“The opportunity is often lost by deliberating.” Publilius Syrus

COVID-19 and Markets Update

In the United States, we currently have 2,932,047 confirmed COVID-19 cases and 132,007 confirmed deaths

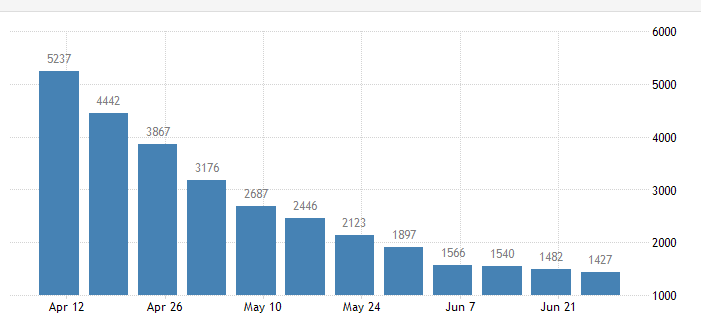

On Thursday of last week, according to the U.S. Labor Department, U.S. workers filed an additional 1.4 million jobless claims, bringing the total losses since the coronavirus pandemic to 46.4 million. See chart:

U.S. Unemployment Claims Since April 2020

The good news folks, is that the claims are getting smaller and Nonfarm payrolls rose by 4.8 million in June, which is much better than the expected increase of 2.9 million. The unemployment rate fell to 11.1%, also better than the 12.4% estimate and the markets reacted positively.

The DOW closed higher on Friday closing up 92.39 points (or 0.36%%) to close out the week at 25,827.36. The S&P 500 traded 0.52% higher, or up 14.15 points, at 3,130.01. The Nasdaq finished the session higher as well, gaining 53.00 points closing out the week at 10,207.63. In overnight trading, DOW futures traded higher and as of the writing of this report is expected to open at 21,657 up 398 points.

West Texas Intermediate (WTI) traded up $0.83 (or 2.1%) to close at $40.65 on Thursday of last week on the New York Mercantile Exchange. Oil kept up its positive momentum going into the Fourth of July holiday weekend, cheered by signs the economy is recovering from coronavirus-related lockdowns, despite fears of a resurgence. Futures, however, did trade on Friday while we were celebrating our holiday, giving back some of Thursday’s gains with WTI losing 0.8% on the day closing at $40.32 per barrel.

Brent traded up $1.11 or 2.6% to close at $43.14 on Thursday of last week. On Friday, Brent followed the lead of WTI also losing 0.08% on the day closing at $42.80

Oil is higher in overnight trading and as of the writing of this report and WTI is poised to open at 40.81 up 16 cents per barrel from Friday’s close.

Petroleum car loads declined week over week again. The four-week moving average of petroleum carloads declined from 19,677 to 19,648 week over week. CP volumes fell by 7.8% and CN’s volumes fell by 7%. Unfavorable basis differentials continue to exist against WTI for the Canadian producer. WSC versus WTI in lighter trade closed at -$8.50 US per barrel in Edmonton on Friday, up $1.20 per barrel week over week.

Enbridge

Good news for Enbridge and the Canadian oil producer. We called it folks, Enbridge was allowed to restart its line 5 east leg pipeline after attempts by the Michigan State Attorney’s office to keep the line shut failed. PFL watched the hearing live via Zoom and if you care to listen please click on this link. Enbridge Inc., North America’s largest pipeline company transports 540,000 barrels a day of oil and LPG’s from Superior Wisconsin to Sarnia, Ontario through Michigan and through the Straits of Mackinac. Michigan’s current Governor, Gretchen Whitmer campaigned to shut the pipeline down permanently. She has contested that the pipeline is unsafe and could compromise the environment and in particular the Great Lakes. The pipeline supplies 55% of heating supplies needed across the state of Michigan. Its closure would have interrupted several U.S. and Canadian refineries. Line 5 feeds refineries in Toledo (PBF), Detroit (Marathon), Sarnia (Imperial Oil) Montreal (Suncor). The impact for crude by rail is things will remain status quo in the short term for the Canadian Crude by rail shipper unless of course crude prices continue to rise.

Trans Mountain Corporation

The battle of Trans Mountain Pipeline is over and the project will be completed adding more take away capacity for Alberta producers. The Supreme Court of Canada will not hear a new appeal from British Columbia First Nations over the Trans Mountain pipeline expansion.

The court last Thursday dismissed the appeal from the Squamish Nation, Tsleil-Waututh Nation, the Ts’elxweyeqw Tribes and Coldwater Indian Band, effectively ending the years of legal battles over the project. The Trans Mountain project was first approved in 2016, but was stopped by the Federal Court of Appeal two years later after First Nations and environmental groups successfully argued the approval process was flawed. The Canadian government approved the project a second time in June 2019 after undergoing additional consultation with the affected communities, but the bands still felt the government did not fulfill its duty to consult and again appealed the decision. The pipeline should be completed sometime in the first quarter of 2022 at a cost of $7.4 billion.

Ian Anderson, President and CEO of Trans Mountain Corporation said:

“We are pleased with the Court’s decision to dismiss these applications and uphold the Federal Court of Appeal’s decision. Following the federal government’s second approval of the Trans Mountain Expansion Project and many years of consultation and regulatory reviews, we are pleased to continue building this nationally important Project.” It’s all over folks, there is no chance to appeal anymore and the pipeline will add incrementally capacity of 590,000 barrels per day for Alberta a head wind for crude by rail.

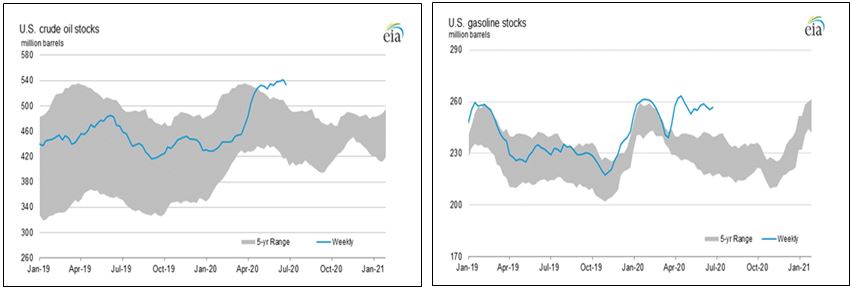

US Crude and Gasoline Inventories

U.S. crude inventories decreased by 7.2 million barrels last week . U.S. inventories now stand at 533.54 after increasing to record highs for 3 straight weeks prior. Much of the draw is attributed to refiners ramping up production, with the refinery utilization rate rising to its highest since April at 75.5%.

Gasoline inventories were up by 1.2 MM/bbls while distillate inventories decreased by 600K/bbls. Demand is certainly coming back.

We have been extremely busy at PFL with return on lease programs and railcar storage. Please call PFL now at 239-390-2885 if you are looking for rail car storage or have storage availability.

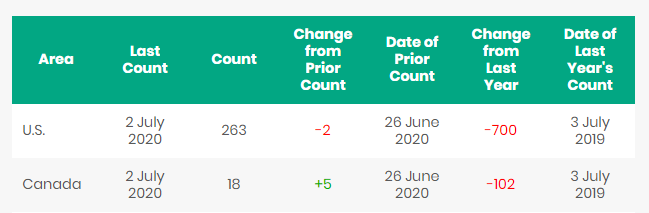

Rig Count

North America rig count moved higher and is up 3 rigs week over week with the U.S. losing 2 rigs and Canada gaining 5 rigs. Year over year we are down 802 rigs collectively. Canada now has 18 rigs nationwide operating and the U.S. has 263 rigs operating (oil 185 rigs – gas 76 rigs) down 73% year over year. U.S. energy firms cut the number of oil and natural gas rigs operating to a record low for a ninth week in a row although the reductions have slowed as higher oil prices have prompted some producers to start and or continue drilling.

North American Rig Count Summary

North American Rail Traffic

Total North American rail volumes were down 14.3% year over year in week 26 (U.S. -13.8%, Canada -15.1%, Mexico -18.0%), resulting in second quarter 2020 volumes that were down 17.8% and year to date volumes that are down 12.0% (U.S. -13.2%, Canada -8.3%, Mexico -10.6%). All of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from coal (-33.4%), intermodal (-6.6%), metallic ores & metals (-27.6%) and nonmetallic minerals (-24.5%).

In the East, CSX’s total volumes were down 12.8%, with the largest decreases coming from coal (-47.2%), motor vehicles & parts (-30.0%) and stone sand & gravel (-18.6%). NS’s total volumes were down 14.8%, with the largest decreases coming from coal (-50.8%), intermodal (-4.0%), metals & products (-32.6%) and chemicals (-20.7%).

In the West, BN’s total volumes were down 16.3%, with the largest decreases coming from coal (-28.5%), intermodal (-7.1%), petroleum (-43.9%), stone sand & gravel (-45.2%) and metallic ores (-78.5%). UP’s total volumes were down 13.7%, with the largest decreases coming from coal (-25.5%), intermodal (-5.9%), stone sand & gravel (-39.5%), motor vehicles & parts (-26.0%) and chemicals (-13.3%).

In Canada, CN’s total volumes were down 18.8% with the largest decreases coming from intermodal (-9.8%), petroleum (-44.7%), stone sand & gravel (-59.9%), metallic ores (-15.8%) and chemicals (-21.3%). RTMs were down 25.7%. CP’s total volumes were down 9.8%, with the largest decreases coming from petroleum (-51.4%), coal (-27.3%), intermodal (-7.0%) and stone sand & gravel (-64.7%). The largest increase came from grain (+18.3%). RTMs were down 8.2%.

KCS’s total volumes were down 15.8%, with the largest decreases coming from intermodal (-16.3%) and metals & products (-56.6%). The largest increase came from grain (+47.9)

Source: Stephens

Other Transportation – Looks Good For Now

West Coast ports remain fluid ahead of a recovery. Average container dwell time at the ports of L.A. and Long Beach was up +4.4% year over year in May at 2.4 days. Shipments with dwell times over five days fell -25% year over year to 3.3% of total shipments. The increase in average dwell times from historically low levels is consistent with improving activity, while a sharp drop in longer dwells reflects non-essential businesses starting to reopen. Overall fluidity at the ports appears supportive for stronger activity in the second half of 2020.

Truck spot rates outperformed seasonally again last week as load-to-truck ratios continued tracking above seasonal trends, despite difficult comps from the week prior. The strong trajectory in load to truck ratios raises the question of whether the post COVID-19 TL was peaking with “normal” factors ahead of the July 4th holiday, including produce and food & beverage or can be extended with inventory re-stocking as businesses reopen. Previously, the post-Independence Day freight market will be an important barometer of whether or not this recovery follows a “V” or “W” shaped recovery, and recent steps to roll back reopening’s suggest the latter is more likely. Additionally, unemployment benefits in excess of many Americans’ typical wages have helped bolster consumption, and this program is set to expire on July 31. Furthermore, the debate on how and whether to reopen schools continues, and we suspect there will be a fragmented approach on a state-by-state basis as well as by large colleges and universities, making it difficult for shippers, retailers, and school purchasing managers to plan inventory.

Railcar Markets

PFL is offering: Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Clean and new cars are available for longer term leases. C02 cars are now available for lease, so get them while you can. A number of sand cars, box cars, coal cars and hoppers are also available for sale.

PFL is seeking: 200 25.5 cpc 1232 cars for use within Mexico for 1-3 years for heavy fuel oil. 100 DOT 117s R’s or J’s for gasoline service – need in Port Arthur for 2 months with a two months option, 2 Covered hoppers to purchase 5500 series for storage at plant site in the Chicago area BN or NS connection, 5-10 syrup cars in the Midwest, 100 steel coal gons for sale, need 10 20K to 23.5 coiled and insolated for one year in ethylene glycol, 10 CPC 1232 or other for Industrial Alcohol use in Indiana off the NS for 6 months lessee would take ethanol cars clean them use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels please call to discuss) 5 CPC 1232 or other for Ethanol use in MN for 6 months.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE HAVE JUST COMPLETED A JOB IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|