The post PFL Railcar Report 3-2-2026 appeared first on PFL Petroleum Services LTD.

]]>Jobs Update

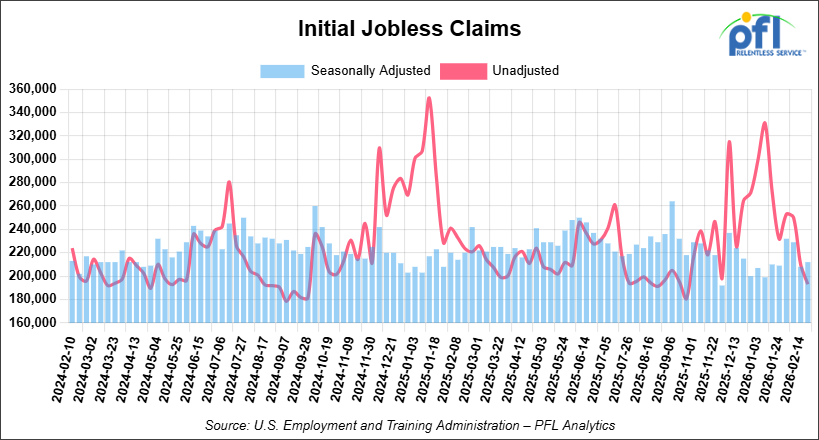

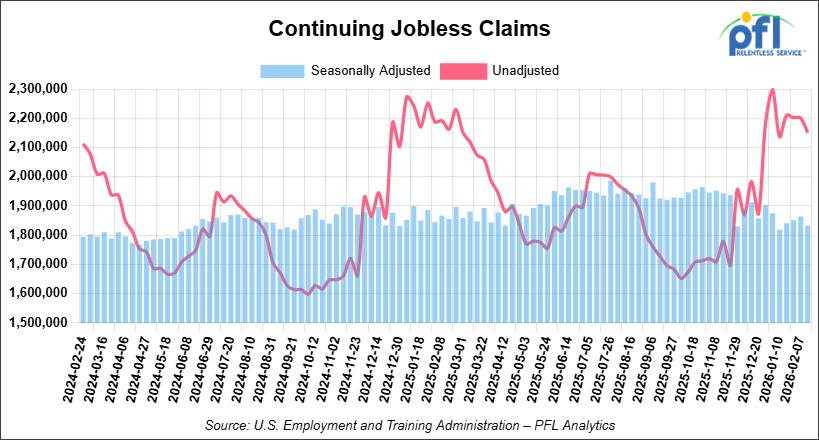

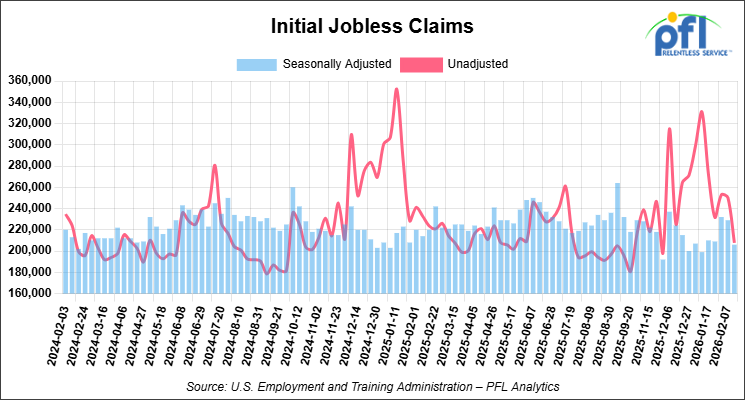

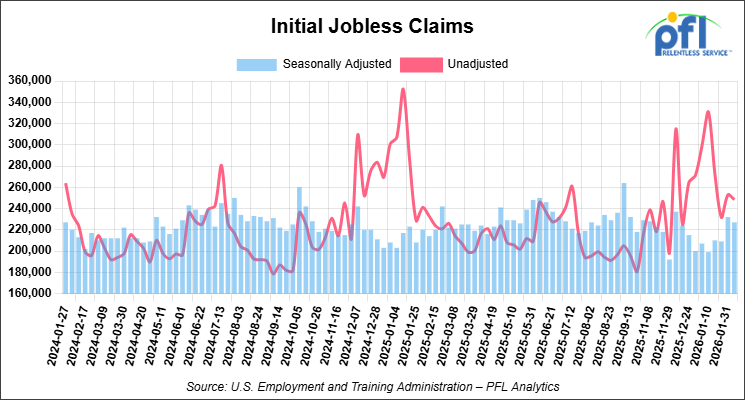

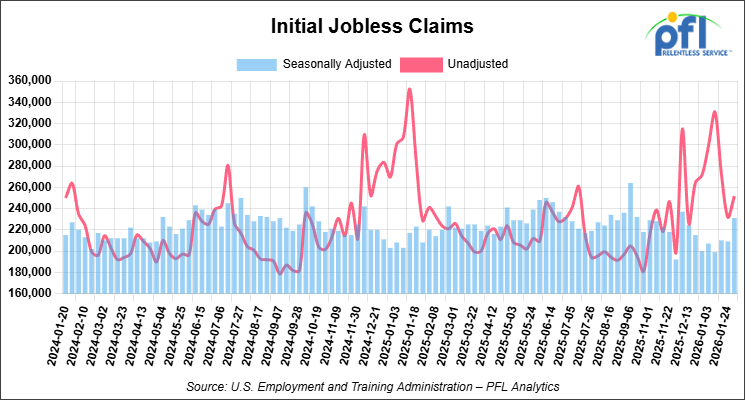

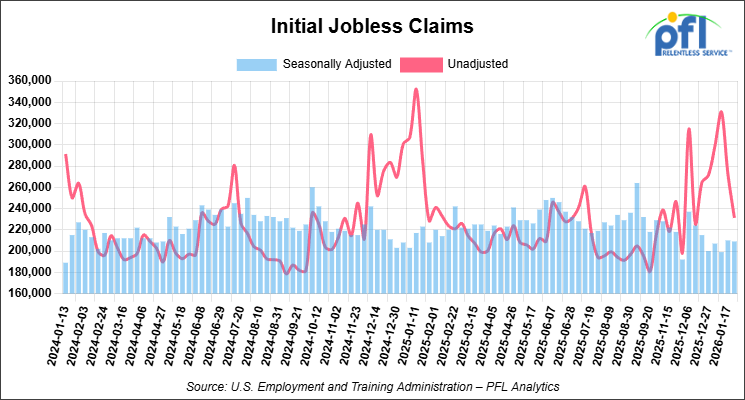

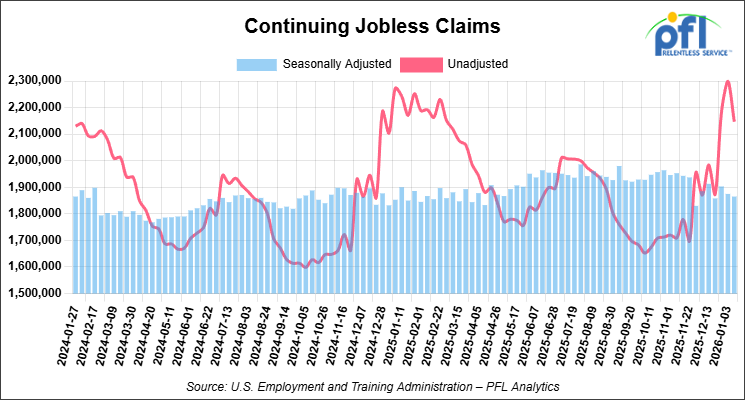

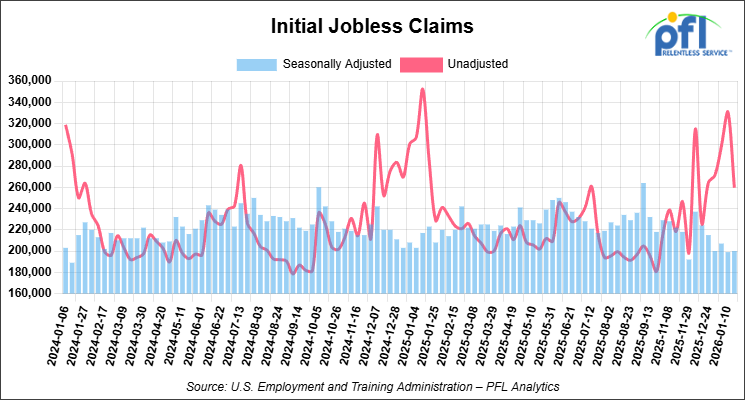

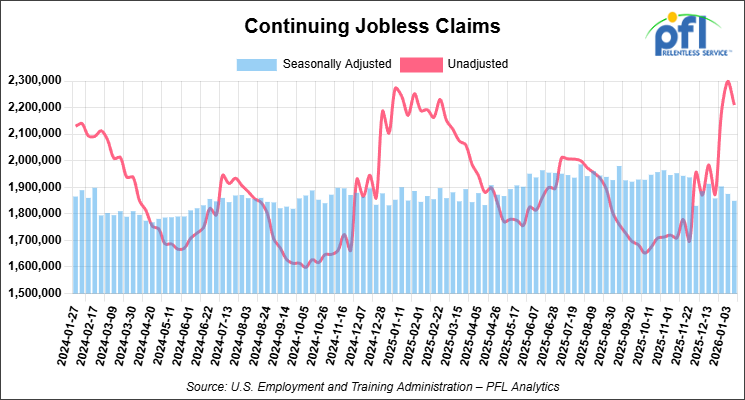

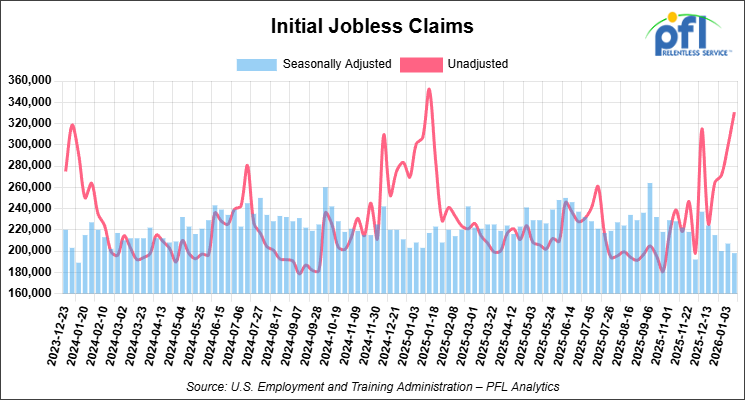

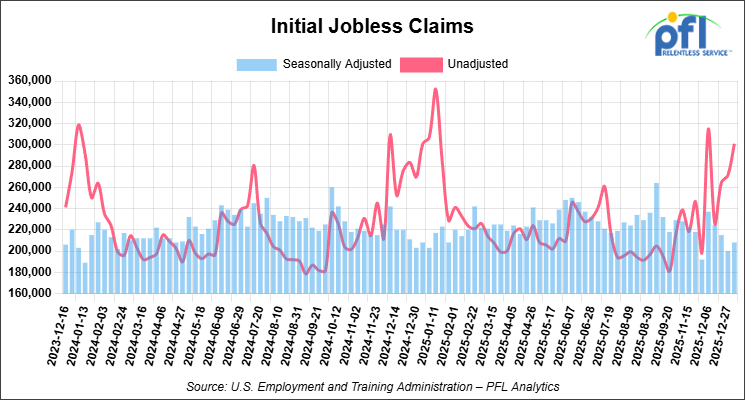

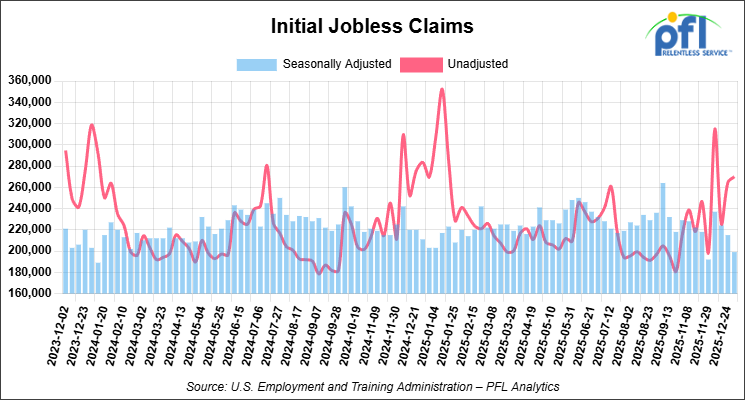

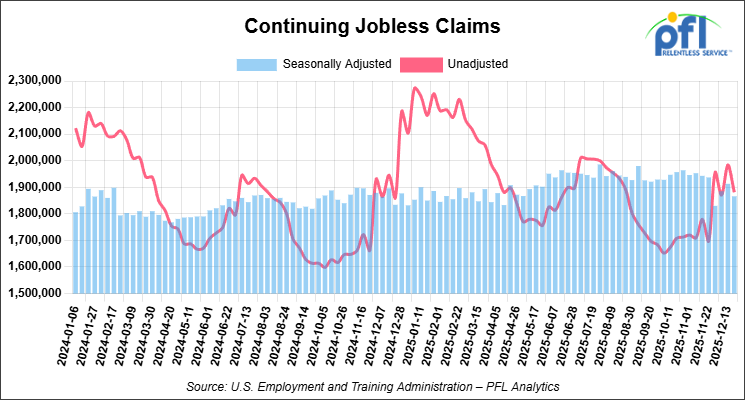

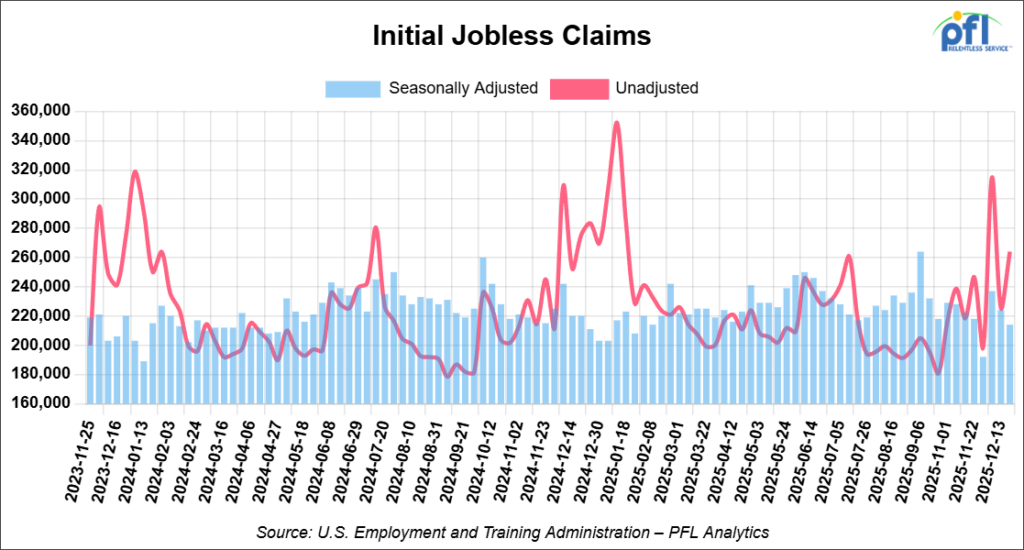

- Initial jobless claims seasonally adjusted for the week ending February 21, 2026 came in at 212,000, versus the adjusted number of 208,000 people from the week prior, up 4,000 people week over week.

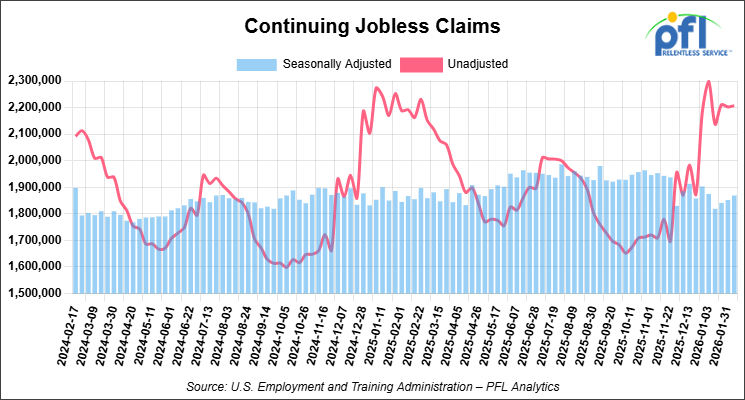

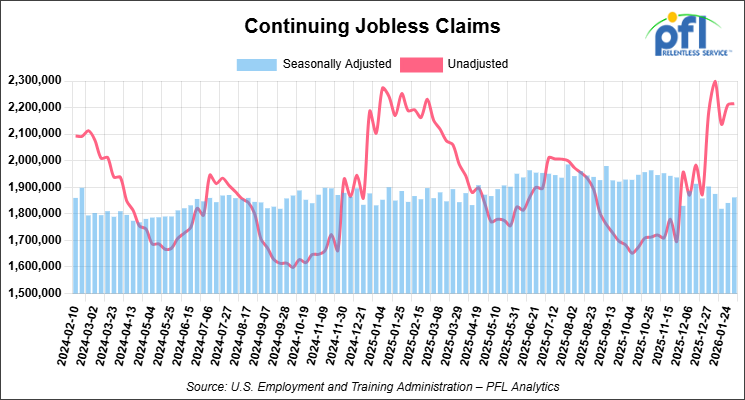

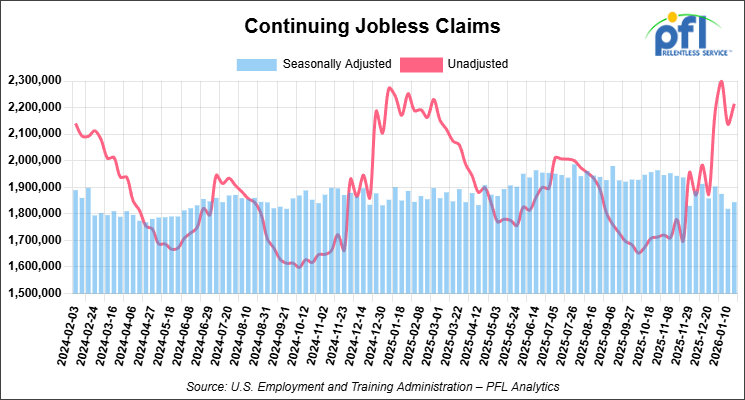

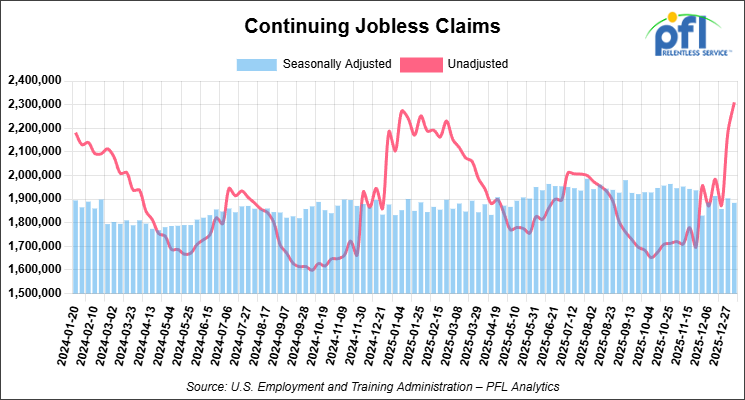

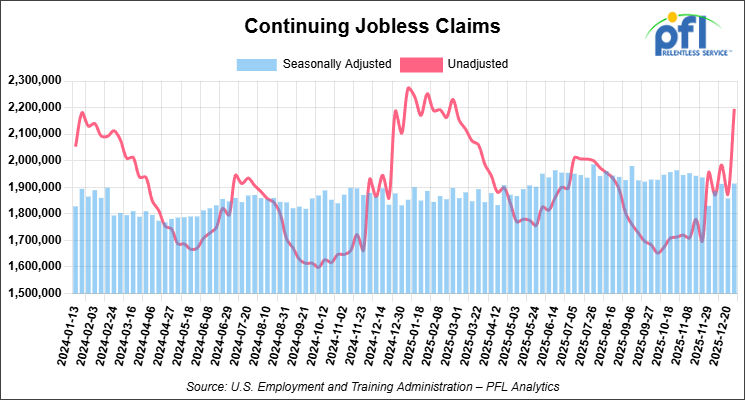

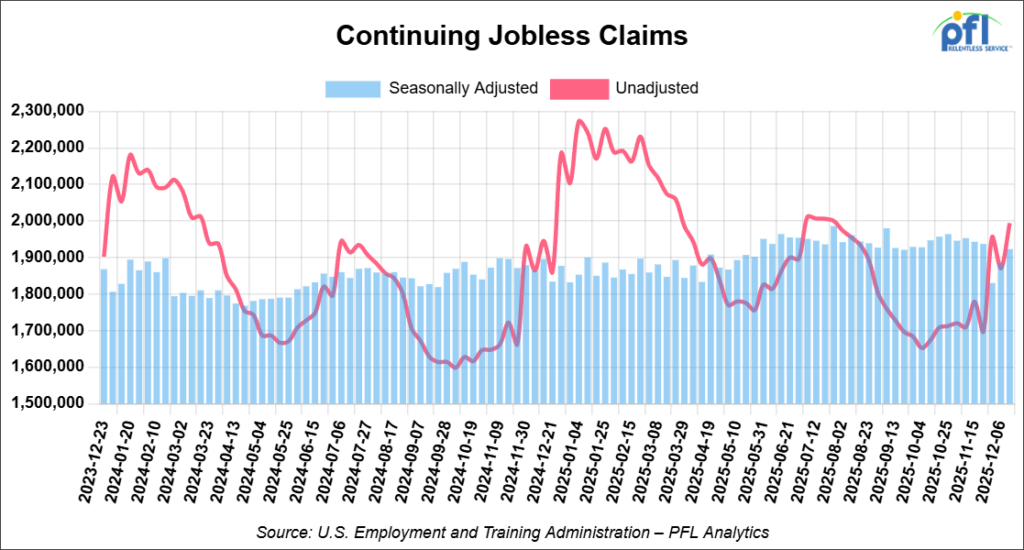

- Continuing jobless claims came in at 1,833,000, versus the adjusted number of 1,864,000 people from the week prior, down 31,000 week-over-week.

Stocks closed lower on Friday of last week and lower week-over-week

The DOW closed lower on Friday of last week, down -521.28 points (-1.05%), closing out the week at 48,997.92, down -628.05 points week-over-week. The S&P 500 closed lower on Friday of last week, down -29.98 points (-0.43%), and closed out the week at 6,878.88, down -30.63 points week-over-week. The NASDAQ closed lower on Friday of last week, down -210.17 points (-0.92%), and closed out the week at 22,668.21, down -217.86 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 48,487 this morning, down 503 points from Friday’s close.

Crude oil closed higher on Friday of last week and higher week-over-week

West Texas Intermediate (WTI) crude closed up $1.81 per barrel (2.78%), to close at $67.02 on Friday of last week, and up $0.63 week-over-week. Brent crude closed up $1.73 per barrel (2.45%), to close at $72.48, and up $0.72 week-over-week.

One Exchange WCS (Western Canadian Select) for April delivery settled on Friday of last week at US$13.95 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$53.07 per barrel.

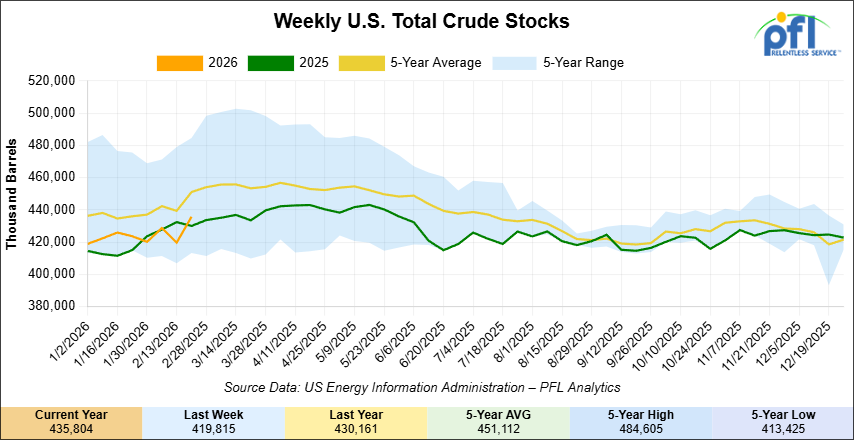

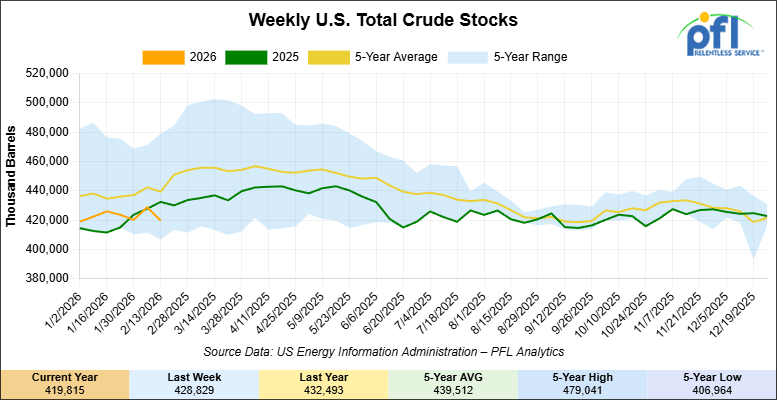

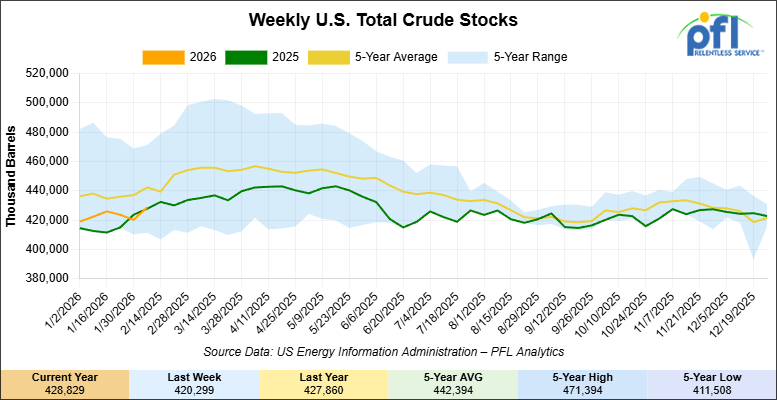

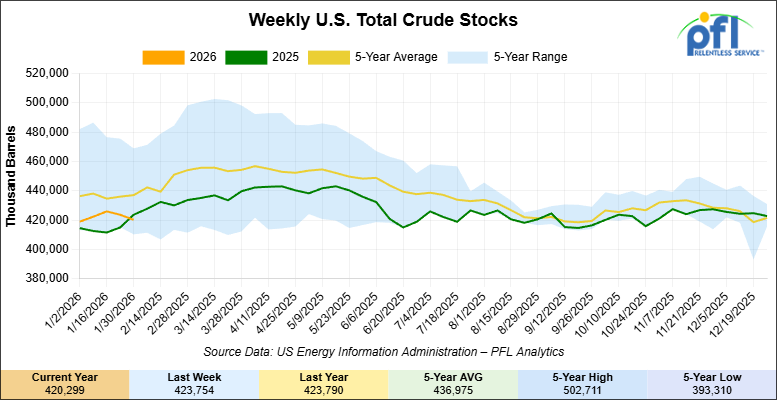

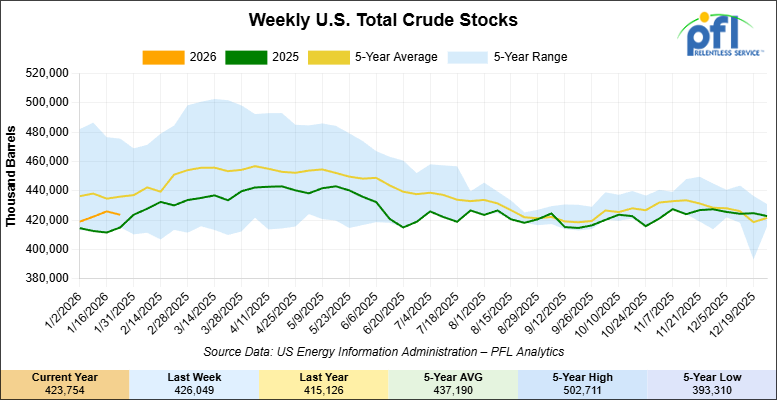

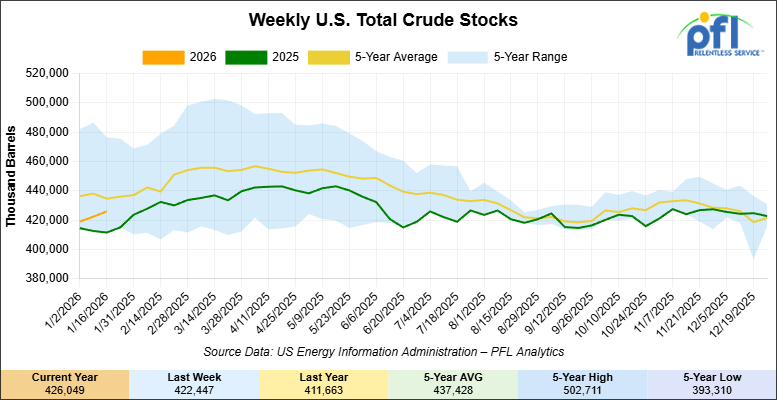

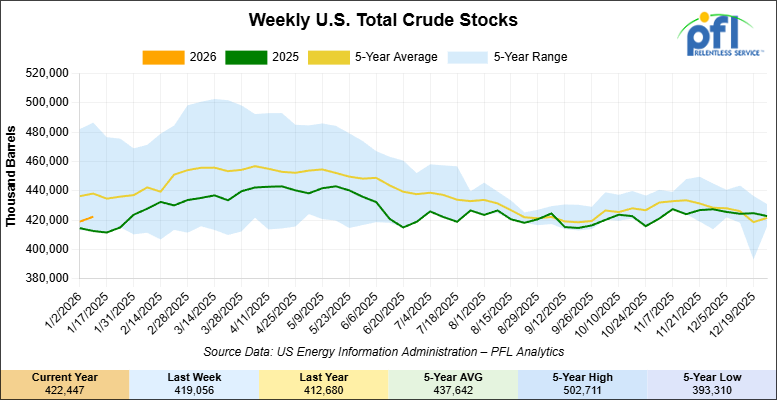

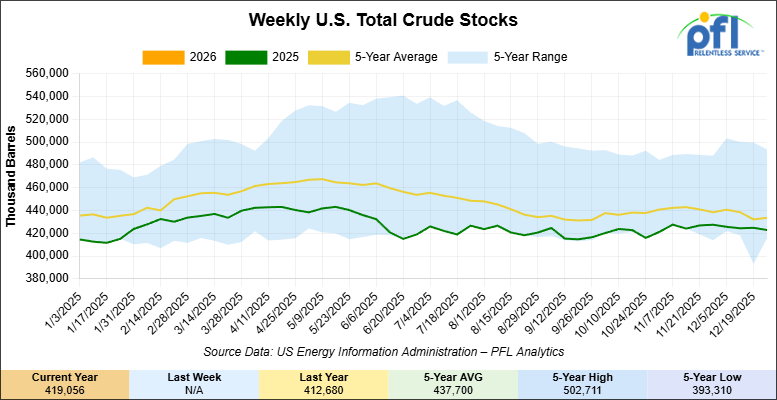

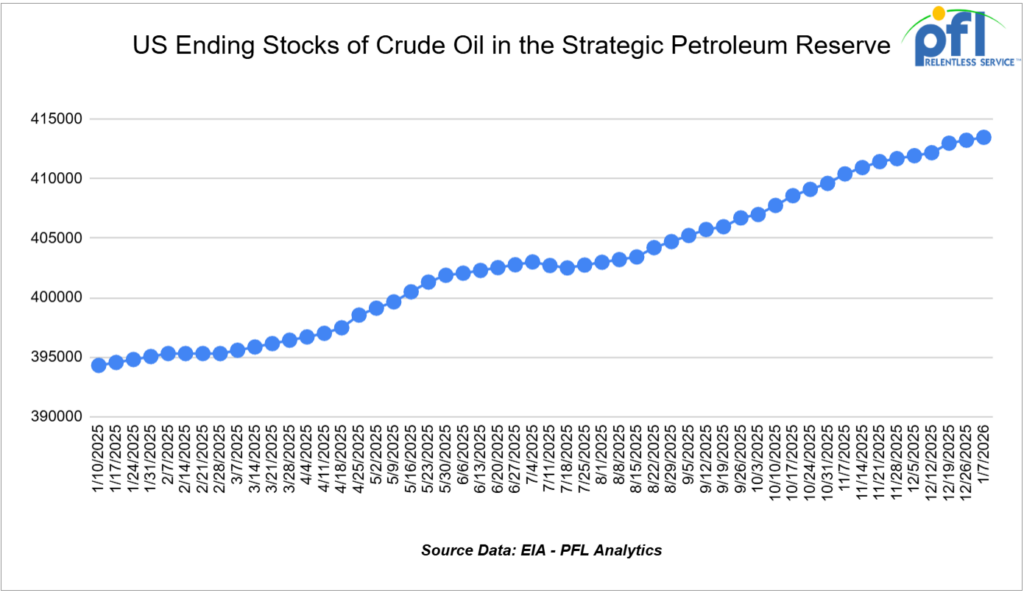

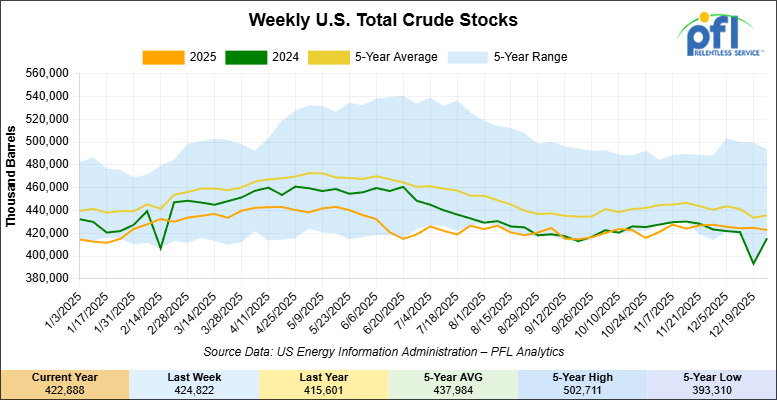

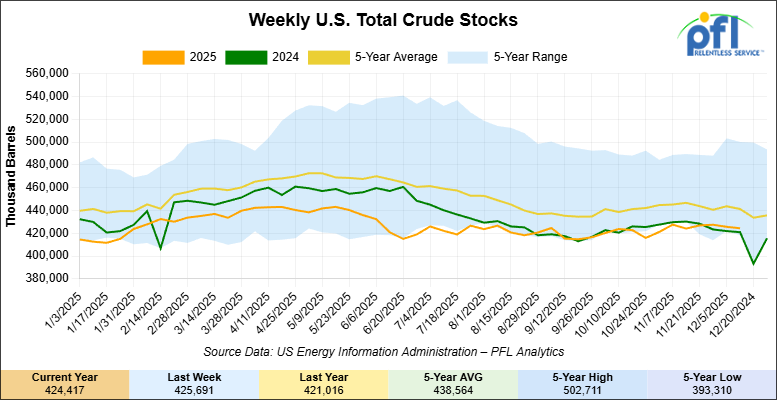

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 16 million barrels week-over-week. At 435.8 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

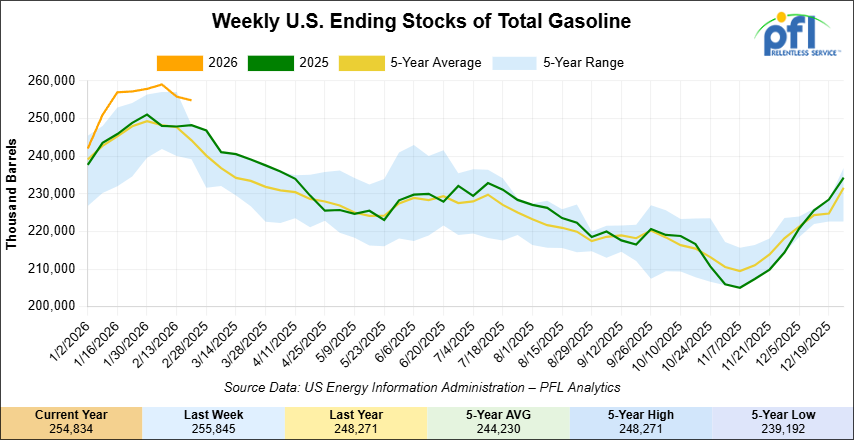

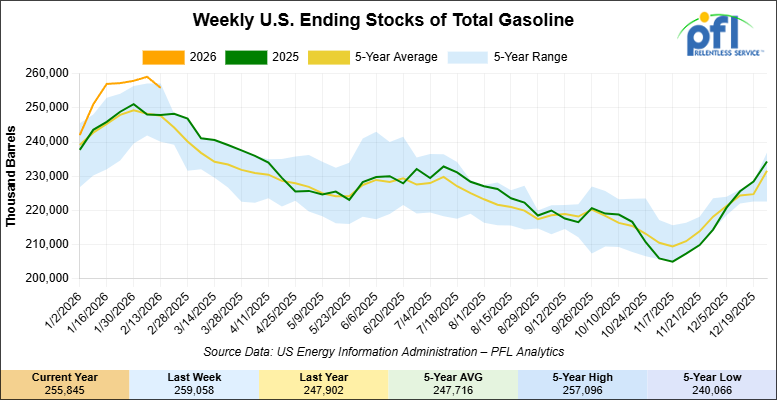

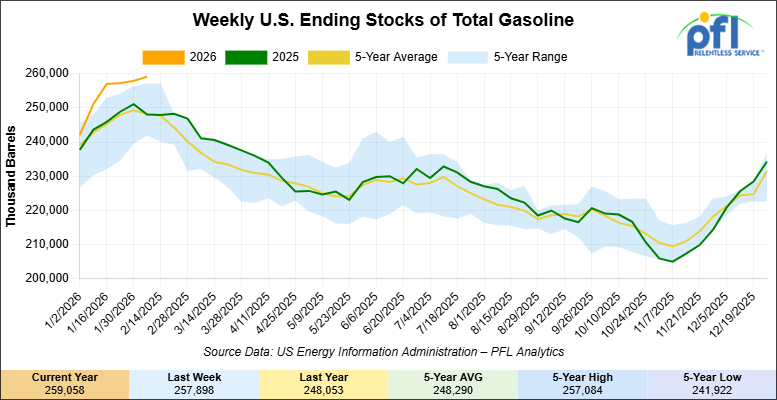

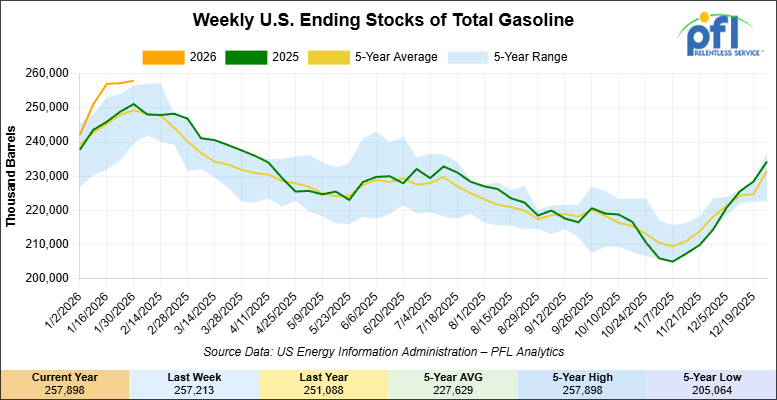

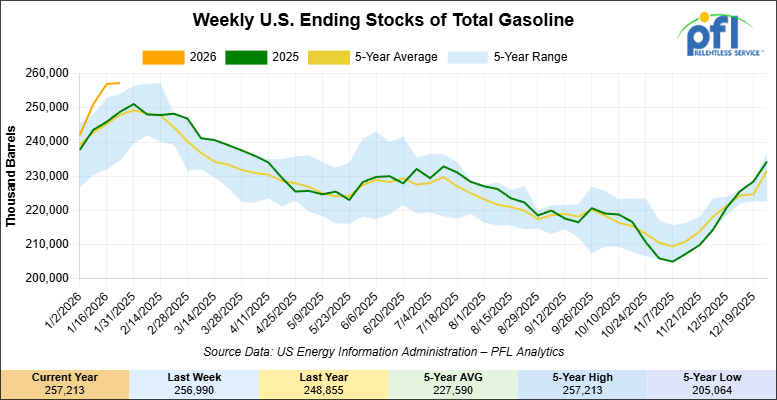

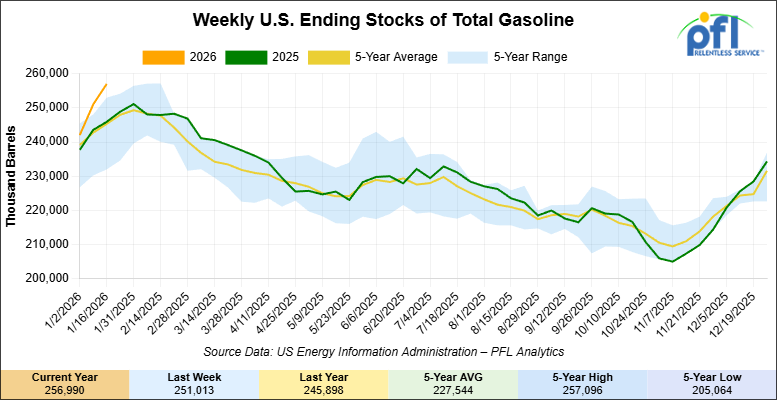

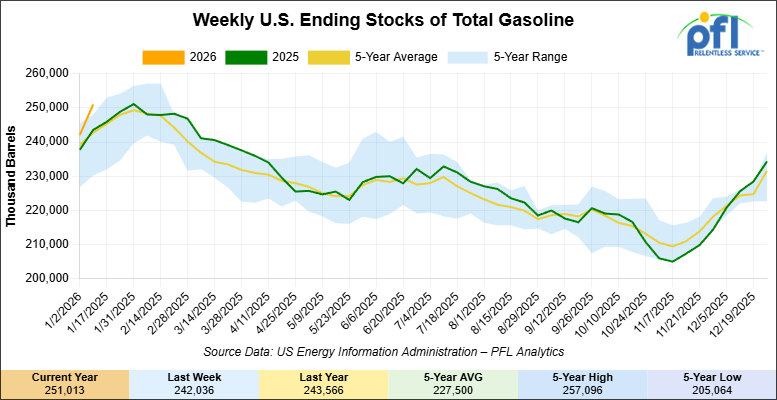

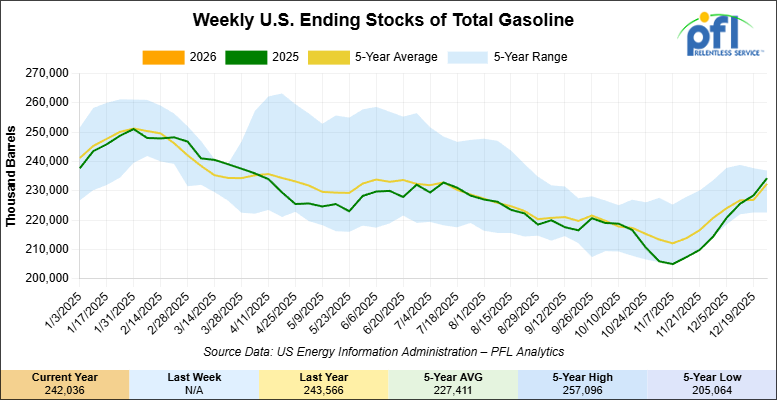

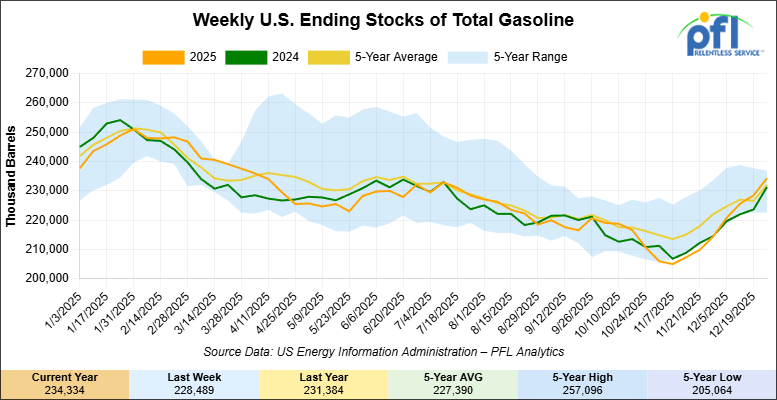

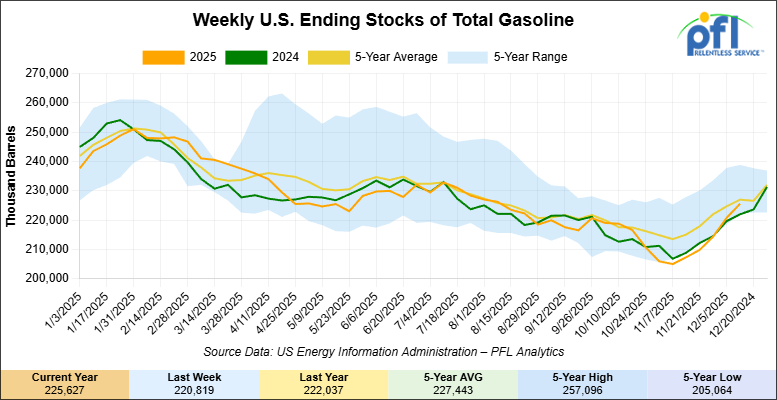

Total motor gasoline inventories decreased by 1 million barrels week-over-week and are 3% above the five-year average for this time of year.

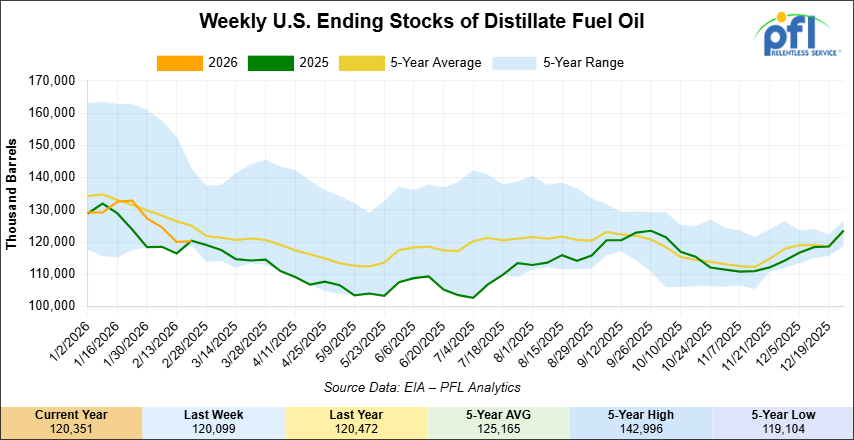

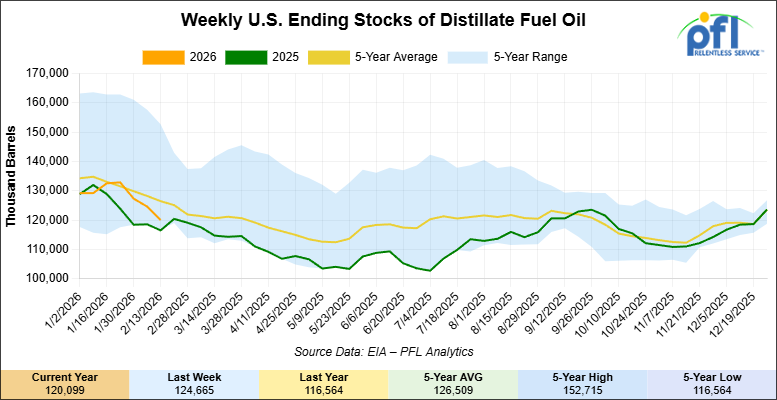

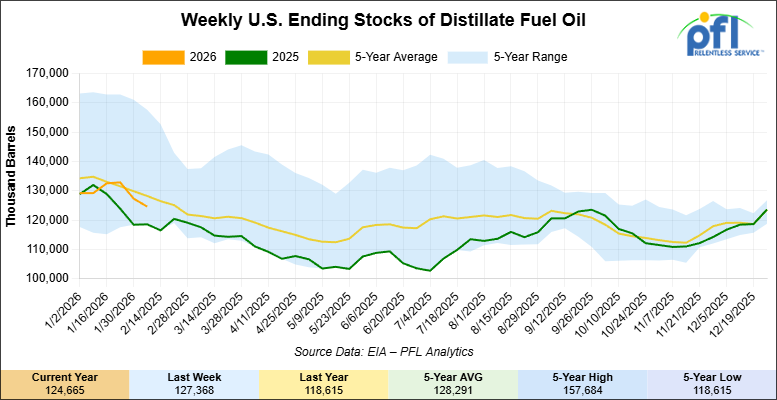

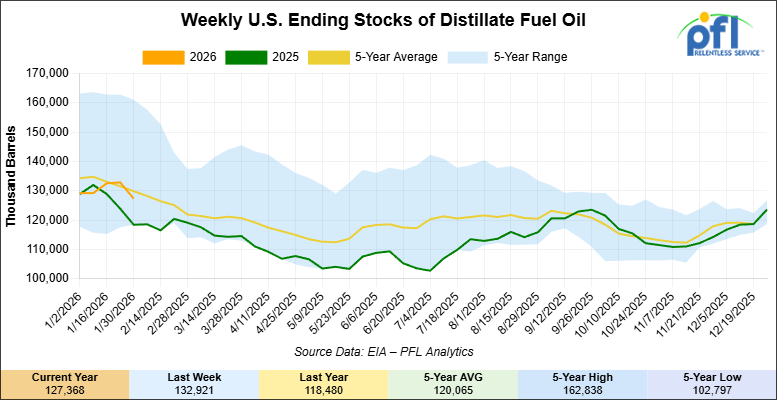

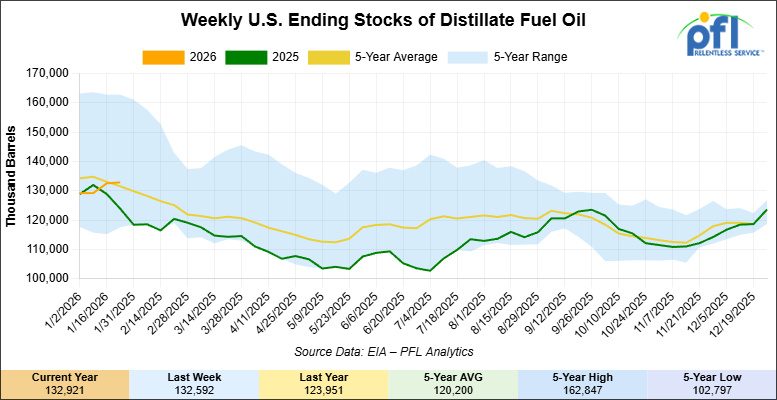

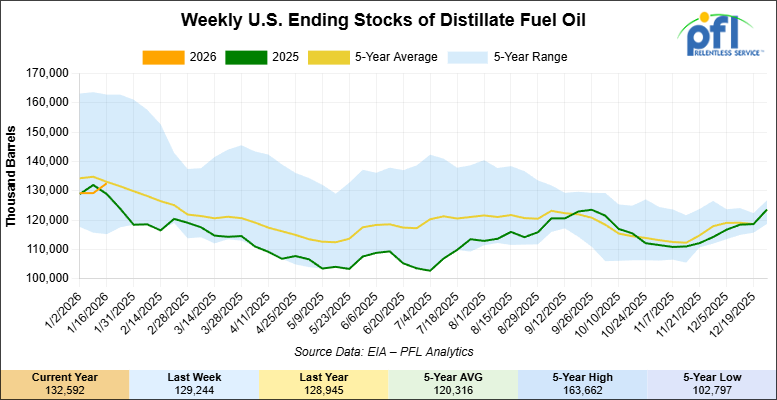

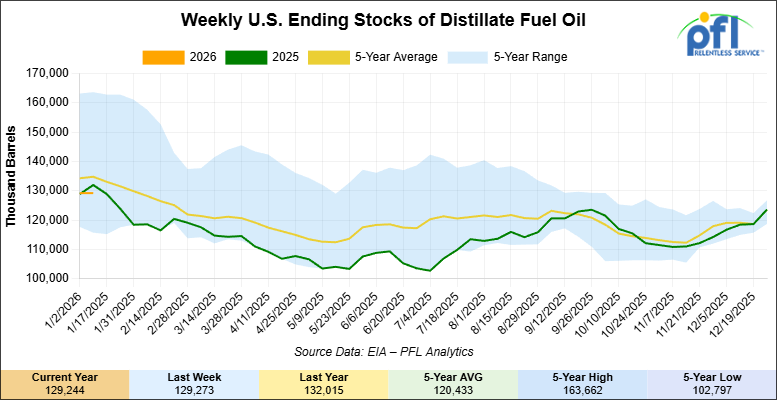

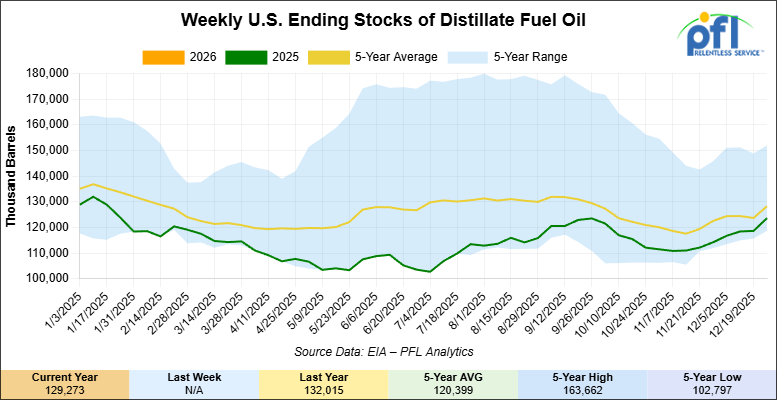

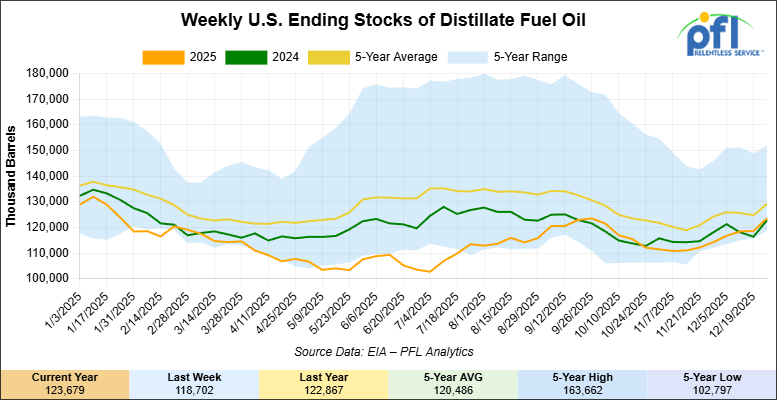

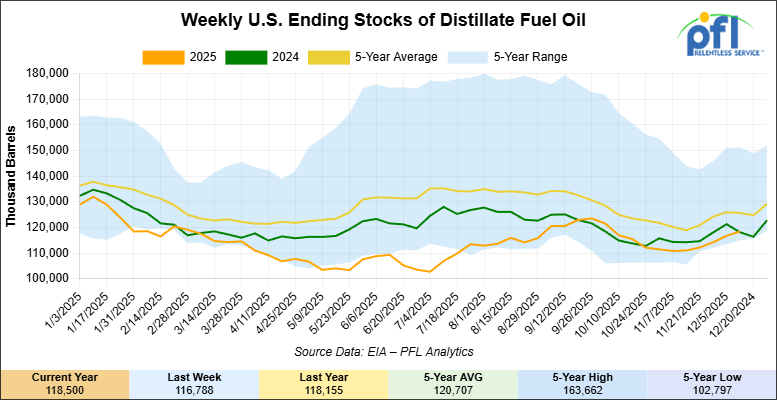

Distillate fuel inventories increased by 300,000 barrels week-over-week and are 5% below the five-year average for this time of year.

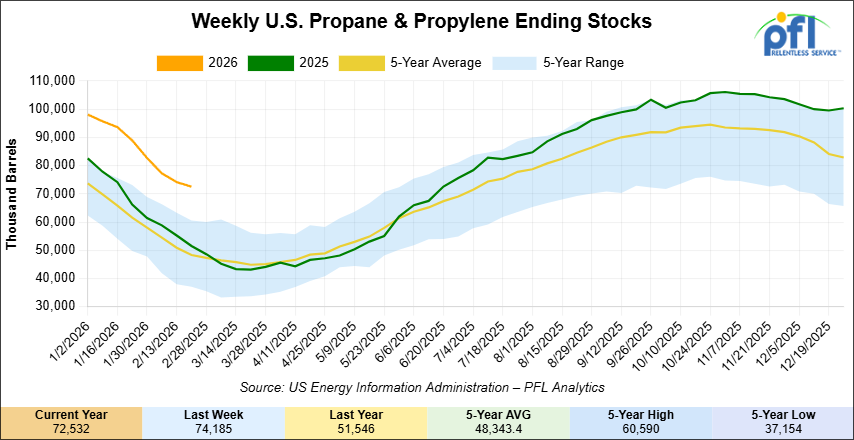

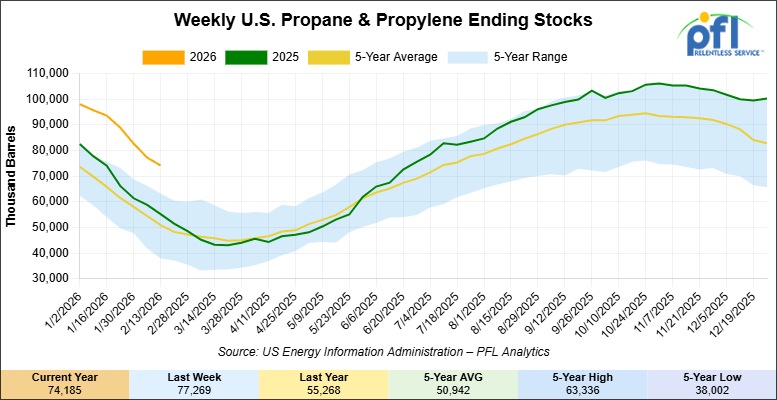

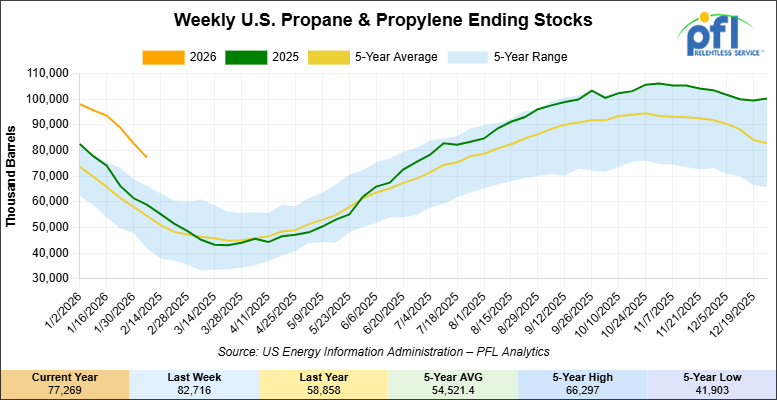

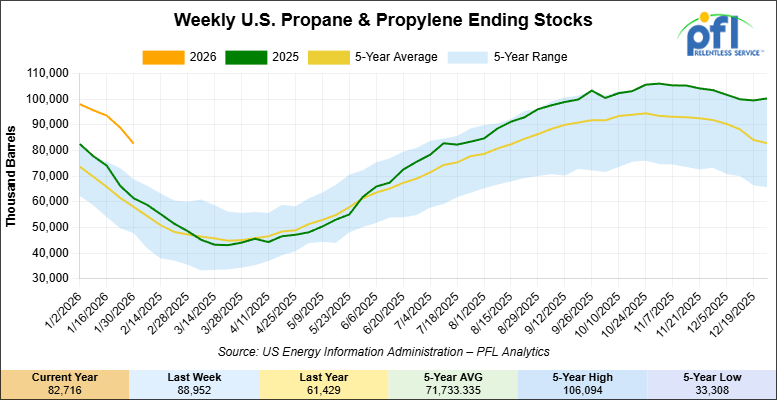

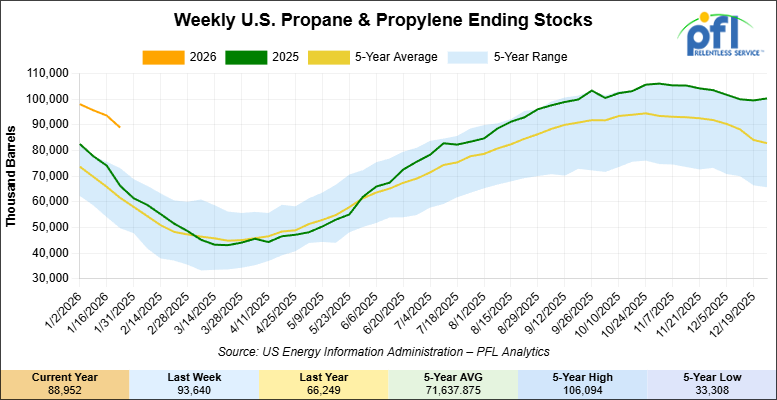

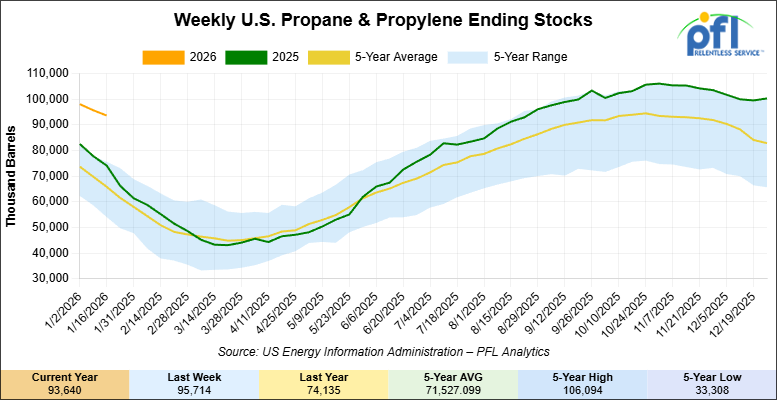

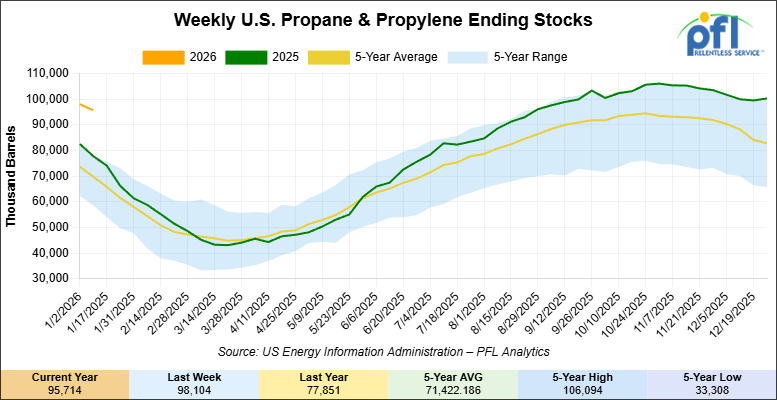

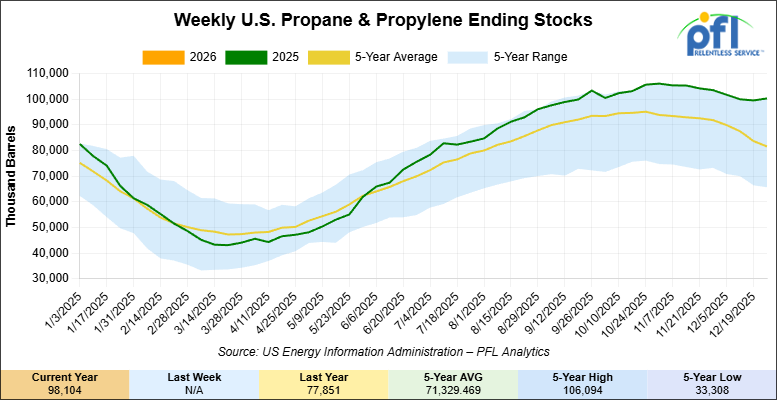

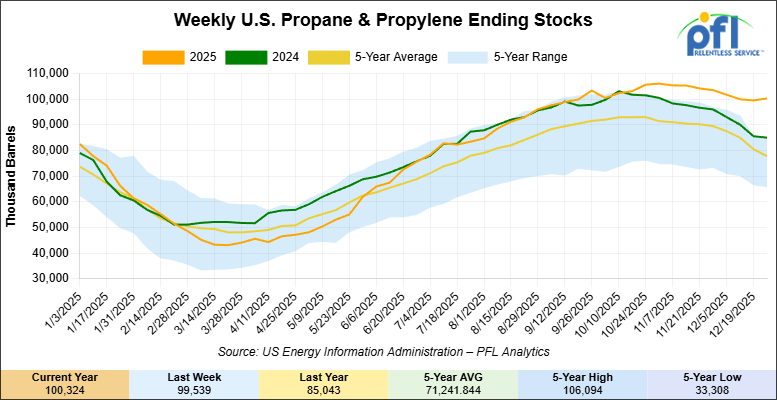

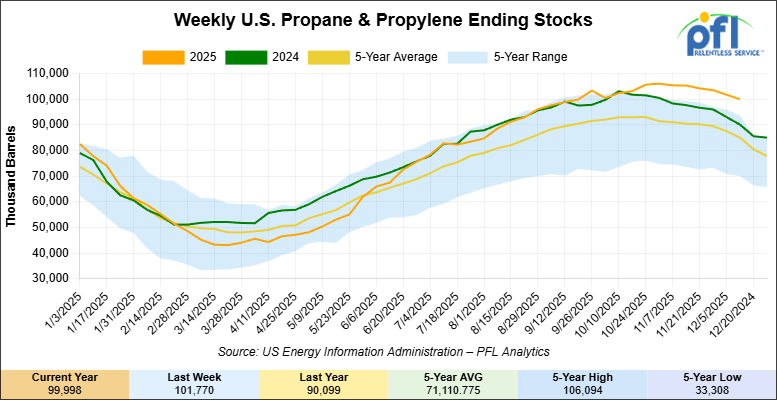

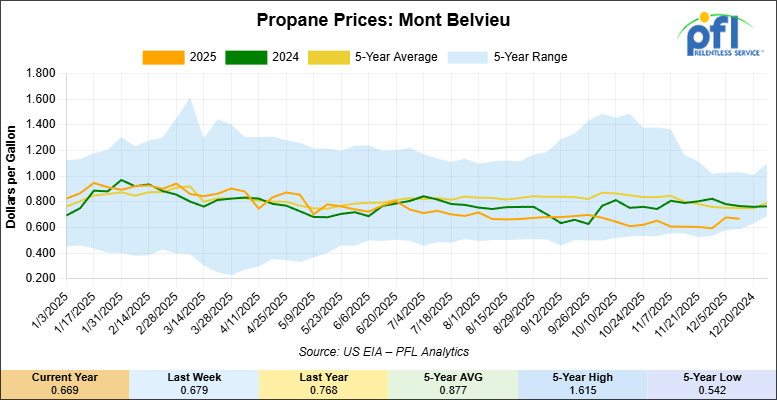

Propane/propylene inventories decreased by 1.7 million barrels week-over-week and are 46% above the five-year average for this time of year

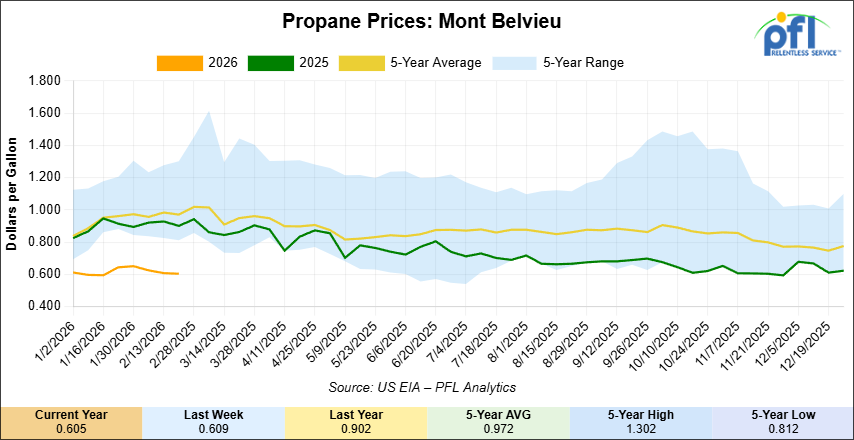

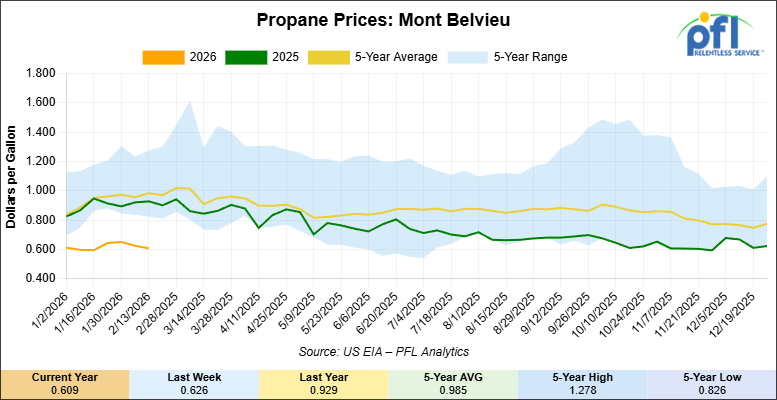

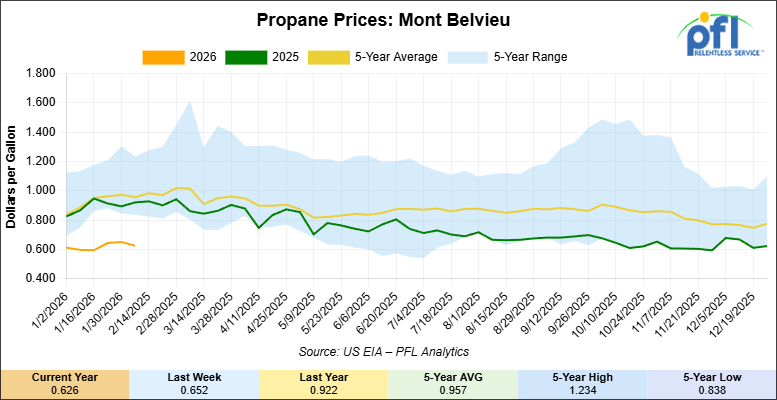

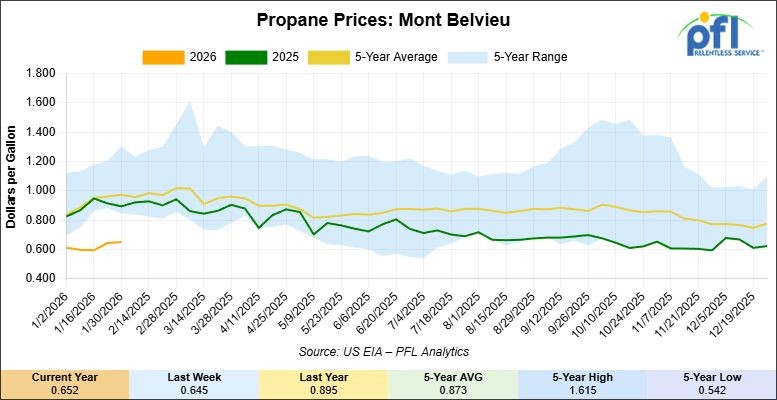

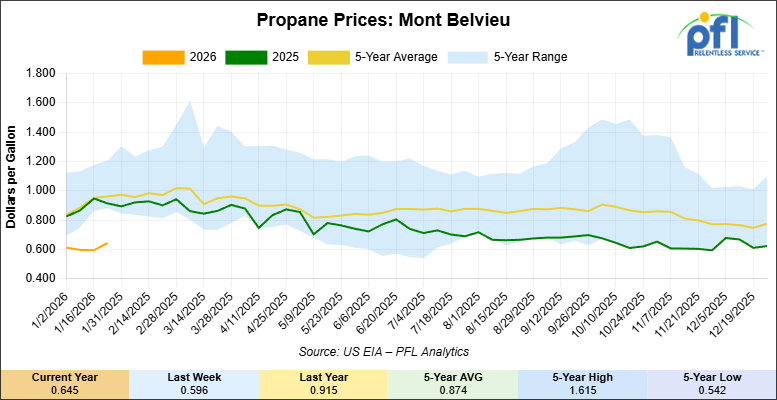

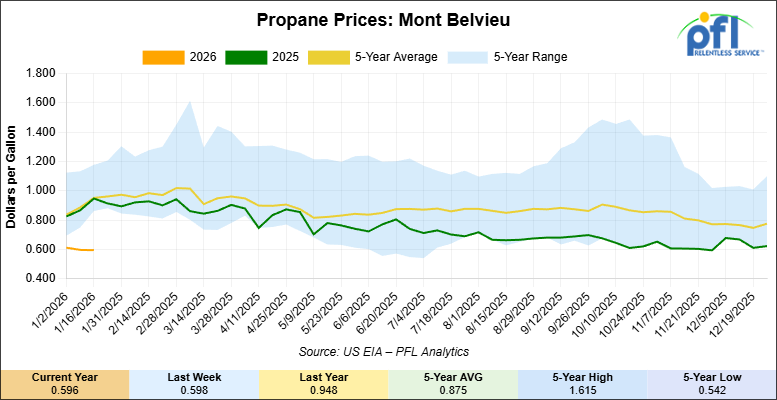

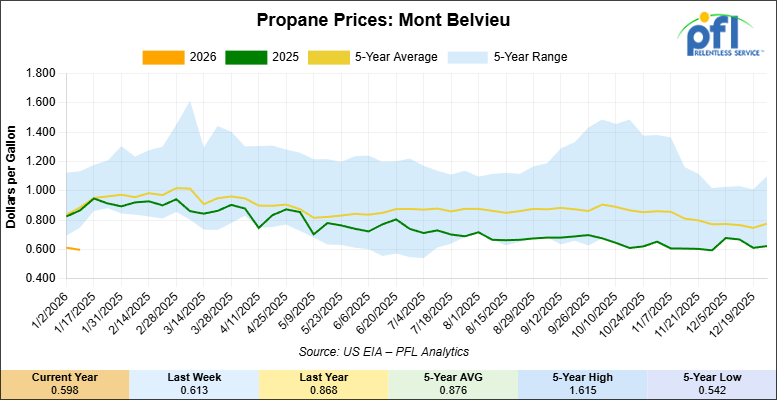

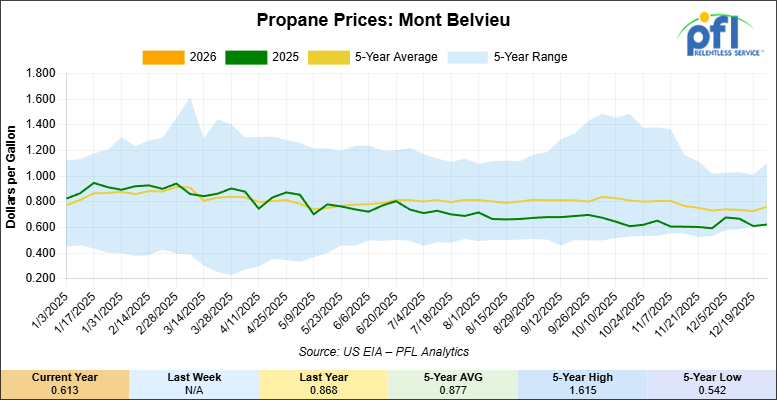

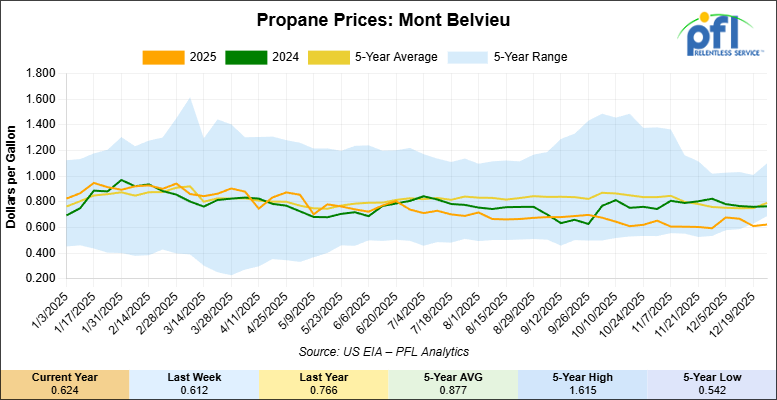

Propane prices closed at 60.5 cents per gallon on Friday of last week, down 0.4 cents per gallon week-over-week, and down 29.7 cents year-over-year.

Overall, total commercial petroleum inventories increased by 11.2 million barrels week-over-week, during the week ending February 20, 2026.

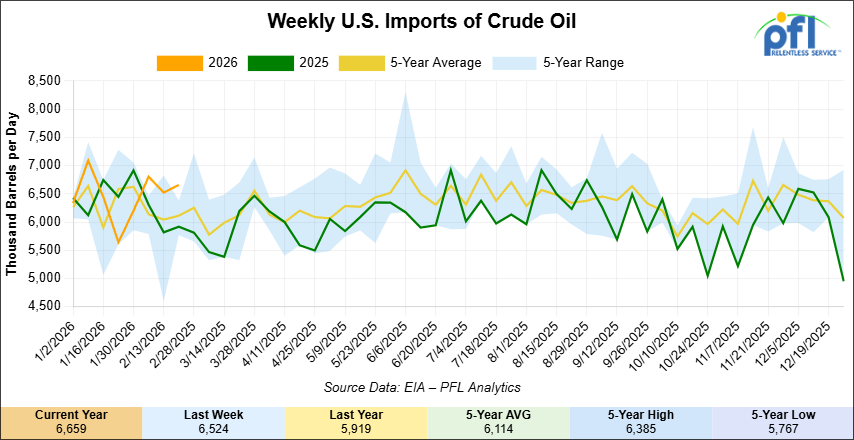

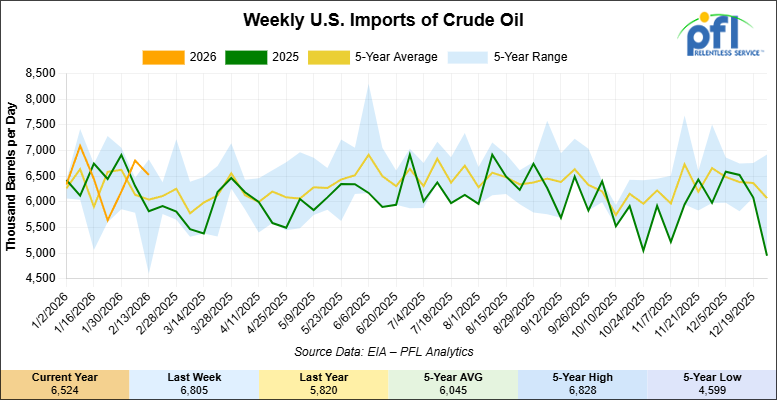

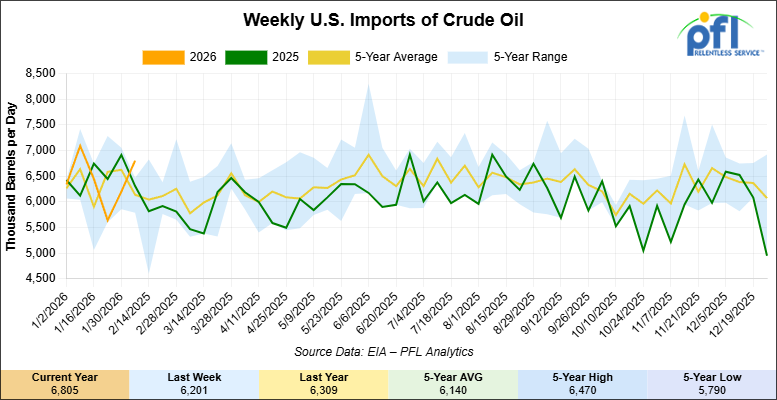

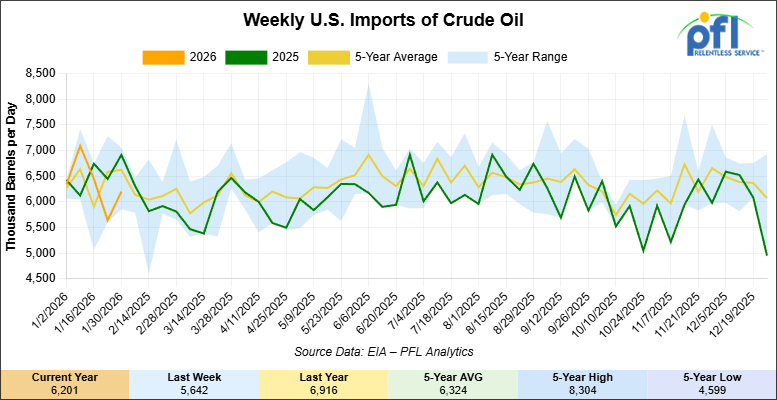

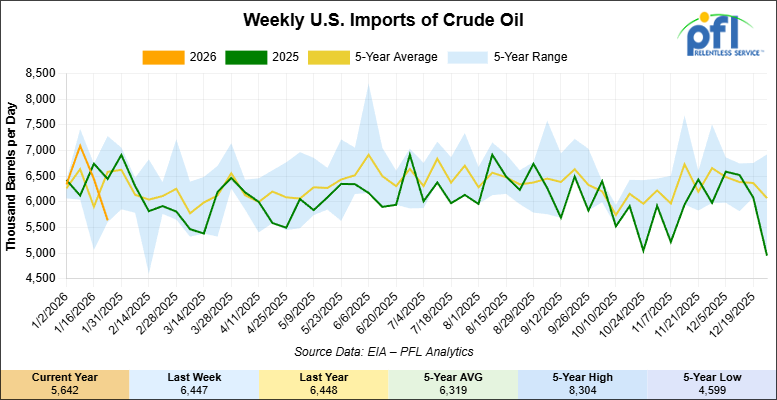

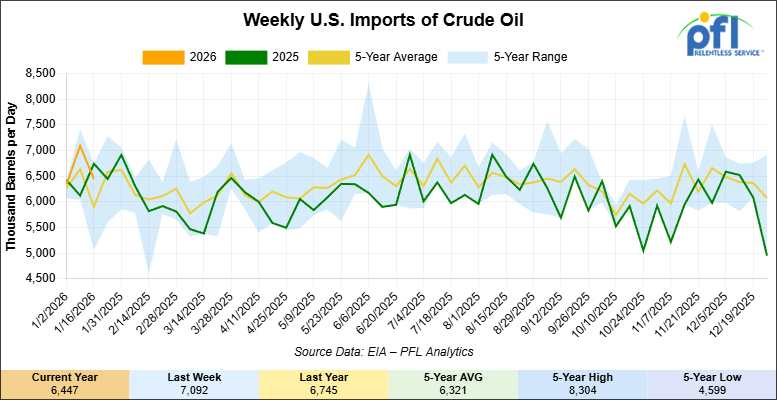

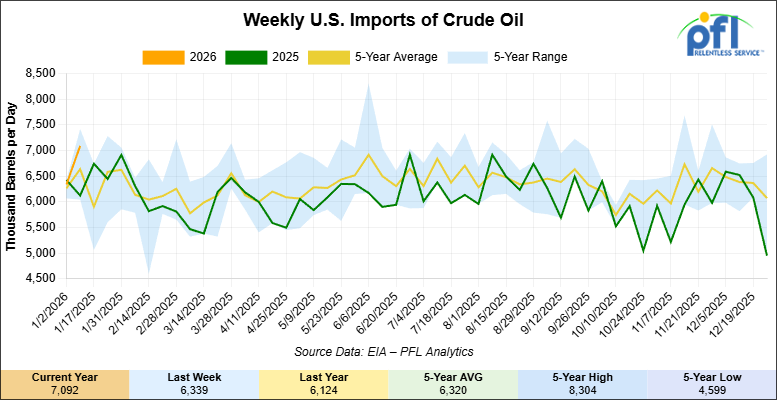

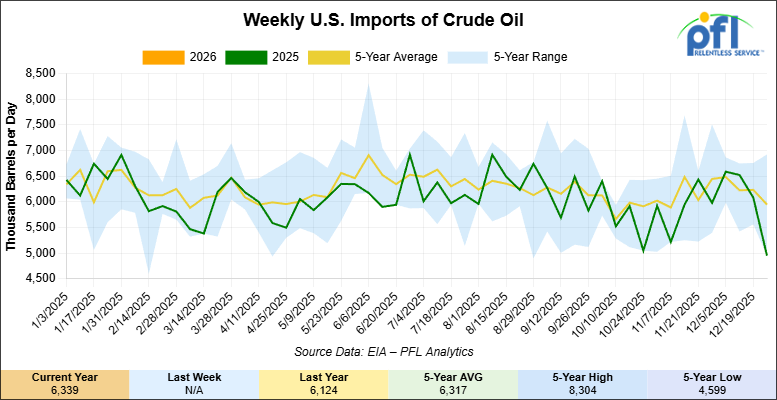

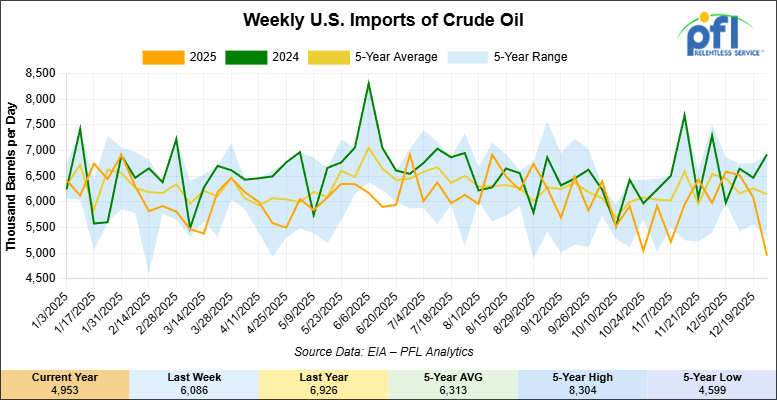

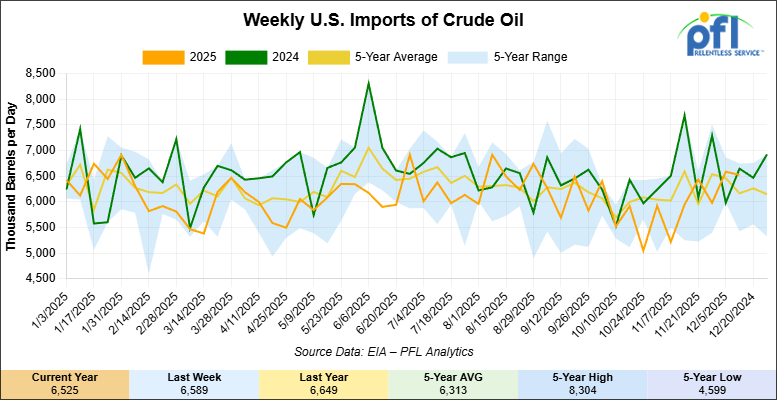

U.S. crude oil imports averaged 6.7 million barrels per day last week, an increase of 136,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 4.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 563,000 barrels per day, and distillate fuel imports averaged 411,000 barrels per day during the week ending February 13, 2026.

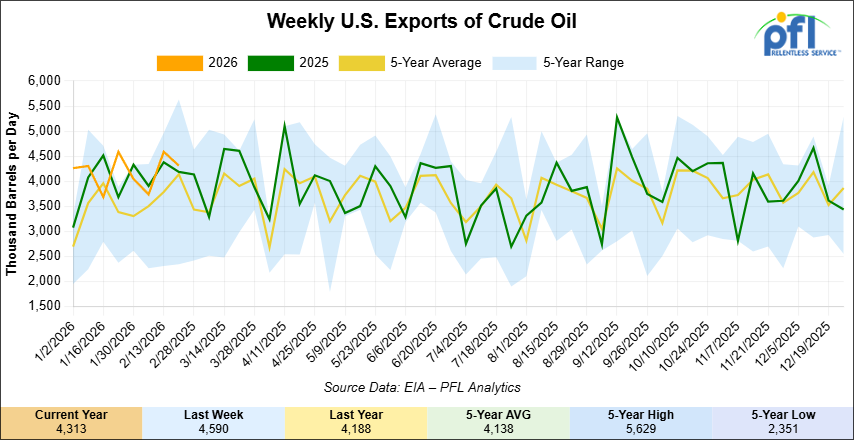

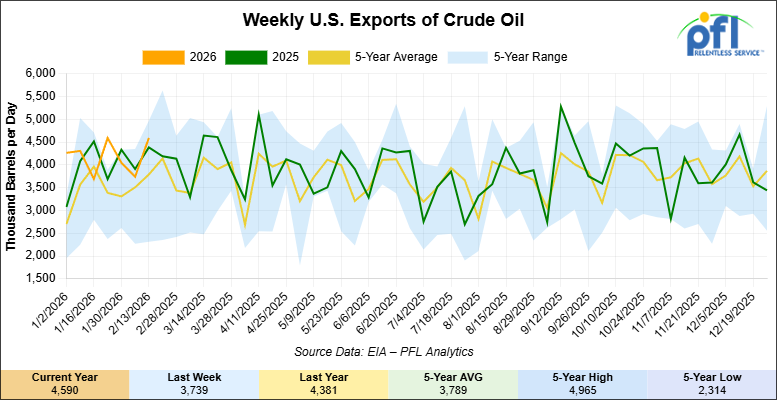

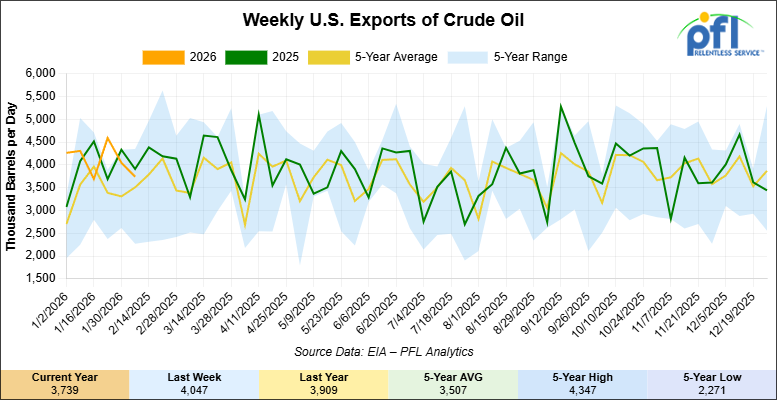

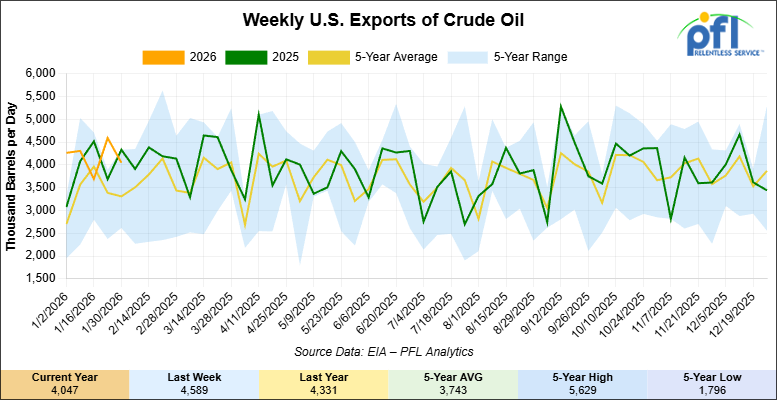

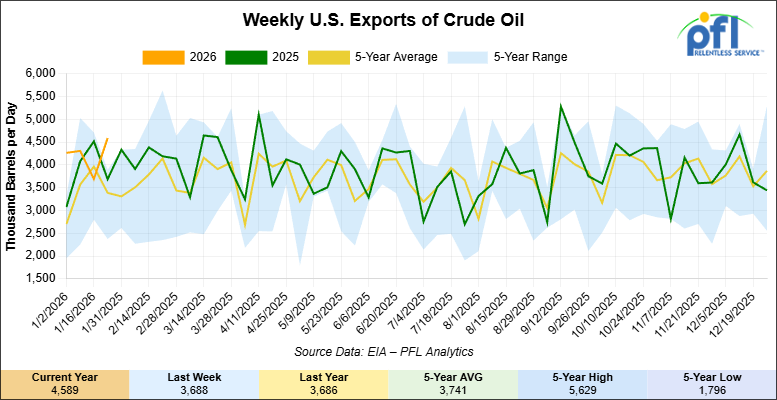

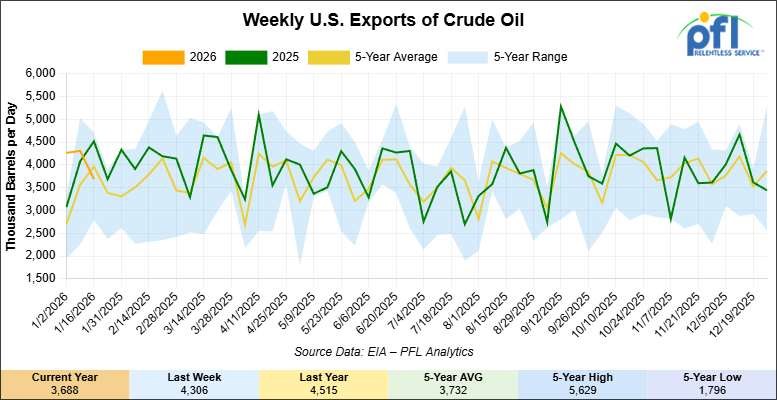

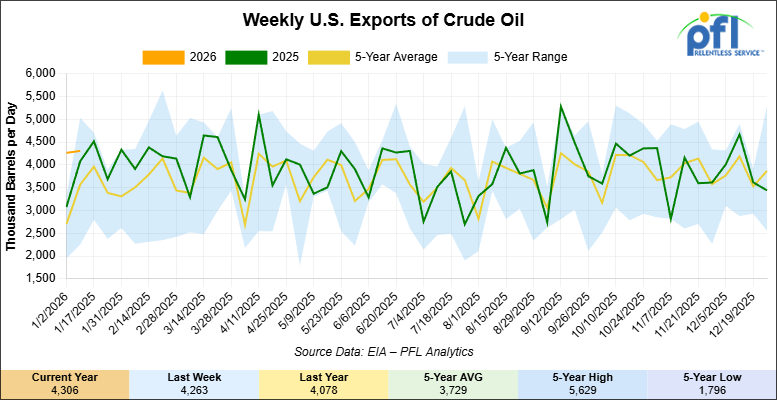

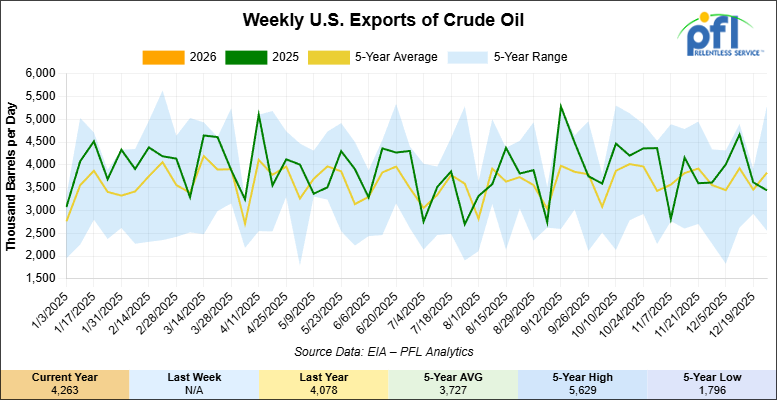

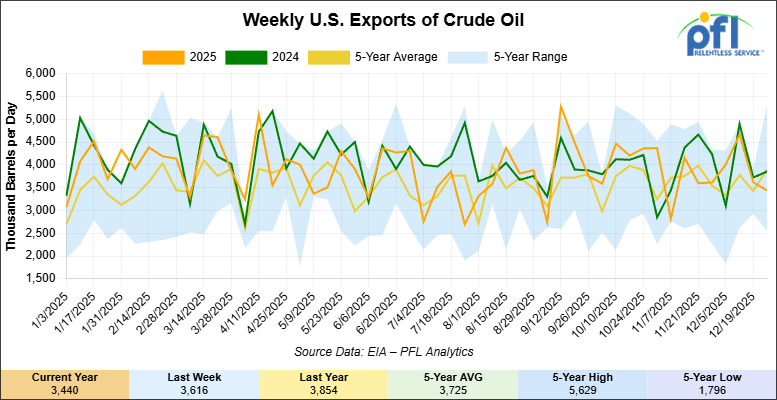

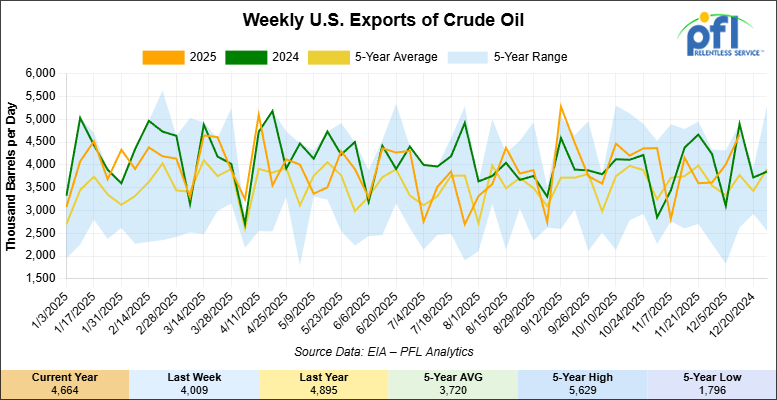

U.S. crude oil exports averaged 4.313 million barrels per day during the week ending February 20, 2026, a decrease of 277,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.172 million barrels per day.

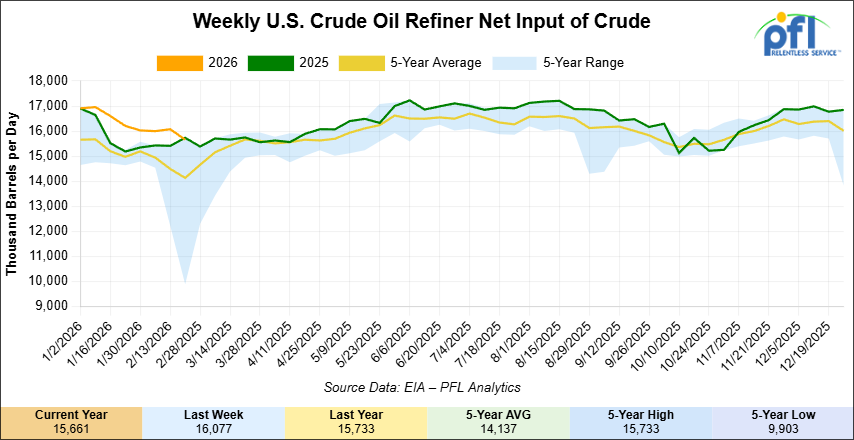

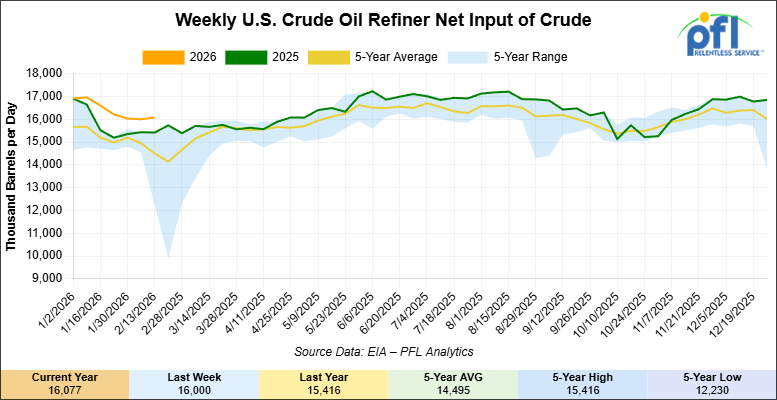

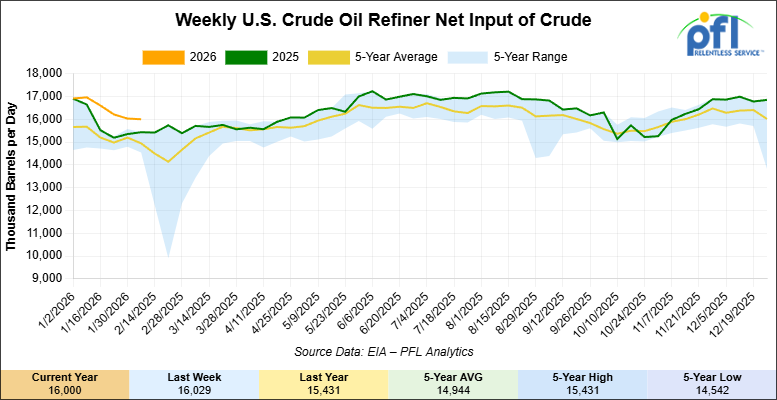

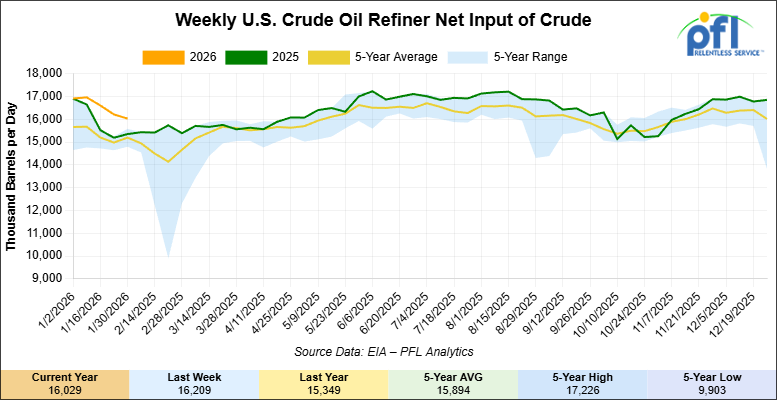

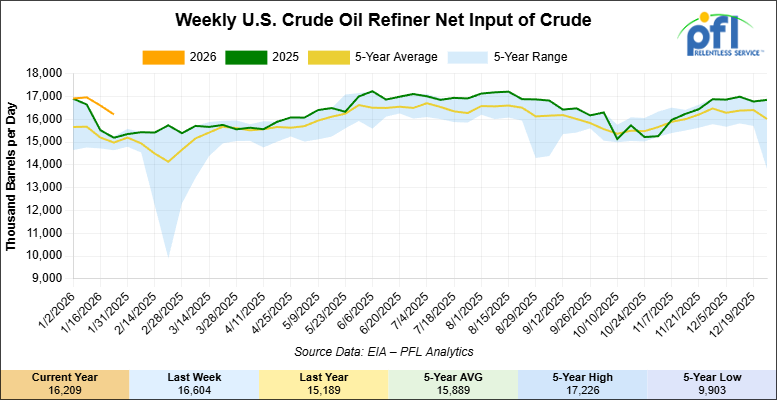

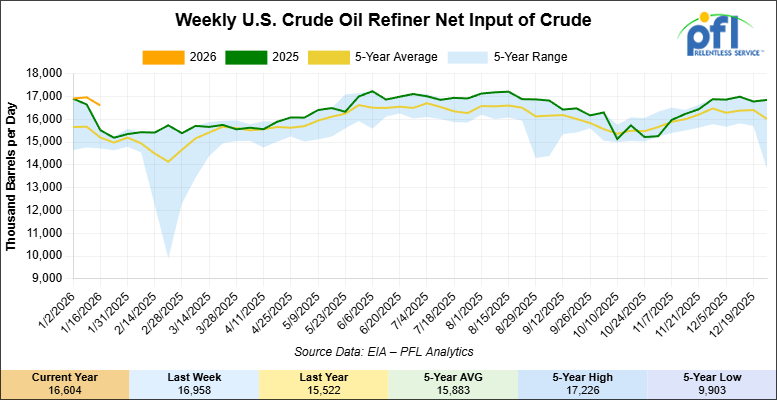

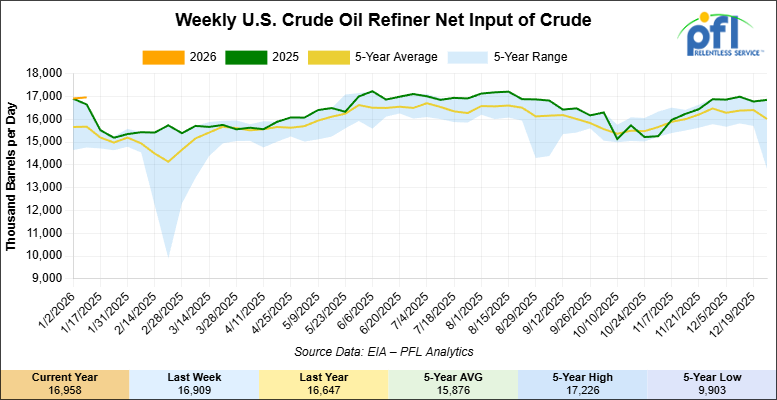

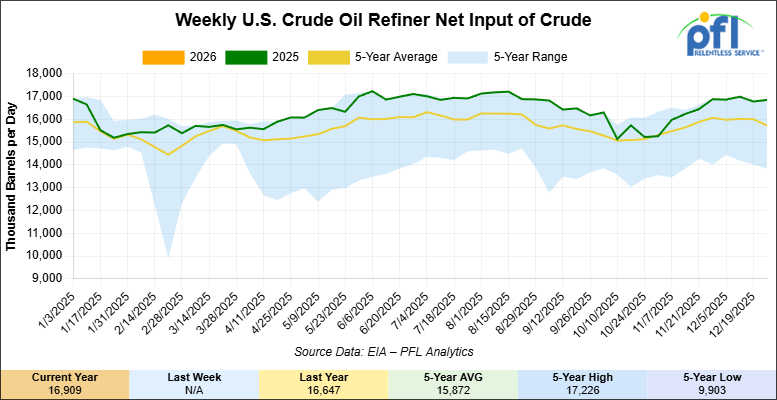

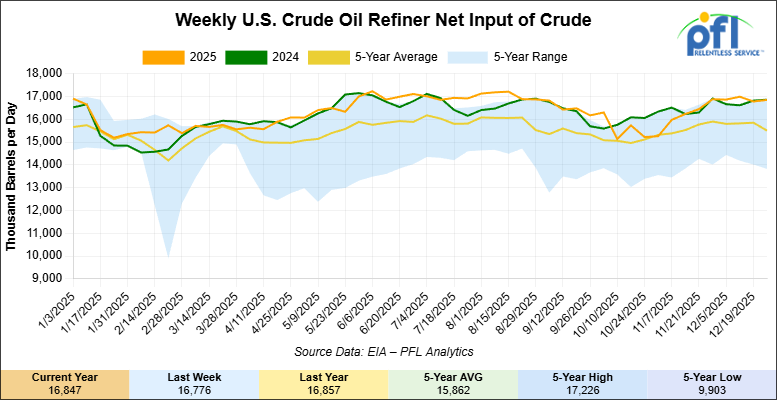

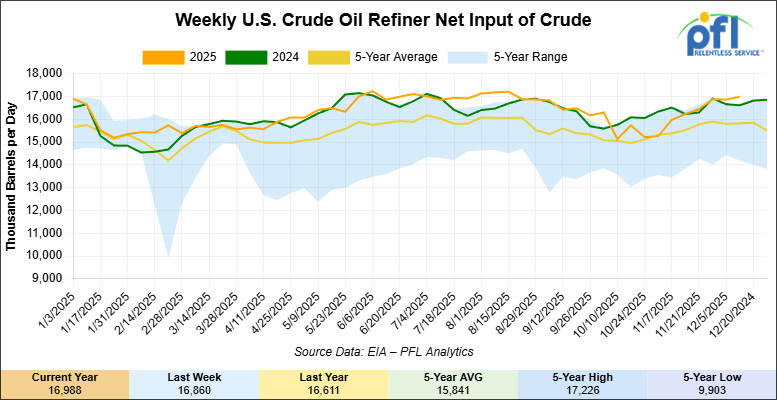

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending February 20, 2026, which was 416,000 barrels per day less week-over-week.

WTI is poised to open at $71.88, up $4.86 per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 25, 2025:

Total North American weekly rail volumes were up (+7.88%) in week 9, compared with the same week last year. Total Carloads for the week ending February 25, 2025 were 329,929, up (+13.32%) compared with the same week in 2025, while weekly Intermodal volume was 339,155, up (+3.07%) year over year. 10 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest decrease came from Forest Products (-15.82%). The largest increase was Grain (+43.90%).

In the East, CSX’s total volumes were up (+11.86%), with the largest decrease coming from Forest Products (-5.80%), while the largest increase came from Grain (+44.65%). NS’s total volumes were up (+6.28%), with the largest increase coming from Coal (+44.67%), while the largest decrease came from Other (-4.88%).

In the West, BNSF’s total volumes were up (+12.76%), with the largest increase coming from Grain (+76.15%), while the largest decrease came from Chemicals (-3.01%). UP’s total volumes were up (+5.48%), with the largest increase coming from Grain (+43.54%), while the largest decrease came from Intermodal Units (-3.18%).

In Canada, CN’s total volumes were up (+18.18%), with the largest increase coming from Grain (+80.56%), while the largest decrease came from Forest Products (-6.11%). CPKCS’s total volumes were down (-20.51%), with the largest increase coming from Nonmetallic Minerals (+36.19%), while the largest decrease came from Forest Products (-68.06%).

Source Data: AAR – PFL Analytics

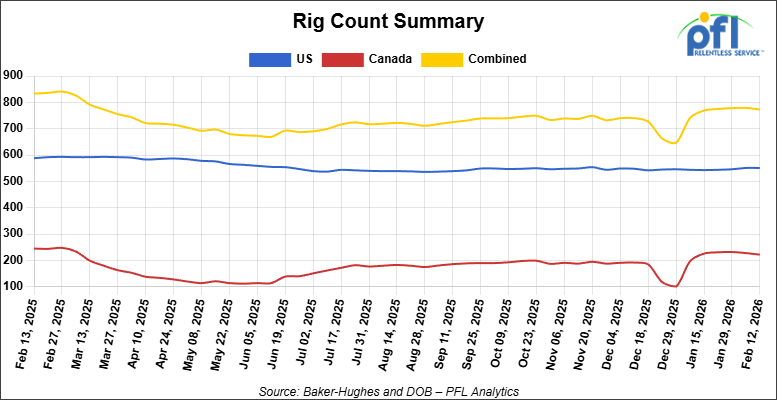

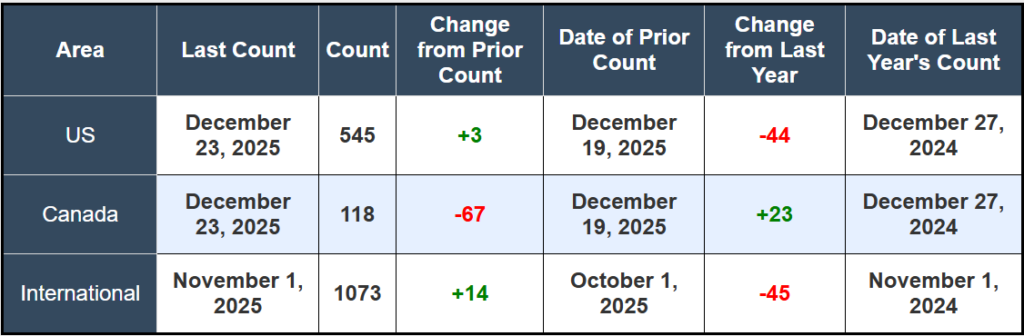

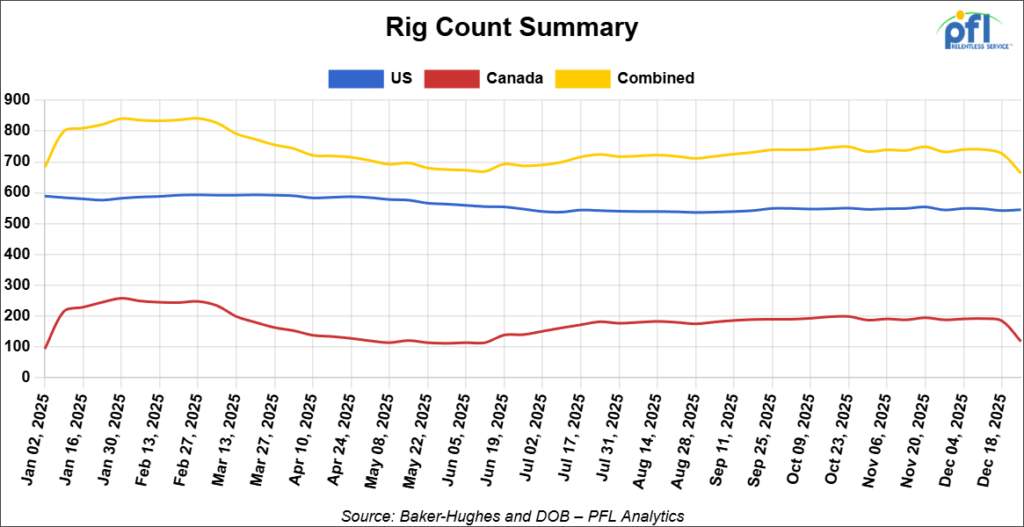

North American Rig Count Summary

Rig Count

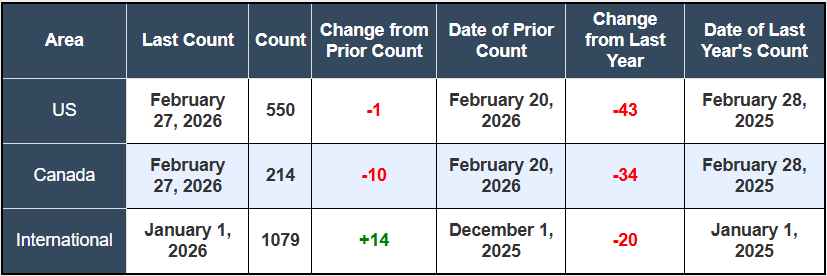

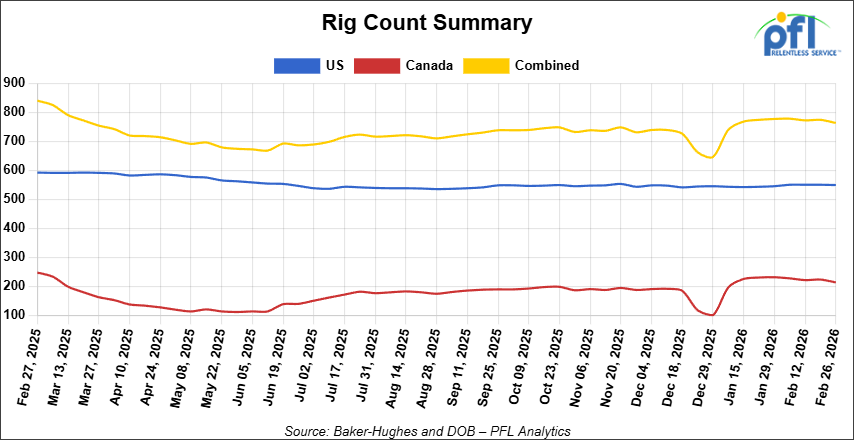

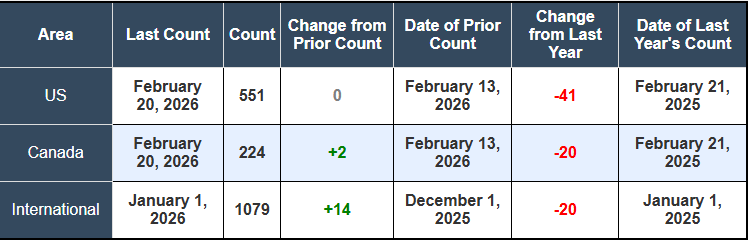

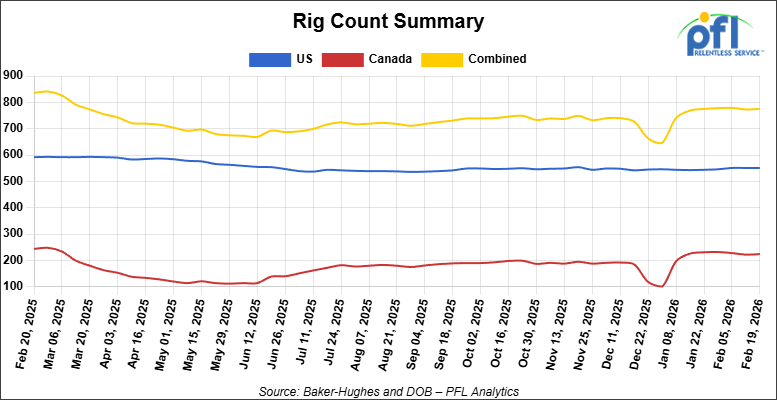

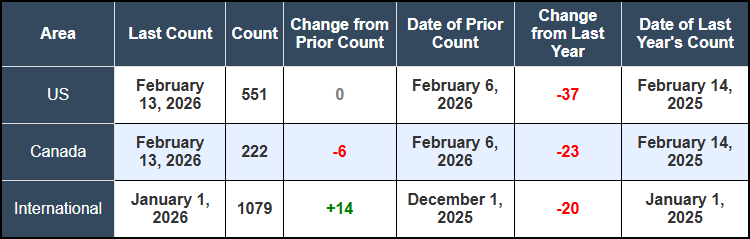

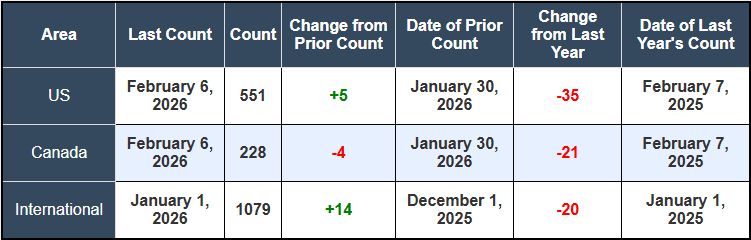

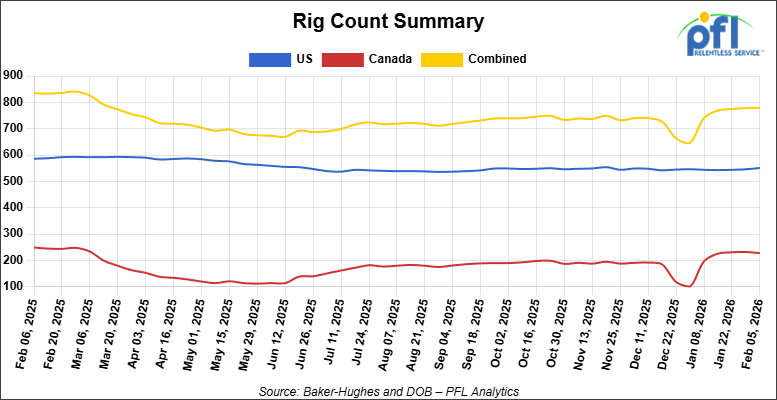

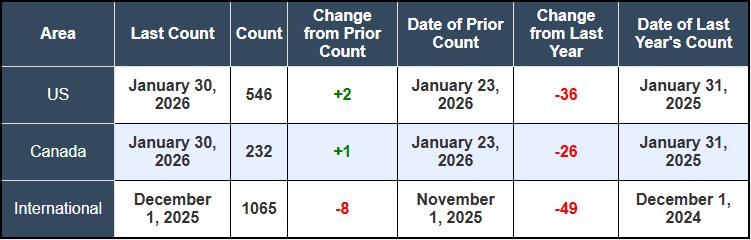

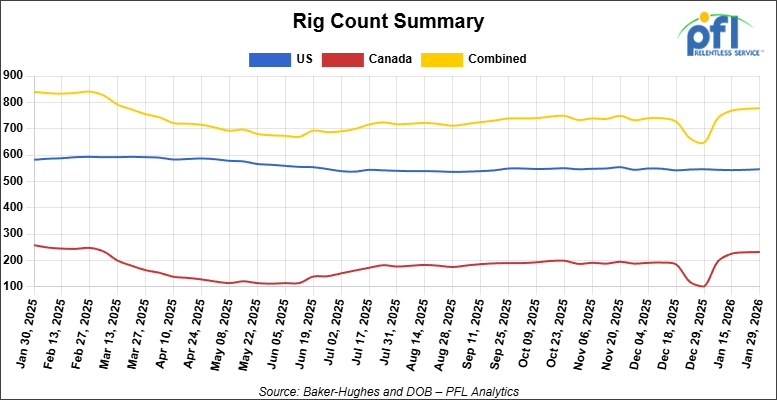

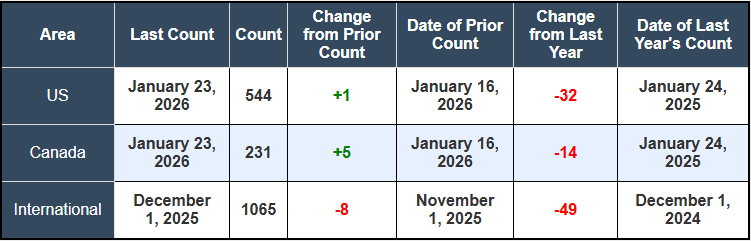

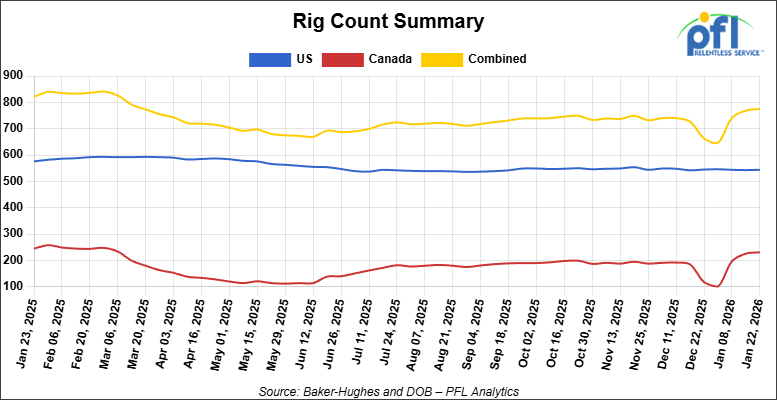

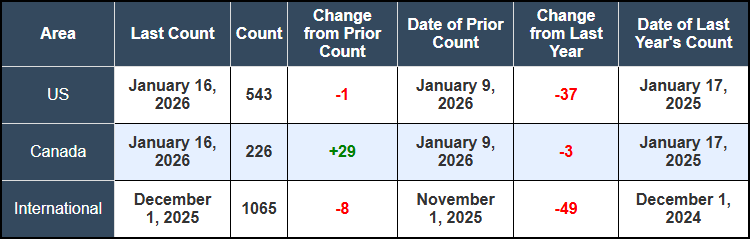

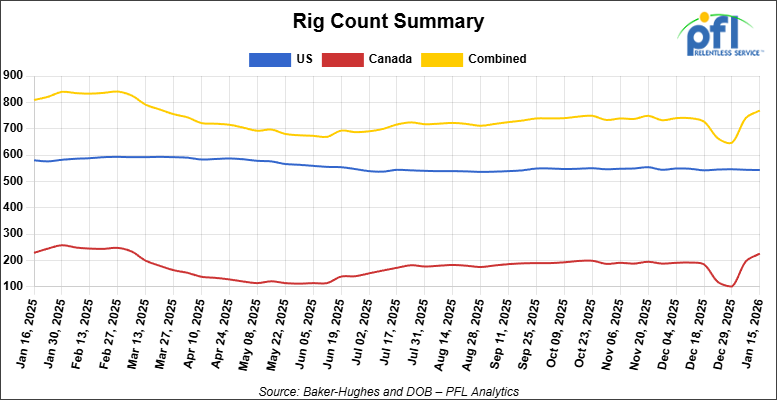

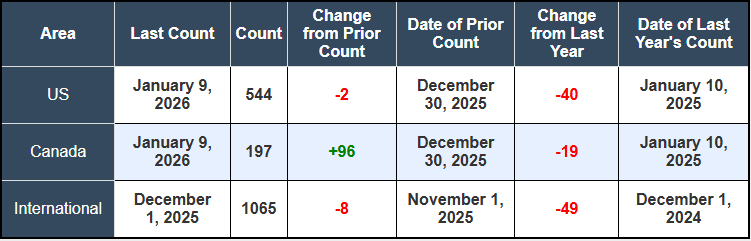

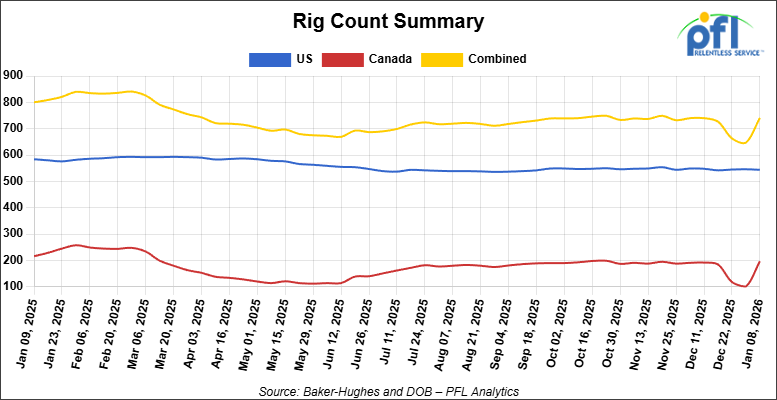

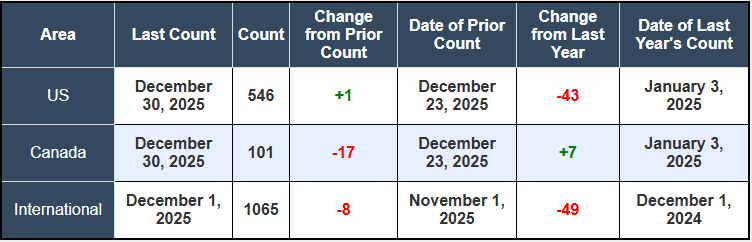

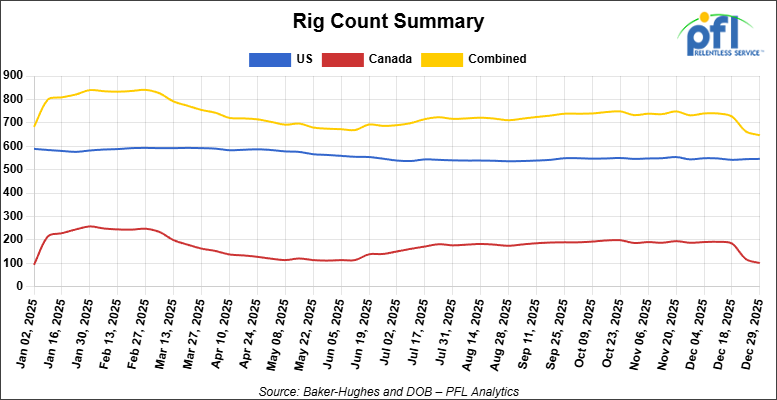

North American rig count was down by -11 rigs week-over-week. The U.S. rig count was down by -1 rig week-over-week, and down by -43 rigs year-over-year. The U.S. currently has 550 active rigs. Canada’s rig count was down by -10 rigs week-over-week and down by -34 rigs year-over-year. Canada currently has 214 active rigs. Overall, year-over-year we are down by -77 rigs collectively.

We are watching a few things out there for you:

We are Watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,874 from 29,673 which was an increase of +201 rail cars week-over-week. Canadian volumes fell. CN’s shipments were lower by -2.0% week-over-week, CPKC’s volumes were lower by -11.0% week-over-week. U.S. shipments were mixed. The UP had the largest percentage increase and was up by +4.0%. The BN had the largest percentage decrease and was down by -5.0%.

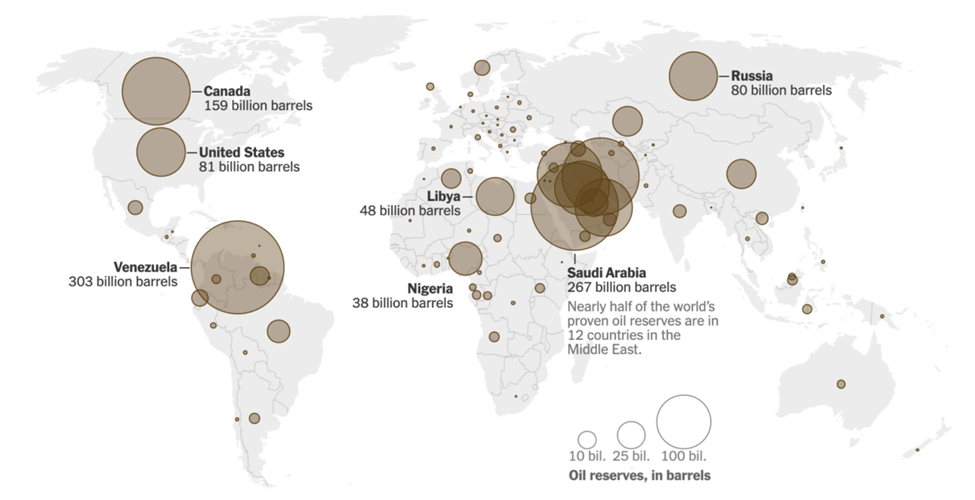

We are Watching the Middle East

Early Saturday morning, the United States and Israel launched what President Trump called “major combat operations” against Iran, under the name Operation Epic Fury. Strikes have been reported across multiple Iranian cities including Tehran, Isfahan, Qom, Tabriz, and Bushehr, targeting military infrastructure, nuclear facilities, and senior leadership. Iran responded quickly, launching ballistic missiles and drones against U.S. military bases in Bahrain, Qatar, and the UAE. The UN Security Council convened an emergency session Saturday. As of this writing, the conflict is live and its scope and duration remain unknown. New leadership has emerged in Iran and vows to strike back, shutting down an oil refinery in Saudi Arabia and civilian targets across gulf state countries.

The crude market was moving before the bombs fell. Three rounds of nuclear talks in Geneva broke down last week over Iran’s refusal to remove its enriched uranium stockpile from the country. WTI settled Friday at $67.02/bbl, its highest close since August, while Brent closed at $72.87/bbl. Both benchmarks had already gained 6-8% over the prior two weeks as U.S. military assets concentrated in the region. Oil is already up 5% in premarket trading. Worth noting: a 16 million barrel build in U.S. commercial crude inventories last week would normally be a bearish fundamental that geopolitics is currently steamrolling

Roughly one-quarter of the world’s seaborne oil trade passes through the Strait of Hormuz daily. Iran has the capability to create serious disruption through tanker harassment, mining, and anti-ship missiles even without a full closure. UBS has publicly flagged a spike to $100/bbl as plausible in a sustained escalation scenario. Some Gulf producers, notably Abu Dhabi, are already ramping crude exports to cushion supply concerns, though that covers a fraction of the exposure.

For our readers, this changes the framework immediately. Prior to Saturday, the narrative was oversupplied markets, soft WCS differentials, and marginal CBR economics. A sustained WTI move above $70-75/bbl reshapes that calculus fast. Higher flat price improves crude-by-rail margins, and any tightening of global heavy sour supply improves the competitive position of Canadian WCS with U.S. Gulf Coast refiners. The Monday morning NYMEX open is the first real read on how the market is pricing this.

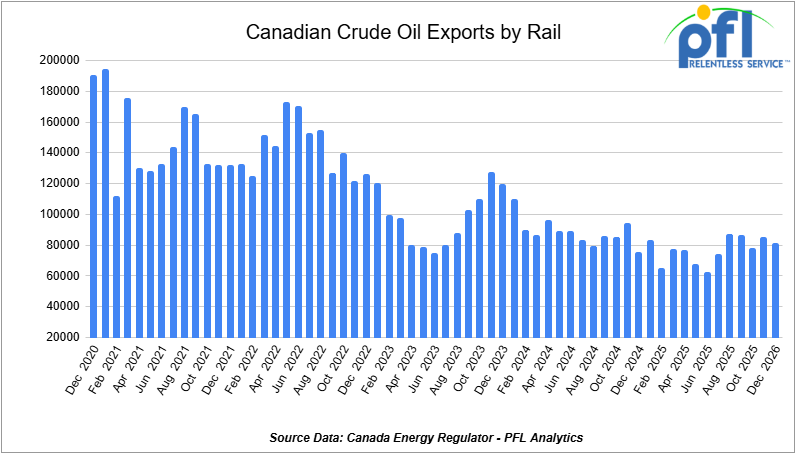

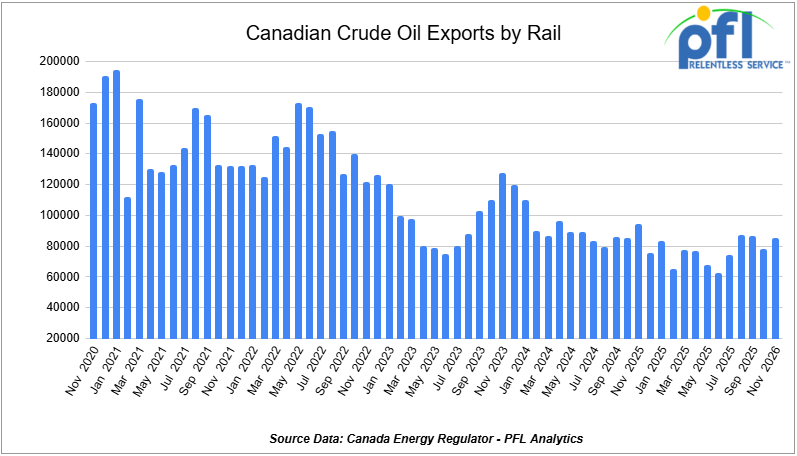

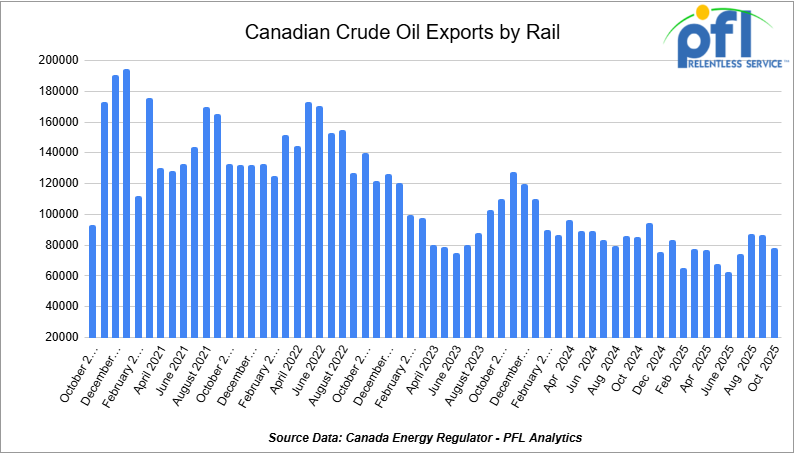

We are Watching Canadian Crude Oil Exports by Rail

The Canadian Energy regulator reported on February 24, 2026, that 81,189 barrels were exported during the month of December 2025 down from 85,055 barrels in November of 2025, a decrease of 3,866 barrels per day month-over-month.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines. Raw bitumen, which is shipped as a non-haz product and is not able to flow in pipelines, is competitive with pipeline tolls and is a growing market to keep an eye on, particularly in light of Strathcona and Gibson announcing new projects. Other factors would be existing long-term contractual commitments and basis – we really need to see the basis WTI-CMA (West Texas Intermediate – Calendar Month Average) blowout to -18 per barrel for sustained periods of time to make economic sense. Current rail rates from Alberta to the U.S. Gulf Coast have averaged $15.36 per barrel, making rail competitive whenever WCS-WTI spreads exceed $18 per barrel, including quality adjustments.

We are Watching Canadian Crude Economics

An important dynamic surfaced on Par Pacific’s fourth quarter earnings call last week. The company’s CEO described Par Pacific as an “indirect beneficiary” of Venezuelan crude returning to the Gulf Coast market. More Venezuelan heavy sour barrels at the Gulf Coast push Canadian barrels back into the midcontinent, where Par Pacific can process 40,000 to 50,000 b/d of Western Canadian Select across its Rocky Mountains and Washington refineries. The company quantified it directly: for every $1/bbl improvement in WCS differentials, Par Pacific estimates a $15-16 million annual benefit.

The Iran situation changes this math immediately if WTI moves higher, as the rail rate is largely fixed while WCS differentials and WTI flat price can reprice overnight.

Pembina Pipeline sanctioned its Taylor-to-Gordondale condensate expansion last week at C$115 million, targeting a Q1 2027 in-service date. Its Birch-to-Taylor expansion adds another C$310 million for 120,000 b/d of propane-plus and condensate capacity in northeast BC, coming online Q4 2027. The condensate story and the crude egress story are two sides of the same coin: Alberta production is growing, and the infrastructure supporting it is still playing catch-up.

We are Still Watching Line 5

Folks, we have been watching this one forever. The Governor of Michigan Gretchen Whitmer still wants this pipeline shut down for whatever reason and the battle continues. On Tuesday, the U.S. Supreme Court heard oral arguments in Enbridge Energy LP v. Nessel, the years-long battle over whether Michigan Attorney General Dana Nessel’s lawsuit to decommission Line 5 should be heard in state or federal court. The pipeline carries 540,000 barrels per day of light crude and natural gas liquids through the Straits of Mackinac, serving refineries in Michigan, Ohio, Pennsylvania, Ontario, and Quebec.

The question before the court is technically narrow but strategically enormous. Enbridge missed the mandatory 30-day deadline to remove Nessel’s 2019 state court lawsuit to federal court by over two years. Enbridge argues the deadline should be flexible given the international treaty implications of a cross-border pipeline. Michigan’s solicitor general called that position an “atextual escape hatch.” The distinction matters because a federal court has already ruled in a separate proceeding that federal pipeline safety law pre-empts Michigan’s authority to order a shutdown, while a state court applying Michigan’s public trust doctrine would be far more sympathetic to Nessel’s closure case. A ruling is expected before June.

If Line 5 is ultimately forced into prolonged uncertainty or shutdown proceedings, crude-by-rail out of Alberta becomes materially more attractive overnight (problem is there is not enough rail cars to even put a dent in that type of volume). Loss of that 540,000 b/d artery forces barrels onto the rail network. Enbridge’s proposed tunnel replacement has Army Corps permitting expected in coming weeks and faces a Michigan Supreme Court challenge scheduled for March 11th. This situation has multiple fronts and none of them are near resolution.

We are Watching a New Pipeline Proposal

Privately held Bridger Pipeline has filed applications with Montana regulators and the U.S. Bureau of Land Management for a 645-mile, 550,000 b/d pipeline running from the U.S.-Canada border in Phillips County, Montana to Guernsey, Wyoming. The details should look familiar: the border entry point is the same one designated for the cancelled Keystone XL line, it uses the same 36-inch pipe diameter, and Bridger says it would leverage existing infrastructure on the Canadian side. Construction could begin as early as July 2027, with an in-service target of mid-2030, assuming a presidential permit clears.

Keystone XL owner South Bow says it is evaluating an expansion that could link Canadian volumes to the Bridger line at Guernsey, though it offered no details ahead of its March 6 quarterly results. From Guernsey, multiple routing options reach downstream markets including a looped Pony Express pipeline to Cushing, or a revival of the shelved Liberty Pipeline route where Bridger and Tallgrass still hold right-of-way. Tallgrass is simultaneously running an open season for Bakken-to-Cushing capacity on the Pony Express, which typically runs near capacity.

The urgency is real. South Bow projects that Western Canadian Sedimentary Basin production will exceed pipeline takeaway capacity by mid-2027. Enbridge is planning a two-phase Mainline expansion adding 400,000 b/d. Trans Mountain is weighing 90,000 b/d of additional capacity through drag reducing agents by January 2027 with a further 210,000 b/d expansion possible by 2029-30. Until any of these pipes are in the ground, crude-by-rail remains the pressure valve for Alberta producers running into the capacity wall.

We are Watching Rail Terminal Consolidation

Canadian rail terminal operator Cando Rail & Terminal announced last week it is acquiring the rail terminal assets of U.S. based Savage Enterprises for an undisclosed sum. The combined company creates a coast-to-coast network of 36 railcar terminals, three short-line railways, and 80 first-and-last-mile operations with connections to all six Class I railroads. This is Cando’s fourth acquisition in two years, bringing its total investment to approximately $1 billion. Closing is expected in the second quarter subject to regulatory approval.

Savage brings a substantial Houston Ship Channel energy footprint, handling hundreds of thousands of railcars of chemical and petrochemical products annually, including petroleum liquids, petroleum coke, sulfur, and polymers. It also has Bakken exposure through a two-mile crude pipeline connecting its Trenton, North Dakota terminal to Energy Transfer’s 750,000 b/d Dakota Access system. Combined with Cando’s October acquisition of the Channelview terminal, which can stage and transload 900 railcars with Class I connections to BNSF, CPKC, and UP, the combined entity becomes a significant player in North American energy logistics. The scale of this consolidation reflects the ongoing view that terminal infrastructure is a durable long-term asset in the rail sector.

We are Watching the Canola Rush

March 1st arrived, and China delivered on half the deal. Beijing’s Finance Ministry issued a formal statement on Friday of last week confirming the suspension of 100% tariffs on Canadian canola meal, peas, lobster, and crab, effective today through year-end 2026. What was conspicuously absent from that statement: any mention of canola seed. The $4 billion seed market, and the headline commitment from Carney’s January Beijing visit to cut seed tariffs from 84% to 15%, went unconfirmed by Chinese authorities as of press time. Ottawa’s response was measured: a statement from the Minister of International Trade’s office said the seed tariff reduction is “on track as officials work on implementation details” and that “more information will be available in due course.” That is not the same as confirmation from Beijing.

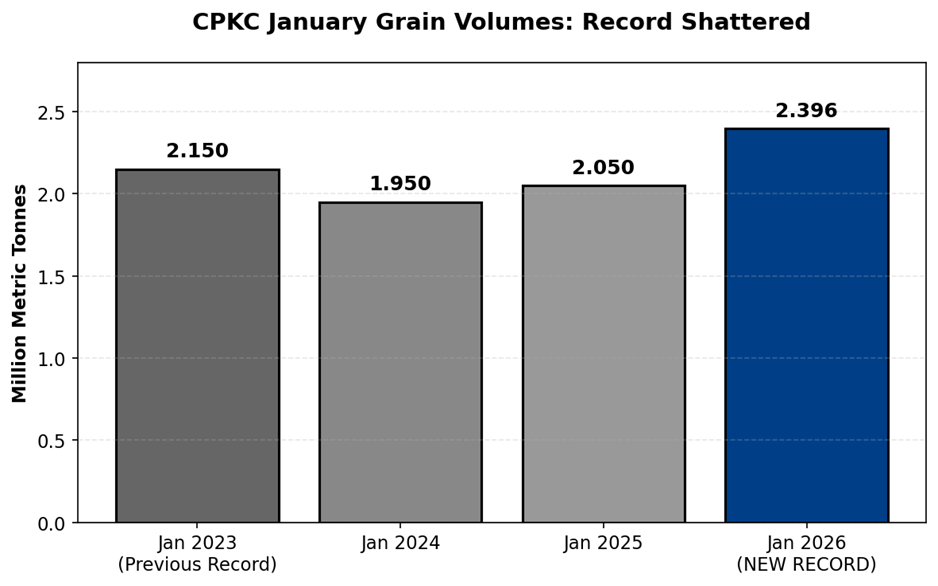

The rail market had already been pricing in the full deal. According to the Globe and Mail, canola shipments in the final two weeks of February surged far above 2025 levels as exporters pushed product toward Vancouver ahead of the deadline. The Canadian Grain Commission’s weekly data showed the surge was real, with grain carloads for the week of February 21 hitting 24,463, up 8,121 week-over-week according to the AAR data. Those shipments are now crossing the Pacific, a 20-21 day voyage from Vancouver, and will arrive in Chinese ports expecting a 15% tariff. If Beijing doesn’t formally confirm the seed reduction in the coming days, there is going to be a very uncomfortable conversation at the dock.

The canola meal confirmation is genuinely meaningful, China was importing nearly 2 million metric tonnes annually before the 2025 tariff surprise gutted the trade, and restoring that flow is a real covered hopper tailwind on CN and CPKC corridors heading west. But the seed story is the one to watch. Six million tonnes annually and $4 billion in trade doesn’t come back until Beijing puts it in writing. We will be updating readers as this develops.

We are Watching a Rail Safety Bill Reintroduced

Three years after the Norfolk Southern derailment in East Palestine, Ohio, a bipartisan group of eight U.S. senators led by Sen. Maria Cantwell (D-WA) reintroduced the Bipartisan Railway Safety Act of 2026 on February 24. The original bill stalled in Congress in 2023-24 due to industry opposition and Republican resistance.

The bill mandates expanded deployment of wayside hotbox detectors, the temperature sensors that flagged the NS East Palestine train’s overheating bearings but under existing railroad policy did not compel a stop in time. It requires all railcars to undergo a full inspection at least once every five years, expands the hazardous chemicals list to include vinyl chloride, and mandates speed restrictions, improved braking technology, and route risk analysis for hazmat movements. The maximum civil penalty for safety violations would jump from $100,000 to $10 million per violation. Carriers would also face new requirements to notify states about hazardous materials crossing their borders.

The legislation has union support. The Association of American Railroads has historically pushed back on prescriptive mandates, and passage in a Republican-controlled Senate is far from certain. Regardless of this bill’s fate, the trajectory toward greater compliance obligations and increased hazmat scrutiny is a durable trend. Operators moving crude, ethanol, and LPG by rail should track this closely.

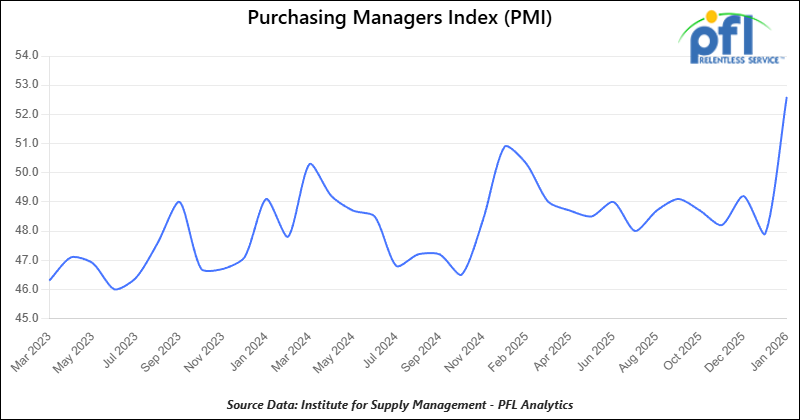

We are Watching Key Economic Indicators

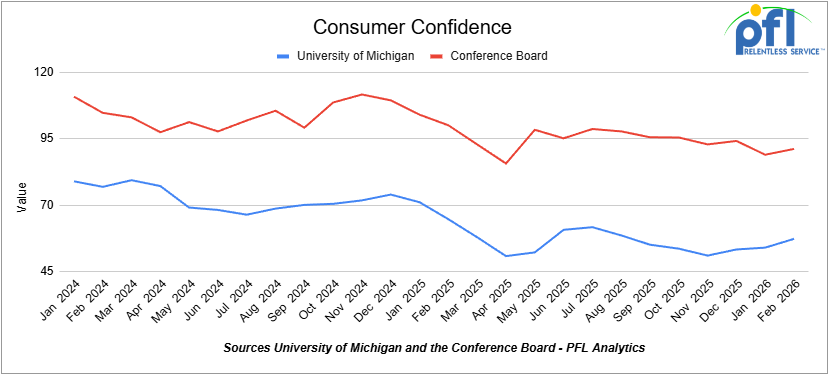

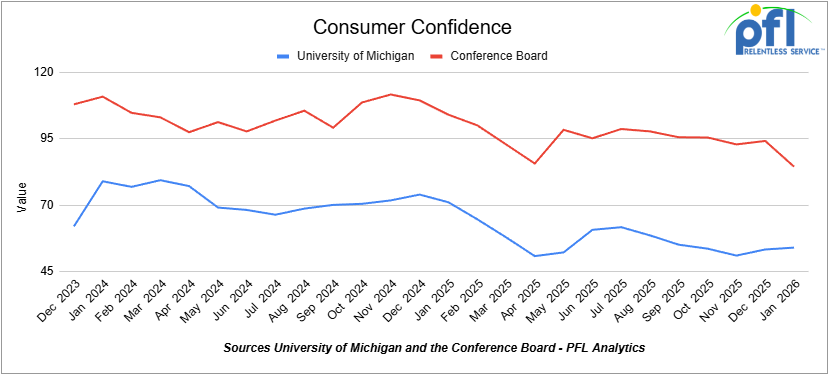

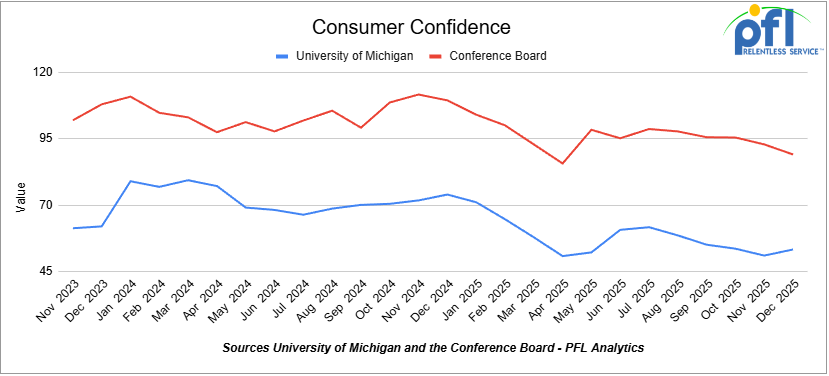

Consumer Confidence

The Index of Consumer Sentiment from the University of Michigan increased from 54.0 in January to 57.3 in February.

The Conference Board Consumer Confidence Index increased from 89.0 in January to 91.2 in February.

Lease Bids

- 100, 21.9K 117J Tanks located off of All Class 1s in Midwest. For use in CO2 service. Period: 6 months.

- 30-50, 30K 117J Tanks located off of NS or CSX in Northeast. For use in C5 service. Period: 1 year.

- 20-50, 4000-5000 Covered Hoppers located off of UP or BN in Houston. For use in Urea, Potash, Ammonium Sulfate service. Period: 6-12 Months.

- 200, 33K Pressure Tanks located off of CSX or NS in Ohio. For use in Propylene service. Period: 18 Months.

- 30-50, 25.5K Dot 111 Tanks located off of All Class 1s in Anywhere. For use in Asphalt service. Period: 1-3 Years.

Sales Bids

- 28, 3400CF Covered Hoppers located off of UP BN in Texas. For use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks located off of various class 1s in various locations. For use in corn syrup service.

- 120, Various Open-Top Aluminum Rotary Gondolas located off of various class 1s in various locations. For use in Sulphur service. Built 2004 or later.

- 30, 29K DOT111 Tanks located off of various class 1s in Chicago. For use in Veg Oil service.

Lease Offers

- 100, 30K CPC1232 Tanks located off of UP or BN in Texas. Last used in Diesel.

- 100, 30K DOT117R Tanks located off of UP or BN in Texas. Last used in Gasoline.

- 100, 29K DOT117R Tanks located off of UP or BN in Texas. Last used in Gasoline. Coiled and Insulated.

- 21, 6351 Covered Hoppers located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 29, 6500 Covered Hoppers located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 50, 20K DOT117J Tanks located off of All Class 1s in Moving. Last used in Styrene.

- 29, 25.5K DOT117J Tanks located off of UP or BN in Texas. Cars are currently clean. Cars are currently clean.

- 90, 30K DOT117J Tanks located off of UP or BN in Corpus Christie. Last used in Diesel.

- 200, 340W DOT 112J Tanks located off of All Class 1s in Multiple Locations. Last used in Propane and Butane. Cars are currently clean.

- 15, 6200CF Covered Hoppers located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

- 30, 6500CF Covered Hoppers located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

- 50, 30K DOT117J Tanks located off of UP or BN in Corpus Christie. Last used in Gasoline.

- 24, 21K Stainless Steel Tanks located off of UP in Texas / Mexico Border. Last used in SULFACTANT. Cars are currently clean.

- 34, 30K DOT 111 Tanks located off of UP in Texas / Mexico Border. Last used in Veg Oil. Cars are currently clean.

Sales Offers

- 50, 31.8K CPC1232 Tanks located off of UP or BN in TX. Last used in Multiple. Requal Due in 2025.

- 35, 3400CF Covered Hoppers located off of UP or BN in Midwest. Last used in Sand.

- 25, 30K 117J Tanks located off of CSX in Jackson, TN. Last used in Fuels. Newly Requalified.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website

The post PFL Railcar Report 3-2-2026 appeared first on PFL Petroleum Services LTD.

]]>The post PFL Railcar Report 2-23-2026 appeared first on PFL Petroleum Services LTD.

]]>Abraham Lincoln

Jobs Update

- Initial jobless claims seasonally adjusted for the week ending February 14, 2026 came in at 206,000, versus the adjusted number of 229,000 people from the week prior, down 23,000 people week over week.

- Continuing jobless claims came in at 1,869,000, versus the adjusted number of 1,852,000 people from the week prior, up 17,000 week-over-week.

Stocks closed higher on Friday of last week and higher week-over-week

The DOW closed higher on Friday of last week, up 230.81 points (0.47%), closing out the week at 49,625.97, up 125.04 points week-over-week. The S&P 500 closed higher on Friday of last week, up 47.62 points (0.69%), and closed out the week at 6,909.51, up 73.34 points week-over-week. The NASDAQ closed higher on Friday of last week, up 203.34 points (0.90%), and closed out the week at 22,886.07, up 339.40 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 49,550 this morning, down -124 points from Friday’s close.

Crude oil closed mixed on Friday of last week and higher week-over-week

West Texas Intermediate (WTI) crude closed down -0.04 per barrel (-0.06%), to close at $66.39 on Friday of last week, but up $3.50 week-over-week. Brent crude closed up 0.10 per barrel (0.14%), to close at $71.76, and up $4.01 week-over-week.

One Exchange WCS (Western Canadian Select) for April delivery settled on Friday of last week at US$15.00 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$51 per barrel.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 9 million barrels week-over-week. At 419.8 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

Total motor gasoline inventories decreased by 3.2 million barrels week-over-week and are 3% above the five-year average for this time of year.

Distillate fuel inventories decreased by 4.6 million barrels week-over-week and are 5% below the five-year average for this time of year.

Propane/propylene inventories decreased 3.1 million barrels week-over-week and are 39% above the five-year average for this time of year.

Propane prices closed at 60.9 cents per gallon on Friday of last week, down 1.7 cents per gallon week-over-week, and down 32 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 19.1 million barrels week-over-week, during the week ending February 13, 2026.

U.S. crude oil imports averaged 6.5 million barrels per day last week, a decrease of 281,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 1.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 353,000 barrels per day, and distillate fuel imports averaged 199,000 barrels per day during the week ending February 13, 2026.

U.S. crude oil exports averaged 4.59 million barrels per day during the week ending February 13, 2026, an increase of 851,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.241 million barrels per day.

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending February 13, 2026, which was 77,000 barrels per day more week-over-week.

WTI is poised to open at $66.07, down 41 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 18, 2026:

Total North American weekly rail volumes were up (+3.77%) in week 8, compared with the same week last year. Total Carloads for the week ending February 18, 2026 were 330,593, up (+5.51%) compared with the same week in 2025, while weekly Intermodal volume was 343,782, up (+2.16%) year over year. 10 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest decrease came from Forest Products (-17.37%). The largest increase was Grain (+39.72%).

In the East, CSX’s total volumes were up (+0.23%), with the largest decrease coming from Coal (-18.61%), while the largest increase came from Intermodal Units (+9.42%). NS’s total volumes were up (+1.43%), with the largest increase coming from Petroleum & Petroleum Products (+16.93%), while the largest decrease came from Forest Products (-8.65%).

In the West, BNSF’s total volumes were up (+9.24%), with the largest increase coming from Grain (+56.48%), while the largest decrease came from Chemicals (-3.62%). UP’s total volumes were up (+7.61%), with the largest increase coming from Grain (+57.03%), while the largest decrease came from Forest Products (-3.25%).

In Canada, CN’s total volumes were up (+9.26%), with the largest increase coming from Grain (+37.89%), while the largest decrease came from Other (-37.95%). CPKCS’s total volumes were down (-21.63%), with the largest increase coming from Grain (+35.70%), while the largest decrease came from Forest Products (-69.79%).

Source Data: AAR – PFL Analytics

North American Rig Count Summary

Rig Count

North American rig count was up by +2 rigs week-over-week. The US rig count was unchanged week-over-week, but down by -41 rigs year-over-year. The US currently has 551 active rigs. Canada’s rig count was up by +2 rigs week-over-week, but down by -20 rigs year-over-year. Canada currently has 224 active rigs. Overall, year-over-year we are down by -61 rigs collectively.

We are watching a few things out there for you:

We are Watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 29,673 from 29,173 which was an increase of +500 rail cars week-over-week. Canadian volumes rose. CN’s shipments were higher by +4.0% week-over-week, CPKC’s volumes were higher by +18.0% week-over-week. U.S. shipments were mixed. The BN had the largest percentage increase and was up by +10.0%. The CSX had the largest percentage decrease and was down by -3.0%.

We are Watching Canada

When Enbridge CEO Greg Ebel was asked last week about building a new West Coast oil pipeline, he did not mince words. The company spent C$600 million (roughly $440 million US) on the Northern Gateway project (never was built), watched the government pull the rug out when approval was overturned in 2016, and has no appetite to repeat the exercise. “That’s not the type of risk we are prepared to take on at this time,” Ebel said. That is as close to a flat no as you will hear from a CEO who still has to be diplomatic about these things.

The irony is that while Enbridge is declining to build new West Coast capacity, its existing Mainline system is under considerable pressure. The system averaged 3.1 million barrels per day in 2025 and was apportioned for nine of those twelve months, and already for both January and February of this year. Enbridge has sanctioned Mainline Line Optimization Phase 1 (MLO1), which will add 150,000 bpd of new capacity by October 2027, with MLO2 adding another 250,000 bpd in 2028. Those are welcome additions, but they are incremental fixes to a system that is already straining. The apportionment data last week confirms the situation has not improved: Enbridge rejected 13% of January heavy crude nominations at Kerrobert, Saskatchewan.

Meanwhile, Trans Mountain waterborne exports fell in January to an 11-month low of 390,000 b/d, the lowest since February 2025, as Chinese SPR buying that had supported prices through late 2025 eased. Chinese state-controlled firms may have added as much as 1.1 million b/d to China’s strategic petroleum reserve in December alone, and that demand has since faded. Heavy Canadian loadings from TMX to Asia-Pacific fell almost 22% from December. The result is that more Alberta barrels are being pushed back onto the Mainline and into US-bound flows rather than heading west. On a brighter note, Enbridge’s Line 5 reroute permit in Wisconsin was upheld by an administrative law judge on February 13, moving construction of the 41-mile reroute around the Bad River Band reservation closer to reality.

The April 1st carbon pricing deadline highlighted by Ebel remains a key near-term watch point. Producers need to understand Canada’s industrial carbon policy before committing to the kind of production growth that would stress the Mainline further. The Alberta government’s West Coast pipeline proposal targets federal submission by July 1st, but is structurally a decade away from moving molecules even in the best case. PFL will be watching how quickly MLO1 and MLO2 are absorbed and whether apportionment tightens further as new oilsands production hits the system.

We are Watching Cenovus

Three months after closing its $6.1 billion acquisition of MEG Energy, Cenovus has already captured the corporate synergies and is now focused on growing production in the field. The company produced a record 918,000 barrels of oil equivalent per day in Q4 2025, up 12% from Q4 2024, and exited the year with a monthly record of over 970,000 boe/d in December. The Q4 profit came in at C$934 million, up from C$146 million a year earlier. This is not a company that is slowing down.

The growth is coming from across the portfolio. Foster Creek hit a new record of 220,000 b/d in Q4, up from 195,000 b/d a year earlier, following completion of a 30,000 b/d optimization project ahead of schedule. Sunrise rose to 58,000 b/d, with three new well pads expected online this year. New to the Cenovus portfolio is Christina Lake North, formerly MEG’s Christina Lake asset, which averaged 110,000 b/d in Q4 for a record at that asset. CFO Kam Sandhar said on last Thursday’s earnings call that Cenovus plans to add approximately 40,000 b/d at Christina Lake North by 2028, growing total Christina Lake production to approximately 400,000 b/d, one of the largest single-asset production footprints in the oilsands.

What this means for pipeline and rail markets is more volume pressing against a system that, as noted above, is already apportioned. The question that matters for freight is whether MLO1 and MLO2 absorb the new barrels, or whether the system tips back toward differential widening that forces incremental production onto rail. The WCS-WTI differential has widened to 23-month highs, and the breakeven economics for crude-by-rail are essentially here right now. Cenovus’s production growth into a tightening Mainline is the single most important underlying driver of crude-by-rail economics in Western Canada over the next two years. PFL will be watching this one closely.

We are Watching the Supreme Court

On Friday of last week, the U.S. Supreme Court threw out most of the tariffs President Trump has imposed on nearly all U.S. trading partners, finding his ability to unilaterally impose tariffs exceeded his powers under the International Emergency Economic Powers Act (IEEPA). The ruling could have potentially sweeping implications for cross-border trade flows and, by extension, for the rail industry that moves goods across the Canada-US and Mexico-US borders.

The timing is almost darkly comic. Last Wednesday, the US House voted 219-211 to revoke Canada’s 25% tariffs through a congressional resolution, a largely symbolic gesture that Trump was expected to veto anyway. Six Republicans crossed the aisle. The White House called it “a fruitless exercise.” Within days, the Supreme Court effectively rendered the entire debate moot. If the ruling holds, the IEEPA-based tariff architecture, which is the legal foundation for the Canada, Mexico, and global tariffs, collapses.

For the rail industry, the immediate question is whether this translates to a recovery in cross-border freight volumes. CN Rail disclosed last week that tariff impacts cost the company more than $350 million in revenue in 2025, with forest products and metals hardest hit. Critically, CN CFO Ghislain Houle made those comments at a Citi conference on February 18th, before the Supreme Court ruling, describing the environment as “still very murky.” A removal of tariffs would directly address the uncertainty that has been causing shippers to defer cross-border commitments. CPKC CEO Keith Creel noted last week that “tariff tribulations” had pushed Canadian and Mexican companies to diversify away from US suppliers, creating demand for CPKC as a Canada-Mexico land bridge. That trade pattern could now partially reverse.

Important caveats apply. The Trump administration will almost certainly appeal, and whether the ruling applies retroactively or only prospectively matters enormously for pricing and contract decisions. The USMCA review scheduled for July is a separate process that proceeds regardless. Readers should watch for the administration’s formal response in the coming days, as that will clarify whether the Canada-specific tariffs are immediately suspended or remain in legal limbo. Over the weekend, Trump struck back, imposing a 15% across-the-board tariff on all countries under separate legal authority. The tariff story is not over. Stay tuned to PFL, we are watching this one closely!

We are Watching Canola

Readers will recall that last month, left-wing Prime Minister Carney returned from Beijing with a trade deal that included significant tariff relief on Canadian canola. The March 1 implementation date is now days away. As of that date, China’s tariffs on Canadian canola seed drop from approximately 84% to 15%, and the 100% tariffs on canola meal are removed entirely through at least year-end. Together, these changes are expected to restore access to nearly $7 billion in annual export markets for Canadian agriculture.

To understand the magnitude of what has been blocked, consider that Canadian canola exports to China were essentially zero from August 2025 onward, after China’s preliminary anti-dumping duties on canola seed hit 75.8%. An industry that had been shipping meaningful volumes to China annually effectively lost that market overnight. With the 2025 crop sitting in storage and spring planting decisions weeks away, the timing of this tariff relief is critical for producer confidence. The Supreme Court ruling discussed above introduces one wrinkle: if US tariffs on Canada are struck down, some of the political calculus that drove Carney to the China deal changes. The canola deal itself is separate and proceeds regardless, but the broader trade picture is shifting quickly.

The rail implication is real and near-term. Covered hopper demand from the prairies into the Pacific export terminals has been depressed since the tariffs hit. A resumption of meaningful canola flow to China, routed through Vancouver export terminals via CN and CPKC, would put cars back to work on a lane that has been underutilized for months. Analysts are rightly cautious, as the tariff relief on canola meal is only guaranteed through year-end, and canola oil remains excluded from the deal entirely. But even a partial restoration of China volumes would be a meaningful shot in the arm for covered hopper utilization. PFL has covered hopper exposure in Western Canada, and we will be monitoring closely as the first post-tariff shipments begin moving.

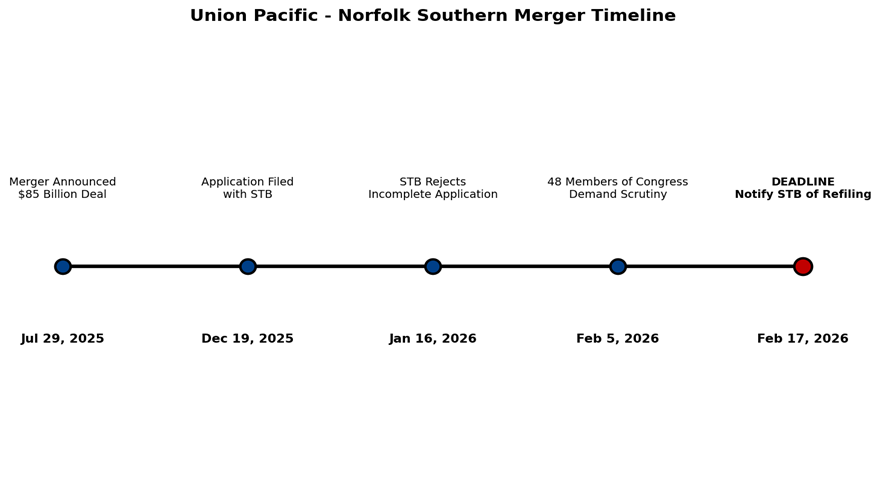

We are Watching the UP and the NS

On Monday of last week, the Union Pacific and the Norfolk Southern jointly notified the Surface Transportation Board that they intend to refile their $85 billion merger application by April 30, 2026. The original December filing was rejected in January as incomplete, with the STB saying it was missing forward-looking market share data and key terms of the merger agreement. UP CEO Jim Vena, speaking at a Wednesday investor conference, said the delay will not derail the timeline and the railroads still expect to close the transaction in early or mid-2027.

What is new is that CN and CPKC have publicly said they will fight hard for concessions as the price of the merger going through. CN CFO Ghislain Houle told a Citi conference on Tuesday of last week: “We’ll be as aggressive as we can be on asking for remedies and concessions.” CPKC CEO Keith Creel described having a “robust” list of demands, including more access to UP’s network in St. Louis and Kansas City, and specifically access to Houston’s chemical alley, the massive refinery and petrochemical complex along the Houston Ship Channel, currently operated by a UP-BNSF joint venture with no direct CPKC connection. Creel made clear he wants one.

For its part, UP had initially budgeted $750 million for potential concessions, but CFO Jennifer Hamann said last week that the deal’s inherent benefits make such concessions unnecessary. “We don’t think they’re necessary to make our point and to drive better enhanced competition,” Hamann said. That position is going to be tested hard. The merger would cover about 55,000 miles of track and roughly half of US freight traffic, and the 2001 STB rules require the merging carriers to demonstrate that competition is enhanced, not merely preserved. That higher bar is exactly what CN and CPKC intend to exploit. For shippers of refined products and petrochemicals, the Houston access question is the one to watch. PFL clients with USGC petrochemical exposure should be paying close attention to what the STB ultimately requires here.

We are Watching Trucking

The truckload market is sending signals that should matter to everyone in intermodal. On Wednesday of last week, the Federal Motor Carrier Safety Administration announced it had issued notices of proposed removal to over 550 CDL training schools following a five-day sting operation involving more than 300 investigators across all 50 states. The sweep included 1,426 on-site inspections and found schools operating with fake addresses, unqualified instructors, vehicles that did not match the training offered, and failures to properly train drivers on hazardous materials transport. Another 109 providers voluntarily withdrew from the national Training Provider Registry the moment investigators arrived. Transportation Secretary Sean Duffy put it bluntly: “For too long, the trucking industry has operated like the Wild, Wild West.”

This follows a December purge that removed nearly 3,000 providers. The cumulative effect on the available driver pool is becoming measurable. J.B. Hunt management said at a Barclays investor conference Tuesday of last week that truck capacity has “notably tightened” and that the market remains firm even in what is seasonally the weakest demand period of the year, a combination you simply do not see at the bottom of a freight cycle. CFO Brad Delco described demand as trending “a little bit more positive” than the company had expected heading into the year, even without the demand-side help that would typically drive this kind of tightening.

For intermodal, this is the setup that practitioners have been waiting for after three years of freight recession. J.B. Hunt reported two-year stacked intermodal growth rates in the high single digits throughout 2025, with Q4 up 11%, and that growth happened during a period of excess truck capacity and low fuel prices. As those tailwinds reverse, the intermodal value proposition only gets stronger. NS’s new CMA CGM partnership, announced mid-week last week, offers a door-to-door “truck-like” intermodal product on West Coast-Midwest lanes under the Triple Crown brand, smart positioning for exactly this environment. PFL’s intermodal exposure stands to benefit if capacity tightening accelerates into spring bid season, as many in the market now expect.

We are Watching Key Economic Indicators

Gross Domestic Product (“GDP”)

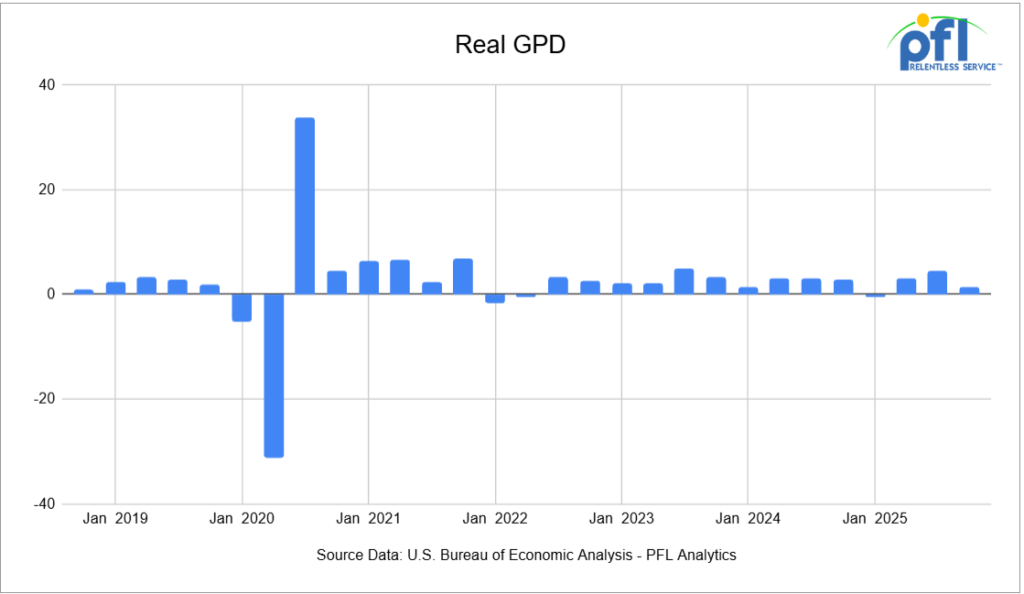

Real GDP in the United States grew at an annualized rate of 1.4% in the fourth quarter of 2025 (covering October through December), according to the advance estimate from the U.S. Bureau of Economic Analysis. This marks a notable slowdown from the 4.4% growth seen in Q3 2025, reflecting weaker government spending and export activity alongside still-positive consumer demand.

Consumer spending (measured by personal consumption expenditures) rose 2.4% in Q4 2025, down from a 3.5% pace in the previous quarter, and contributed approximately +1.6 percentage points to overall GDP growth. Investment also made a positive contribution, while government spending and exports declined, acting as a drag on overall growth. Imports fell, which provided a small positive effect on the GDP calculation because imports are subtracted in the GDP formula.

Consumer spending rose during the quarter, supported by gains in services such as healthcare and other non-durable sectors, though the pace of increase was lower compared with earlier in 2025. Other components of domestic demand—including fixed investment—added modestly to growth, but the overall slower pace of activity indicates weakening momentum at the end of the year.

Real final sales to private domestic purchasers (the sum of household consumption and fixed investment) increased 2.4% in Q4 2025, compared with a stronger 2.9% pace in Q3 2025, indicating that underlying private demand expanded at a more moderate rate late in the year but remained a notable contributor to economic activity.

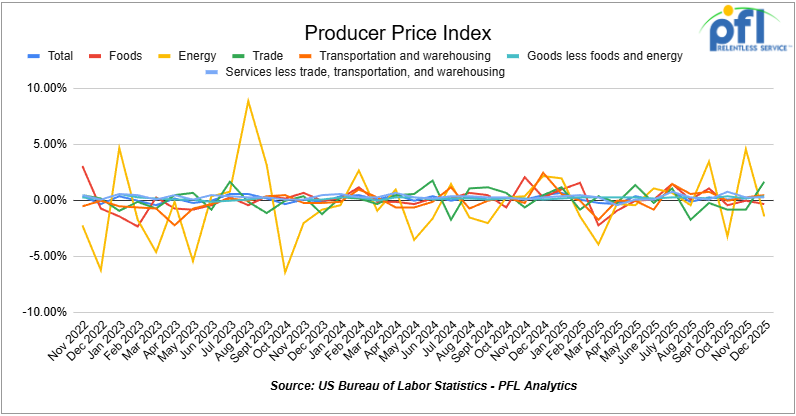

On the price front, the price index for gross domestic purchases rose 3.7%, while the PCE price index increased 2.9% and core PCE (excluding food and energy) rose 2.7% in Q4. These inflation figures suggest persistent price pressures even as growth slowed.

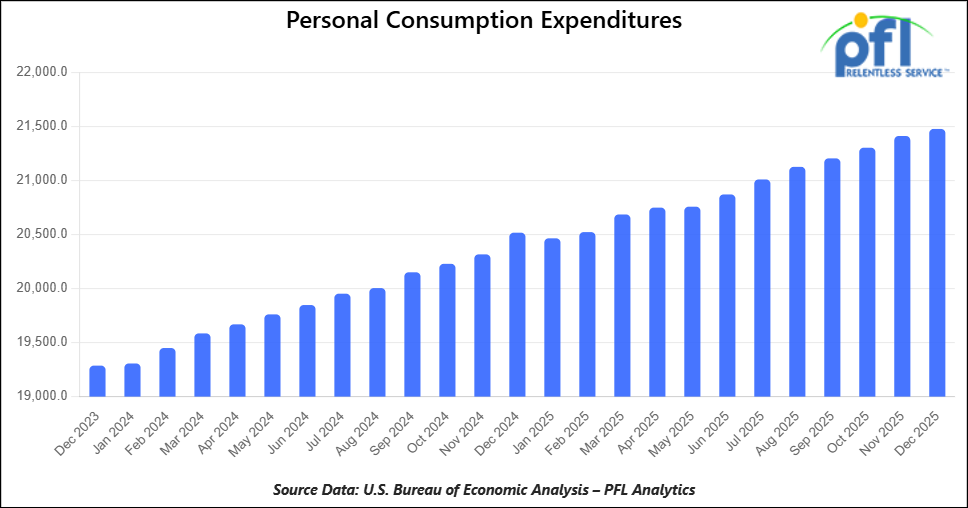

Consumer Spending

In December 2025, total consumer spending continued to expand, with personal consumption expenditures (PCE) rising 0.4 percent from November 2025, reflecting steady household demand late in the year. Current-dollar PCE increased by $91.0 billion, driven by a $98.5 billion rise in services outlays that more than offset a $7.5 billion decline in goods spending. Real (inflation-adjusted) PCE rose 0.1%in December.

The personal saving rate declined to 3.6 percent in December, down from September and early-fall levels, as consumer outlays continued to outpace growth in disposable income.

On inflation, the PCE price index — the Federal Reserve’s preferred inflation gauge — rose 0.4 percent month-over-month in December and 2.9 percent year-over-year, accelerating from earlier in the autumn. Excluding food and energy, the core PCE price index also rose 0.4 percent month-over-month and 3.0 percent year-over-year, indicating persistent underlying price pressures above the Fed’s long-run 2%target.

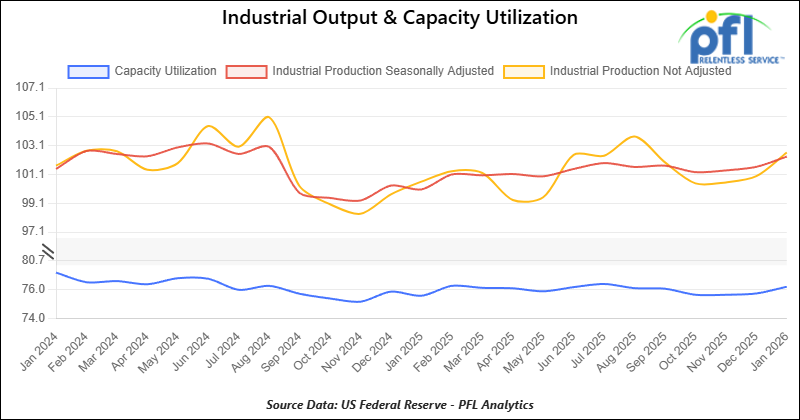

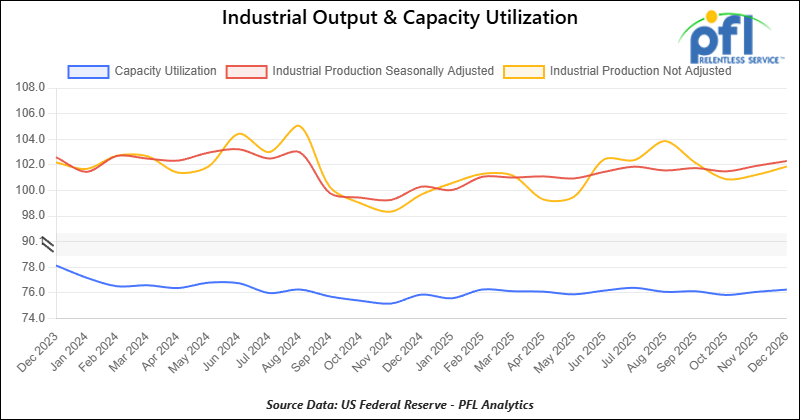

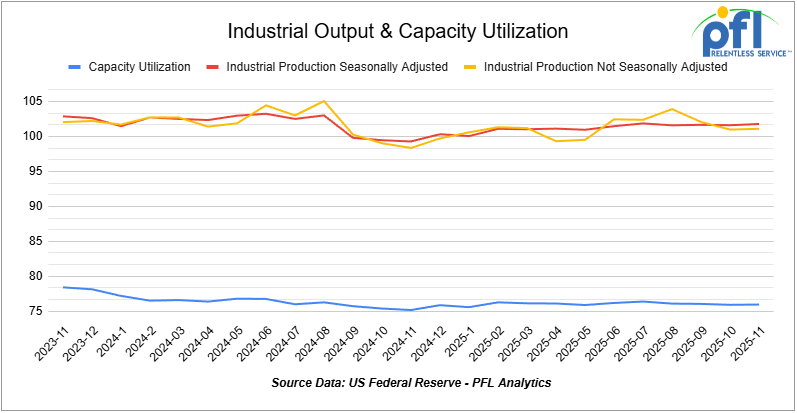

Industrial Output and Capacity Utilization

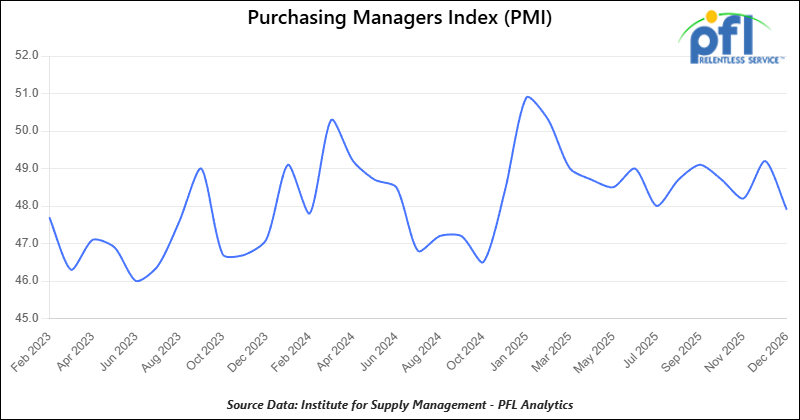

Manufacturing accounts for approximately 75% of total output. Manufacturing output in January 2026 was up 0.6% from December 2025. Overall industrial production rose 0.7% month-over-month in January 2026 after a 0.2% rise in December.

Capacity utilization is a measure of how fully firms are using machinery and equipment. Capacity utilization increased from December to January 2026 — total industry moved up to about 76.2% in January, and manufacturing utilization edged up to about 75.6%.

Lease Bids

- 100, 21.9K 117J Tanks located off of All Class 1s in Midwest. For use in CO2 service. Period: 6 months.

- 30-50, 30K 117J Tanks located off of NS or CSX in Northeast. For use in C5 service. Period: 1 year.

- 20-50, 4000-5000 Covered Hoppers located off of UP or BN in Houston. For use in Urea, Potash, Ammonium Sulfate service. Period: 6-12 Months.

- 200, 33K Pressure Tanks located off of CSX or NS in Ohio. For use in Propylene service. Period: 18 Months.

- 30-50, 25.5K Dot 111 Tanks located off of All Class 1s in Anywhere. For use in Asphalt service. Period: 1-3 Years.

Sales Bids

- 28, 3400CF Covered Hoppers located off of UP BN in Texas. For use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks located off of various class 1s in various locations. For use in corn syrup service.

- 120, Various Open-Top Aluminum Rotary Gondolas located off of various class 1s in various locations. For use in Sulphur service. Built 2004 or later.

- 30, 29K DOT111 Tanks located off of various class 1s in Chicago. For use in Veg Oil service.

Lease Offers

- 100, 30K CPC1232 Tanks located off of UP or BN in Texas. Last used in Diesel.

- 100, 30K DOT117R Tanks located off of UP or BN in Texas. Last used in Gasoline.

- 100, 29K DOT117R Tanks located off of UP or BN in Texas. Last used in Gasoline. Coiled and Insulated.

- 21, 6351 Covered Hoppers located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 29, 6500 Covered Hoppers located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 50, 20K DOT117J Tanks located off of All Class 1s in Moving. Last used in Styrene.

- 29, 25.5K DOT117J Tanks located off of UP or BN in Texas. Cars are currently clean. Cars are currently clean.

- 90, 30K DOT117J Tanks located off of UP or BN in Corpus Christie. Last used in Diesel.

- 200, 340W DOT 112J Tanks located off of All Class 1s in Multiple Locations. Last used in Propane and Butane. Cars are currently clean.

- 15, 6200CF Covered Hoppers located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

- 30, 6500CF Covered Hoppers located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

- 50, 30K DOT117J Tanks located off of UP or BN in Corpus Christie. Last used in Gasoline.

- 24, 21K Stainless Steel Tanks located off of UP in Texas / Mexico Border. Last used in SULFACTANT. Cars are currently clean.

- 34, 30K DOT 111 Tanks located off of UP in Texas / Mexico Border. Last used in Veg Oil. Cars are currently clean.

Sales Offers

- 50, 31.8K CPC1232 Tanks located off of UP or BN in TX. Last used in Multiple. Requal Due in 2025.

- 35, 3400CF Covered Hoppers located off of UP or BN in Midwest. Last used in Sand.

- 25, 30K 117J Tanks located off of CSX in Jackson, TN. Last used in Fuels. Newly Requalified.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website

The post PFL Railcar Report 2-23-2026 appeared first on PFL Petroleum Services LTD.

]]>The post PFL Railcar Report 2-17-2026 appeared first on PFL Petroleum Services LTD.

]]>Carl Jung

Jobs Update

- Initial jobless claims seasonally adjusted for the week ending February 7, 2026 came in at 227,000, versus the adjusted number of 232,000 people from the week prior, down 5,000 people week over week.

- Continuing jobless claims came in at 1,862,000, versus the adjusted number of 1,841,000 people from the week prior, up 21,000 week-over-week.

Stocks closed mixed on Friday of last week and lower week-over-week

The DOW closed higher on Friday of last week, up 48.95 points (0.10%), closing out the week at 49,500.93, down -614.74 points week-over-week. The S&P 500 closed higher on Friday of last week, up 3.41 points (0.05%), and closed out the week at 6,836.17, down -96.13 points week-over-week. The NASDAQ closed lower on Friday of last week, down -50.48 points (-0.22%), and closed out the week at 22,546.67, down -484.54 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 49,486 this morning, down 83 points from Friday’s close.

Crude oil closed higher on Friday of last week, but lower week-over-week

West Texas Intermediate (WTI) crude closed up +5 cents per barrel (0.1%), to close at $62.89 on Friday of last week, but down -66 cents week-over-week. Brent crude closed up +23 cents per barrel (0.3%), to close at $67.75, and down -30 cents week-over-week.

One Exchange WCS (Western Canadian Select) for March delivery settled on Friday of last week at US$15.80 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$46.79 per barrel.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.5 million barrels week-over-week. At 428.8 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

Total motor gasoline inventories increased by 1.2 million barrels week-over-week and are 4% above the five-year average for this time of year.

Distillate fuel inventories decreased by 2.7 million barrels week-over-week and are 4% below the five-year average for this time of year.

Propane/propylene inventories decreased 5.4 million barrels week-over-week and are 36% above the five-year average for this time of year.

Propane prices closed at 62.6 cents per gallon on Friday of last week, down 2.6 cents per gallon week-over-week, and down 29.6 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 1.7 million barrels week-over-week, during the week ending February 6, 2026.

U.S. crude oil imports averaged 6.8 million barrels per day last week, an increase of 604,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.3 million barrels per day, 5% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 365,000 barrels per day, and distillate fuel imports averaged 151,000 barrels per day during the week ending February 6, 2026.

U.S. crude oil exports averaged 3.739 million barrels per day during the week ending February 6, 2026, a decrease of 308,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.016 million barrels per day.

U.S. crude oil refinery inputs averaged 16 million barrels per day during the week ending February 6, 2026, which was 29,000 barrels per day less week-over-week.

WTI is poised to open at $63.67, up 92 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending February 11, 2026:

Total North American weekly rail volumes were down (-5.01%) in week 7, compared with the same week last year. Total Carloads for the week ending February 11, 2026 were 306,102, down (-4.40%) compared with the same week in 2025, while weekly Intermodal volume was 335,686, down (-5.55%) year over year. 9 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Forest Products (-22.15%). The largest increase was Grain (+9.07%).

In the East, CSX’s total volumes were down (-4.30%), with the largest decrease coming from Coal (-22.93%), while the largest increase came from Intermodal Units (+2.22%). NS’s total volumes were down (-10.61%), with the largest increase coming from Petroleum & Petroleum Products (+6.43%), while the largest decrease came from Coal (-25.60%).

In the West, BNSF’s total volumes were up (+0.91%), with the largest increase coming from Petroleum & Petroleum Products (+23.92%), while the largest decrease came from Coal (-24.31%). UP’s total volumes were down (-3.50%), with the largest increase coming from Grain (+17.59%), while the largest decrease came from Forest Products (-12.68%).

In Canada, CN’s total volumes were up (+5.24%), with the largest increase coming from Grain (+35.16%), while the largest decrease came from Other (-31.10%). CPKCS’s total volumes were down (-30.42%), with the largest increase coming from Other (+16.22%), while the largest decrease came from Forest Products (-66.99%).

Source Data: AAR – PFL Analytics

North American Rig Count Summary

Rig Count

North American rig count was down by -6 rigs week-over-week. The U.S. rig count was unchanged week-over-week, but down by -37 rigs year-over-year. The U.S. currently has 551 active rigs. Canada’s rig count was down by -6 rigs week-over-week and down by -23 rigs year-over-year. Canada currently has 222 active rigs. Overall, year-over-year we are down by -60 rigs collectively.

We are watching a few things out there for you:

We are Watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,173 from 29,625 which was a decrease of -452 rail cars week-over-week. Canadian volumes were mixed. CN’s shipments were lower by -2.0% week-over-week, CPKC’s volumes were higher by +3.0% week-over-week. U.S. shipments were also mixed. The NS had the largest percentage increase and was up by +9.0%. The CSX had the largest percentage decrease and was down by -6.0%.

We are Watching Canadian Crude Flows

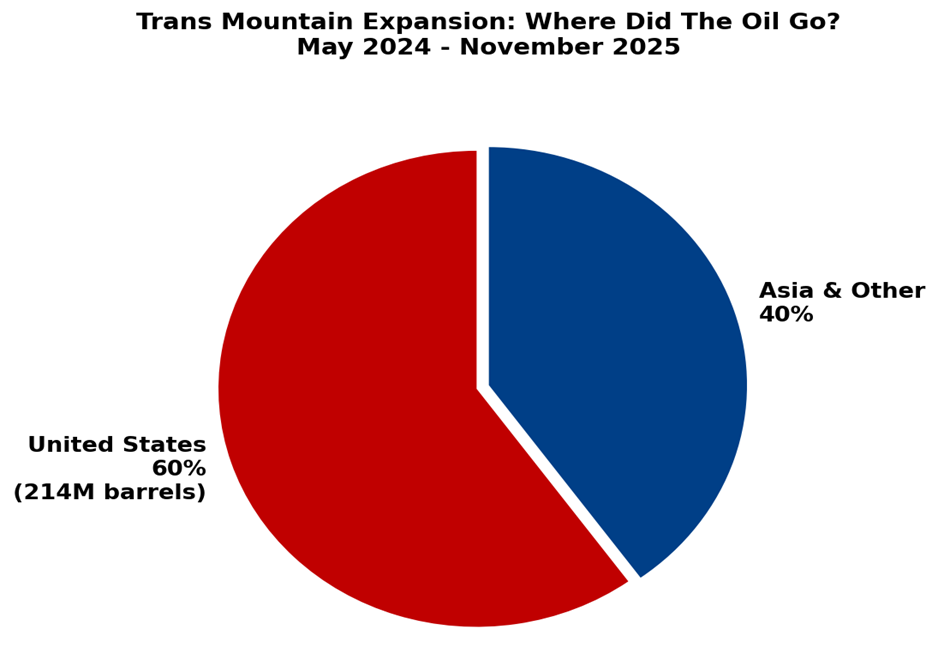

Canadian oil exports hit record levels while crude-by-rail collapsed to eight-year lows, highlighting how dramatically the Trans Mountain expansion has reshaped North American energy logistics.

Fresh data released from Stats Canada last week confirms the scale of the shift. Canada exported 4.44 million barrels per day in November, up from 4.21 million b/d a year earlier, according to Statistics Canada. But, the story beneath that headline is striking: exports to non-U.S. countries nearly tripled to 676,000 b/d, up from just 234,000 b/d in November 2024. Asian demand drove the surge, with the expanded Trans Mountain pipeline finally providing meaningful waterborne access to Pacific markets. The 890,000 b/d system, which came online in May 2024 after adding 590,000 b/d of capacity, now moves roughly 15% of Canada’s total crude exports to buyers that don’t require routing through the United States.

Alberta production hit a record 4.4 million b/d in November of 2025, and Prime Minister Carney has made expanding energy exports to China and India a centerpiece of his effort to reduce dependence on U.S. markets. Trans Mountain plans further expansions totaling 300,000 b/d, with the first 100,000 b/d increase targeted for January 2027. Meanwhile, Alberta wants to build another pipeline to the west coast with at least 1 million b/d of capacity.

The flip side – Rail has been pushed to the margins. Canadian crude-by-rail exports averaged just 88,700 b/d in 2024, down 10% from 2023. So far in 2025 (still waiting on December data from the Canadian Energy Regulator) the country has exported an average of 76,791 barrels per day – lowest level since 2016, according to Canada Energy Regulator data. Rail becomes economic only when WCS-WTI differentials widen past certain thresholds, and with differentials narrowing post -TMX, the math doesn’t work for most shippers in this low priced crude environment we seem to find ourselves in.

We are Watching Trump

President Trump is privately weighing whether to withdraw from the CUSMA trade pact he negotiated, according to reports last week. The move would mark one of the most significant reversals in North American trade policy in decades and would immediately disrupt cross-border rail traffic that has operated under relatively stable rules since 1994.

Five Republicans broke ranks last Wednesday to join Democrats in blocking an extension of tariffs on Canadian goods, delivering a blow to House Speaker Mike Johnson, who had been holding the line on Trump’s trade measures. Johnson later said that Trump could veto any tariff rollback if it reaches his desk, but the congressional pushback signals eroding support for the administration’s trade war even within the president’s own party. Senate Democratic leader Chuck Schumer said both chambers have now rejected Trump’s “phony emergency and fabricated trade war,” while the Republican-controlled Senate also voted to abandon tariffs on Brazil and other emergency global duties.

The Supreme Court is expected to rule on the legality of Trump’s tariffs as soon as February 20, which could force the administration’s hand one way or another.

For railroads, CUSMA withdrawal would be catastrophic. Cross-border rail movements between the U.S., Canada, and Mexico have grown substantially under the agreement, with integrated supply chains depending on predictable tariff-free treatment. Automotive parts routinely cross borders multiple times during production. Grain, energy products, and intermodal containers move seamlessly north and south. A sudden shift to World Trade Organization rules or worse would inject massive uncertainty into routing decisions, pricing, and long-term contracts.

Even the threat of withdrawal creates problems. Shippers are already dealing with the policy whiplash from conflicting signals out of Washington. Now they have to game out scenarios where the foundational trade framework for North America simply disappears. PFL clients moving cross-border freight need to stay close to this. L Give the desk a call, we can help you!

We are Watching Trucking

Intermodal is having a moment, and it’s not because freight demand is surging. It’s because trucking capacity is bleeding out.

Spot rates and tender rejections stayed elevated despite volumes running 6-7% below year-ago levels, a clear signal the market shift is supply-driven, not demand-led. Carriers continue leaving lanes and reducing fleets after years of attrition and stretched balance sheets. The result: higher spot rates, rising tender rejections, and greater route-guide noncompliance even with weak baseline volumes post-holiday.

Shippers are responding by moving freight to intermodal where the lanes make sense. C.H. Robinson reported “interest in converting truckload shipments to intermodal surged“ due to tightening over-the-road capacity, a trend continuing into RFP season as shippers target cost savings on longer hauls where intermodal pencils. Railroads are holding pricing relatively flat, keeping intermodal competitive with truckload rates and maintaining service metrics that have been solid for 30 consecutive weeks.

This isn’t about intermodal stealing share through better service or lower prices. It’s about trucking’s structural capacity problems making rail look attractive again. Union Pacific cut its priority LA-to-Chicago service to three days. BNSF and CSX introduced nine new intermodal schedules from California to the Ohio Valley and Northeast. Norfolk Southern and UP launched new outbound service from Louisville to the West Coast. These moves are tactical responses to demand that’s flowing their way because over-the-road alternatives are either unavailable or prohibitively expensive.

U.S. rail intermodal volume fell 3.4% in December 2025 from a year earlier, the fourth consecutive month of year-over-year decline, so it’s not like the sector is booming. But, the setup for 2026 looks better than it did six months ago, largely because the trucker pain is real and likely to persist. If contract trucking rates move up in the back half, intermodal could see volume growth for the first time since early 2025.

For PFL’s intermodal customers, now is a good time to lock in coverage on longer lanes. The pricing window won’t stay open if trucking starts adding capacity.

We are Watching Coal

Coal was supposed to fade cleanly. Instead, it’s a stubborn, cash-flow-relevant anomaly. While U.S. power generation continues a long-term shift away from coal, demand has proven highly sensitive to stress: weather events, export market volatility, grid reliability concerns, and geopolitical energy shocks. Railroads sit squarely in the middle of that stress response.

One important nuance is export coal, particularly metallurgical coal used in steelmaking. When global steel demand rises or supply disruptions hit Australia or Russia, U.S. coal suddenly becomes marginal supply again. These swings translate directly into rail volume surges on corridors feeding East Coast and Gulf export terminals. Unlike domestic utility coal, export volumes tend to move long distances at higher rates, making them disproportionately profitable even at modest volume levels.

What makes coal uniquely attractive to railroads at this stage is not growth, but capital efficiency. The infrastructure is fully depreciated. The locomotives, crews, and terminals already exist. Incremental coal traffic flows through networks with minimal incremental cost, producing strong contribution margins even as total coal volumes trend downward. In effect, coal has become a harvest asset: one that railroads no longer optimize for growth, but one they are happy to monetize as long as it shows up. Investors may discount coal’s future, but the cash it throws off today helps fund dividends, buybacks, and capital investment elsewhere on the network.

Coal’s persistence is also being reinforced by policy intervention. DOE forced Consumers Energy to delay closure of its J.H. Campbell coal plant in Michigan. When one large facility is forced to remain online, it tightens coal supply logistics across a broader regional system. Mines remain active longer than planned, rail contracts are extended rather than wound down, and supporting infrastructure stays utilized. In the Midwest and parts of the Southeast, railroads have seen coal volumes stabilize and in certain corridors modestly rebound, not because demand is growing structurally, but because retirements are proving harder to execute than anticipated.

Utilities are quietly reassessing closure timelines as reserve margins shrink and peak-load risk rises. While few are announcing outright reversals, several are delaying decommissioning, maintaining dual-fuel flexibility, or running coal units at higher capacity factors during periods of stress. Each of those decisions translates directly into incremental rail carloads that were assumed to be gone.

From the railroads’ perspective, the impact is disproportionately positive. Coal traffic moves in long, dense unit trains that efficiently absorb network capacity. Even flat or slightly higher volumes can meaningfully support cash flow because the cost structure is already in place and largely depreciated. Unlike growth commodities that require new terminals or equipment, coal simply keeps moving on rails that were built decades ago and never stopped working.

The takeaway is not that coal is “back,” but that it is exiting more slowly and opportunistically than consensus models suggest. As long as utilities prioritize reliability, railroads will continue to extract value from a commodity that was supposed to have already left the building.

We are Watching Left Wing Carney

Prime Minister Mark Carney made a significant policy reversal on November 27th, when he signed a memorandum of understanding with Alberta that allows enhanced oil recovery (EOR) projects to qualify for federal carbon capture tax credits. Ottawa had explicitly banned this since 2021. The move ties Alberta’s massive $16.5 billion Pathways Alliance carbon capture project directly to approval of a new oil pipeline to the West Coast. Neither can proceed without the other.

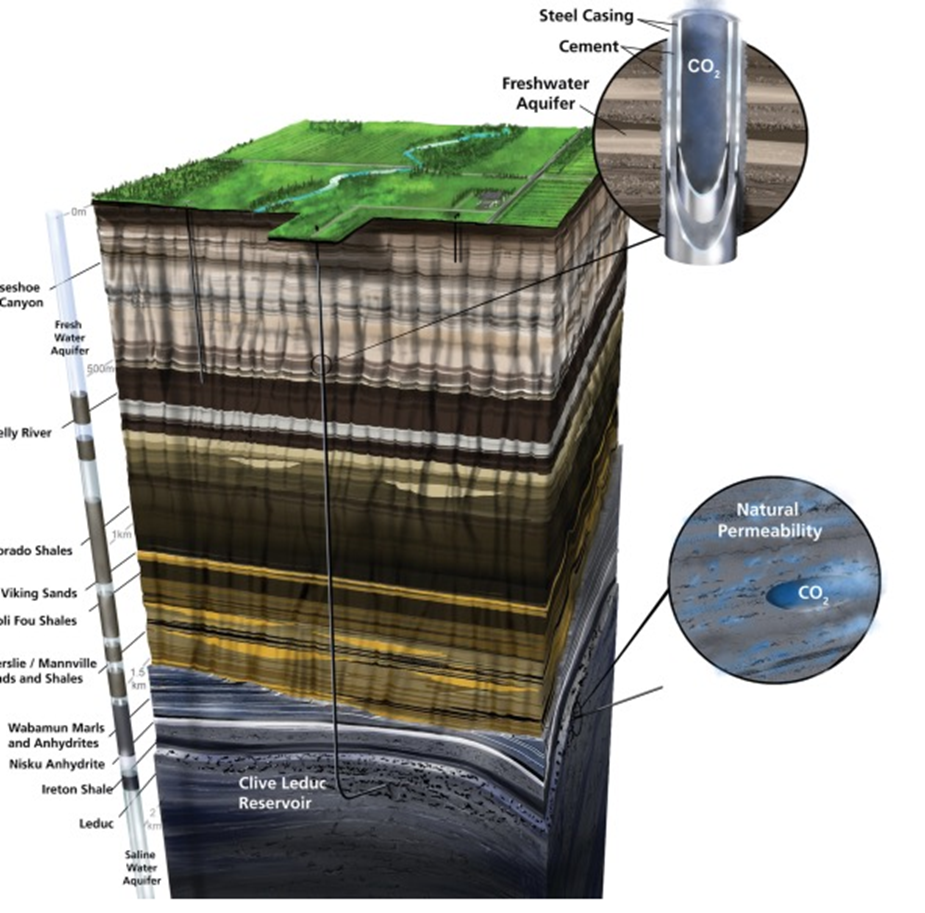

Here’s the thing: this is how carbon capture should have been done all along. Enhanced oil recovery kills two birds with one stone. You permanently store industrial CO₂ emissions underground while extracting additional oil from depleting reservoirs. Pure carbon storage, where you capture CO₂ and just bury it, is economically stupid when you can use that same captured carbon to increase oil production and extend the life of mature fields. It is already done successfully at sites like Whitecap Resources’ facility near Estevan, Saskatchewan, which uses CO₂ purchased from the coal-fired Boundary Dam Power Station.

How Enhanced Oil Recovery Works: CO₂ captured from industrial emitters can be separated, compressed, and transported via pipeline or rail to mature oil fields. Once it reaches the injection site, the CO₂ is pumped into depleting reservoirs, creating increased pressure that pushes additional oil to the surface. The CO₂ remains permanently stored underground. It’s not released back into the atmosphere. This is a true win-win: you sequester carbon AND produce more oil from fields that would otherwise be abandoned.

Once the CO₂ reaches its destination it is injected into the depleting reservoir.

Alberta Carbon Trunk Line (ACTL), completed in 2020, demonstrates this works at scale. It’s the world’s largest capacity CO₂ pipeline, capable of transporting up to 14.6 million tonnes of CO₂ per year. That represents 20% of all current oil sands emissions or the equivalent of capturing CO₂from more than 2.6 million cars. The system captures CO₂ at the North West Redwater Partnership Sturgeon Refinery and Nutrien’s Redwater Fertilizer Facility, then transports it to mature oil fields for injection. It works. It’s profitable. And it should have been the model from day one.

Carney’s policy shift now allows projects like Pathways Alliance to access federal investment tax credits covering up to 50 percent of capital costs, with Alberta adding another 12 percent. The Pathways project would build a 400-kilometer pipeline connecting over 20 oilsands facilities to an underground storage hub near Cold Lake, Alberta. The federal government had previously refused to subsidize EOR, insisting that carbon capture projects could only receive tax credits for “pure” storage where the CO₂ is buried and left alone.

That policy was never a very good one. If you’re going to spend billions capturing industrial carbon emissions, why NOT use it productively? The carbon stays underground either way, but with EOR you get economic value from enhanced production. Canada already possesses world-leading carbon capture technology. The ACTL system proves the infrastructure can be built and operated profitably.

The Rail Angle:

If EOR scales up as promised, it could create demand for specialized railcars to transport compressed CO₂ from industrial capture facilities to injection sites although these cars are very expensive to build. This is important for emitters not directly connected to pipeline infrastructure. You need pressure cars rated for supercritical CO₂, and you need a lot of them if this expands beyond the Pathways project. Could be new demand for rail equipment and logistics that doesn’t currently exist at scale.

So Is Carney Waking Up? Maybe. But we’re skeptical. Carney has publicly admitted Canada will miss its 2030 and 2035 climate targets under current policies. The proof will be in Carney’s actions. Does the Pathways project actually get built, or does it stall out over operational cost disputes like it did under Trudeau? Does the promised West Coast pipeline materialize, or does environmental opposition kill it? Does Alberta’s industrial carbon price stay frozen at $95 per tonne, undermining the entire economic case for carbon capture?

Carney may have finally figured out that EOR is the only economically viable path for large-scale carbon capture in Canada’s oil patch. But figuring it out in late 2025, after years of banning EOR from federal subsidies, means we’ve lost half a decade when this infrastructure could have been getting built. If he’s serious, we’ll see shovels in the ground soon. If not, this is just another announcement designed to keep Alberta happy while accomplishing nothing.

Whether Carney has the political will to build at scale, or if this is just window dressing to deflect criticism while he approves more pipelines, remains to be seen.

In other Carney news, he scrapped the Trudeau-era electric vehicle mandate on February 5th, the policy requiring 100% of new vehicle sales to be electric by 2035, and replaced it with a rebate program and vague emissions standards. Carney paused the mandate back in September for a “60-day review,” spent the fall insisting Canada needed binding targets, then killed it entirely. In its place? A $2.3 billion rebate scheme offering $5,000 for EVs and $2,500 for plug-in hybrids, but only in 2026, declining annually until it expires in 2030. The $50,000 price cap excludes most vehicles Canadians actually want to buy, and the program only covers imports from free-trade countries, meaning the 49,000 Chinese EVs Carney just negotiated access to won’t qualify.

The charging infrastructure spend of $1.5 billion through the Canada Infrastructure Bank sounds impressive until you realize Ottawa has been funding charger buildouts since 2016 and EV adoption is still stuck at 11% of new sales. Government officials admitted they haven’t modeled the emissions impact, which replaces binding 2026 sales targets with “aspirational” goals of 75% EV sales by 2035 and 90% by 2040. Carney claims new tailpipe standards will deliver equivalent reductions, but the details won’t be published until later this year. Bottom line Carney still wants Canadians to drive electric vehicles but realized the original targets were not in line with reality or what people really want. This new scheme is just putting lipstick on a pig, in our opinion.

For the rail sector, this policy chaos matters less for what it does than for what it represents. Carney’s approach to EVs is the same playbook he’s running on energy policy writ large. The mandate’s death won’t meaningfully impact finished vehicle imports by rail; most Canadian-bound autos move by truck or are assembled domestically. But, Carney’s willingness to capitulate to industry lobbying while maintaining retaliatory tariffs on U.S. vehicles creates exactly the kind of policy uncertainty that strangles investment decisions. You can’t plan a supply chain when the government changes direction every quarter.

We are Watching Wabtec

Last week, Wabtec announced nearly $1.8 billion in locomotive agreements with CSX and Union Pacific, a clear sign the big railroads are focused on running leaner, not necessarily bigger.

CSX signed a $670 million agreement that includes 100 new locomotives, upgrades to 50 existing units, and expanded digital systems. A big piece of that is converting older DC locomotives to more efficient AC traction, improving pulling power and fuel burn while extending the life of assets already on the books.

Union Pacific followed with a $1.2 billion modernization program, centered on upgrading its AC4400 fleet with updated propulsion systems and diagnostics to improve reliability and efficiency over time.

This isn’t about expanding fleets, it’s about tightening operations. Class I railroads are improving fuel efficiency, extending asset life, investing in digital performance tools, and strengthening reliability. That suggests a steady-demand environment where protecting margins and maintaining service consistency matter more than rapid growth.

For shippers, especially in bulk and energy markets, better locomotive performance typically translates into more predictable network performance and fewer operational surprises.Even with freight growth remaining moderate, Class I railroads are putting real capital behind efficiency, signaling confidence in long-term demand and a clear commitment to operational performance.

We are watching Key Economic Indicators

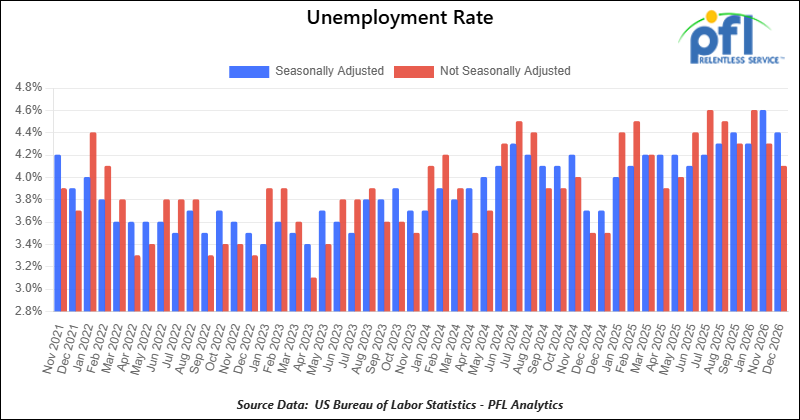

Unemployment Rate

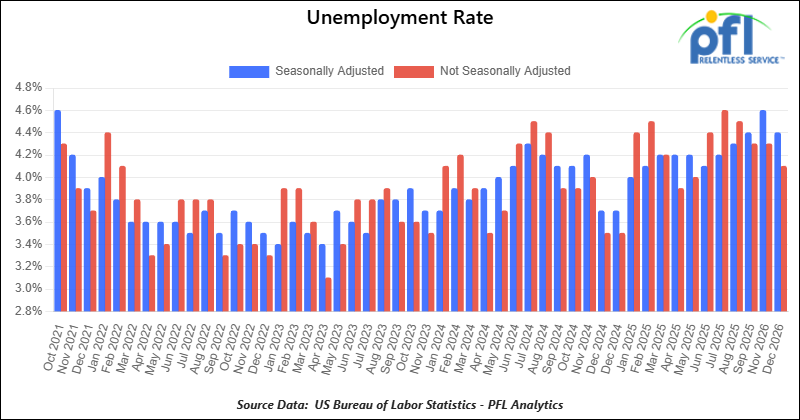

On February 11, 2026, the BLS reported that 130,000 net new jobs were created in January 2026. Job gains were concentrated in health care, social assistance, and construction, while some sectors like federal government and financial activities saw losses.

Figures for prior months were revised sharply lower, with 2025’s net new job gains adjusted down from 584,000 to approximately 181,000, marking one of the weakest years for U.S. job growth in decades.

The official unemployment rate declined slightly to 4.3% in January 2026, down from 4.4% in December 2025.

Lease Bids

- 30-50, 6000cf Steel Hopper located off of CSX or NS in East. For use in petcoke service. Period: 5 Years.

- 10, 2500CF Open Top Hopper located off of UP or BN in Texas. For use in aggregate service. Period: 5 years. Need Rapid Discharge Doors.

- 100, 21.9K 117J Tank located off of All Class 1s in Midwest. For use in CO2 service. Period: 6 months.

- 30-50, 30K 117J Tank located off of NS or CSX in Northeast. For use in C5 service. Period: 1 year.

- 20-50, 4000-5000 Covered Hopper located off of UP or BN in Houston. For use in Urea, Potash, Ammonium Sulfate service. Period: 6-12 Months.

Sales Bids

- 28, 3400CF Hopper Covered located off of UP BN in Texas. For use in Cement service. Cement Gates needed.

- 20, 17K Tank DOT111 located off of various class 1s in various locations. For use in corn syrup service.

- 120, Various Gondola Open-Top Aluminum Rotary located off of various class 1s in various locations. For use in Sulphur service. Built 2004 or later.

- 30, 29K Tank DOT111 located off of various class 1s in Chicago. For use in Veg Oil service.

Lease Offers

- 100, 30K CPC1232 Tanks located off of UP or BN in Texas. Last used in Diesel.

- 100, 30K DOT117J Tanks located off of UP or BN in Texas. Last used in Gasoline.

- 100, 29K DOT117J Tanks located off of UP or BN in Texas. Last used in Gasoline. Coiled and Insulated.

- 21, 6351 Covered Hopper located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 29, 6500 Covered Hopper located off of CN in Wisconsin. Last used in DDG. Available until February 2027.

- 50, 20K DOT117J Tank located off of All Class 1s in Moving. Last used in Styrene.

- 29, 25.5K DOT117J Tank located off of UP or BN in Texas. Cars are currently clean. Cars are currently clean.

- 90, 30K DOT117J Tank located off of UP or BN in Corpus Christie. Last used in Diesel.

- 200, 340W DOT 112J Tank located off of All Class 1s in Multiple Locations. Last used in Propane and Butane. Cars are currently clean.

- 15, 6200CF Covered Hopper located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

- 30, 6500CF Covered Hopper located off of All Class 1s in Wisconsin. Last used in Plastic. Cars are currently clean.

Sales Offers

- 50, 31.8K CPC1232 Tanks located off of UP or BN in TX. Last used in Multiple. Requal Due in 2025.

- 100, 4600CF Open Top Hoppers located off of BN or CSX in Southeast. Last used in Coal.

- 35, 3400CF Covered Hoppers located off of UP or BN in Midwest. Last used in Sand.

- 25, 30K 117J Tanks located off of CSX in Jackson, TN. Last used in Fuels. Newly Requalified.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website

The post PFL Railcar Report 2-17-2026 appeared first on PFL Petroleum Services LTD.