“If you really want to do something, you’ll find a way. If you don’t, you’ll find an excuse.”- Jim Rohn“

COVID 19 and Markets Update

The United States currently has 3,898,550 confirmed COVID 19 cases and 143,289 confirmed deaths

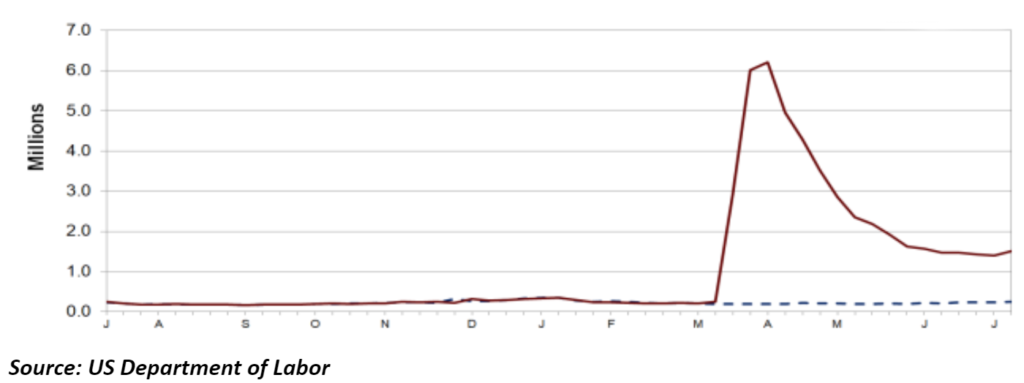

The U.S. Labor Department stated on Thursday of last week that U.S. workers filed an additional 1.3 million jobless claims, bringing the total job losses since the coronavirus pandemic to 49 million. Folks, it’s not getting better and the outlook is bleak. Small businesses are on the brink of destruction, most particularly in California, as they cannot survive another lockdown and so many are not going to come back. Eighteen states have now entered what they call the “RED zone” and are being advised that stricter measures must be taken to control the outbreak.

U.S. Unemployment Initial Claims

The DOW closed lower on Friday, down 62.76 points (- 0.23%) to finish out the week at 26,671.95. The S&P 500 traded up 9.16 points (+0.28%) on Friday, closing at 3,224.73. The Nasdaq finished the session higher as well, gaining 29.36 points and closing out the week at 10,503.19. In overnight trading, DOW futures traded lower and are expected to open down 16 points this morning at 26,504.

West Texas Intermediate (WTI) traded down 16¢ to close at $40.59 on Friday on the New York Mercantile Exchange, up 4¢ per barrel week over week. Fresh outbreaks of Chinese COVID-19 continue to weigh on the market and the threat of the world’s 4th largest economy (California) shutting down yet again.

Brent traded down 23¢ cents to close at $43.24 on Friday of last week a loss of 10¢ per barrel week over week.

U.S. crude inventories increased by 7.49 million barrels last week and now stand at 531.65 MM/bbls.

Gasoline inventories were down by 3.14 MM/bbls while distillate inventories decreased by 454 k/bbls.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $40.28 down .31 ¢/ barrel from Friday’s close.

Ethanol at Argo had a terrible week last week erasing the previous week’s gains and then some as ethanol producers’ ramp up and demand concerns reemerge despite a rally in corn. Ethanol at Argo closed the trading week at $1.23 per gallon a loss of 9 ¢/gallon on the day and a loss of 23 ¢/gallon week over week.

Petroleum car loads decreased slightly week over week. The four-week moving average of petroleum carloads declined from 19,948 to 19,939 week over week. CP volumes decreased by 4.1% while CN’s volumes decreased by a 3.4%.

Well, folks, cooler heads did prevail last week in regards to Energy Transfers request for a stay not to shut their pipeline down pending an appeal for the Dakota Access Pipeline (“DAPL”) was denied by U.S. District Judge James Boasberg on Thursday July 9th. DAPL is a 1,172-mile-long (1,886 km) underground oil pipeline in the U.S. Originating in the shale oil fields of the Bakken formation in northwest North Dakota, it continues through South Dakota and Iowa to an oil terminal near Patoka, Illinois and has a current capacity of 570,000 barrels per day. A Federal appeals court ruled Tuesday of last week that it will allow the Dakota Access Pipeline to continue shipping oil for the time being. The temporary administrative stay will allow the Energy Transfer to keep the oil flowing, pending its appeal of a judge’s order to shut down and drain the system by August 5th 2020. That closure would remain in effect until the completion of another environmental review, which could take 13 months.

The District of Columbia’s U.S. Circuit Court of Appeals, which issued the administrative stay, made it clear that it is temporary and “should not be construed in any way as a ruling on the merits.” Instead, it will allow the pipeline, which has been operating since 2017, to continue shipping oil until the court rules on the appeal. This is good news for the already battered Bakken producer and the state and citizens of North Dakota. Senator Kevin Cramer of North Dakota said: “Common sense prevails. The shutdown order was unreasonable and a clear example of judicial overreach. I hope the time will be used to find common ground among litigants.”

The U.S. Army Corps of Engineers has also filed a notice of appeal at an appeals court against the district court’s decision to shut down DAPL.

If Energy Transfer wins, they’ll be able to maintain the pipeline’s operations during the environmental review. If not, they’ll need to shut the line down, while likely appealing the ruling to the U.S. Supreme Court. The fire drill is over and contingency plans to increase rail out of the Bakken will be put on hold for the time being. A headwind for crude by rail.

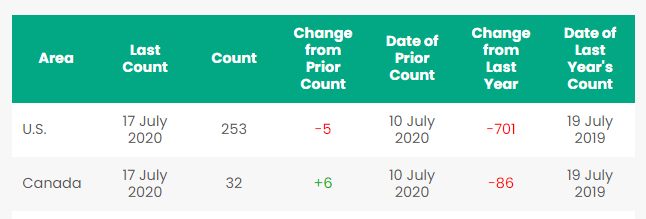

Rig Count

North America rig count moved higher and is up 1 rig week over week with the U.S. losing 5 rigs and Canada gaining 6 rigs. Year over year we are down 787 rigs collectively. Canada now has 32 rigs nationwide operating and the U.S. has 253 rigs operating. In the U.S. there are 180 rigs drilling for oil, 71 rigs drilling for gas and two miscellaneous rigs according to Baker Hughes. This is the third consecutive week where we have seen U.S. rig counts continue to deteriorate while Canadian rig counts posted gains.

North American Rig Count Summary

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

North American Rail Traffic

Total North American rail volumes were down 14.2% year over year in week 28 (U.S. -14.9%, Canada -12.5%, Mexico -10.0%), resulting in quarter to date volumes that are down 9.8% and year to date volumes that are down 11.8% (U.S. -12.9%, Canada -8.5%, Mexico -10.8%). 10 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from coal (-36.4%), intermodal (-7.8%) and metallic ores & metals (-32.1%). The largest increase came from farm products & food (+5.4%).

In the East, CSX’s total volumes were down 7.6%, with the largest decrease coming from coal (-31.8%). NS’s total volumes were down 14.1%, with the largest decreases coming from coal (-45.1%) and intermodal (-7.0%.)

In the West, BN’s total volumes were down 19.0%, with the largest decreases coming from coal (-41.3%), intermodal (-9.1%) and petroleum (-41.1%). UP’s total volumes were down 13.1%, with the largest decreases coming from coal (-28.6%), stone sand & gravel (-30.4%) and intermodal (-3.3%).

In Canada, CN’s total volumes were down 12.9% with the largest decreases coming from intermodal (-7.2%), petroleum (-38.3%) and metallic ores (-19.9%). The largest increase came from farm products (+134.0%). RTMs were down 20.5%. CP’s total volumes were down 13.9%, with the largest decreases coming from coal (-42.3%), petroleum (-55.0%) and intermodal (-10.6%). The largest increases came from farm products (+125.7%) and chemicals (+17.5%). RTMs were down 14.4%.

KCS’s total volumes were down 4.2%, with the largest decreases coming from motor vehicles & parts (-26.6%) and coal (-27.5%). The largest increase came from intermodal (+8.3%).

Source: Stephens

The crude oil market may be approaching another rough patch, with the trajectory of the COVID 19 pandemic and OPEC+ again poised to inflict a double whammy on Canadian and U.S. producers. For the past couple of months, refinery demand for crude has been rebounding as the U.S. has made tentative steps toward reopening. Over the same period, domestic production of oil declined and then flattened out, and now appears to be headed for a midsummer uptick as more shut-in wells are brought back online. But there’s potential trouble just ahead. The multiple month-long imbalance between crude supply and demand boosted U.S. oil inventories in commercial storage to record-high levels over the past few weeks, with even more oil flowing into rented space in the Strategic Petroleum Reserve (SPR) salt caverns. Worse yet for producers, a resurgence of the coronavirus may put some parts of the U.S. back into semi-lockdown, and if that happens, refinery utilization could take a second tumble. That could push more crude into storage or onto supertankers for export, even as OPEC+ is talking about relaxing their production cuts.

Other Transportation

U.S. Trucking Trends

- Spot market activity continues to rise off mid-April lows, with dry-van TL rates now flat year over year (versus down 20% year over year in April, have been declining year over year since 3Q18). As economic activity resumes post-COVID shutdowns in the early second quarter, demand appears to be trending above seasonal average to replenish inventories

- Seasonally-adjusted truck tonnage in May fell 9% year over year according to the ATA, less bad than April’s 12% decline, as weak industrial/automotive markets offset improving retail sales. The 3 month moving average was down 4.4% year over year in May and down 3.7% month over month.

- Cass shipment activity was down 20%+ year over year in April and May. With our work indicating a recovery in demand in June, expectations for the second half of the year indicate a normalization of demand, but limited forecasting remains a challenge.

- Average truckload rates (blended contract and spot) were down 6% year over year in June (excluding fuel surcharges and assessorial fees), according to Cass Information Systems, as capacity exceeds demand. Linehaul rates have been declining year over year since August 2019 (spot rates have been lower year over year since 3Q18). TL contract rates are likely down 5-10% year over year in 2020 (2019 down 5-15%, 2018 up 8-11%)

Global Airfreight, Containerized Ocean Traffic

- Total U.S. and Canadian container imports were down 5% year over year in June, according to PIERS, slightly better than expectations. Ocean volumes will improve into 2H20, likely flat by 4Q20

- During the past 45 days, spot market rates from Asia to the U.S. West Coast rose from $1,700 to $2,700 due to capacity reductions and incremental volume. FAK (spot rates with fuel) rates are now 30% above year ago levels according to the Shanghai Containerized Freight Index.

- Airfreight rates during May were up 145% year over year (up 11% month over month) as markets lap persistent demand weakness. Rates will likely decline over the next 60 days. The duration remains unclear for factory production schedules and reduced passenger flights.

Railcar Markets

PFL is offering: Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Clean and new cars are available for longer term leases. C02 cars are now available for lease, so get them while you can. A number of sand cars, box cars, coal cars and hoppers are also available for sale.

PFL is seeking: 40 LPG cars for use in propane in Conway October – March 100 DOT 117s R’s or J’s for gasoline service – need in Port Arthur for 2 months with a two months option, 2 Covered hoppers to purchase 5500 series for storage at plant site in the Chicago area BN or NS connection, 5-10 syrup cars in the Midwest, 100 steel coal gons for sale, need 10-20K to 23.5 coiled and insulated for one year in ethylene glycol, 10 CPC 1232 or other for Industrial Alcohol use in Indiana off the NS for 6 months lessee would take ethanol cars clean them use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels please call to discuss) 5 CPC 1232 or other for Ethanol use in MN for 6 months.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE HAVE JUST COMPLETED A JOB IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|