“When you understand the value of time you will realize what you have lost in this world.”

― Anuj Jasani

Jobs Update

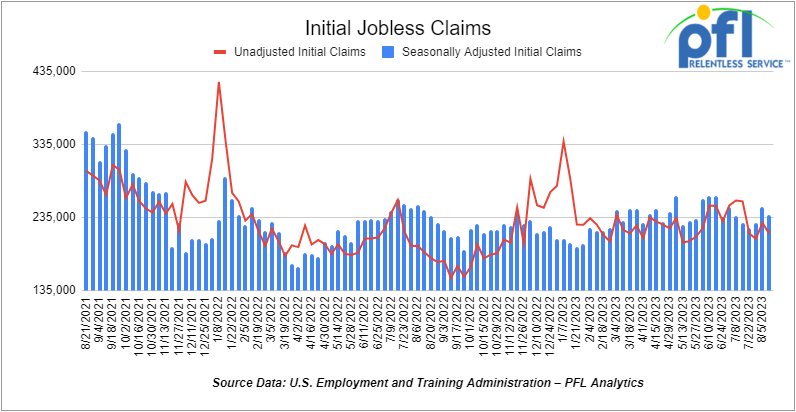

- Initial jobless claims for the week ending August 12th, 2023 came in at 239,000, down -11,000 people week-over-week.

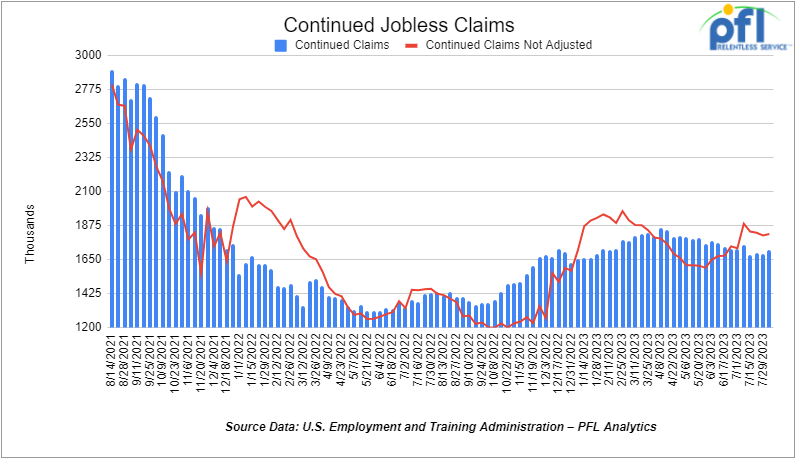

- Continuing jobless claims came in at 1.716 million people, versus the adjusted number of 1.684 million people from the week prior, up 32,000 people week over week.

Stocks closed mixed on Friday of last week, but lower week over week

The DOW closed higher on Friday of last week, up 25.83 points (0.07%), closing out the week at 34,500.66, down -780.74 points week over week. The S&P 500 closed lower on Friday of last week, down -0.65 points (-0.01%), and closed out the week at 4,369.71, down -94.34 points week over week. The NASDAQ closed lower on Friday of last week, down -26.16 points (-0.19%), and closed the week at 13,290.78, down -354.07 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 34,684 this morning up +119 points.

Crude oil closed up on Friday of last week, but lower week over week

WTI traded up $0.86 per barrel (+1.1%) to close at $81.25 per barrel on Friday of last week, down -$1.94 per barrel week over week. Brent traded up US$0.68 per barrel (+0.8%) on Friday of last week, to close at US$84.80 per barrel, up -US$2.01 per barrel week over week.

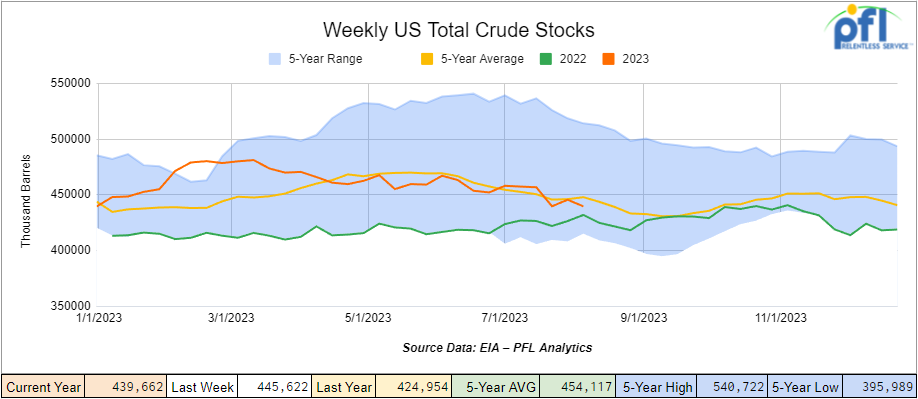

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 6 million barrels week-over-week. At 439.7 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

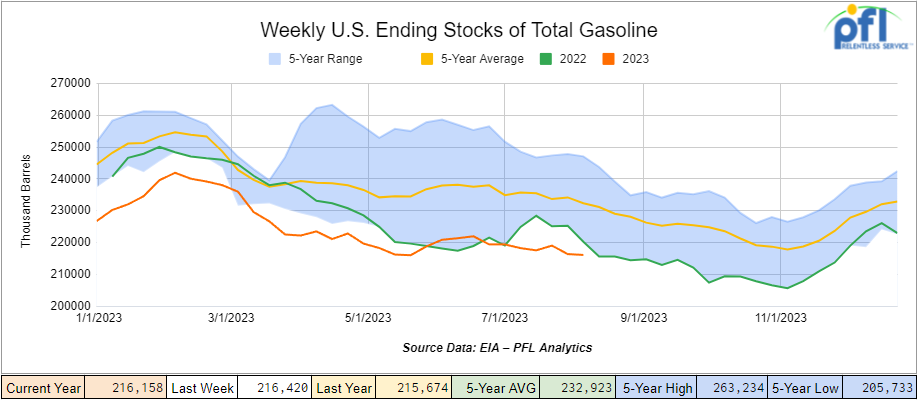

Total motor gasoline inventories decreased by 300,000 barrels week-over-week and are 6% below the five-year average for this time of year.

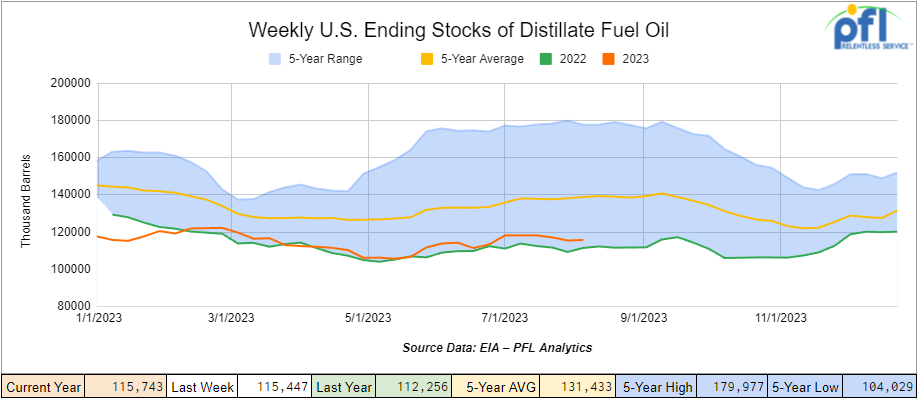

Distillate fuel inventories increased by 300,000 barrels week-over-week and are 16% below the five-year average for this time of year.

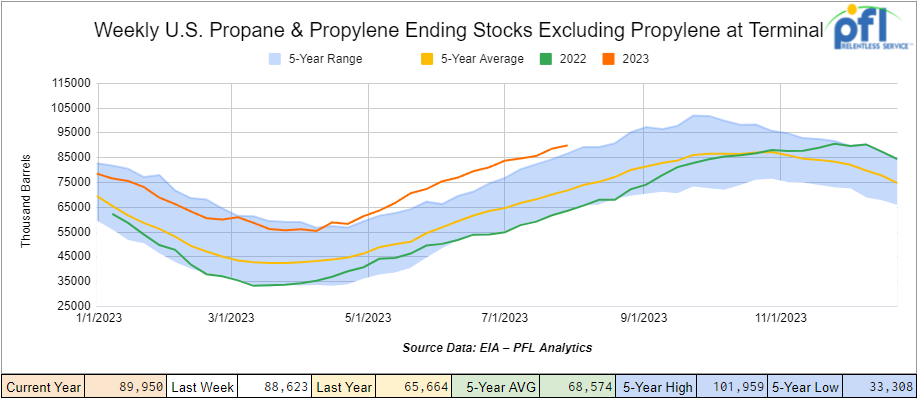

Propane/propylene inventories increased by 700,000 barrels week-over-week and are 21% above the five-year average for this time of year.

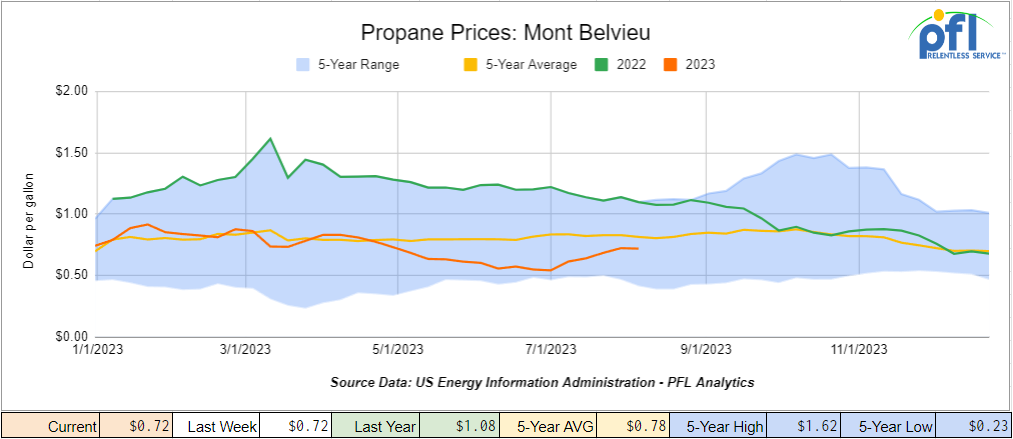

Propane prices closed at 72 cents per gallon, flat week-over-week, but down 36 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 7.4 million barrels during the week ending August 11th, 2023.

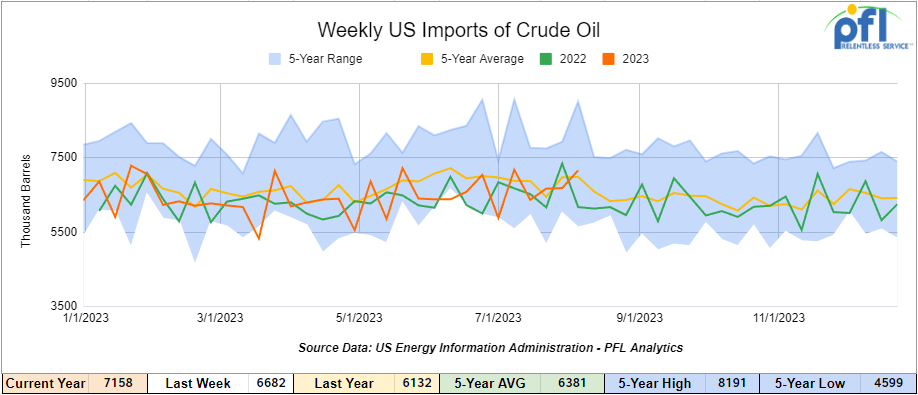

U.S. crude oil imports averaged 7.2 million barrels per day during the week ending August 11th, 2023, an increase of 476,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 4.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 586,000 barrels per day, and distillate fuel imports averaged 129,000 barrels per day during the week ending August 11th, 2023.

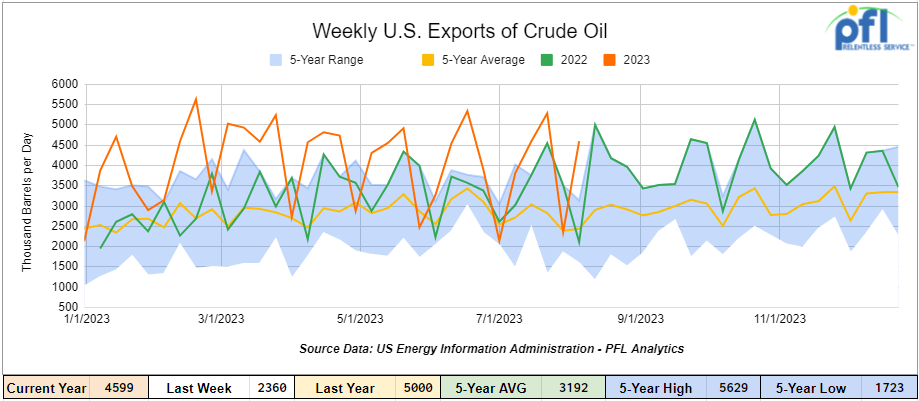

U.S. crude oil exports averaged 4.599 million barrels per day for the week ending August 11th, 2023, an increase of 2.239 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.208 million barrels per day.

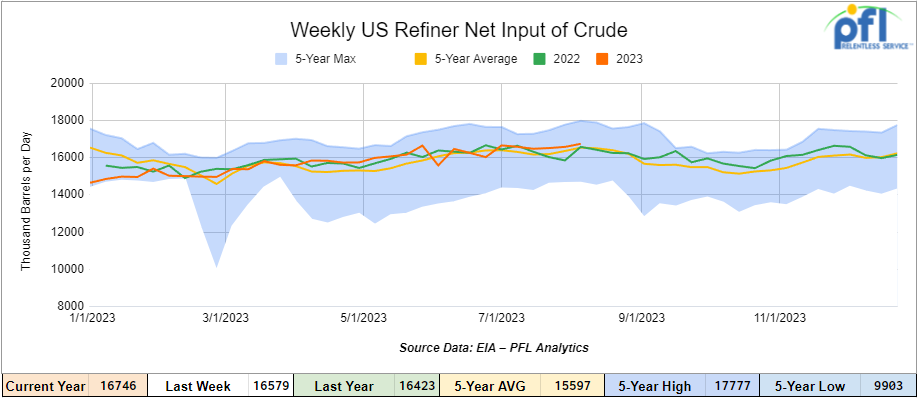

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending August 11, 2023, which was 166,000 barrels per day more week over week.

WTI is poised to open at 81.77, up 52 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 16th, 2023.

Total North American weekly rail volumes were down (-4.48%) in week 32, compared with the same week last year. Total carloads for the week ending on August 16th, 2023 were 347,745, down (-2.35%) compared with the same week in 2022, while weekly intermodal volume was 313,131, down (-6.47%) compared to the same week in 2022. 8 of the AAR’s 11 major traffic categories posted year over year decreases with the most significant decrease coming from Grain (-21.66%). The largest increase came from Motor Vehicles and Parts (+6.42%).

In the East, CSX’s total volumes were down (-2.11%), with the largest decrease coming from Grain (-28.51%) and the largest increase from Coal (+12.38%). NS’s volumes were down (-2.19%), with the largest decrease coming from Petroleum and Petroleum Products (-26.59%) and the largest increase from Metallic ores and Metals (+3.85%).

In the West, BN’s total volumes were down (-6.98%), with the largest decrease coming from Grain (-25.21%), and the largest increase coming from Other (+25.42%). UP’s total rail volumes were down (-5.43%) with the largest decrease coming from Grain (-38.87%) and the largest increase coming from Petroleum and Petroleum Products (+7.4%).

In Canada, CN’s total rail volumes were down (-5.61%) with the largest increase coming from Motor Vehicles and Parts (+15.35%) and the largest decrease coming from Grain (-30.11%). CP’s total rail volumes were up (22.01%) with the largest decrease coming from Coal (-37.57%) and the largest increase coming from Petroleum and Petroleum products (+27.27%).

KCS’s total rail volumes were down (-10.21%) with the largest decrease coming from Other (-27.34%) and the largest increase coming from Motor Vehicles and Parts (+64.65%).

Source Data: AAR – PFL Analytics

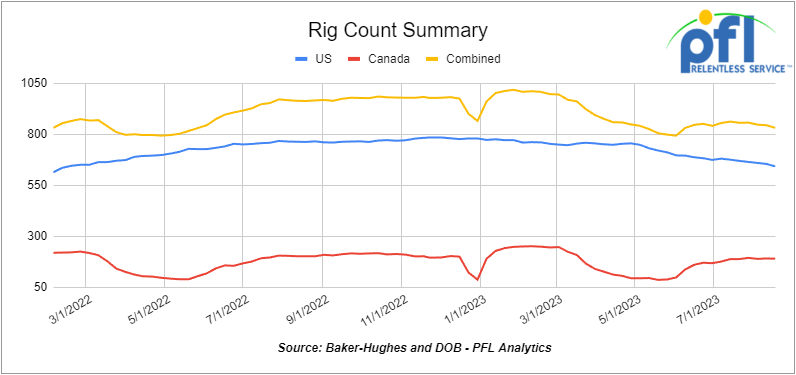

Rig Count

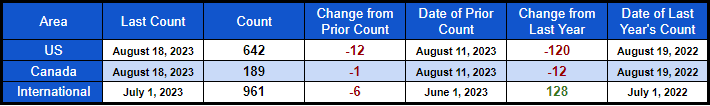

North American rig count was down by -13 rigs week over week. U.S. rig count was down by -12 rigs week over week and down by -120 rigs year-over-year. The U.S. currently has 642 active rigs. Canada’s rig count was down by -1 rigs week-over-week, and down by -12 rigs year over year. Canada’s overall rig count is 189 active rigs. Overall, year-over-year, we are down -132 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We Continue to Watch The Biden Administration Destroy America’s Energy and Rail

Folks are you surprised at the latest and greatest? On Friday of last week, a U.S. Appeals Court struck down a critical approval for a railroad project that would have allowed oil businesses in eastern Utah to significantly expand fossil fuel production and exports. The ruling is the latest development in the fight over the proposed Uinta Basin Railway, an 88-mile (142-kilometer) railroad line that would connect oil and gas producers in rural Utah to the broader rail network, allowing them to access larger markets and ultimately sell to refineries near the Gulf of Mexico. The railroad would let producers, currently limited to tanker trucks, ship an additional 350,000 barrels of crude daily on trains extending for up to 2 miles (3.2 kilometers). The Washington, D.C.-based appeals court ruled that a 2021 environmental impact statement and biological opinion from the federal Surface Transportation Board were rushed and violated federal laws. It sided with environmental groups and Colorado’s Eagle County, which had sued to challenge the approval. So no pipelines – no rail – let’s buy our oil from our enemies that is what they are telling us to do folks. We report you decide.

We are watching Significant Data Breaches

Cyber-attacks are on the rise, becoming increasingly frequent in today’s digital landscape. These attacks, which often target large-scale interconnected digital systems and networks, have grown more common due to the growing reliance on technology and the internet. Hackers use a wide array of methods to exploit vulnerabilities, often aiming to steal sensitive information, disrupt services, or cause damage. As technology continues to advance, it is crucial for individuals and organizations to prioritize cyber security measures to safeguard against these evolving threats. Even the smallest of companies are being targeted these days for ransom – it is a multibillion dollar business and growing.

A recent cyberattack on Canada’s Suncor Energy is expected to result in significant financial losses for the company as it works to resolve the issue. The breach, which impacted Suncor’s operations, particularly its Petro-Canada retail locations and Petro-Points app, caused disruptions such as the inability to process credit or debit payments. When it comes to large corporations like this, the longer the recovery process, the higher the potential costs, including expenses related to ransom payments, legal fees, data breach response, and reputational damage.

In 2022, the global average cost of a data breach reached a record high of $4.35 million, with the U.S. averaging $9.44 million per breach and Canada averaging USD $5.64 million per breach. Prompt action is crucial for minimizing expenses, as swift response time directly correlates with cost reduction. Cyberattacks have become a widespread concern, affecting numerous organizations, with a notable portion of American and Canadian entities having experienced breaches and ransomware attacks in recent years.

Verizon recently released its 2023 Data Breach Investigations Report showing that data breaches have surged to 5,199 incidents over the past year. Underscoring the growing frequency and severity of cyber attacks. Particularly worrying is the near doubling of social engineering attacks, a manipulation tactic that preys on human psychology to gain unauthorized access. Verizon reports that a whopping 74% of all breaches include an internal human element, with people being involved either via error, privilege misuse,use of stolen credentials or social engineering. Equally concerning, Verizon report’s that 83% of these breaches involved external actors, highlighting the persistent vulnerability of digital infrastructure. The prevalence of ransomware attacks has held steady at 24%, indicating a sustained and persistent threat that continues to jeopardize organizations’ digital assets. Verizon’s assertion that financial gain serves as the primary motivation for these attacks serves as a stark reminder of the high-stakes landscape organizations face and the urgency for robust cybersecurity measures. Keep an eye out for potential breaches in your security and, if you have not done so already, update your security and look for holes and plug them. We are in the process of doing so over here at PFL with a couple of close calls and an incident close to home. Make sure any old servers not in use are unplugged – older equipment is replaced with newer equipment. Be safe out there.

We Continue to Watch Labor Strike’s

Labor Strikes across the world continue – In Australia LNG workers are going on strike at Chevron’s facility driving up Asia’s LNG prices – Shell lost 1 billion in Exports in 2022 because of strikes in Australia. Here at home Locomotive manufacturing company, Wabtec, is facing the potential closure of its Erie plant due to an ongoing strike by 1,400 workers. The strike, initiated by Locals 506 and 618 of the United Electrical, Radio and Machine Workers of America, began on June 22 following the expiration of the prior contract. The company’s attempts to reach a new labor agreement have been hindered by disagreements over wage scales, new hire wages, and the right to strike.

Wabtec, which merged with GE Transportation in 2019, has been negotiating with the striking workers and has offered $41 million in wage improvements. However, the union’s demands, particularly concerning “new hire wages and unfettered right to strike, seem out of touch with the economic realities,” according to Wabtec.

Legacy employees currently earn around $35 per hour, while new workers start at approximately $22 per hour and gradually progress to full wages over a decade. The union proposed reducing the pay scale transition to five years, but the company rejected this. Despite relatively close positions on general wage increases, which involve percentages and bonuses over a multi-year span, the negotiations have yet to yield a resolution.

The potential closure of the Wabtec plant holds significant implications for the local economy, as it employs around 2,000 workers and ranks as Erie County’s third-largest employer. County Executive Davis is urging both parties to reach a tentative agreement that can be put to a vote among the employees to prevent the plant’s closure and ensure the preservation of manufacturing in the area. At the end of the day too many strikes at once upsets the supply chain in a big way, not only hurts the company being striked against but also hurts the workers striking and we ultimately pay more for everything on the back of it.

We are watching the Trans-Atlantic Shipping Market

The trans-Atlantic shipping market, once a thriving sector during the COVID-19 pandemic, has experienced a rapid and unprecedented drop in spot rates. This decline, described as one of the steepest and quickest in industry history, has prompted major carriers such as Zim and Hapag-Lloyd to reevaluate their strategies. Overcapacity resulting from shifting fleets from the west coast to the east coast routes, creating an overcrowded marketplace has led to falling rates, impacting the trans-Atlantic trade.

Simultaneously, U.S. rail traffic has faced a downward trend, with a 4.2% reduction in total weekly rail traffic compared to the same period last year. Carload volumes and intermodal volume also dipped by 3% and 5.3%, respectively. It is difficult to correlate this to shipping rates, however it stands to reason that as trans-Atlantic shipping rates decrease, businesses may alter their supply chains to import goods from regions that were previously cost prohibitive, potentially affecting rail transportation demand. Given that this is largely happening due to an imbalance in fleet placement and size, we expect an imminent market correction or a slowdown in trips taken by shippers. PFL does not anticipate that this will cause an impactful change in US or Canadian rail traffic in the long term.

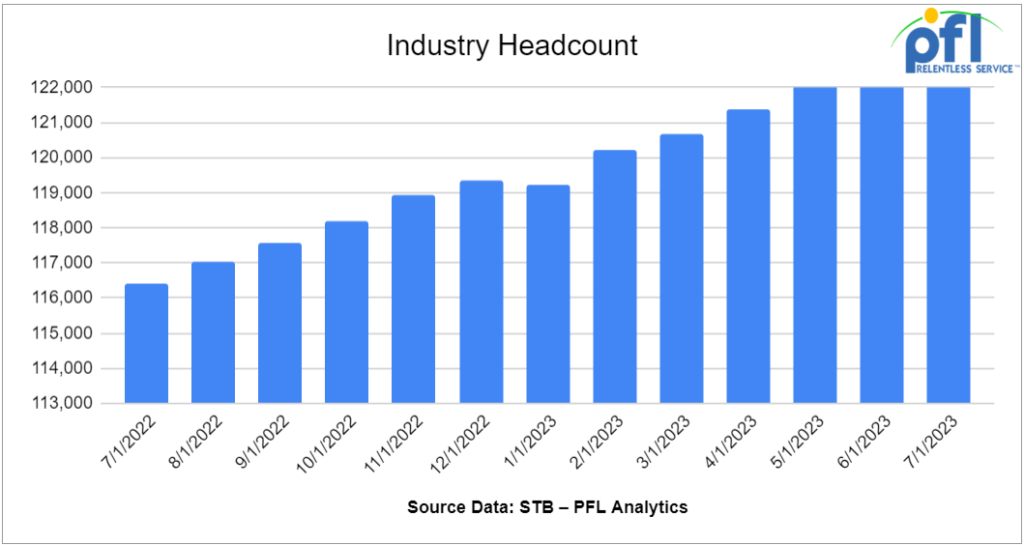

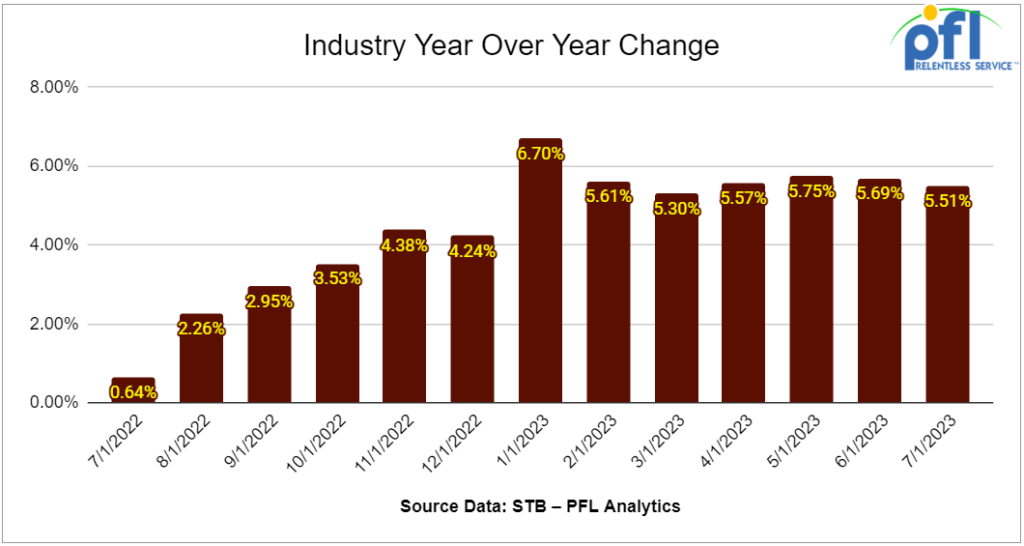

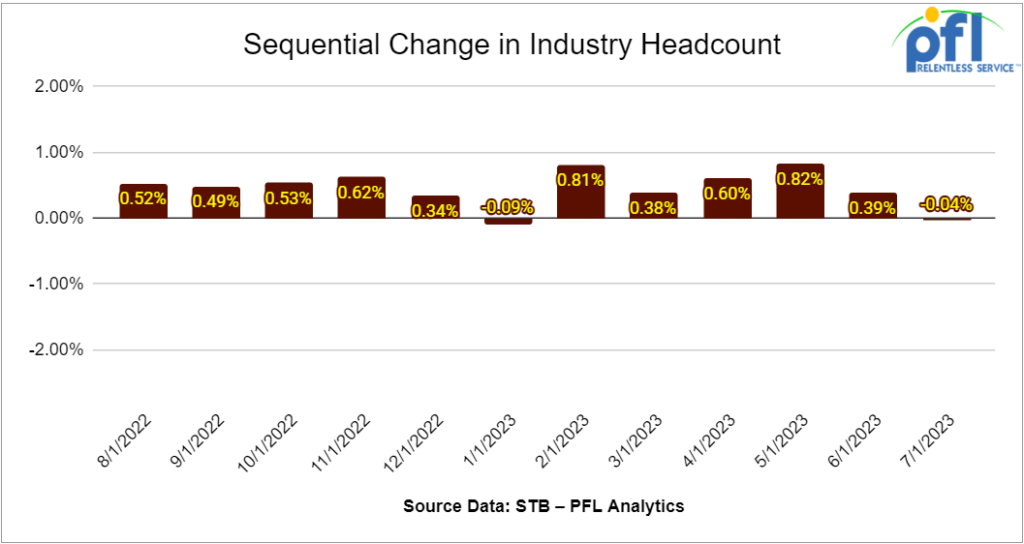

We are watching Class 1 Industry Headcount

Headcount at the Class 1’s was mostly unchanged in July while rail traffic continues to be negative year over year – we at least in the short term, have seen increased levels of service. Below is the latest and greatest:

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel / Gasoline service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

- 100, 6300 Covered Hoppers needed off of BN in South Dakota for 3-6 Months. Cars are needed for use in DDG service.

- 30-100, 31.8K CPC 1232 Tanks needed off of UP or BN in Texas for Purchase or Lease.

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

- 100, 28.3K, 117R Tanks located off of All Class 1’s in St. Louis. Cars are clean

- 10, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 110, 25.5K, DOT 111 Tanks located off of UP and BN in multiple locations. Dirty, Food Grade. Cars are currently moving

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|