“I find that the harder I work, the more luck I seem to have.” Thomas Jefferson

COVID 19 and Markets Update

The United States currently has 3,304,942 confirmed COVID 19 cases and 135,205 confirmed deaths. Florida had its largest increase over the weekend with over 15,000 confirmed cases on Saturday,

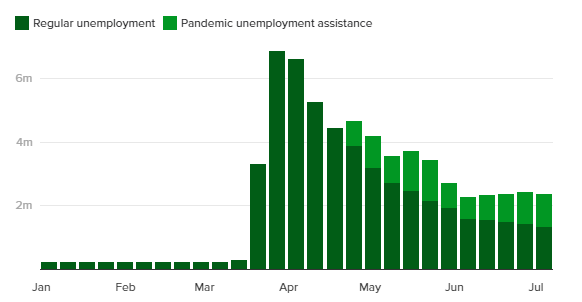

The U.S. Labor Department stated on Thursday that U.S. workers filed an additional 1.3 million jobless claims, a decrease of nearly 100K week over week, bringing the total job losses since the coronavirus pandemic to 47.7 million. Another 1 million filed for Pandemic Unemployment Assistance, a new federal program for self-employed workers. You will note from the chart below that this has been steadily increasing since early June.

U.S. Unemployment and Pandemic Unemployment Assistance

The DOW closed higher on Friday, up 369.21 points (+ 0.66%) to finish out the week at 26,074.75. The S&P 500 also traded up 32.99 points (+1.04%) on Friday, closing at 3,184.92. The Nasdaq finished the session higher as well, gaining 69.69 points and closing out the week at 10,617.44. In overnight trading, DOW futures traded higher and is expected to open up Monday 126 points as of the writing of this report.

West Texas Intermediate (WTI) traded up $0.93 (2.3%) to close at $40.55 on Friday on the New York Mercantile Exchange, down 10¢ week over week. Crude has struggled to extend recent rallies as fresh outbreaks of the virus worldwide emerged. In particular California, Texas and Florida have recorded some of their biggest daily gains in cases and deaths last week. There’s a growing risk that resurgence will impede efforts to reopen the economy fully. Increased supply out of Libya weighed on markets as plans to bring on 730,000 barrels a day are in the works.

Brent traded up 89 cents (+2.1%) to close at $43.24 on Friday of last week.

U.S. crude inventories increased by 5.6 million barrels last week and now stand at 539.14 MM/bbls

Gasoline inventories were down by 4.8 MM/bbls while distillate inventories increased by 3.14 MM/bbls.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $39.85 per barrel down roughly 70¢/ barrel from Friday’s close. And below the physiological $40 per barrel mark.

Ethanol at Argo had a great week last week, but took a breather on Friday in a lackluster session, trading down to a low of $1.56/gallon before closing out the day and the week at $1.57 per gallon. This resulted in a loss of 4 ½ ¢ per gallon on the day but a gain of 19 ¢/gallon week over week.

Petroleum car loads increased week over week. The four-week moving average of petroleum carloads rose from 19,648 to 19,948 week over week. Despite unworkable differentials for Canadian crude, CP volumes increased by 10.1% while CN’s volumes had a 14.2% uptick. This may be attributed to the fact that some producers have sunk transportation costs due to take or pay commitments on the Class Ones. Unfavorable basis differentials continue to exist against WTI for the Canadian producer, but keep an eye on Canada’s having a possible tailwind for crude by rail! At least 20% of shut-in Canadian production is being ramped up just months after the price crash forced producers in Alberta’s oil sands to shut in 1 million barrels/day of output. Since there is no pipe out of Alberta presently available and pipeline appropriations are now in place, one must assume that any incremental barrel has to move by rail. In an interesting move, Cenovus is moving a cargo to Irving oil. The oil was piped from Edmonton to a port in British Columbia, loaded on to a tanker which is now making its way to the Panama Canal for delivery to Irving’s refinery on Canada’s East Coast.

Cenovus Energy Inc., Husky Energy Inc. and Baytex Energy Corp. are among companies that have opened up production. According to Chief Executive Officer, Brad Corson of Imperial Oil Ltd., operator of the Kearl oil sands mine and Cold Lake wells, they also expect to return to full upstream production after maintenance is wrapped up. ARC Resources Ltd. said on Tuesday of last week that it had restored output.

On a TD Securities conference webcast last week, Cenovus’ CEO Alex Pourbaix said “We’re seeing a strong price signal to bring production back. Nobody should be surprised to see our production moving back to full production capacity. We are significantly cash-flow positive at the levels we’re at now.”

According to the Alberta government, Alberta’s oil output fell by almost 25% when China’s Covid-19 destroyed energy demand. WSC versus WTI in lighter trade closed at -$7.95 US per barrel in Edmonton on Friday, the strongest level in this trading cycle. One would expect basis to get weaker as more production comes online; it would take a brave soul to short basis at these price levels.

The biggest rail story of the week is a possible crude by rail comeback in the Bakken, as the battle to either shut in existing pipelines or stop them from being built continues. Energy Transfers request for a stay not to shut their pipeline down pending an appeal for the Dakota Access Pipeline (“DAPL”) was denied by U.S. District Judge James Boasberg on Thursday of last week. DAPL is a 1,172-mile-long (1,886 km) underground oil pipeline in the U.S. originating in the shale oil fields of the Bakken formation in northwest North Dakota, and continues through South Dakota and Iowa to an oil terminal near Patoka, Illinois and has a current capacity of 570,000 barrels per day. Boasberg last Monday ordered the pipeline shut down by August 5th, 2020, calling for an additional environmental assessment more than three years after it began pumping oil. Folks, I am going to candidly say it: this is the craziest and most ridiculous thing I have ever heard of! Who would ever attempt to build a pipeline in the U.S. ever again? It’s simply not worth the risk. This is not a light switch and is not a simple task, as the pipeline would take months to empty, not the one month given by the judge, and would require a series of complex tasks to ensure it is done properly.

According to Energy Transfer:

- It would take three months to empty the pipe of oil and complete steps to preserve it for future use. Energy Transfer claims the court order is impossible to comply with.

- In order to keep the line from corroding without the flow of oil, it must be filled with an inert gas, such as nitrogen. This is not cheap folks.

- The line must undergo a “purge-and-fill process” that involves draining segments one at a time while the pipeline is operating to replace the oil with nitrogen.

- Energy Transfer estimates it will cost $24 million to empty the oil and take steps to preserve the pipe. The company says that to maintain the line, it would spend an additional $67.5 million each year it remains inoperable.

- The pipeline holds 5 million barrels of oil when full and it is full folks.

Despite the court order, Energy Transfer is booking shipments for August delivery leading to speculation that they are prepared to violate the order. The bottom line is: this ruling is going to be appealed and what happens from there is anyone’s guess. If in fact the pipeline is shut down, it should lead to more crude by rail volumes out of the region in the order of 5 unit car trains a day. Although a possible tail wind for crude by rail in the short term, it is a significant blow to the state of ND, the Bakken producer and is a job killer over the long term. You can only shake your head in amazement at these shortsighted judicial decisions and hope that clearer heads will prevail!

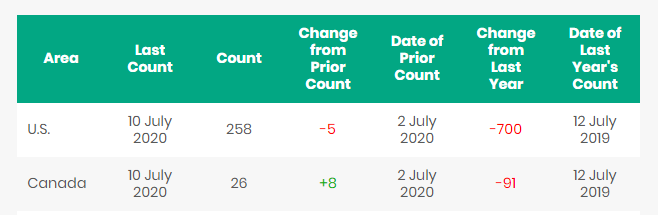

Rig Count

North America rig count moved higher and is up 3 rigs week over week with the U.S. losing 5 rigs and Canada gaining 8 rigs. Year over year we are down 791 rigs collectively. Canada now has 26 rigs nationwide operating and the U.S. has 258 rigs operating. This is the second consecutive week where we have seen U.S. rig count continue to deteriorate while Canadian rig counts posted gains.

North American Rig Count Summary

North American Rail Traffic

Total North American rail volumes were down 4.9% year over year in week 27 (U.S. -2.4%, Canada -9.7%, Mexico -16.1%), resulting in year to date volumes that are down 11.8% (U.S. -12.8%, Canada -8.3%, Mexico -10.8%). 7 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from coal (-21.1%), metallic ores & metals (-23.2%) and nonmetallic minerals (-18.6%). The largest increase came from intermodal (+2.9%).

In the East, CSX’s total volumes were down 3.8%, with the largest decrease coming from coal (-47.7%). The largest increase came from intermodal (+7.4%). NS’s total volumes were down 7.5%, with the largest decreases coming from coal (-26.5%) and petroleum (-58.1%). The largest increase came from motor vehicles and parts (+15.8%)

In the West, BN’s total volumes were down 6.8%, with the largest decreases coming from coal (-15.9%) and metallic ores (-92.8%). The largest increase came from intermodal (+5.7%). UP’s total volumes were down 0.1%, with the largest decreases coming from stone sand & gravel (-32.7%), petroleum (-30.8%) and chemicals (-8.3%). The largest increase came from intermodal (+9.8%).

In Canada, CN’s total volumes were down 10.7% with the largest decreases coming from intermodal (-6.8%), petroleum (-35.5%) and metallic ores (-13.9%). RTMs were down 17.9%. CP’s total volumes were down 10.5%, with the largest decreases coming from coal (-43.3%) and intermodal (-12.8%). The largest increase came from grain (+34.8%). RTMs were down 9.5%.

KCS’s total volumes were down 10.8%, with the largest decreases coming from metals & products (-43.1%) and motor vehicles & parts (-24.6%).

Source: Stephens

Coal Trouble

Coal by rail is still struggling as a large amount of coal cars remain in storage despite the warmer weather with natural gas abundantly available. Coal averaged 50,519 carloads per week in June 2020, up from May’s average of 46,320 carloads but still the third-lowest for any month on record (behind April and May 2020). Coal carloads in June were down 34.1% from last year. In the second quarter, U.S. coal carloads were down a record 37.6%; year to date, they’re down 27.3% (553,495 carloads).

The EIA recently reported that in April 2020 (the most recent month available), U.S. electricity generation from coal was 40.6 million megawatt hours. This is the lowest for any month in many decades and equal to just 15% of total U.S. electricity generation. In April, coal was behind natural gas (39%), nuclear power (22%), and renewables excluding hydropower (16%). In the first four months of 2020, U.S. electricity generation from coal was down 33.5% from the same period last year, while total U.S. electricity generation was down just 4.1%.

The million dollar question is “Where does the economy go from here?” The Wall Street Journal’s (“WSJ”) most recent monthly survey of 60 prominent economists calls for a U.S. GDP contraction of 32.3% on an annualized basis in Q2 2020, followed by a rise of 14.2% in Q3 2020 and up 7.5% in Q4 2020. More than two-thirds of the WSJ economists expect a swoosh-shaped recovery — that is, shaped like the Nike logo, characterized by a big drop and then a gradual recovery. WSJ’s Greg Ip wrote on June 15, “The unprecedented nature of this shock means one should be ready for the economy to do either much better or much worse” than forecast.

Railcar Markets

PFL is offering: Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Clean and new cars are available for longer term leases. C02 cars are now available for lease, just out of shop. A number of sand cars, box cars, coal cars and hoppers are also available for sale. PFL has a number of cars for sale at bargain prices. Call PFL today for further details.

PFL is seeking: 100 gasoline cars for 1 year 31.8,s delivered to Brownsville Texas.40 340W’s dirty in propane delivered to Conway for winter service U.S. traveled only,100 DOT 117s R’s or J’s for gasoline service – need in Port Arthur for 2 months with a two months option, 2 Covered hoppers to purchase 5500 series for storage at plant site in the Chicago area BN or NS connection, 5-10 syrup cars in the Midwest, 100 steel coal gons for sale, need 10 20K to 23.5 coiled and insulated for one year in ethylene glycol, 10 CPC 1232 or other for Industrial Alcohol use in Indiana off the NS for 6 months lessee would take ethanol cars clean them use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels please call to discuss) 10 CPC 1232 or other for Ethanol use in MN for 6 months. 50 7200 or greater wood chip hoppers for long term lease in the Chicago area..

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE HAVE JUST COMPLETED A JOB IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|