“He who is not courageous enough to take risks will accomplish nothing in life.” —Muhammad Ali

Jobs Update

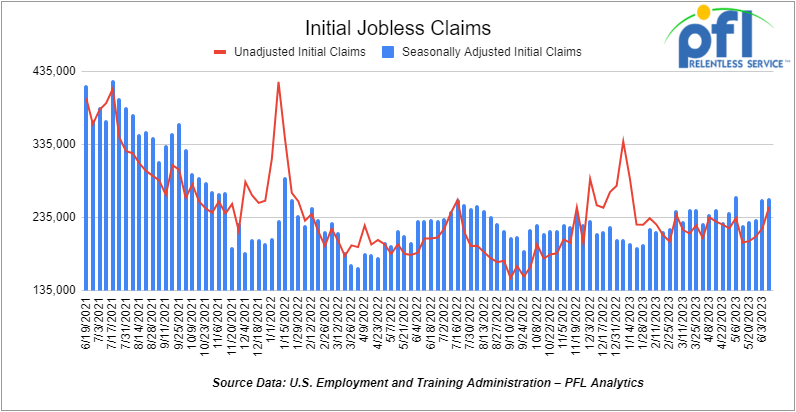

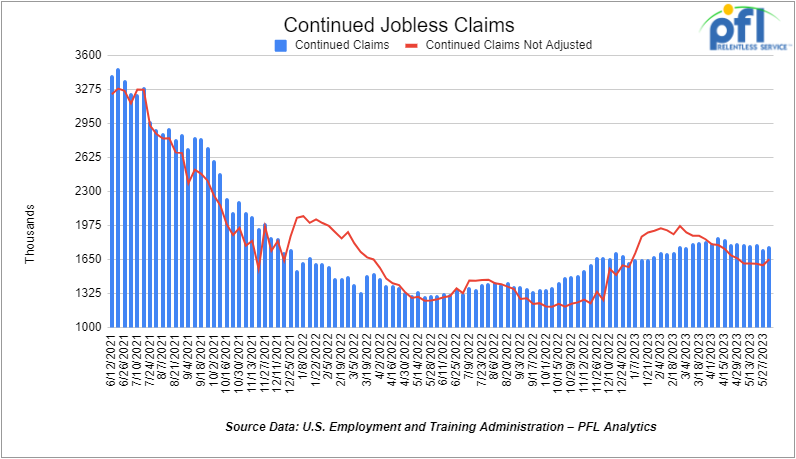

- Initial jobless claims for the week ending June 10th, 2023 came in at 262,000, up +1,000 people week-over-week.

- Continuing jobless claims came in at 1.775 million people, versus the adjusted number of 1.755 million people from the week prior, up 20,000 people week over week.

Stocks closed lower on Friday of last week, but higher week over week

The DOW closed lower on Friday of last week, down -108.94 points (-0.32%), closing out the week at 34,299.12, up 422.34 points week over week. The S&P 500 closed lower on Friday of last week, down -16.25 points (-.037%) and closed out the week at 4,409.59, up +110.73 points week over week. The NASDAQ closed lower on Friday of last week, down -93.25 points (-0.7%), and closed the week at 13,689.57, up +430.43 points week over week.

Financial Markets are closed today in observance of Juneteenth.

Crude oil closed higher on Friday of last week and up week over week

WTI traded up $1.16 per barrel (+3.44%) to close at $71.78 per barrel on Friday of last week, up $1.61 per barrel week over week. Brent traded up US$0.94 per barrel (3.37%) on Friday of last week, to close at US$76.61 per barrel, up US$1.82 per barrel week over week.

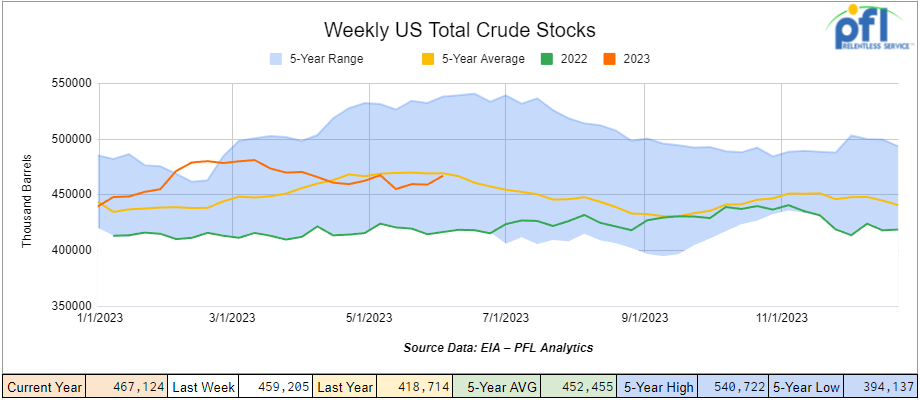

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 7.9 million barrels week over week. At 467.1 million barrels, U.S. crude oil inventories are at the five-year average for this time of year.

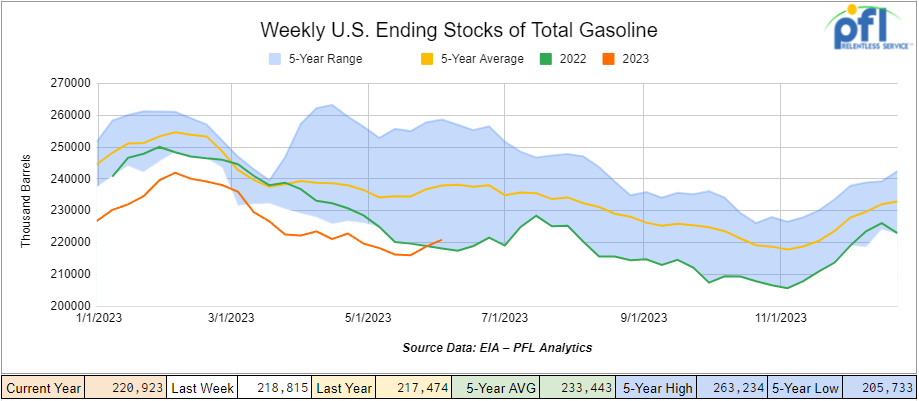

Total motor gasoline inventories increased by 2.1 million barrels week over week and are 7% below the five-year average for this time of year.

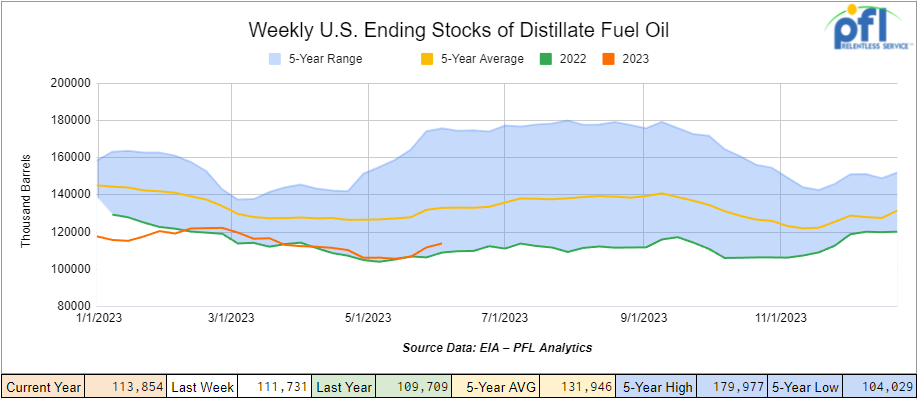

Distillate fuel inventories increased by 2.1 million barrels week over week and are 14% below the five-year average for this time of year.

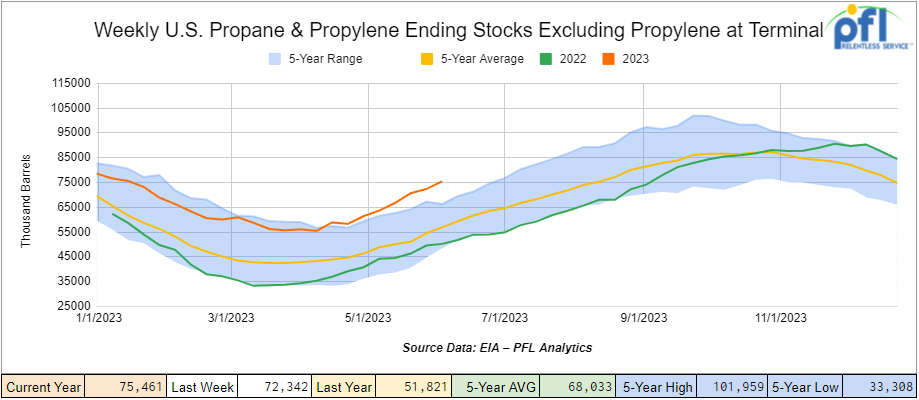

Propane/propylene inventories increased 3.1 million barrels week over week and are 30% above the five-year average for this time of year.

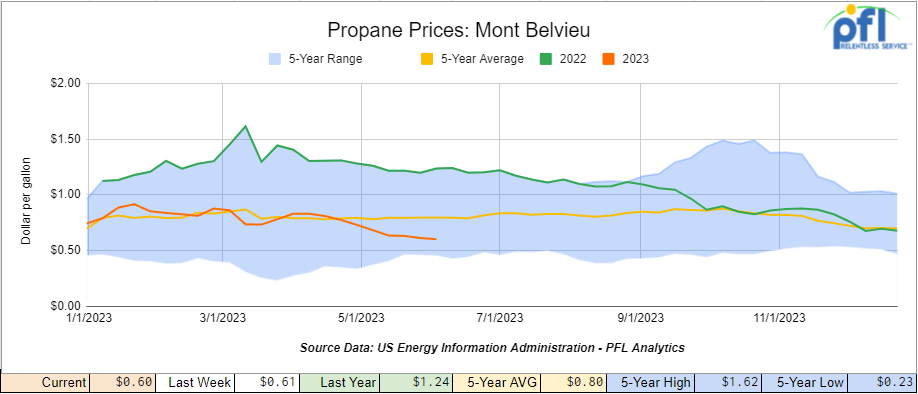

Propane prices closed at 60 cents per gallon, down 1 cent per gallon week over week and down 64 cents per gallon year over year, as inventories continue to increase.

Overall, total commercial petroleum inventories increased by 12.8 million barrels during the week ending June 2nd, 2023.

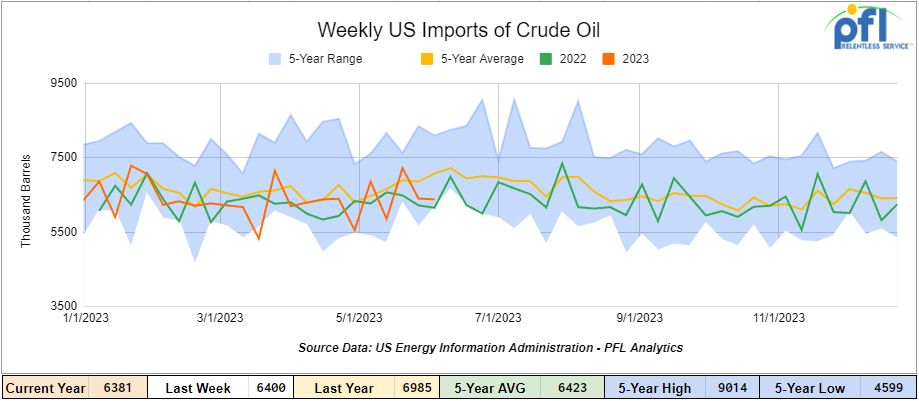

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending June 2nd, 2023, a decrease of 817,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, which is 3.5% higher than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 973,000 barrels per day, and distillate fuel imports averaged 172,000 barrels per day during the week ending June 2nd, 2023.

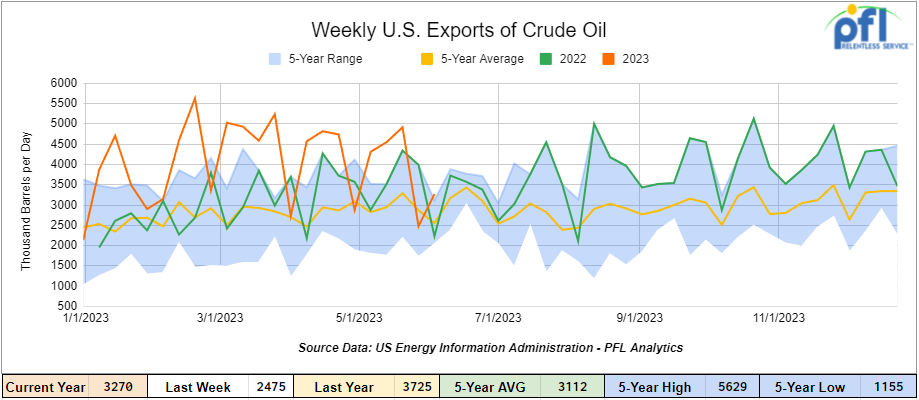

U.S. crude oil exports averaged 3.27 million barrels per day for the week ending June 9th, 2023, an increase of 795,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.802 million barrels per day.

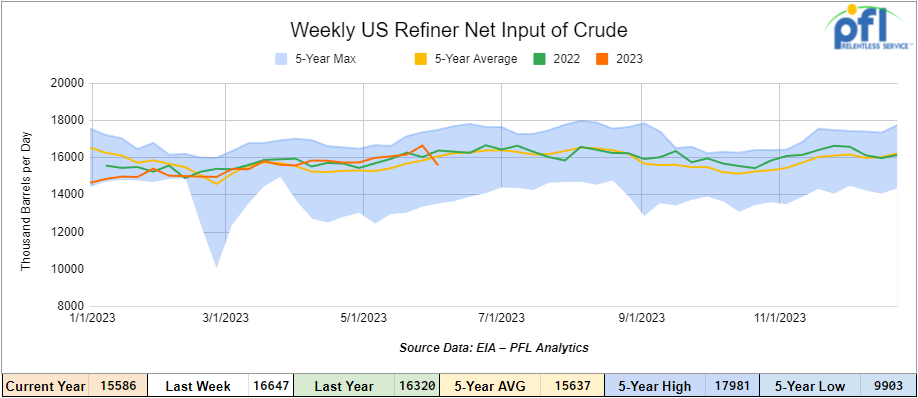

U.S. crude oil refinery inputs averaged 16.6 million barrels per day during the week ending June 9, 2023, which was 60,000 barrels per day less week over week.

Oil Markets are closed today in observance of Juneteenth.

North American Rail Traffic

Week Ending June 14th, 2023.

Total North American weekly rail volumes were down (-6.3%) in week 23 compared with the same week last year. Total carloads for the week ending on June 14th, 2023 were 345,626, down (-1.29%) compared with the same week in 2022, while weekly intermodal volume was 306,519, down (-11.36%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year over year decreases with the most significant decrease coming from Grain (-17.84%). The largest increase came from Motor Vehicles and Parts (+15.66%).

In the East, CSX’s total volumes were down (-1.6%), with the largest decrease coming from Grain (-16.59%) and the largest increase from Motor Vehicles and Parts (+17.05%). NS’s volumes were down (-4.28%), with the largest decrease coming from Petroleum and Petroleum Products (-16.43%) and the largest increase from Grain (+17.13%).

In the West, BN’s total volumes were down (-11.92%), with the largest decrease coming from Grain (-27.17%), and the largest increase coming from Motor Vehicles and Parts (+22.16%). UP’s total rail volumes were down (-5.99%) with the largest decrease coming from Grain (-19.05%) and the largest increase coming from Motor Vehicles and Parts (+18.02%).

In Canada, CN’s total rail volumes were down (-5.37%) with the largest increase coming from Coal (+32.75%) and the largest decreases coming from Grain (-45.05%). CP’s total rail volumes were up (14.46%) with the largest decrease coming from Chemicals (-11.59%) and the largest increase coming from Coal (+153%).

KCS’s total rail volumes were down (-10.29%) with the largest decrease coming from Other (-39.09%) and the largest increase coming from Motor Vehicles and Parts (+43.9%).

Source Data: AAR – PFL Analytics

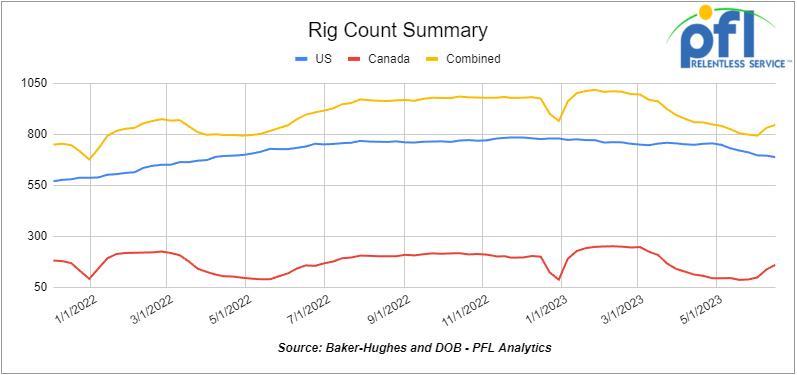

Rig Count

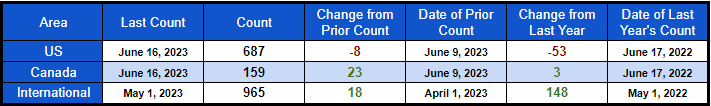

North American rig count was up by 15 rigs week over week. U.S. rig count was down by -8 rigs week over week and down by -53 rigs year-over-year. The U.S. currently has 687 active rigs. Canada’s rig count up by +23 rigs week-over-week and up by 3 rigs year over year. Canada’s overall rig count is 159 active rigs. Overall, year-over-year, we are down -50 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 25,557 from 25,334, which was a gain of +223 rail cars week-over-week. Canadian volumes rose week over week; CPKC’s shipments increased by +16.7% week over week, and CN’s volumes were higher by +8.0% week-over-week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +28.8% week-over-week. The BN was the sole decliner and was down by -4.9%.

We are watching Gibson

One of our favorite companies here at PFL just expanded its Liquids Infrastructure Platform with acquisition of Texas Gulf Coast Crude Oil Export Facility for US$1.1 Billion, in an announcement made on Wednesday of last week.

As a result, here are some Key Points:

- Enhances Gibson’s liquids-focused infrastructure business with on-strategy acquisition of high-quality export terminal at Ingleside, one of only two Texas Gulf Coast terminals with VLCC capabilities;

- Strengthens cash flow with >95% of revenue under take-or-pay contracts with investment grade or high-quality counterparties who are existing customers of Gibson.

- Expands Gibson’s footprint with connectivity to the Permian basin and provides a platform for future infrastructure growth with existing and new customers.

Texas Gulf Coast Crude Oil Export Facility

Source: Gibson – PFL Analytics

Gibson Energy Inc. has entered into an agreement to acquire 100% of the membership interests of South Texas Gateway Terminal LLC (“STLLC”) for a total purchase price of US$1.1 billion in cash, subject to closing adjustments. Through the Transaction, Gibson acquires the South Texas Gateway Terminal (“STGT” or the “Terminal”) which is positioned as one of the most competitive liquids terminal and export facilities globally with direct pipeline connections to low-cost, long reserve-life resource supply, and very large crude carrier (“VLCC”) capabilities. The Transaction implies a multiple of less than 9x the projected forward Adjusted EBITDA and is immediately accretive, with DCF per share accretion in the mid-teens 4,5,6.

“Since establishing Gibson as a leading liquids-focused infrastructure company, we have been looking for an opportunity that is a strategic fit, while enhancing our scale and diversity,” said Steve Spaulding, President and Chief Executive Officer. “After much patience and discipline, I am excited to add the world-class South Texas Gateway Terminal to our infrastructure portfolio. This transaction amplifies our high-quality infrastructure revenues and bolsters the continued growth of our distributable cash flow per share. To add 1 mmbbl/d of export capacity and nearly 9 million barrels of terminal storage in a highly strategic location furthers our momentum in growing Gibson’s infrastructure footprint and provides a platform for future growth with existing and new customers.”

STGT is a newly built, high-quality crude oil export facility, operating a deep-water, open access marine terminal in Ingleside, Texas at the mouth of the Corpus Christi Bay. The Terminal was officially placed in-service and loaded its first vessel in July 2020. In March 2021, STGT completed the final construction phase of incremental storage facilities bringing the total terminalling capacity to 8.6 million barrels of crude oil across 20 tanks. The Terminal is connected to the Permian and Eagle Ford basins through multiple, newly-built pipelines and is strategically positioned to connect these basins to global exports. With two deep-water docks that enable the simultaneous loading of two VLCCs and a permitted throughput capacity of 1 mmbbl/d, STGT is the second largest U.S. crude oil export terminal by capacity and accounted for approximately 12% of the United States’ total crude oil exports in 2023 year-to-date.

The Terminal achieved record volumes of over 670,000 bbl/d of oil in March 2023. Its advantaged location and operational efficiencies, combined with its pipeline-connections to leading North American resources, position STGT for continued growth through optimization of existing capacity, and increasing throughput volume. As U.S. crude oil exports grow, driven by production growth from the low-cost, resource-rich Permian basin, Gibson anticipates the potential for future expansions at the Terminal.

We are Watching the Mountain Valley Pipeline

Folks, it seems like we have been watching this one forever. It looks as though the construction of the MVP could restart End of June. (Thanks, MDN) The restart will occur after the U.S. Army Corps of Engineers issues a Section 404 water permit (deadline is June 24), construction will resume to finish up the final 6% of the MVP project.

MVP Asked the FERC for an Extension in NC. The owners of the Mountain Valley Pipeline sent a letter to federal regulators last week, asking for a three-year extension to finish the southern leg, most of which would run through North Carolina. The controversial MVP Southgate Project would start in Chatham, Virginia, and enter North Carolina in Eden, in Rockingham County. From there, the natural gas pipeline would continue roughly 46 miles southeast, ending near Haw River in Alamance County. It originally was scheduled to be finished and in service this month, but it has not received the necessary permits. Stay tuned to PFL on this one – great for rail and our ever-expanding NGL business here in the U.S.

PFL is Watching Energy Sales in the East – Hits Here at Home

Asian spot LNG prices have risen to a three-month high, driven by Nordic outages and increased cooling demand due to unseasonably high temperatures in parts of Asia and Europe. The average LNG price for August delivery into northeast Asia surged by 50% from the previous week to $13.50/mmBtu.

Despite the increase, Asian prices remain discounted compared to rallying European gas prices. This has led to the prompt loading cargoes from the United States shifting back toward Europe. The tightening of vessel availability ahead of winter has also resulted in a jump in spot LNG freight rates. Overall, this suggests that the factors affecting LNG prices and trade are primarily influenced by European gas market dynamics and global shipping constraints, rather than US sanctions on Russian crude oil exports.

Europe has a trick up their sleeve for Natgas stockpiles, but will it work? Is it too risky?

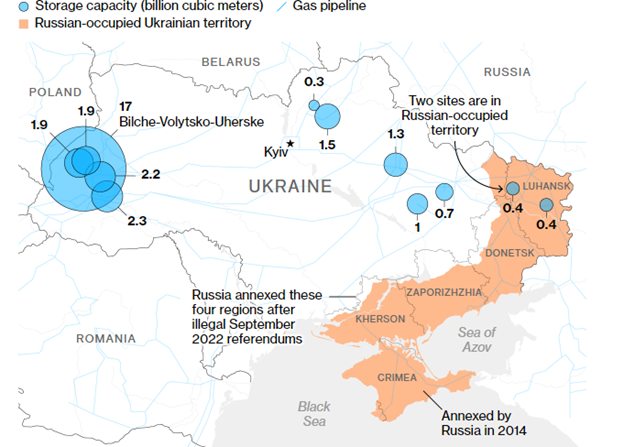

About 60 miles from Ukraine’s border with the European Union, an array of pipes and pumps hints at what stands to become an important part of the bloc’s efforts to secure energy supplies and thwart Vladimir Putin.

Tucked between farm fields and forests, the Bilche-Volytsko-Uherske storage facility can stockpile more than four times as much natural gas as the largest site in Germany and connects easily to the bloc’s grids, thanks to Ukraine’s decades-long role as a transit route for Russian energy.

Bilche-Volytsko-Uherske

Source: Institute for the Study of War – PFL Analytics

Storing vital fuel in a country subjected to missile strikes and attacks on critical energy infrastructure may sound like a crazy idea. However, it’s winning backers as the facilities are far enough from the front line to be deemed safe, and some traders reckon it’s worth the risk.

In Oil news – Iranian crude oil exports have surged to their highest level since US sanctions were reinstated in 2018. With the majority of these exports going to China, Iran’s presence on the geopolitical stage is becoming increasingly evident. The increased market supply is undermining efforts to stabilize crude prices by OPEC+ members. Despite US sanctions, Iranian shipments have doubled, potentially exceeding three million barrels per day. The resurgence aligns with Iran’s efforts to repair regional ties and form strategic alliances with China. Everyone saw that one coming! Everyone except the people running our country or maybe they did?

Additional shipments, along with Russian and Venezuelan sanctioned oil, are impacting global oil markets, leading to a 12% price decrease this year. Iran has found ways to bypass sanctions through alternative shipping routes. Chinese refiners, attracted by Iran’s discounts, have increased purchases. The impact of Iran’s oil on prices may be limited, but global markets are predicted to face a supply deficit due to China’s rebound. Crude traders remain skeptical, citing concerns over increased Iranian barrels.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 20-25, 30K 117 Tanks needed off of UP or BN in Illinois for 5 Years. Cars are needed for use in Ethanol service.

- 10, 30K 117 Tanks needed off of NS or CSX in Marcellus for Trip Lease. Cars are needed for use in C5 service.

- 100, 28.3K DOT 111/117 Tanks needed off of UP or BN in Midwest/Texas for 5 Years. Cars are needed for use in Veg Oils/Biodiesel service. Need to be Unlied

- 25-50, 33K 400W Pressure Tanks needed off of CN or CP in Canada for Short Term. Cars are needed for use in Propylene service.

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 Years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 Year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 25-50, 25.5K 117J, 117R, CPC 1232 Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Asphalt service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 30K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Beaumont, Houston, Sunray for 6 Months. Cars are needed for use in Diesel service. Dirty to Dirty

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for more details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Negotiable

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in the Midwest. Cars were last used in Fertilizer / Corn syrup. Free Move

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located off of in Canada. Cars were last used in Crude. Dirty to Dirty

- 25, 28.3K, DOT111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free Move, Dirty to Dirty

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations.

- 150, 89’6, Flatcars located off of CN in Canada.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|