“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.” -Sam Walton

COVID 19 and Markets Update

In the United States, we currently have 2,324,956 confirmed COVID 19 cases and 121,766 confirmed deaths

On Thursday of last week, according to the Labor Department, U.S. workers filed an additional 1.5 million jobless claims, bringing the total losses since the coronavirus pandemic to 45.5 million. This is not good folks and higher than expected, this last round of job cuts are most likely permanent.

After gaining as much as 371 points earlier in Friday’s trading session the DOW closed lower closing down 208.64 points (or 0.8%) to close out the week at 25,871.46. The S&P 500 traded 0.5% lower, or down 17.42 points, at 3,097.92, after dropping 1.0% at one point during Friday’s trading session. The Nasdaq finished the session just points higher at 9,946.12. In overnight trading, DOW futures traded higher and as of the writing of this report is expected to open up 188 points at 25,717.

West Texas Intermediate (WTI) for July delivery rose 91 cents to settle at $39.75 per barrel on the New York Mercantile Exchange on Friday of last week. Oil turned around last week’s setback, extending a slow rise since falling into negative territory in April. The 2.3% rally in crude on Friday was the highest level since March 6, 2020. However, the market now is in backwardation – the contango is long gone indicating increased supply will hit the market in the not so distant future.

Brent crude futures settled up $0.68 cents per barrel to settle at $38.23 U.S.D. per barrel on Friday of last week.

Oil is lower in overnight trading and as of the writing of this report and WTI is poised to open up at 39.50 down 25 cents per barrel from Friday’s close.

U.S. crude inventories rose by 1.2 million barrels last week and U.S. Strategic Petroleum Reserves rose by 1.7 million bringing the total build to 2.9 million barrels week over week. U.S. inventories now stand at 539.3 million barrels while U.S. Strategic Petroleum Reserves stand at 593 million barrels.

Russian Minister of Energy

PFL was on a conference call last week with Russia’s Minister of Energy. Russia denies getting involved in any price war and are taking their compliance cuts very serious. They are currently at 90% compliance and are focused on shutting down older wells. They have budgeted for crude for this fiscal year at $42.50 per barrel and have agreed to cuts until the end of July. In their opinion, they see any price movement beyond $50 per barrel as bad for the market as new supply would likely have an adverse impact on pricing. Regardless of politics Russia wants to build relations with the U.S.

On the brighter side of things, U.S. jet fuel consumption is up significantly over May levels showing it is heading in the right direction, but is still 50% down from last year’s levels. Gasoline consumption is rising as well and we are starting to see cars pulled out of storage here and there for refined products and Ethanol. Gasoline consumption in Europe is rising higher than anyone predicted rising to near 80% of last year’s levels. Demand in Asia is also strong for gasoline as traders are almost done unloading storage cargos in the region.

We have been extremely busy at PFL with return on lease programs and railcar storage. Please call PFL now at 239-390-2885 if you are looking for rail car storage or have storage availability.

Rig Count

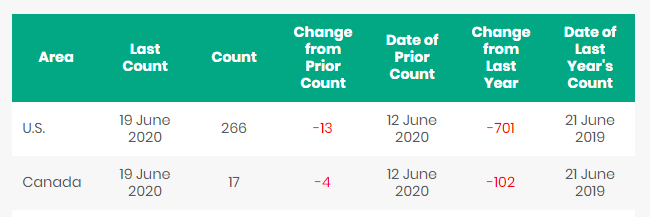

North America rig count continues to deteriorate and is down 17 rigs week over week with the U.S. losing 13 rigs and Canada losing 4 rigs. Year over year we are down 803 rigs collectively. Canada now has 17 rigs nationwide operating and the U.S. has 266 rigs now operating.

North American Rig Count Summary

North American Rail Traffic

U.S. rail traffic was down nearly 15 percent in Week 24. U.S. freight railroads hauled 449,291 carloads and intermodal units during the week ending June 13, a 14.9 percent decrease in traffic moved during the same week in 2019, according to Association of American Railroads (AAR) data.

Total carloads for the week fell 22.8 percent to 198,437, while intermodal volume fell 7.3 percent to 250,854 units. Only one of the 10 carload commodity groups — miscellaneous carloads — posted an increase during the week, up 1,030 carloads to 10,259.

Meanwhile, Canadian railroads logged 72,127 carloads, down 15.5 percent, and 64,378 intermodal units, down 8.6 percent.

Mexican railroads reported 19,300 carloads, down 10.9 percent, and 14,112 intermodal units, down 23.8 percent.

Individual Class Is reported the following carload activity for the week compared with 2019

- BN., 74,705 carloads, down from 97,328;

- CN, 52,990 carloads, down from 66,770;

- Canadian Pacific, 29,922 carloads, down from 33,436;

- CSX, 53,306 carloads, down from 71,930;

- Kansas City Southern, 11,969 carloads, down from 14,427;

- Norfolk Southern Railway, 46,113 carloads, down from 67,957;

- Union Pacific Railroad, 75,707 carloads, down from 92,406.

During the first 24 weeks of 2020 compared with the same period in 2019:

• U.S. railroads logged 10,782,849 carloads and intermodal units, down 13.2 percent;

• Canadian railroads reported 3,328,572 carloads, containers and trailers, down 7.8 percent; and

• Mexican railroads posted 804,302 carloads and intermodal containers and trailers, down 10.1 percent.

Petroleum car loads rose slightly. The four-week moving average of petroleum carloads rose from 20,042 to 20,061 week over week. CP volumes rose by 19.5% and CN’s volume rose by 15.8%, however, unfavorable basis differentials continue to exist against WTI for the Canadian producer. WCS versus WTI closed at -$9.00 per barrel on Friday. On a good note, Enbridge’s 3 million barrel per day mainline system that delivers crude oil out of Canada will be apportioned in July for the first time in three months. Enbridge is rejecting 3% of all nominations on its system. Hopefully the trend will continue and create a demand for rail cars to get moving again.

The Surface Transportation Board (STB) has released May headcount data for the U.S. rails. For the industry as a whole, May headcount was down 16.8% year over year versus April headcount that was down 13.7% year over year. On a sequential basis, industry headcount was down 4.5%. The most substantial year over year declines occurred at the UP and the NS while the most substantial sequential decline occurred at the KCS. Continued economic woes, reduced rail traffic and PSR implementation have all been contributing factors to the headcount reduction.

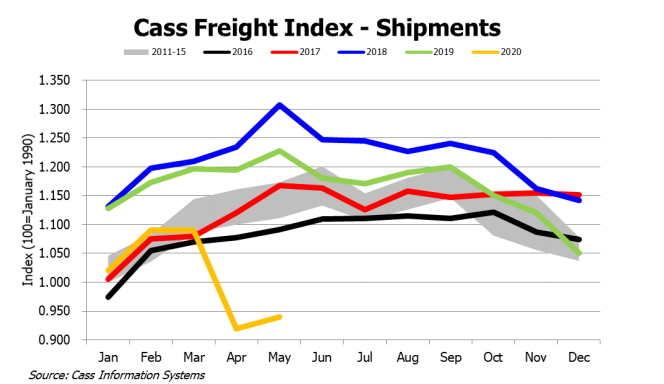

In May, shipments across all transport modes declined 23% year over year, its eighteenth consecutive month of year over year declines. 2019 shipments were down 4%, with an accelerated decline in the fourth quarter of 2019. See Chart below:

Railcar Markets

PFL is offering: : Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Clean and new cars are available for longer term leases. Much wanted pre pandemic C02 cars are now available for lease get them while you can. Sand cars, Box cars, coal cars and hoppers. A number of cars are available for sale.

PFL is seeking: 100 DOT 117s R’s or J’s for gasoline service – need in Port Arthur for 2 months with a two months option, 2 Covered hoppers to purchase 5500 series for storage at plant site in the Chicago area BN or NS connection, 5-10 syrup cars in the Midwest, 100 steel coal gons for sale, need 10 20K to 23.5 coiled and insolated for one year in ethylene glycol, 10 CPC 1232 or other for Industrial Alcohol use in Indiana off the NS for 6 months lessee would take ethanol cars clean them use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels please call to discuss) 5 CPC 1232 or other for Ethanol use in MN for 6 months.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE HAVE JUST COMPLETED A JOB IN THE EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|