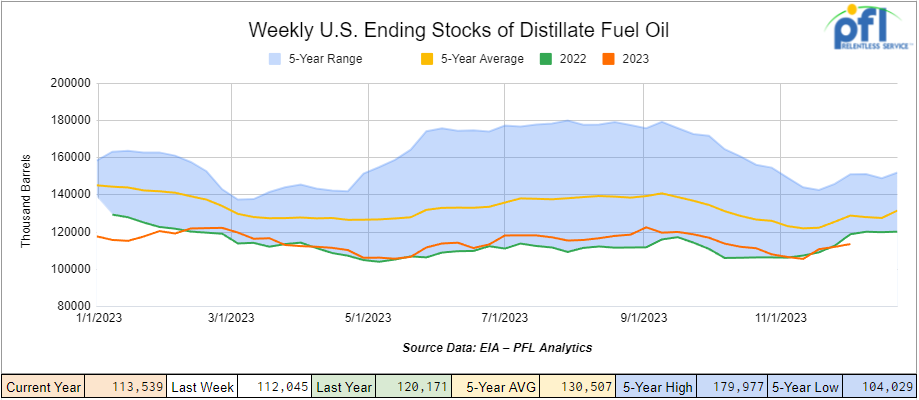

Distillate fuel inventories increased by +1.5 million barrels week-over-week and are 12% below the five-year average for this time of year.

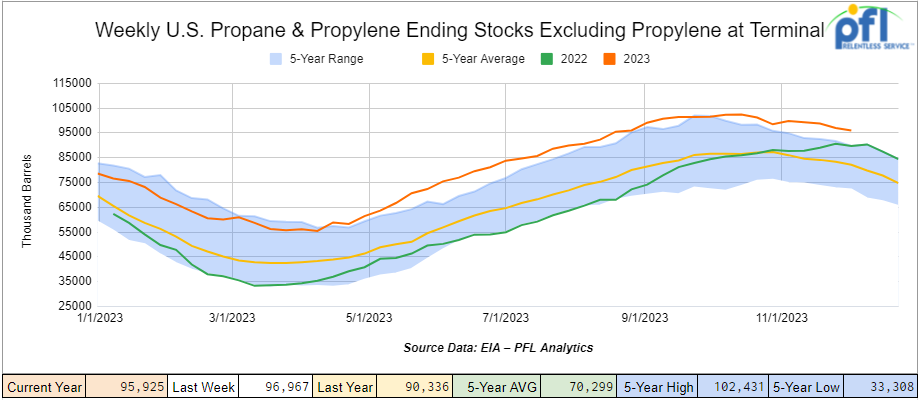

Propane/propylene inventories decreased by -1 million barrels week-over-week and are 18% above the five-year average for this time of year.

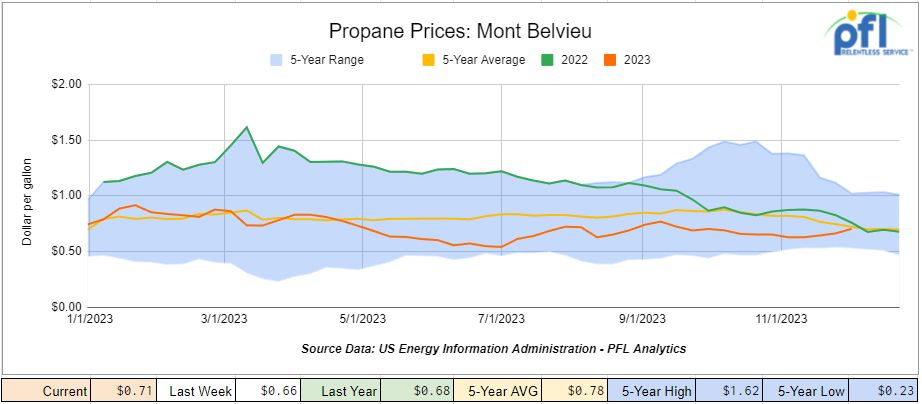

Propane prices closed at 71 cents per gallon, up +5 cents week-over-week, but down -3 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 10 million barrels during the week ending December 9th, 2023.

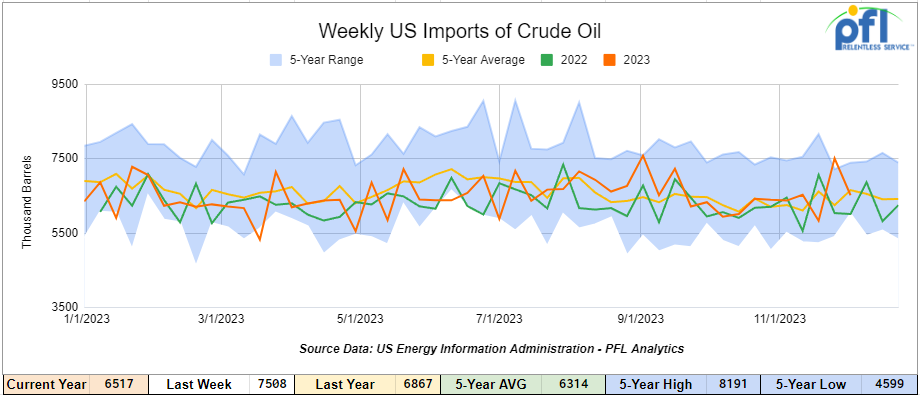

U.S. crude oil imports averaged 6.5 million barrels per day during the week ending December 9th, 2023, a decrease of 1 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 1.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) for the week ending December 9, 2023, averaged 715,000 barrels per day, and distillate fuel imports averaged 205,000 barrels per day during the week ending December 9th, 2023

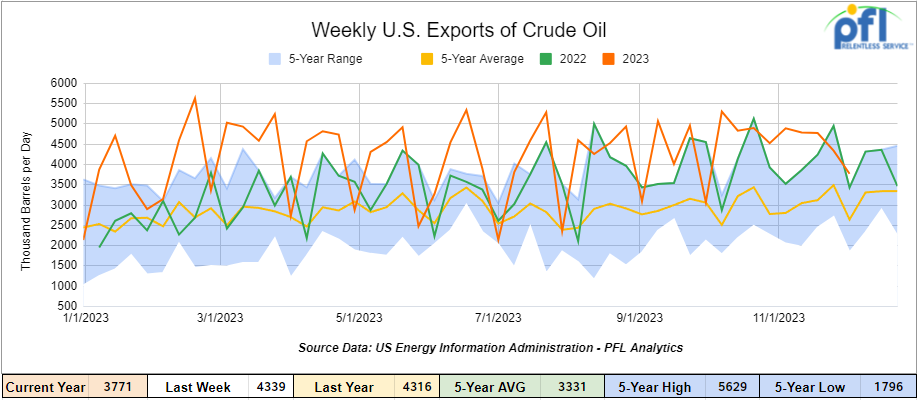

U.S. crude oil exports averaged 3.771 million barrels per day for the week ending December 9th, a decrease of 568,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.418 million barrels per day.

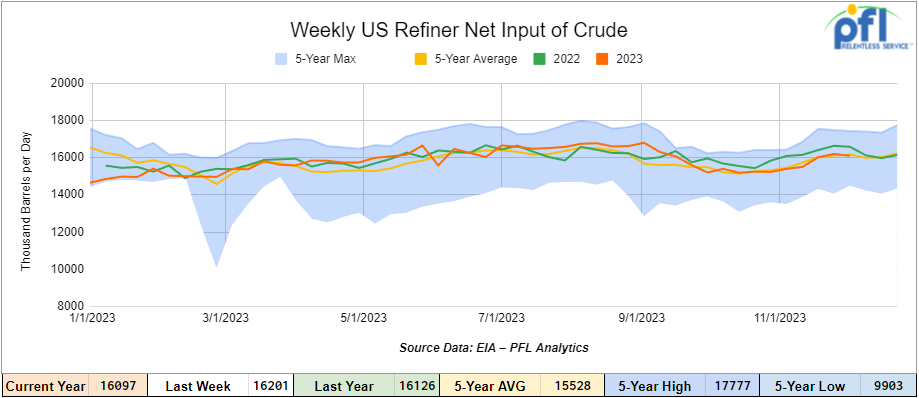

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending December 8, 2023, which was 104,000 barrels per day less than the previous week’s average.

WTI is poised to open at 70.92, down -51 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending December 13th, 2023.

Total North American weekly rail volumes were up (0.77%) in week 49, compared with the same week last year. Total carloads for the week ending on December 13th, 2023 were 356,091, down (-1.36%) compared with the same week in 2022, while weekly intermodal volume was 336,007, up (3.14%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Grain (-9%). The largest increase came from Motor Vehicles and Parts (+13.04%).

In the East, CSX’s total volumes were down (-0.68%), with the largest decrease coming from Grain (-15.81%) and the largest increase from Petroleum and Petroleum Products (+12.32%). NS’s volumes were up (+1.13%), with the largest decrease coming from Grain (-15.26%) and the largest increase from Motor Vehicles and Parts (+16.45%).

In the West, BN’s total volumes were up (+1.28%), with the largest decrease coming from Coal (-12.08%), and the largest increase coming from Other (+20.43%). UP’s total rail volumes were up (+3.83%) with the largest decrease coming from Other (-25.58%) and the largest increase coming from Forest Products (+16.25%).

In Canada, CN’s total rail volumes were down (-5.88%) with the largest increase coming from Petroleum and Petroleum Products (+19.33%) and the largest decrease coming from Coal (-39.75%). CP’s total rail volumes were up (2.24%) with the largest decrease coming from Other (-62.26%) and the largest increase coming from Motor vehicles and Parts (+89.45%).

KCS’s total rail volumes were down (-9.45%) with the largest decrease coming from Other (-20.42%) and the largest increase coming from Motor Vehicles and Parts (+52.33%).

Source Data: AAR – PFL Analytics

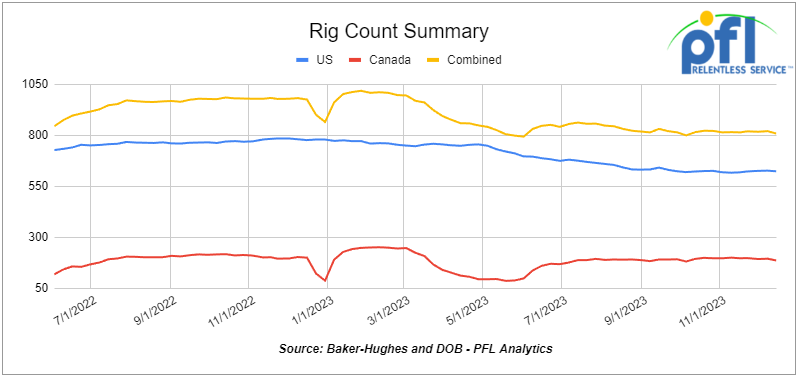

Rig Count

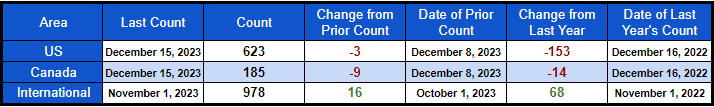

North American rig count was down by -12 rigs week-over-week. U.S. rig count was down by -3 rigs week-over-week, but down by -153 rigs year-over-year. The U.S. currently has 623 active rigs. Canada’s rig count was down by -9 rigs week-over-week and down by -14 rigs year over year. Canada’s overall rig count is 185 active rigs. Overall, year-over-year, we are down -167 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,935 from 28,769, which was a gain of +166 rail cars week-over-week. The second week of consecutive week-over-week increases. Canadian volumes were higher. CPKC’s shipments rose by +0.7% week over week, CN’s volumes were higher by 3.8% week-over-week. U.S. shipments were mixed The CSX was the largest percentage increase and was up by +12.4%. The NS had the largest percentage decrease and was down by -15.7%.

We are watching The Trans Mountain Pipeline – Another Potential Delay

In a never-ending battle, a Federal Government Canadian-owned pipeline continues to battle with its own government and the Canadian Energy Regulator (CER) to finish up the building of its now C$30.9-billion-dollar pipeline. Trans Mountain Corporation asked the CER on Thursday to reverse a decision rejecting proposed construction changes on its oil pipeline expansion, warning of a possibly “catastrophic” two-year delay and billions of dollars in losses if not approved.

If Trans Mountain goes ahead with the construction plan that is currently approved, complications could result in a borehole for the pipeline becoming compromised, forcing Trans Mountain to find an alternative installation plan, the company said in a letter to the CER.

The CER earlier this month had denied Trans Mountain’s request for a variance on a section of pipeline under construction in British Columbia. Trans Mountain had asked to be allowed to install a smaller diameter pipe in a 2.3-kilometre section of the oil pipeline’s route after encountering difficult drilling conditions due to the hardness of the rock in a mountainous area between Hope and Chilliwack British Columbia.

The CER decision was yet another setback for the hugely over-budget and now C$30.9-billion expansion.

In Thursday’s letter, Trans Mountain said the hard rock conditions and fractured areas within the bedrock have allowed high rates of water ingress, causing complications. Those problems are likely to worsen if Trans Mountain has to proceed with installing larger-diameter pipe, it said.

“If the [horizontal directional drill] fails and Trans Mountain is required to implement an alternative installation plan, the TMEP schedule will likely be delayed by approximately two years, and Trans Mountain will suffer billions of dollars in losses,” the company said.

Trans Mountain asked for a decision no later than Jan. 9 to stick to its current schedule.

The Trans Mountain expansion is due to start shipping oil by the end of March 2024. Trans Mountain had previously warned of a shorter delay of 59 days if it was forced to install larger-diameter pipe.

Given the new information provided by Trans Mountain, the CER will likely approve its request, Stifel analyst at Michael Dunn said in a note.

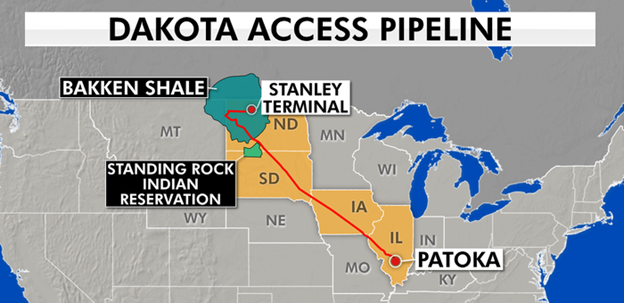

We are watching the Dakota Access Pipeline (DAPL)

In yet another pipeline drama story, the Standing Rock Sioux Tribe wants DAPL shut down. Energy Transfer’s 1,172-mile underground 30-inch diameter pipeline is transporting 750,000 barrels per day of light sweet crude oil from the Bakken/Three Forks production area in North Dakota to Patoka, Illinois to refiners in the Midwest has been a factor in keeping gasoline prices low. It is the main pipeline that moves oil out of North Dakota, our number 2 oil-producing state.

DAPL Pipeline System

In the latest and greatest the U.S. Army Corp of Engineers received 195,000 comments and the comment period ended on Friday of last week. The corps will review the 195,000 comments comparing it to its new draft Environmental Impact Statement that was released on September 8th 2023. The corps was seeking public input on:

- Shut the pipeline down

- Keeping the pipeline operational while completing alternative routes around the tribe.

Stay tuned to PFL on this one – obviously a massive rail impact if this pipeline is shut down even for a short period of time.

We were watching COP28 in Dubai where Climate Alarmists Gathered in their Private Planes

Last week’s COP28 agreement to transition away from fossil fuels has triggered both hope and despair as the world tries to tackle what United Nations Secretary-General Antonio Guterres has called the “root cause” of the climate crisis – the production and consumption of oil, natural gas and coal.

The commitment was made by some 200 countries at the UN climate talks in Dubai on Wednesday of last week. The agreement on fossil fuels was part of the response to the first Global Stocktake of the Paris Agreement, which in September showed the world was way off track in meeting the 2015 accord’s climate targets.

The final text called for “transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner, accelerating action in this critical decade, so as to achieve net zero by 2050 in keeping with what they refer to as “science,”

COP28 President Sultan Al Jaber praised the agreement as a “historic package” – He also added I want to say that a fossil fuel phase-out is inevitable whether they like it or not,”. “Let’s hope it doesn’t come too late.”

Former U.S. Vice President Al Gore, who has championed environmental causes for years, wrote on X on Wednesday of last week that the decision to “finally recognize that the climate crisis is, at its heart, a fossil fuel crisis” is an important milestone. It is estimated it is going to cost us $400 billion a year!

As it relates to rail also out of the meeting The United States and Canada will form a task force to reduce train emissions. The two countries made the announcement at the United Nations climate conference in Dubai. The goal of the task force is to develop a common vision to reduce emissions from the rail sector. According to the government, Freight railroads make up 0.5% of total emissions and 2% of transportation-related emissions in the United States.

As part of the task force, the U.S. and Canada will establish a joint research agenda to test hydrogen- and battery-powered locomotives

“The governments of the United States and Canada share a strong commitment to addressing the urgent global challenge of climate change,” U.S. Energy Secretary Jennifer Granholm, U.S. Transportation Secretary Pete Buttigieg and Canada’s Minister of Transport Pablo Rodriguez said in a joint statement. We are watching this one folks – stay tuned to PFL for further details.

We are watching the Panama Canal as the drought continues to raise havoc

The official Panama Canal transit numbers for November are out — and they’re not good. The total number of transits declined 22% in November versus October, according to just-released data from the Panama Canal Authority (ACP). And for the first time since the drought began, the numbers are not just falling at the older, smaller Panamax locks. They’re also declining sharply at the larger Neopanamax locks, which debuted in 2016.

The Neopanamax locks are a crucial conduit for high-capacity container vessels bringing goods from Asia to U.S. East and Gulf Coast ports, and for liquefied petroleum gas (LPG) and liquefied natural gas (LNG) carriers transporting exports from the U.S. Gulf to Asia.

Transits through the Neopanamax locks fell 28% in November versus October, while transits through the Panamax locks dropped by 19%. Container ships, LPG ships and LNG ships were all hard-hit on the Neopanamax side. At the Panamax locks, dry bulk shipping was the biggest decliner, by far.

This time of year is the height of the export season for American farmers when grain cargoes traditionally move via the Panama Canal from the U.S. Gulf to Asia.

These transits have gone off a cliff as grain-laden bulkers have shifted to the Suez Canal: 164 Panamax bulkers transited in October and just 87 in November — a 47% month-on-month decline.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K 117R, 117J, DOT 111 Tanks needed off of UP in Iowa for 2-3 Years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 Year. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 Dot 111 Tank s needed off of Any Class 1 in USA for 5 Year. Cars are needed for use in Asphalt service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 Years. Cars are needed for use in Crude service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in Northeast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service. Q1

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service. Q2-Q3

- 10, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Iowa for 2 Years. Cars are needed for use in Biodiesel service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Closed Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

Lease Offers

- 10, 28.3K, 117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 13, 3915, PD Hoppers located off of UP in Kansas. Cars are clean Call 239-390-2885 for more information

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 10, 21.9K, Tanks located off of UP in Longview, TX. The cars are clean and brand new. 2-5 Year Lease

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Mix of dirty and clean cars

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT-111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT-111 Tanks located off of various class 1s in multiple locations.

- 20, Refer, Box Boxcars located off of UP in ID.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|