“For to be free is not merely to cast off one’s chains, but to live in a way that respects and enhances the freedom of others.” — Nelson Mandela

Jobs Update

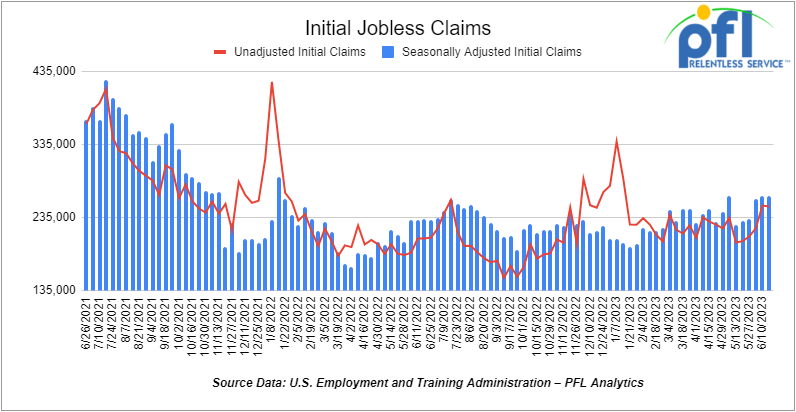

- Initial jobless claims for the week ending June 17th, 2023 came in at 264,000, flat week-over-week.

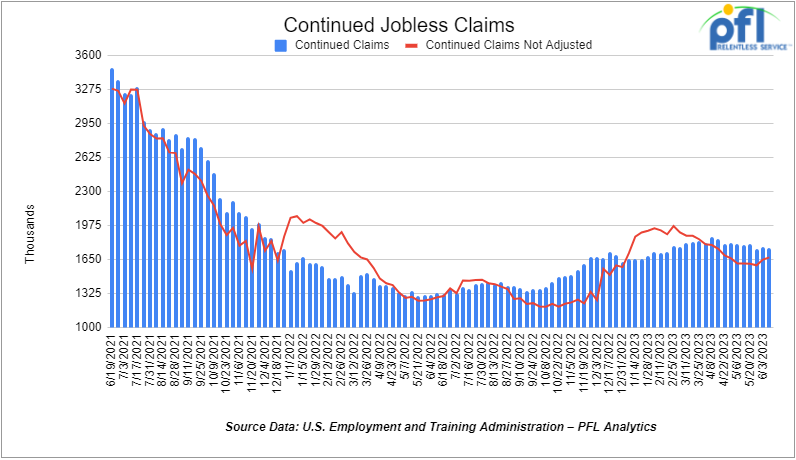

- Continuing jobless claims came in at 1.759 million people, versus the adjusted number of 1.772 million people from the week prior, down -13,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -219.28 points (-0.65%), closing out the week at 33,727.43, down -571.69 points week over week. The S&P 500 closed lower on Friday of last week, down -33.56 points (-0.77%), and closed out the week at 4,348.33, down -61.26 points week over week. The NASDAQ closed lower on Friday of last week, down -138.09 points (-1.01%), and closed the week at 13,492.52, down -197.05 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,958 this morning down -19 points.

Crude oil closed down on Friday of last week and lower week over week

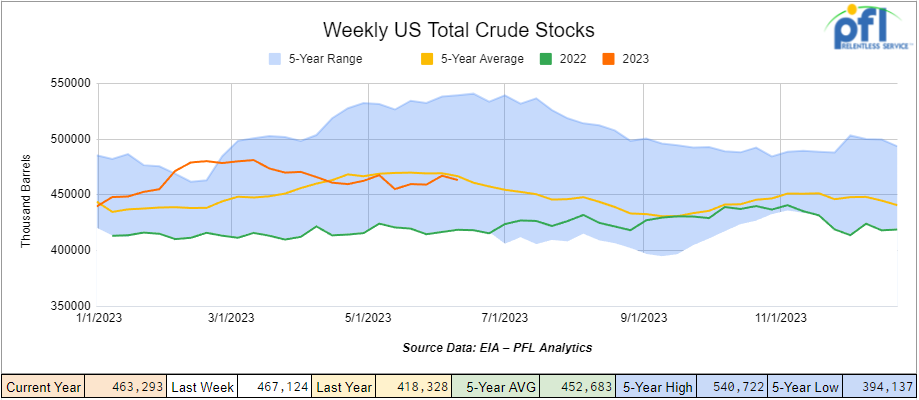

Oil prices declined over the week due to concerns over potential interest rate hikes dampening demand, despite indications of tighter supplies such as lower U.S. crude stocks. The interest rate increases by central banks and weaker-than-expected economic data from China contributed to the risk-averse sentiment. Although supply-side factors, such as reduced U.S. inventories and Saudi Arabia’s production cut, suggest tightening of the market, recession fears and demand uncertainties dominated market sentiment.

WTI traded down -$0.35 per barrel (-0.5%) to close at $69.16 per barrel on Friday of last week, down -$2.62 per barrel week over week. Brent traded down -US$0.29 per barrel (-0.4%) on Friday of last week, to close at US$73.85 per barrel, down -US$2.76 per barrel week over week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by -3.8 million barrels week over week. At 463.3 million barrels, U.S. crude oil inventories are at the five-year average for this time of year.

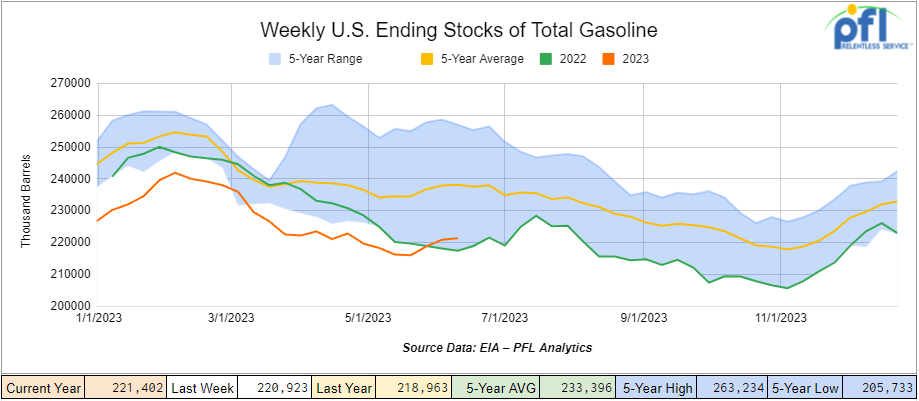

Total motor gasoline inventories increased by +500,000 barrels week over week and are 7% below the five-year average for this time of year.

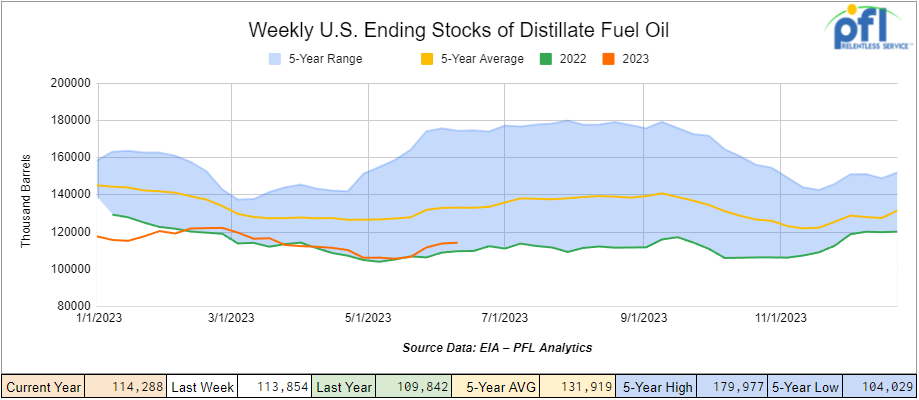

Distillate fuel inventories increased by 400,000 barrels week over week and are 14% below the five-year average for this time of year.

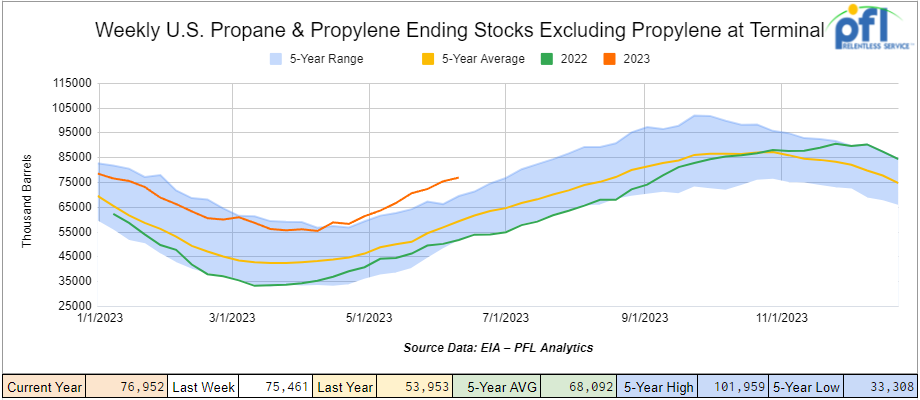

Propane/propylene inventories increased 1.5 million barrels week over week and are 27% above the five-year average for this time of year.

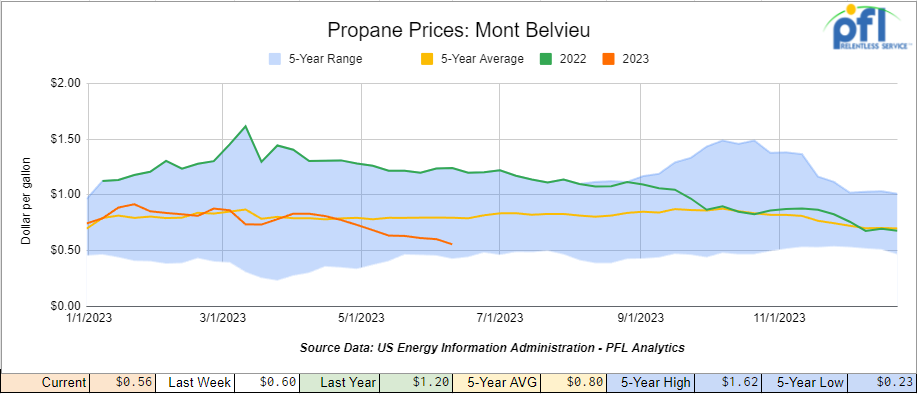

Propane prices closed at 56 cents per gallon, down 4 cents per gallon week over week and down 64 cents per gallon year over year, as storage continues to fill.

Overall, total commercial petroleum inventories increased by 1.3 million barrels during the week ending June 16th, 2023.

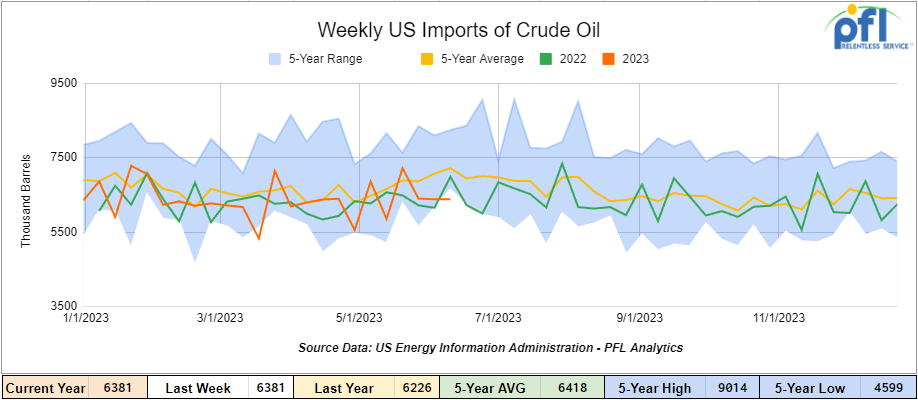

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending June 16th, 2023, a decrease of 220,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 2.3% more the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 925,000 barrels per day, and distillate fuel imports averaged 144 thousand barrels per day during the week ending June 16th, 2023.

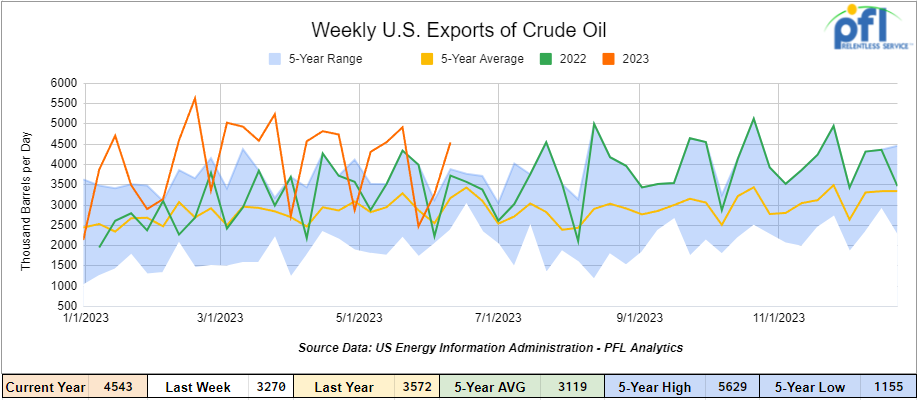

U.S. crude oil exports averaged 4.543 million barrels per day for the week ending June 16th, 2023, an increase of 1.273 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.801 million barrels per day.

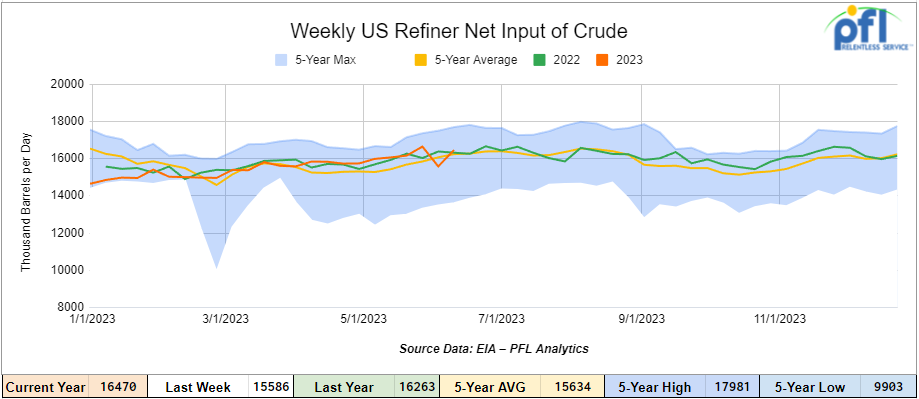

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending June 9, 2023, which was 60,000 barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $69.45, up 29 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending June 21st, 2023.

Total North American weekly rail volumes were down (-5.02%) in week 24, compared with the same week last year. Total carloads for the week ending on June 21st, 2023 were 344,552, down (-1.44%) compared with the same week in 2022, while weekly intermodal volume was 210,387, down (-8.71%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year over year decreases with the most significant decrease coming from Grain (-23.94%). The largest increase came from Motor Vehicles and Parts (+19.11%).

In the East, CSX’s total volumes were down (-0.62%), with the largest decrease coming from Petroleum and Petroleum Products (-8.25%) and the largest increase from Motor Vehicles and Parts (+36.84%). NS’s volumes were down (-4.79%), with the largest decrease coming from Petroleum and Petroleum Products (-22.24%) and the largest increase from Farm Products (+11.84%).

In the West, BN’s total volumes were down (-9.03%), with the largest decrease coming from Grain (-33.72%), and the largest increase coming from Motor Vehicles and Parts (+28.04%). UP’s total rail volumes were down (-2.4%) with the largest decrease coming from Grain (-24.10%) and the largest increase coming from Motor Vehicles and Parts (+22.01%).

In Canada, CN’s total rail volumes were down (-7.89%) with the largest increase coming from Nonmetallic Minerals (+4%) and the largest decreases coming from Grain (-28.59%). CP’s total rail volumes were down (-0.58%) with the largest decrease coming from Grain (-49.90%) and the largest increase coming from Coal (+87.86%).

KCS’s total rail volumes were down (-9.94%) with the largest decrease coming from Intermodal (-22.2%) and the largest increase coming from Motor Vehicles and Parts (+43.77%).

Source Data: AAR – PFL Analytics

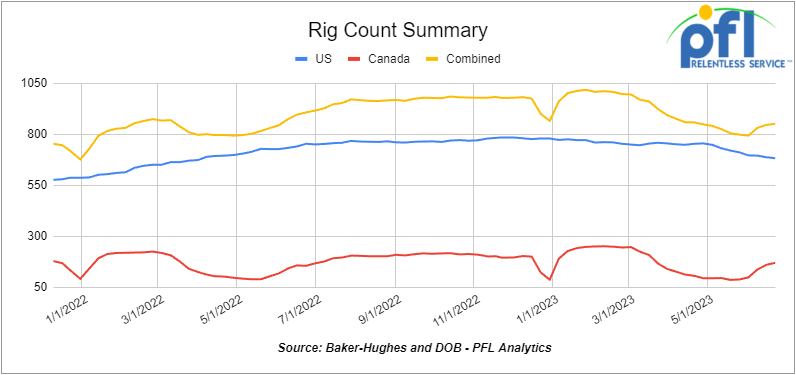

Rig Count

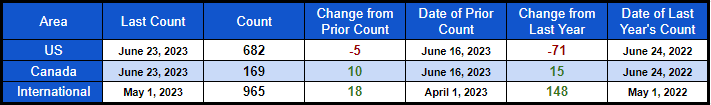

North American rig count was up by +5 rigs week over week. U.S. rig count was down by -5 rigs week over week and down by -71 rigs year-over-year. The U.S. currently has 682 active rigs. Canada’s rig count up by +10 rigs week-over-week and up by 15 rigs year over year. Canada’s overall rig count is 169 active rigs. Overall, year-over-year, we are down -56 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,697 from 25,557, which was a gain of +140 rail cars week-over-week. Canadian volumes fell week over week; CPKC’s shipments decreased by -7.0% week over week, and CN’s volumes were lower by -7.1% week-over-week. U.S. shipments were mixed. The UP had the largest percentage increase and was up by +6.9% week-over-week. The NS had the largest percentage decrease and was down by -11.6%.

We were watching Russia’ drama from over the weekend

Folks, in case you missed it there was a little bit of a drama in Russia over the weekend. Russia’s notorious mercenary leader Yevgeny Prigozhin staged an apparent insurrection, sending an armored convoy towards Moscow late Friday and raising questions about Vladimir Putin’s grip on power.

The Russian president accused his former ally of treason, embarking on an armed rebellion and “a stab in the back of our country.”

But, by the end of Saturday, Prigozhin had called the whole thing off and ordered his men back to base. He then fled to Belarus in a brokered deal between Putin and the leader of that country in exchange for Putin dropping charges against him. Seems to us that Putin looks weak and unstable and avoided a take down. Should be interesting how this one plays out and how it affects the markets this week.

We are watching India Continue to buy Illegal Russian Oil

Despite Indian PM meeting with President Joe Biden in Washington last week to meet regarding strengthening ties, technology and defense India continues to defy U.S. and European Bloc leaders and continues to purchase Russian crude at steep discounts. India’s rising imports of Russian oil hit a record high of about 1.95 million barrels per day (bpd) in May denting purchases from Iraq and Saudi Arabia fell, tanker data from trade and industry sources showed.

India, the world’s third biggest oil consumer and importer, buys more than 80% of its oil from overseas markets.

Its refiners have been gorging on Russian oil since the West imposed sanctions over Moscow for its invasion of Ukraine.

Russian oil accounted for about 40% of India’s crude imports in May, cutting imports from Iraq to a three-year low and from Saudi Arabia to their lowest since September 2021.

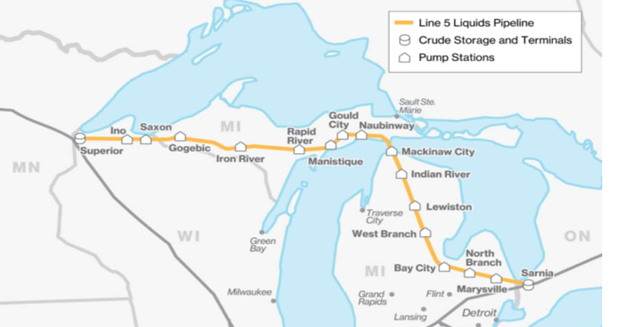

We are Watching Enbridge Line 5

As our readers know the governor of Michigan Governor Gretchen Whitmer in her wisdom really wants Line 5 shut down. She even ordered the pipeline shut down at one point – Enbridge did not listen to this craziness – would have been good for rail but just does not make sense for the people of Michigan not to mention all the refiners in the Midwest and our Canadian friends that rely on that pipeline to continue to be operational for basic human needs! The contention – Whitmer claimed there was a potential for a spill in a channel linking two of the Great Lakes. Enbridge solution was to build a new line and a tunnel encased by cement to prevent a leak in the straits.

Line 5 Tunnel Project Proposal Enbridge Energy Limited Partnership is currently seeking approval to build a utility tunnel and to replace and relocate the portion of the Line 5 pipeline that runs beneath the Straits of Mackinac. The proposed tunnel would house the replacement segment for the Line 5 petroleum pipeline that sits on the bottom of the Straits.

The Straits of Mackinac

Source: The University of Michigan – PFL Analytics

Review and permitting decisions for the proposed project involve multiple state agencies and the U.S. Army Corps of Engineers

Staff at the Michigan Public Service Commission (MPSC) recommended the commission approve Enbridge’s application for the project, maintaining the proposed tunnel will “fulfill the alleged purpose of reducing the environmental risk to the Great Lakes posed by the dual pipelines.”

Calgary-based Enbridge’s 645-mile conduit moves crude and NGLs from Superior, Wisconsin, to Sarnia, Ontario, with most of the pipeline located in Michigan. It crosses beneath the Straits of Mackinac between lakes Michigan and Huron, where Enbridge has applied to replace two existing 20-inch pipelines with a tunnel containing one single 30-inch line.

Enbridge Line 5

Source: Enbridge – PFL Analytics

The recommendation for approval comes after the MPSC reopened the file in July 2022 and sent staff back for more analysis and evidence gathering. It looks like that process is now moving forward, despite the Governor’s objection.

If approved by the state, a key environmental review by the U.S. Army Corps of Engineers still needs to be completed and would likely delay construction of the project until sometime in 2026, but it seems to us that the pipeline is not shutting down at this time anytime soon. Enbridge seems to be winning one battle at a time.

Boring of the tunnel would move at about 40 feet per day, taking Enbridge about two years to make the roughly 4.1-mile long tunnel.

We are watching Safety and bracing for new rules headed our way

Freight railcar inspections are happening less often and are not as thorough as in years past due to staff cuts, time constraints and regulatory loopholes, a union official testified Friday of last week during a federal hearing to examine the reasons behind a fiery train derailment in Ohio.

East Palestine, Ohio

Source: ntsb.gov – PFL Analytics

The National Transportation Safety Board said in its preliminary report that an overheating wheel bearing likely caused the Feb. 3 Norfolk Southern derailment that sent a plume of toxic black smoke into the sky near East Palestine, Ohio. Several tank cars were damaged in the crash, and officials decided that five of them containing vinyl chloride needed to be blown open to release the chemical and prevent an explosion.

It’s not clear whether an inspector would have been able to catch that the bearing was failing because it is sealed within the railcar’s axle. No inspector was even given a chance.

Jason Cox with the Transportation Communications Union testified Friday during the second day of the NTSB hearing that the railcar that caused the derailment wasn’t inspected by Norfolk Southern even though it passed through three railyards where qualified inspectors were working.

Cox said the lack of inspections reflects the changes Norfolk Southern has made since 2019 to slash the ranks of car inspectors and other employees, and that the company increasingly uses a loophole in federal regulations to rely on train crews to complete inspections instead of experts trained to do that work. He said train crews look at just 12 points on a rail car instead of the 90 to 105 points a carman checks.

Meanwhile, the Pipeline and Hazardous Materials Safety Administration (PHMSA) has proposed a new rule that would require railroads to maintain and update in real time information about rail hazmat shipments in a train consist that would be accessible to authorized emergency response personnel.

Railroads would also be required to proactively “push” that information to authorized local first response personnel as soon as the railroad is aware of an accident involving any hazardous materials, PHMSA officials said in a press release.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils/Biodiesel service. Need to be Unlied

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 25-50, 25.5K 117J, 117R, CPC 1232 Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Asphalt service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 30K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Beaumont, Houston, Sunray for 6 Months. Cars are needed for use in Diesel service. Dirty to Dirty

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Negotiable

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for more information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free move available

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free move available

- 108, 28.3K, 117R Tanks located off of All Class 1’s in St. Louis. Cars are clean

- 25, 28.3K, DOT111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free move available. Dirty to dirty service.

- 47, 6500, Covered Hoppers located off of UP and BN in Iowa. Cars are clean

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|