“Don’t do nothing halfway, else you find yourself dropping more than can be picked up.”

~ Louis Armstrong

Jobs Update

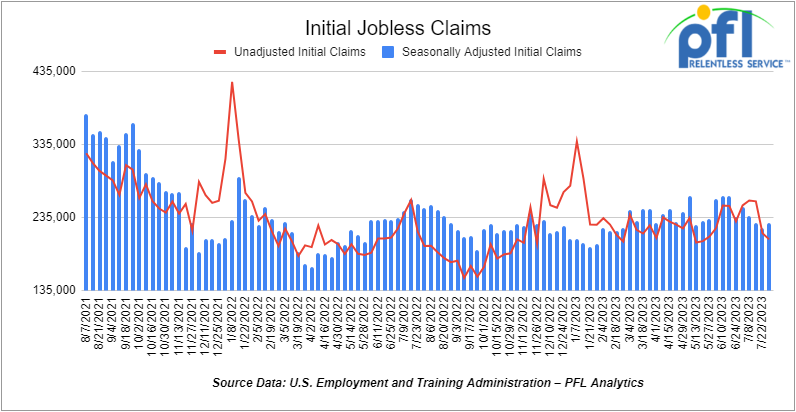

- Initial jobless claims for the week ending July 29th, 2023 came in at 227,000, up 6,000 people week-over-week.

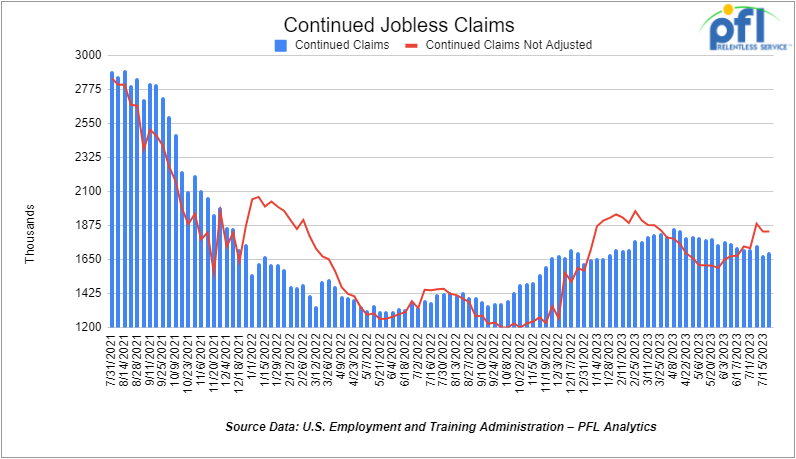

- Continuing jobless claims came in at 1.7 million people, versus the adjusted number of 1.679 million people from the week prior, up 21,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -150.27 points (-0.43%), closing out the week at 35,065.62, down -393.67 points week over week. The S&P 500 closed lower on Friday of last week, down -23.86 points (-0.53%) and closed out the week at 4,478.03, down -104.20 points week over week. The NASDAQ closed lower on Friday of last week, down -50.48 points (-0.35%), and closed the week at 13,909, down -407.42 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 35,238 this morning up 84.25 points.

Crude oil closed up on Friday of last week and higher week over week

WTI traded up $1.27 per barrel (+1.6%) to close at $82.82 per barrel on Friday of last week, up $2.24 per barrel week over week. Brent traded up US$1.10 per barrel (+1.3%) on Friday of last week, to close at US$86.24 per barrel, up US$1.25 per barrel week over week.

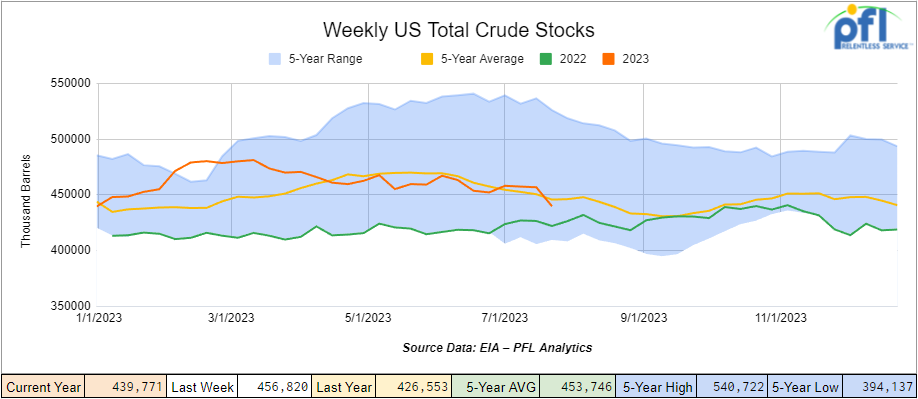

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 17 million barrels week over week. At 439.8 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

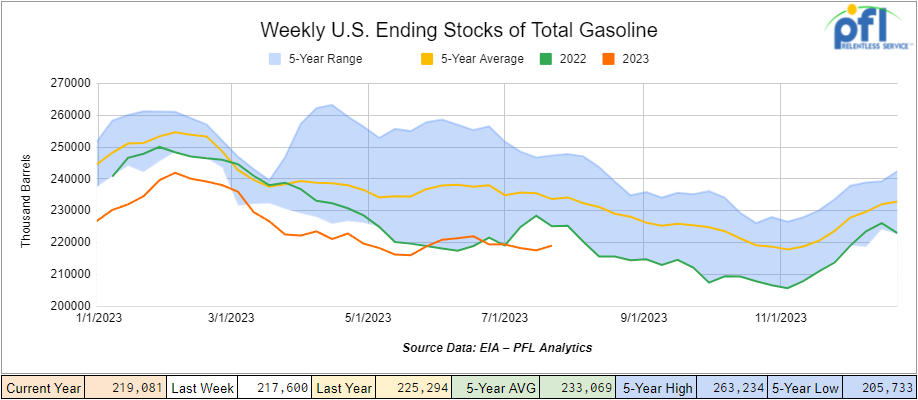

Total motor gasoline inventories increased by 1.5 million barrels week over week and are 6% below the five-year average for this time of year.

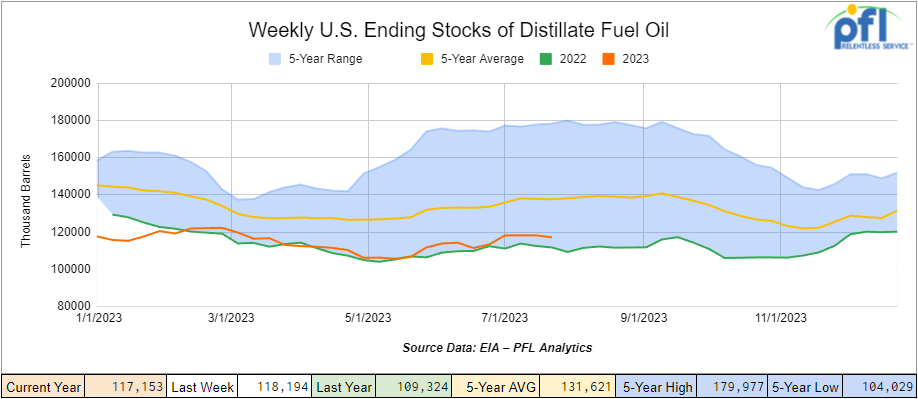

Distillate fuel inventories decreased by 800,000 barrels week over week and are 15% below the five-year average for this time of year.

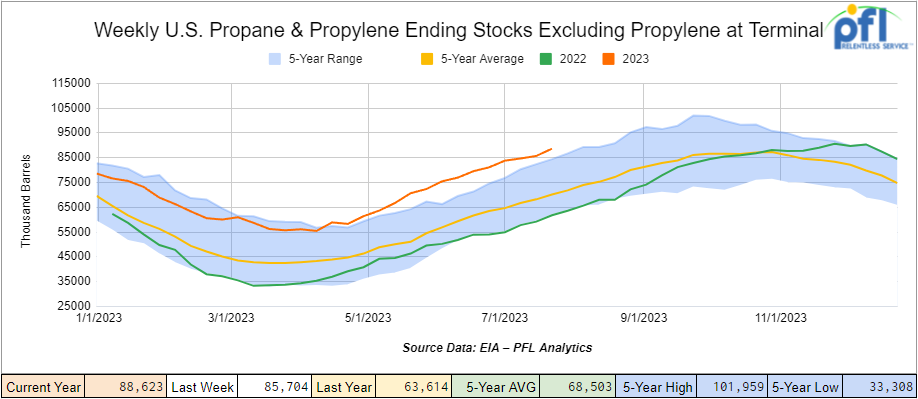

Propane/propylene inventories increased 2.9 million barrels week over week and are 24% above the five-year average for this time of year.

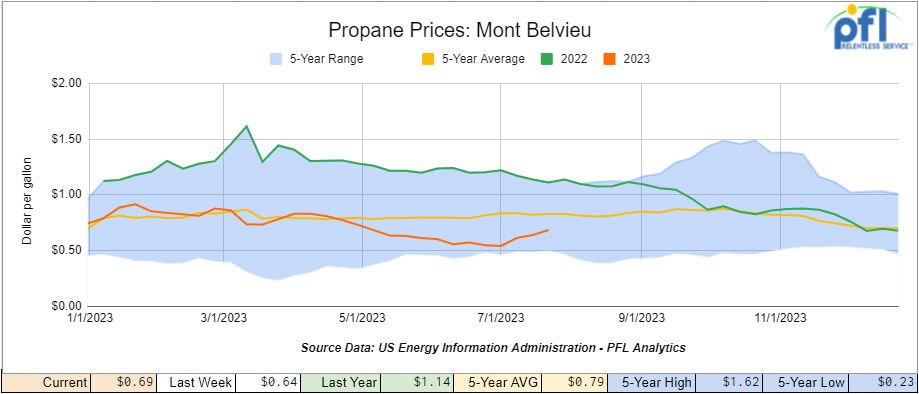

Propane prices closed at 69 cents per gallon, up 5 cents per gallon week over week, but down 45 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 10.4 million barrels during the week ending July 28th, 2023.

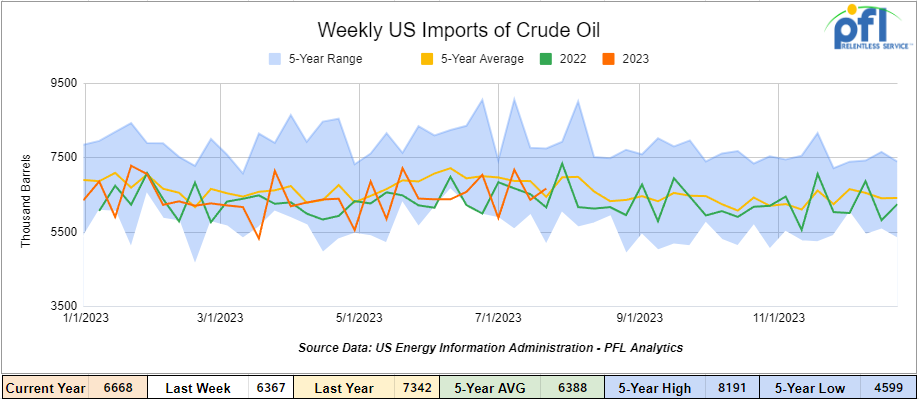

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending July 28th, 2023, an increase of 301,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 2.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 945,000 barrels per day, and distillate fuel imports averaged 113,000 barrels per day during the week ending July 28th, 2023.

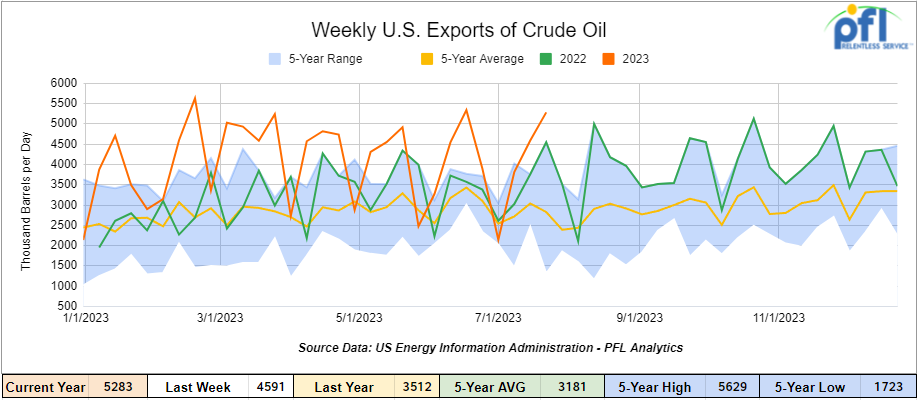

U.S. crude oil exports averaged 5.283 million barrels per day for the week ending July 28th, 2023, an increase of 692,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.958 million barrels per day.

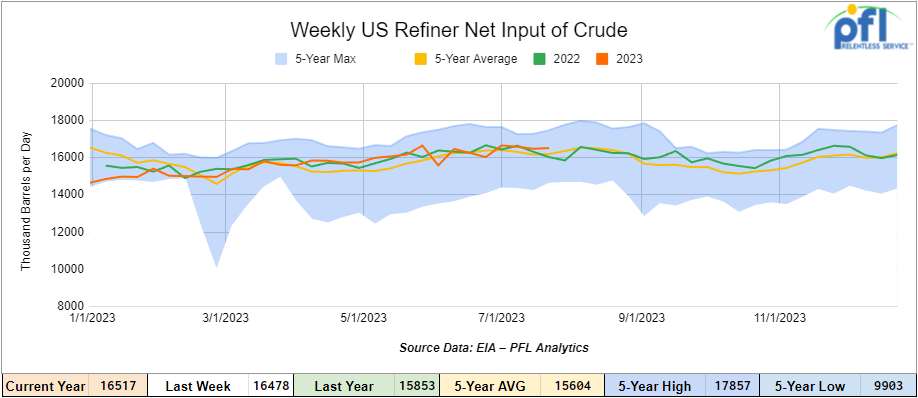

U.S. crude oil refinery inputs averaged 16.5 million barrels per day during the week ending July 28, 2023, which was 40,000 barrels per day more week over week.

WTI is poised to open at 81.99, down -83 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending August 2nd, 2023.

Total North American weekly rail volumes were down (-4.44%) in week 30, compared with the same week last year. Total carloads for the week ending on August 2nd, 2023 were 349,458, down (-0.38%) compared with the same week in 2022, while weekly intermodal volume was 312,565, down (-8.61%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year over year increases with the most significant decrease coming from Grain (-22.61%). The largest increase came from Motor Vehicles and Parts (+21.88%).

In the East, CSX’s total volumes were down (-3.76%), with the largest decrease coming from Grain (-31.16%) and the largest increase from Motor Vehicles and Parts (+32.55%). NS’s volumes were down (-1.93%), with the largest decrease coming from Grain (-25.57%) and the largest increase from Other (+8.93%).

In the West, BN’s total volumes were down (-5.32%), with the largest decrease coming from Grain (-24.99%), and the largest increase coming from Motor Vehicles and Parts (+23.78%). UP’s total rail volumes were down (-2.32%) with the largest decrease coming from Grain (-21.27%) and the largest increase coming from Motor Vehicles and Parts (+23.47%).

In Canada, CN’s total rail volumes were down (-10.40%) with the largest increase coming from Metallic Ores and Metals (+12.41%) and the largest decreases coming from Petroleum and Petroleum Products as well as Intermodal collectively down (-28.68%). CP’s total rail volumes were down (-9.5%) with the largest decrease coming from Grain (-38.03%) and the largest increase coming from Motor Vehicles and Parts (+107.37%).

KCS’s total rail volumes were down (-12.56%) with the largest decrease coming from Other (-32.86%) and the largest increase coming from Motor Vehicles and Parts (+62.37%).

Source Data: AAR – PFL Analytics

Rig Count

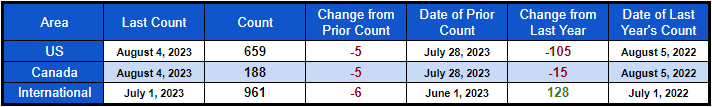

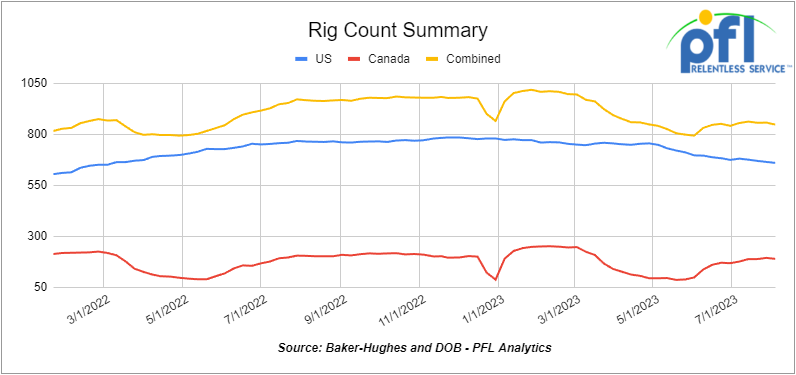

North American rig count was down by 10 rigs week over week. U.S. rig count was down by -5 rigs week over week and down by -105 rigs year-over-year. The U.S. currently has 659 active rigs. Canada’s rig count was down by -5 rigs week-over-week, and down by -15 rigs year over year. Canada’s overall rig count is 188 active rigs. Overall, year-over-year, we are down -120 rigs collectively.

International rig count which is reported monthly was down by -6 rigs month-over-month but up by 128 rigs year-over-year. Internationally there are 961 active rigs.

North American Rig Count Summary

A few things we are watching:

We watching Gibson Energy

Calgary based Gibson Energy is set to acquire the South Texas Gateway oil terminal from Buckeye Partners, Marathon Petroleum, and Phillips 66 for $1.1 billion in cash. The terminal has been operational since 2020 and is the second largest U.S. crude oil export terminal, boasting two deepwater docks and a 1 million barrel per day throughput capacity. It has contributed about 12% of the country’s total crude oil exports thus far in 2023. The terminal is located in Ingleside, Texas, and achieved record oil volumes in March 2023. The acquisition is expected to enhance Gibson’s cash flow, as the majority of revenue comes from established customers through reliable contracts. With the expiration of the waiting period under the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976 satisfied, the parties are positioned to conclude the deal shortly and without requiring further third-party action or approval.

We are Watching the White House and Biden- Here We Go Again

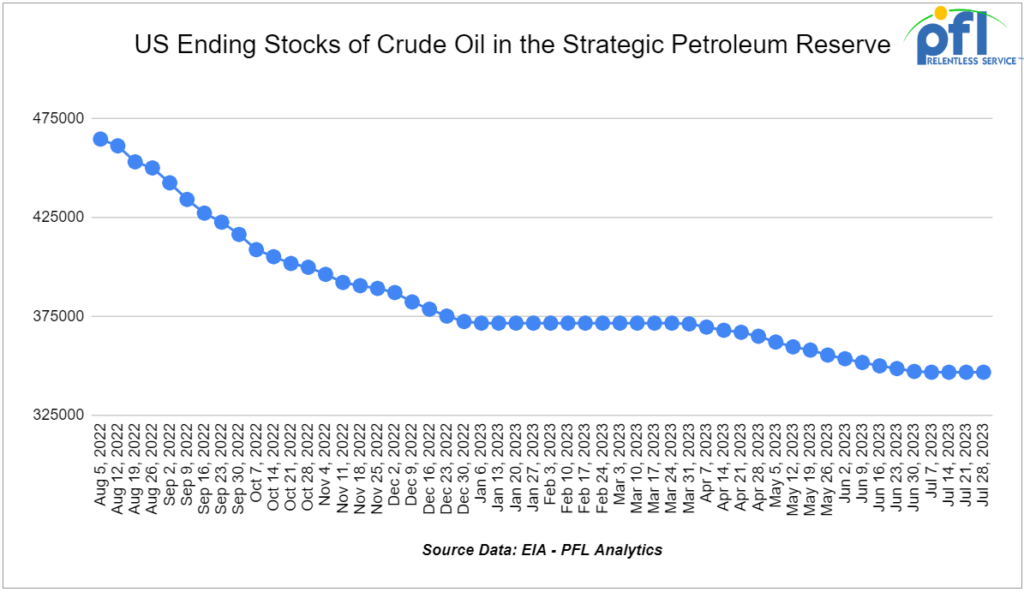

Biden is delaying SPR restocking. The Biden administration is delaying plans to restock the nation’s emergency oil reserve amid a price hike that has pushed oil above $80 a barrel. The Energy Department canceled a planned purchase of 6 million barrels for the strategic reserve last week, saying it wants to secure a good deal for taxpayers. The administration said it remains committed to refilling the reserve, which President Joe Biden significantly drained last year in what he thought would stop gasoline and oil prices from rising. “The DOE remains committed to its replenishment strategy for the SPR, including direct purchases when we can secure a good deal for taxpayers,” Energy Department Deputy Chief of staff Bridget Bartol said in a statement last week. Here is a recap of where we sit as far as emergency reserves:

We are watching Ukraine and Russia

A Russian warship sustained serious damage in an overnight Ukrainian naval drone attack on Russia’s Black Sea navy base at Novorossiysk on Thursday of last week. The civilian port, handling 2% of global oil supply and grain exports, briefly halted ship movement but resumed operations. Novorossiysk is Russia’s main Black Sea oil port, exporting about 600,000 barrels a day. It is also the main export point for oil from Kazakhstan, with the 1.2 million barrel per day pipeline from the Caspian Pipeline Consortium terminating there. The Ukrainian attack involving two sea drones carrying 450 kilograms of TNT resulted in their destruction and no reported casualties, as stated by Russia’s Defence Ministry. The Olenegorsky Gornyak, a Russian Navy landing ship with around 100 Russian servicemen onboard, suffered a significant breach, hindering its combat capabilities. The pipeline is reportedly undamaged.

We are Watching the Mountain Valley Pipeline

Folks, we finally have a completion date – the MVP will be completed in 2023. Equitrans Midstream on Tuesday of last week said it still expects to complete the Mountain Valley natural gas pipeline by the end of the year, despite being tangled in numerous court fights since construction began in 2018. The U.S. Supreme Court on Thursday of last week removed an obstacle to completing the estimated $6.6 billion pipeline that runs from West Virginia to Virginia, one of several projects delayed by regulatory and legal fights with environmental and local groups who seemingly don’t want clean-burning natural gas or American Energy Security.

We are Watching Some Key Economic Indicators

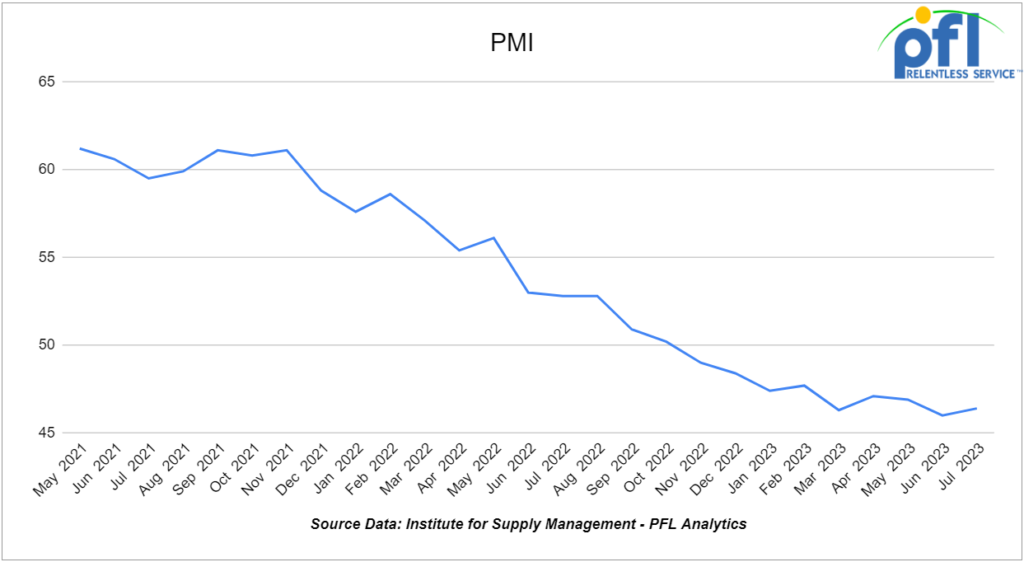

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50. In July, the PMI slightly increased to 46.4% from June’s 46.0%, marking the ninth consecutive month of readings below 50% and a 0.4% increase month over month from June. Meanwhile, the new orders component also increased to 47.4% in July.

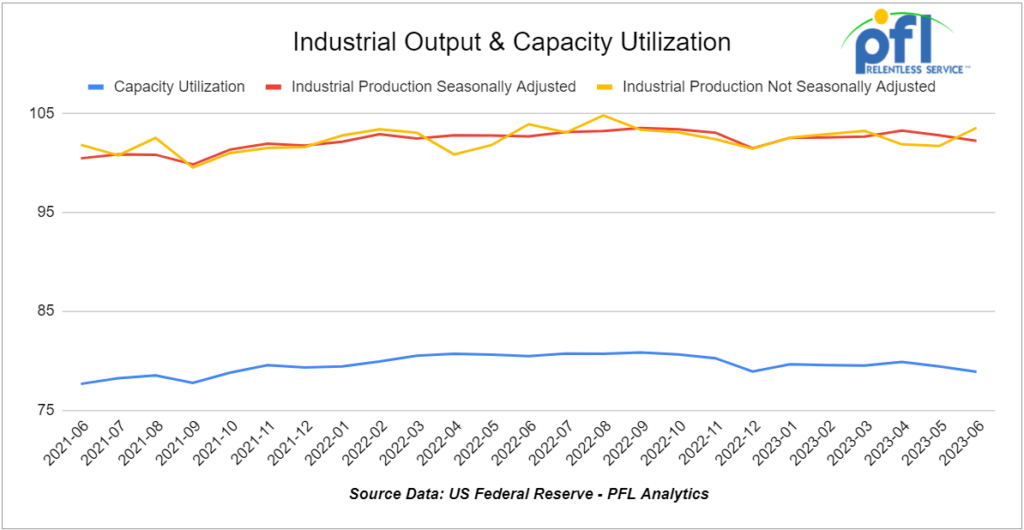

Industrial Output & Capacity Utilization

The Federal Reserve reported that total U.S. industrial output fell a preliminary 0.5% in June 2023 over May 2023, marking its second straight month-to-month decline. The decrease was mainly driven by a drop in manufacturing output in June. Year-over-year industrial output in June 2023 was 0.4% below April 2022. Capacity utilization stepped down to 78.9 percent in June, a rate that is 0.8 percentage point below its long-run (1972–2022) average.

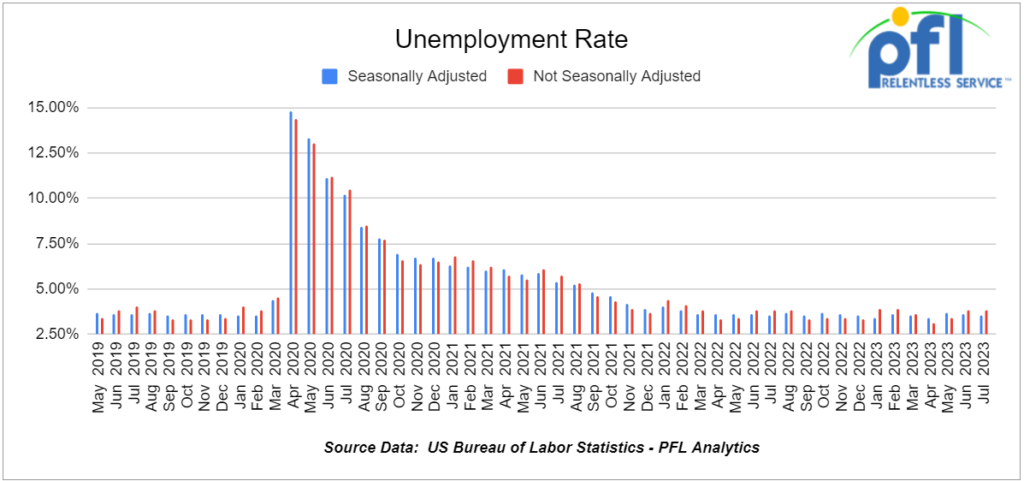

U.S. Unemployment Rate

The Bureau of Labor Statistics’ May Employment Report, released on August 4th, indicated another month of solid job growth. The labor market in the U.S. appears to be strong despite weakness in manufacturing output and the Manufacturing PMI. In July, 187,000 net new jobs were created, and the official unemployment rate fell to 3.5%. The overall labor force participation rate in July was 62.6%, and the participation rate for prime-age workers was 83.4%, the highest it’s been since January of 2007 and the first time in two decades that it has persisted at this level for three straight months. Average hourly earnings for private-sector workers rose 4.8% in July 2023 over July 2022.

Consumer Confidence

The Conference Board’s Index of Consumer Confidence increased in July to 117.0, its highest since July of 2021 and up from 110.1 last month, indicating a positive change over the past few months. The University of Michigan improved to 88.3 from 80 in June. In spite of the increasing interest rates, continued rising inflation albeit not at the rate once seen, consumers seem to have a positive outlook, possibly influenced by a strong job market. While consumer confidence in an impending recession has diminished, The Conference Board reports that their projections still suggest a likelihood of one occurring before the end of the year. We see it coming – seems to us there is a false sense of optimism for whatever reason.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel / Gasoline service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- 25-50, 25.5K 117J, 117R, CPC 1232 Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Asphalt service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 25, 33K 340W Pressure Tanks needed off of UP or BN in Midwest for Oct-March. Cars are needed for use in Propane service.

- 15, 30K 117 Tanks needed off of NS in SouthEast for 1 Year. Cars are needed for use in Diesel service.

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

- 108, 28.3K, 117R Tanks located off of All Class 1’s in St. Louis. Cars are clean

- 10, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

- 5, 6300, Covered Hoppers located off of in Across US.

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 110, 25.5K, DOT 111 Tanks located off of UP and BN in multiple locations. Dirty, Food Grade. Cars are currently moving

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|